Technical analysis - Page 81

February 14, 2025

– GBPUSD broke resistance zone – Likely to rise to resistance level 1.2720 GBPUSD currency pair recently broke the resistance zone between the key resistance level 1.2530 (which has been reversing the price from the start of January) and the.

February 14, 2025

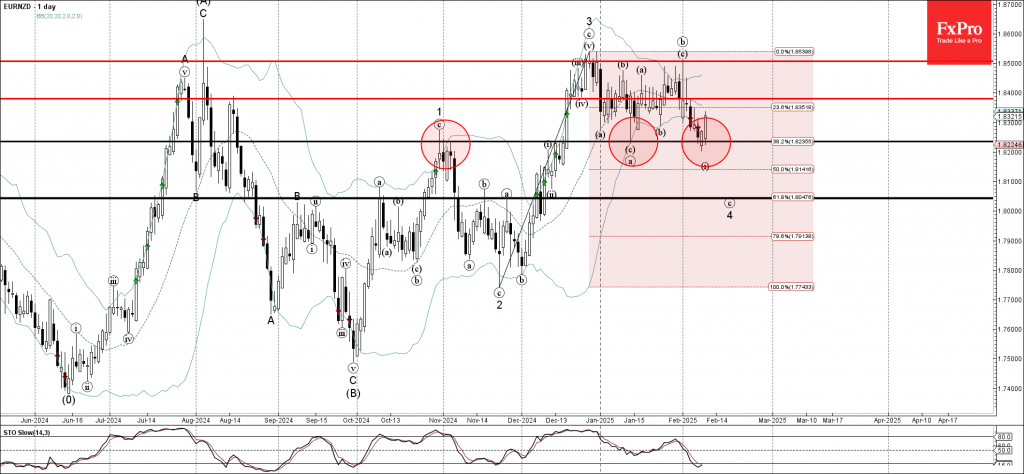

– EURNZD reversed from long-term resistance level 1.8495 – Likely to fall to support level 1.8200 EURNZD currency pair recently reversed down from the major long-term resistance level 1.8495, which has been reversing the price from the middle of 2023,.

February 14, 2025

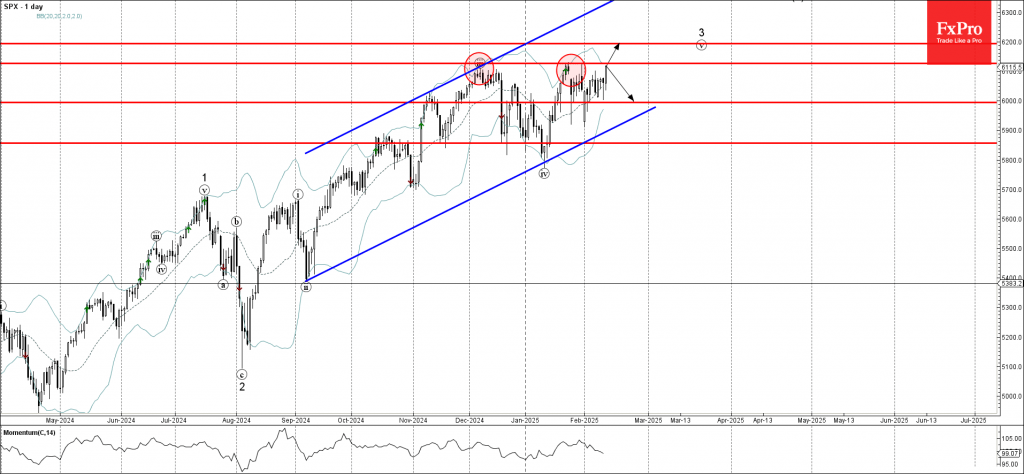

– S&P 500 approaching key resistance level 6125.00 – Likely to rise to resistance level 6200.00 S&P 500 index recently rose sharply and is currently approaching the key resistance level 6125.00, which has been reversing the index from December. The.

