Technical analysis - Page 82

February 12, 2025

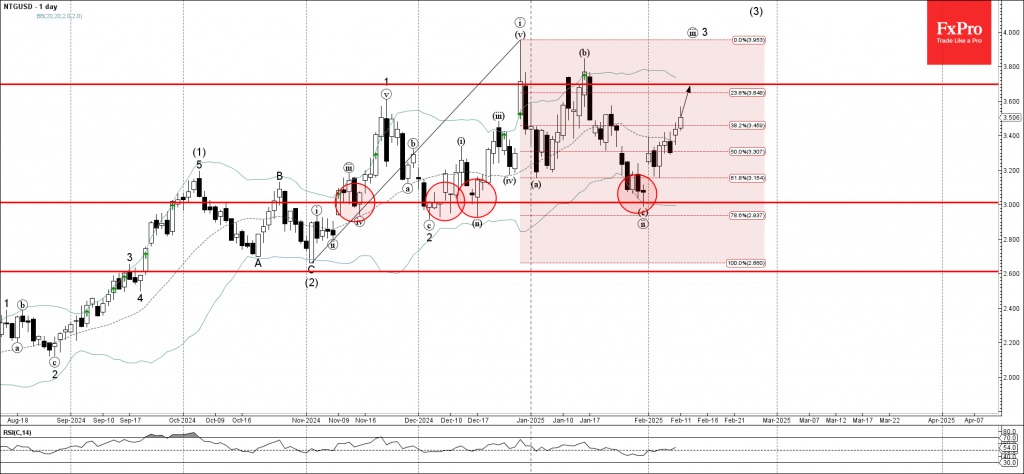

– Natural gas reversed from the support area – Likely to rise to the resistance level 3.67 Natural gas continues to rise strongly inside the short-term upward impulse wave iii, which started earlier from the support area located between the.

February 12, 2025

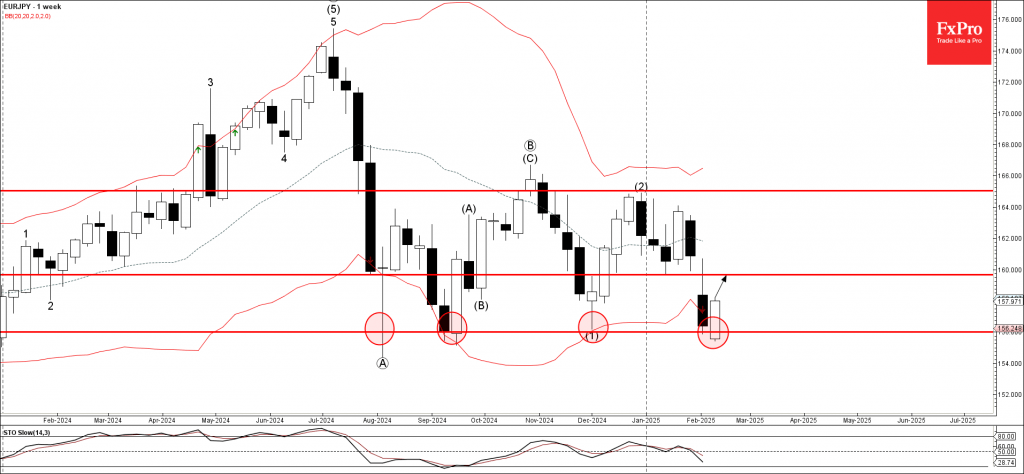

– EURJPY reversed from the support area – Likely to rise to the resistance level 159.65 EURJPY currency pair recently reversed up from the support area located between the key support level 156.000 (which has been steadily reversing the price.

