Technical analysis - Page 80

February 20, 2025

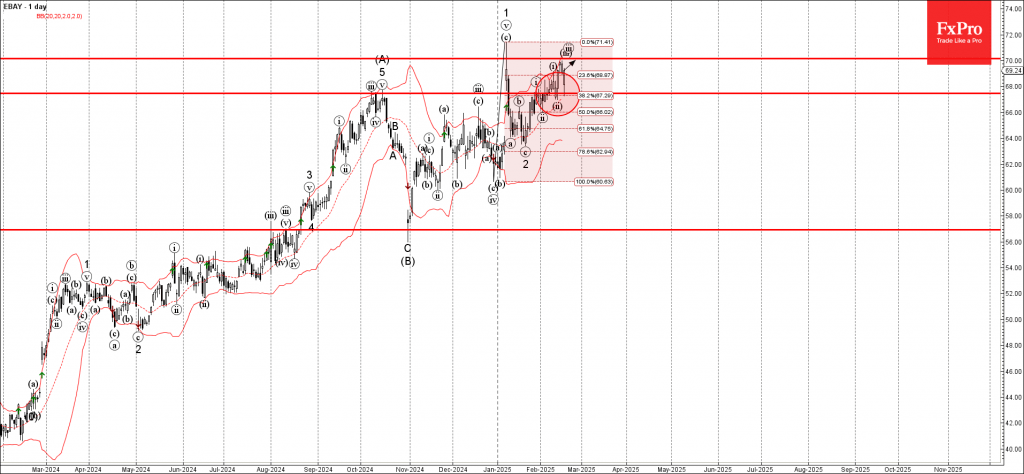

– Ebay reversed from the support area – Likely to rise to resistance level 70.00 Ebay recently reversed up from the support area between the key support level 67.45 (which has been reversing the price from January), lower daily Bollinger.

February 19, 2025

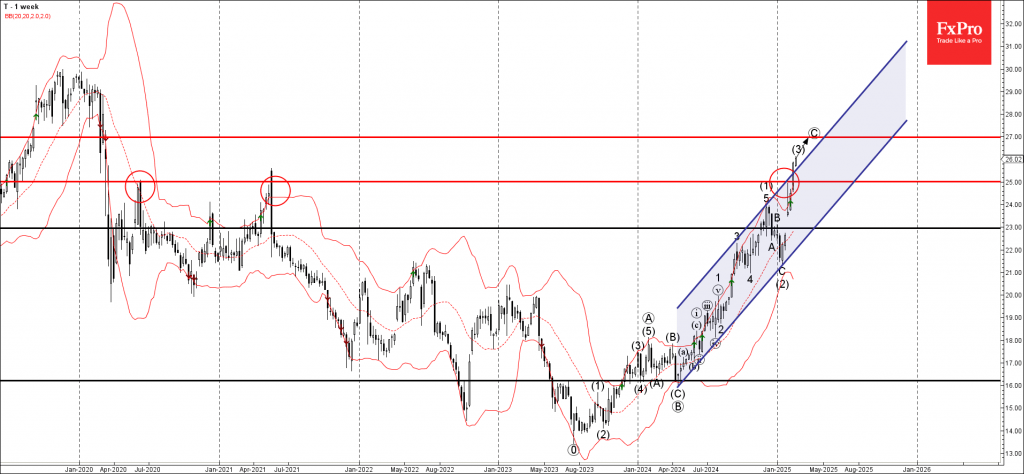

– AT&T broke the resistance zone – Likely to rise to resistance level 27.00 AT&T recently broke through the resistance zone at the intersection of the long-term resistance level 25.00 (which has been reversing the price from 2020) and the.