February 14, 2025

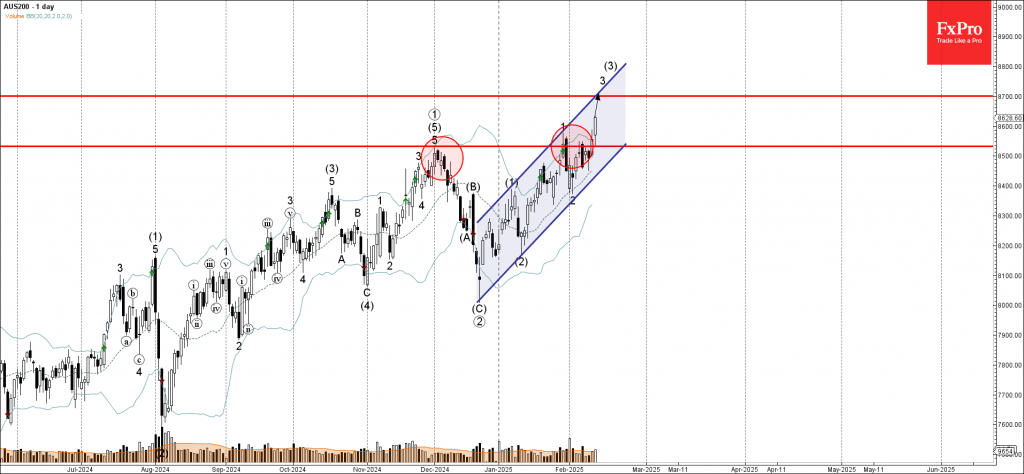

– AUS200 broke strong resistance level 8530.00 – Likely to rise to resistance level 8700.00 AUS200 index previously broke the strong resistance level 8530.00, which has been reversing the index from the start of December. The breakout of the resistance.

February 13, 2025

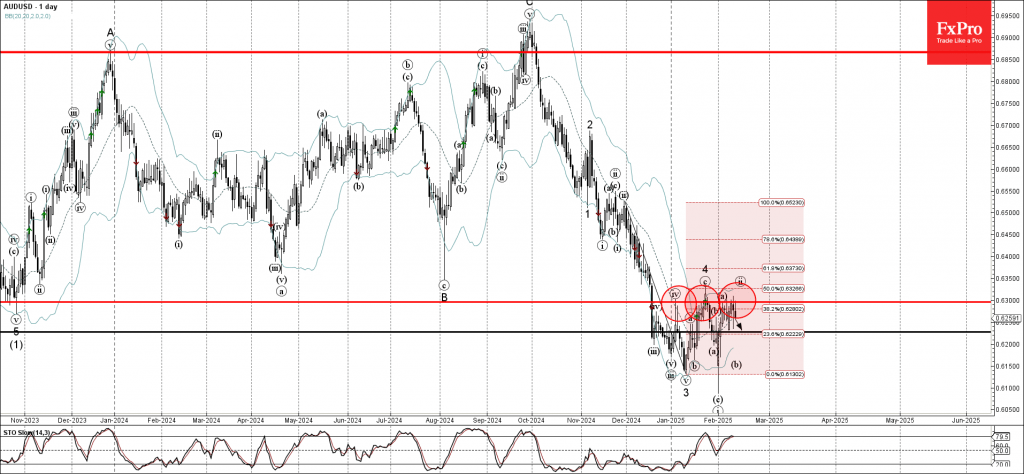

– AUDUSD reversed from the resistance area – Likely to fall to support level 0.6225 AUDUSD currency pair recently reversed down from the resistance area located between the key resistance level 0.6300 which has been reversing the price from the.

February 13, 2025

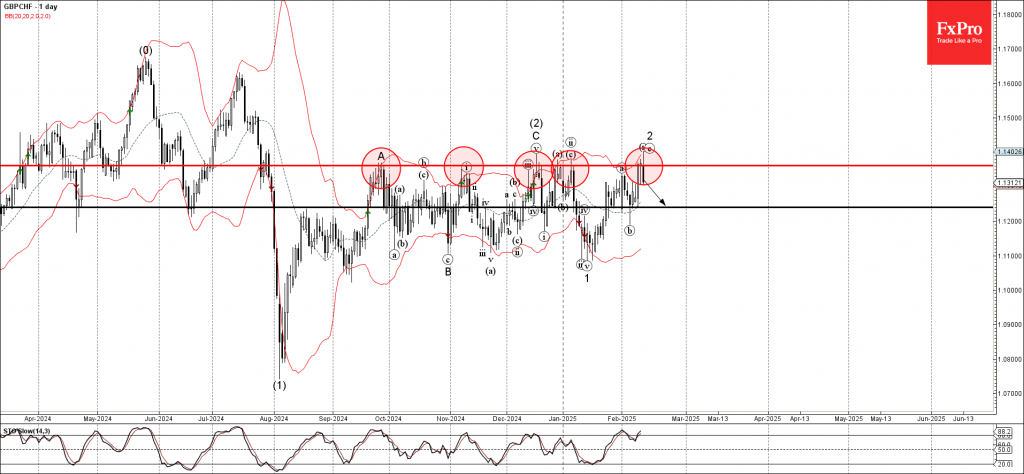

– GBPCHF reversed from the resistance zone – Likely to fall to support level 1.1240 GBPCHF currency pair recently reversed from the resistance zone between the powerful resistance level 1.1360, (which stopped multiple upward waves from September) and the upper.