February 11, 2025

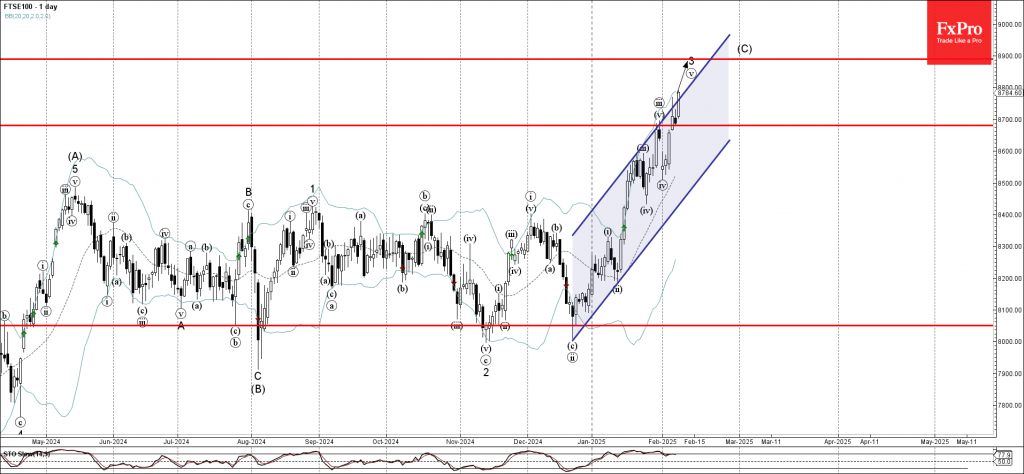

– FTSE 100 index broke resistance level 8700.00– Likely to rise to resistance level 8900.00 FTSE 100 index recently broke the resistance area between the key resistance level 8700.00 (which stopped the price at the end of January) and the.

February 11, 2025

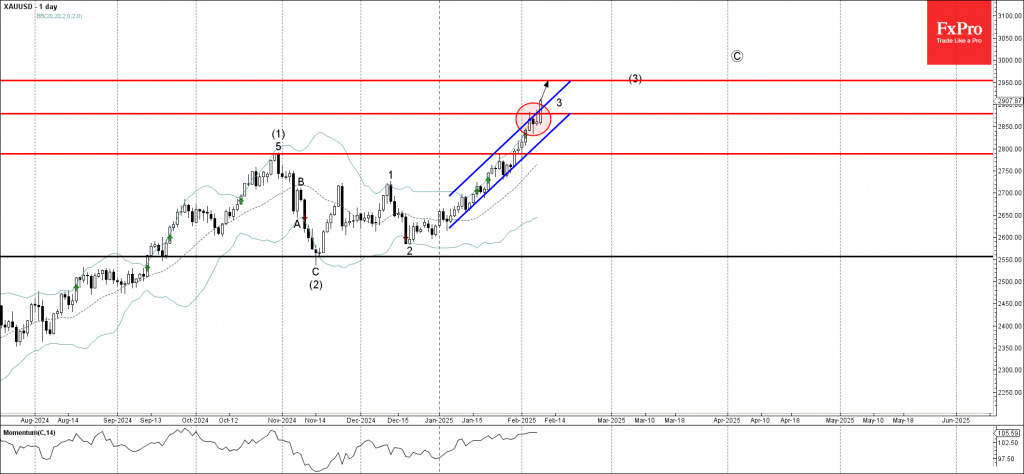

– Gold broke resistance area– Likely to rise to resistance level 2950.00 Gold continues to rise strongly after the earlier breakout of the resistance area located between the key resistance level 2878.00 (which stopped the price at the start of.