February 19, 2025

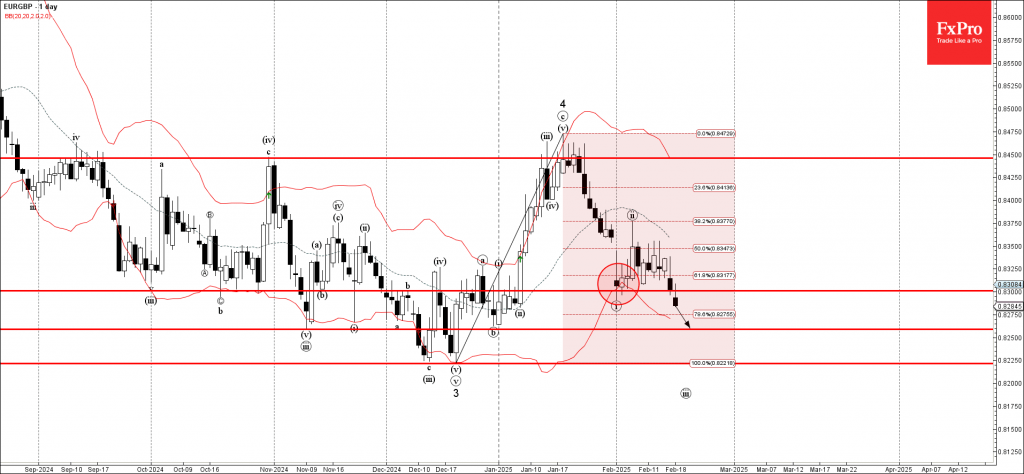

– EURGBP broke the support zone – Likely to fall to support level 0.8265 EURGBP currency pair recently broke the support zone between the support level 0.8300 (which stopped the previous impulse wave i at the end of January) and.

February 18, 2025

The crypto market’s facing a tough time with a 3% drop in market cap and no signs of a bullish reversal. Bitcoin is nearing $95K, trading below its 50-day moving average, while Solana drops 40% in the last month. Institutional.

February 18, 2025

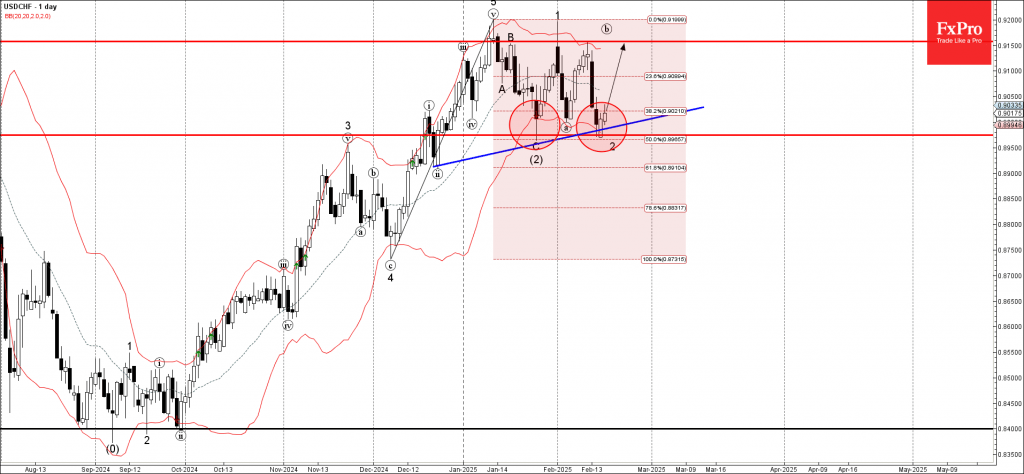

– USDCHF reversed from the support zone – Likely to rise to resistance level 0.9150 USDCHF currency pair recently reversed up from the support zone located between the support level 0.8975 (which stopped wave (2) in January), support trendline from.

February 18, 2025

– EURUSD reversed from the resistance zone – Likely to fall to support level 1.0400 EURUSD currency pair recently reversed down from the resistance zone located between the resistance level 1.0500 (which has been reversing the price from December), upper.

February 18, 2025

– Alibaba broke daily up channel – Likely to rise to the resistance level 130.00 Alibaba Group recently broke the resistance trendline of the narrow up channel from January – which accelerated the active impulse wave 5. The breakout of.

February 18, 2025

– AXP reversed from the support zone – Likely to rise to the resistance level 315.40. AXP recently reversed up with the daily Doji from the support zone between the pivotal support level 302.72 (former strong resistance from December and.

February 18, 2025

– Brent Crude Oil reversed from support zone – Likely to rise to resistance level 76.75 Brent Crude Oil recently reversed up from the support zone between the key support level 74.00 (former strong resistance from December), lower daily Bollinger.

February 18, 2025

– AUDUSD broke the resistance zone – Likely to rise to resistance level 0.6400 AUDUSD currency pair recently broke the resistance zone between the key resistance level 0.6320 (which stopped the previous minor correction iv) and the 50% Fibonacci correction.

February 15, 2025

– Gold reversed from resistance zone – Likely to fall to support level 2860.00 Gold today reversed down the resistance zone between the key resistance level 2940.00 (which formed daily Doji earlier this month), the resistance trendline of the daily.