February 13, 2025

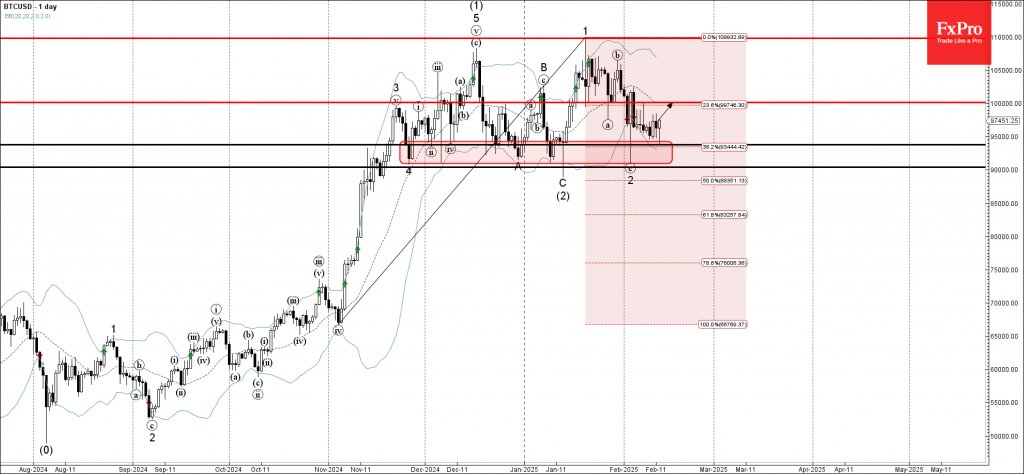

– Bitcoin reversed from the support area – Likely to rise to resistance level 100,000.00 Bitcoin cryptocurrency recently reversed up from the support area between support levels 93775.00 and 90000.00. This support area has stopped the previous corrections 4, A,.

February 13, 2025

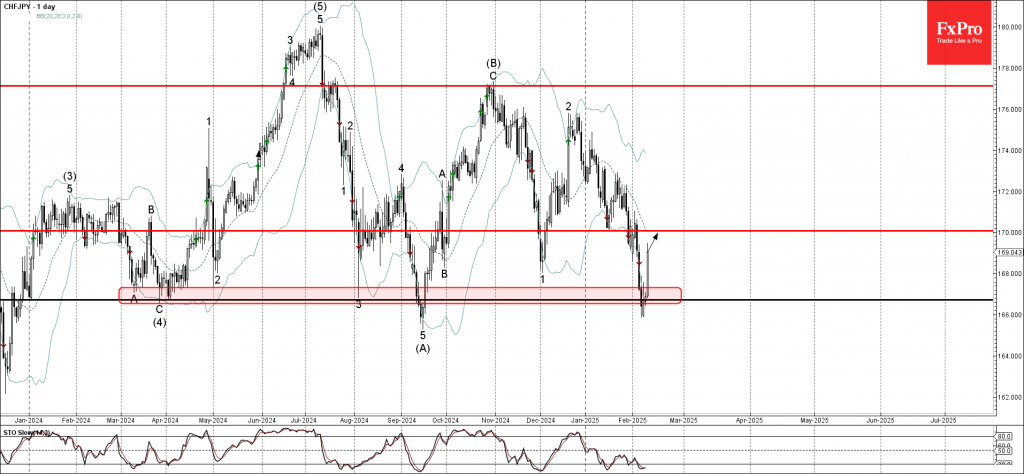

– CHFJPY reversed from the support area – Likely to rise to the resistance level 170.00 CHFJPY currency pair recently reversed up from the support area located between the multi-month support level 166.70 (which has been reversing the price from.