February 8, 2025

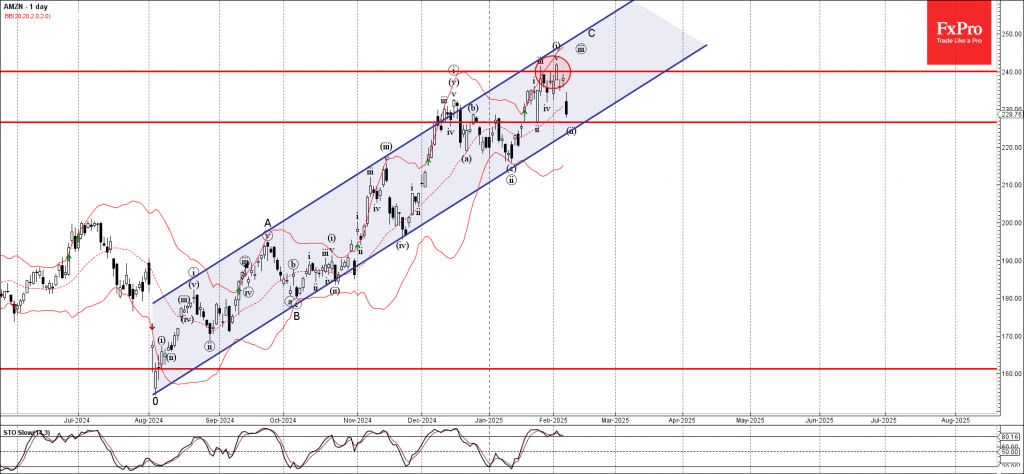

– Amazon reversed from the resistance area – Likely to fall to support level 226.60 Amazon recently reversed down with the downward gap from the resistance area between the pivotal resistance level 240.00 (which has stopped the previous waves iii.

February 8, 2025

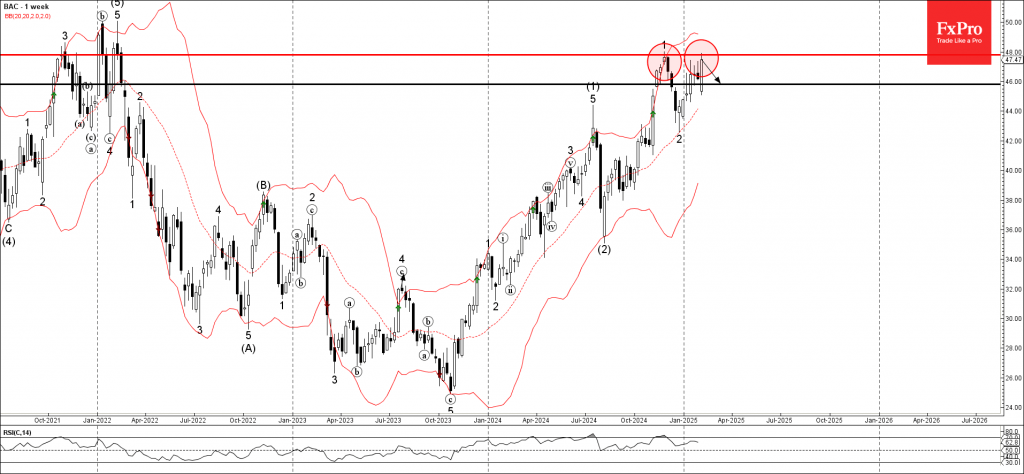

– Bank of America reversed from resistance level 47.80 – Likely to fall to support level 46.00 Bank of America recently reversed down from the resistance zone located between the major resistance level 47.80 (which also stopped the earlier minor.

February 7, 2025

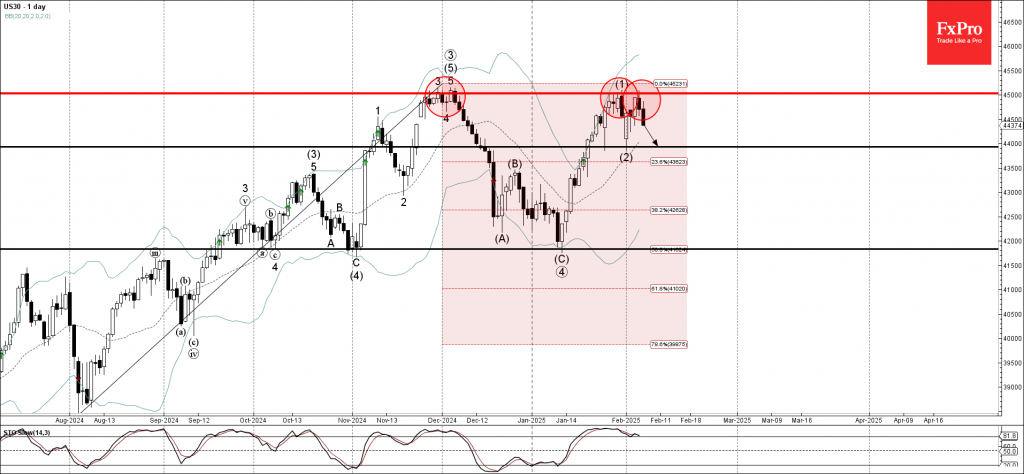

– Dow Jones reversed from the resistance level 45000.00 – Likely to fall to support level 44000.00 Dow Jones index recently reversed down from the strong resistance level 45000.00 (which has been reversing the price from November) coinciding with the.

February 7, 2025

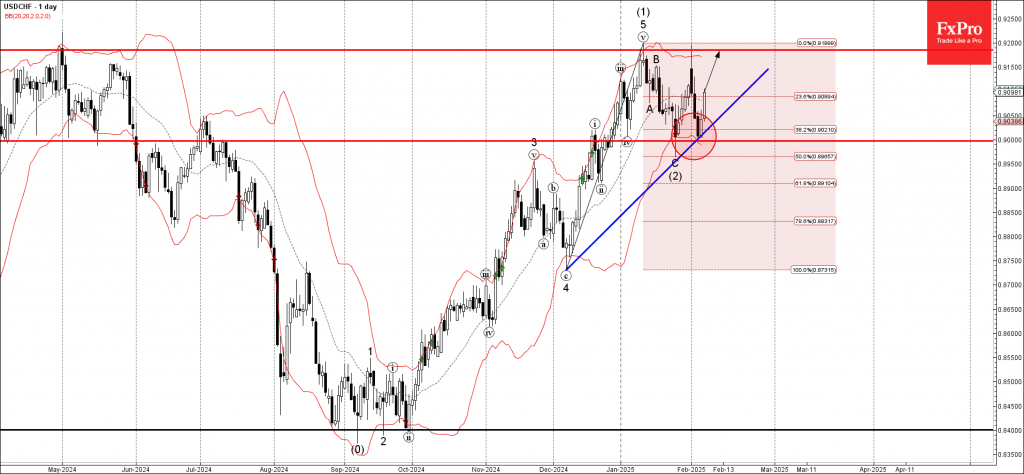

– USDCHF reversed from support zone – Likely to rise to resistance level 0.9185 USDCHF currency pair recently reversed up from the support zone between the round support level 0.9000 (which also stopped the previous correction (2)), lower daily Bollinger.

February 7, 2025

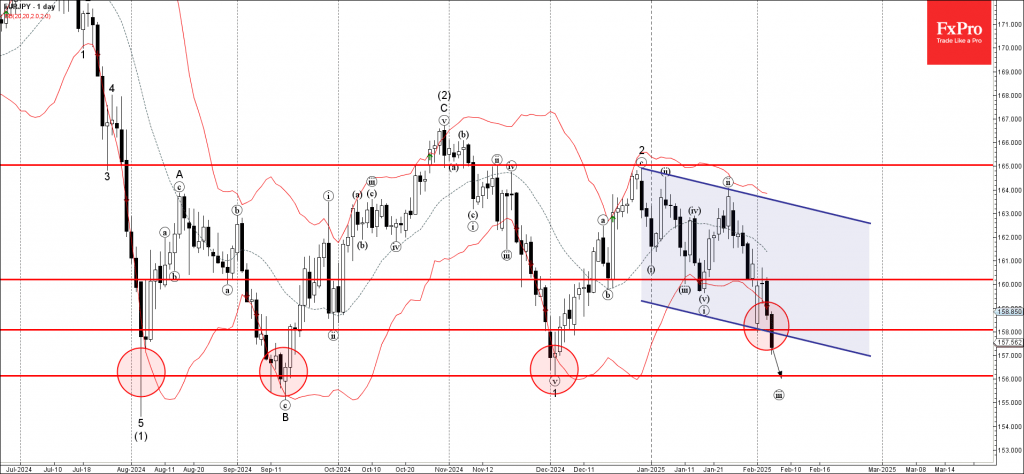

– EURJPY broke support zone – Likely to fall to support level 156.00 EURJPY currency pair today broke support zone between the support level 158.00 (which reversed the price at the start of this month) and the support trendline of.