February 13, 2025

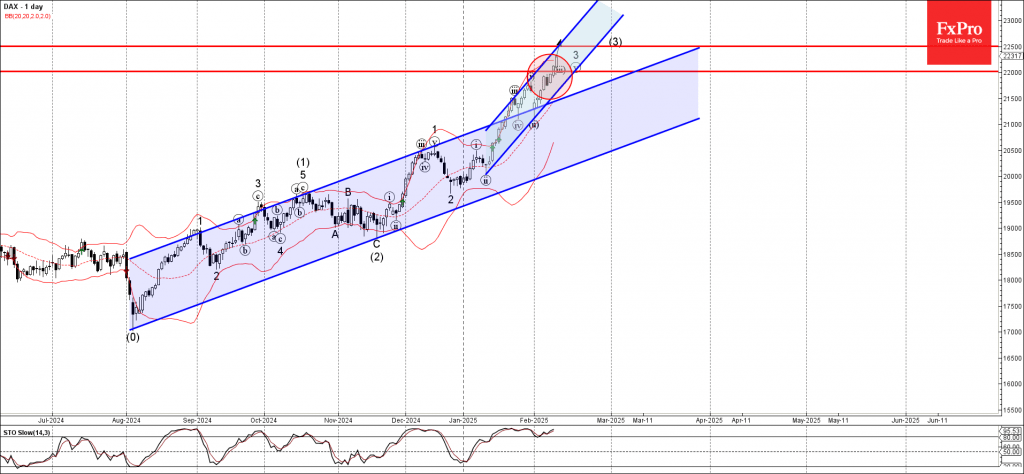

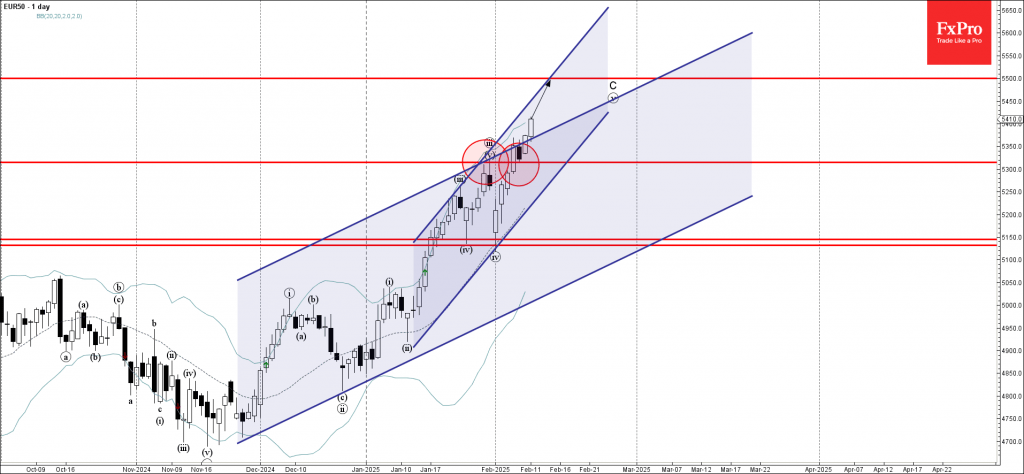

– DAX index broke resistance level 22000.00 – Likely to rise to resistance level 22500.00 DAX index is under the bullish pressure afar the earlier breakout of the daily up channel from August and the resistance level 22000.00 The breakout.

February 13, 2025

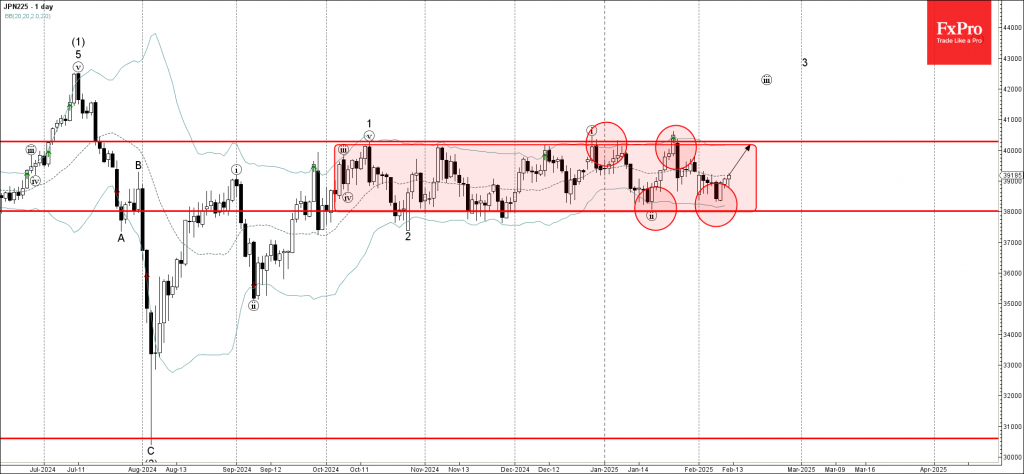

– Nikkei 225 index reversed support level 38000.00 – Likely to rise to resistance level 40285.00 Nikkei 225 index recently reversed up from the support level 38000.00, which is the lower border of the narrow sideways price range inside which.

February 12, 2025

EURNZD currency pair recently reversed up from the support area located between the pivotal support level 1.8235 (former monthly low from January), lower daily Bollinger Band and the 38.2% Fibonacci correction of the upward impulse from November The upward reversal.