February 7, 2025

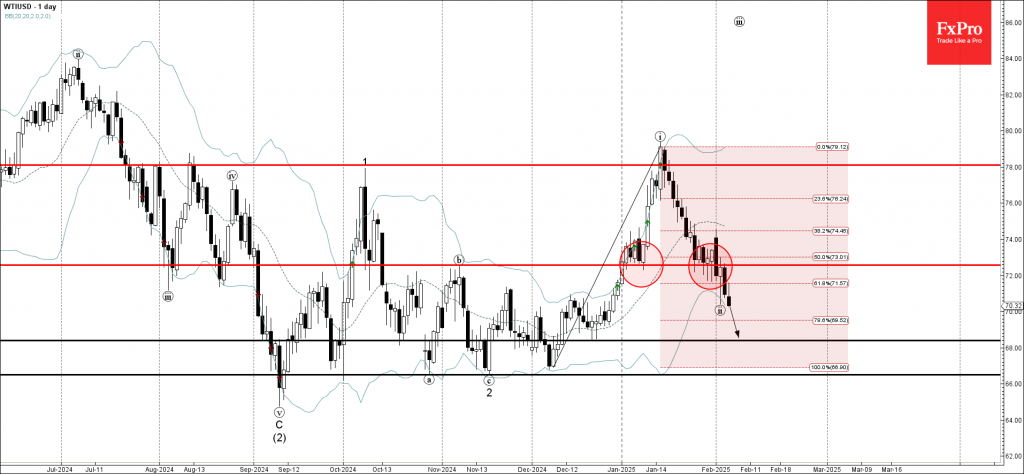

– WTI Crude oil broke support zone – Likely to fall to support level 68.00 WTI Crude oil recently broke the support zone between the support level 72.60 (which has been reversing the price from the start of January) and.

February 6, 2025

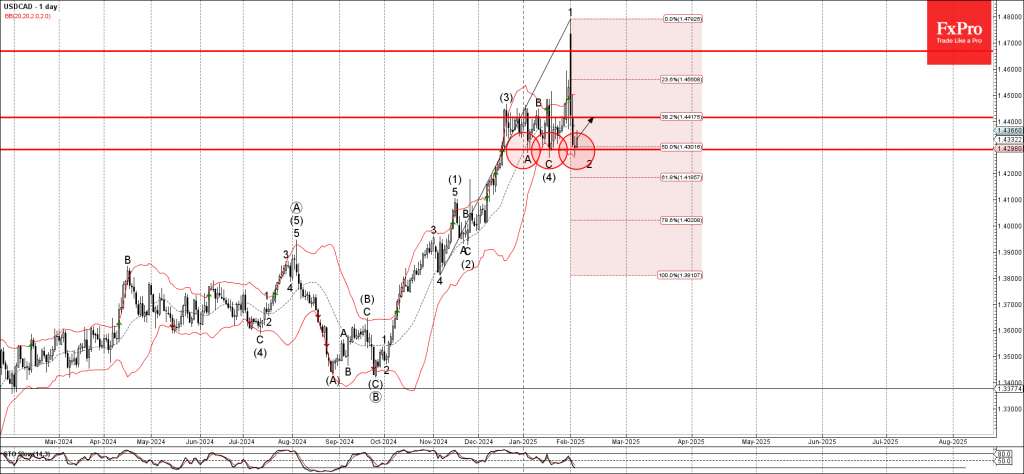

– USDCAD reversed from the support zone – Likely to rise to resistance level 1.4400 USDCAD currency pair recently reversed from the support zone between the pivotal support level 1.4290, which has stopped the previous corrections A, C , as can.