Technical analysis - Page 78

February 28, 2025

– AUDUSD falling inside wave b – Likely to fall support level 0.6200 AUDUSD currency pair continues to fall inside the b-wave which started earlier from the major resistance level 0.6400 (former strong support from April and August of 2024)..

February 26, 2025

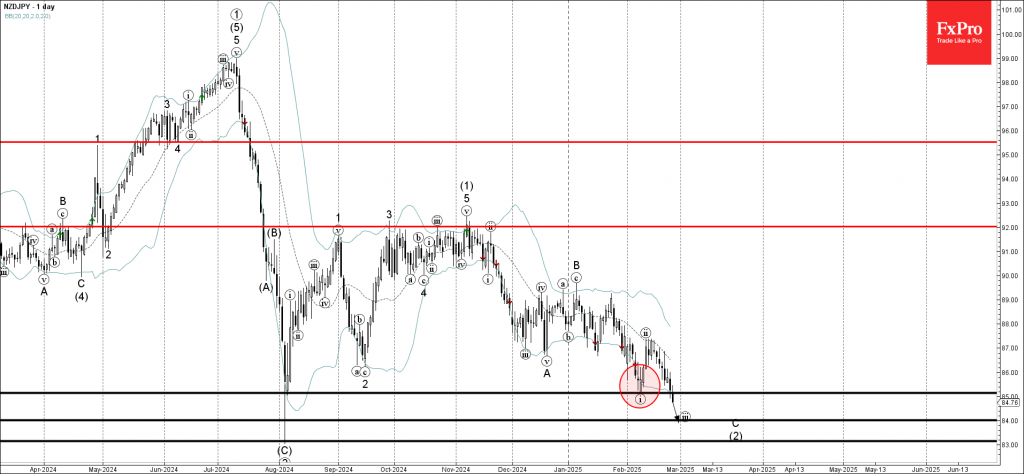

– NZDJPY broke key support level 85.00 – Likely to fall support level 84.00 NZDJPY currency pair recently broke the key support level 85.00 (which stopped the previous minor impulse wave i at the start of February). The breakout of.

February 26, 2025

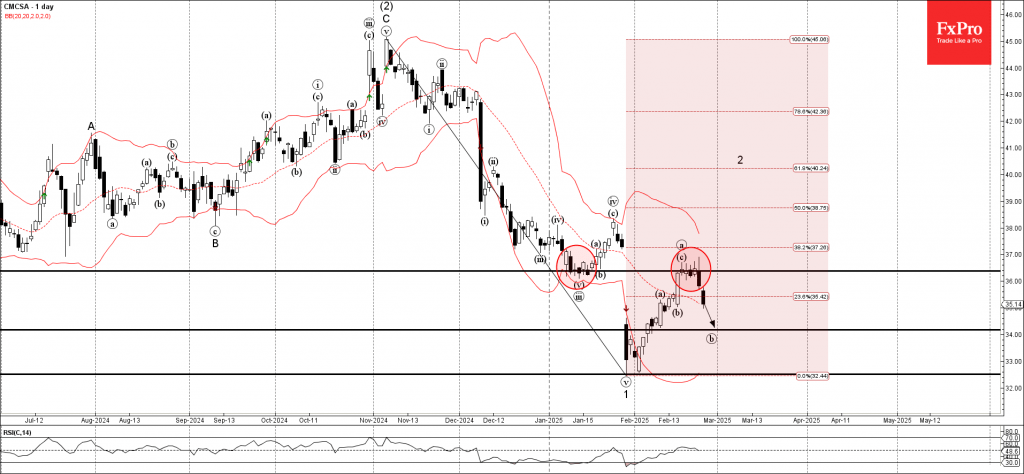

– Comcast reversed from the resistance level 36.40 – Likely to fall support level 34.00 Comcast recently reversed down from the resistance area between the resistance level 36.40 (former strong support from January) and the 38.2% Fibonacci correction of the.

February 26, 2025

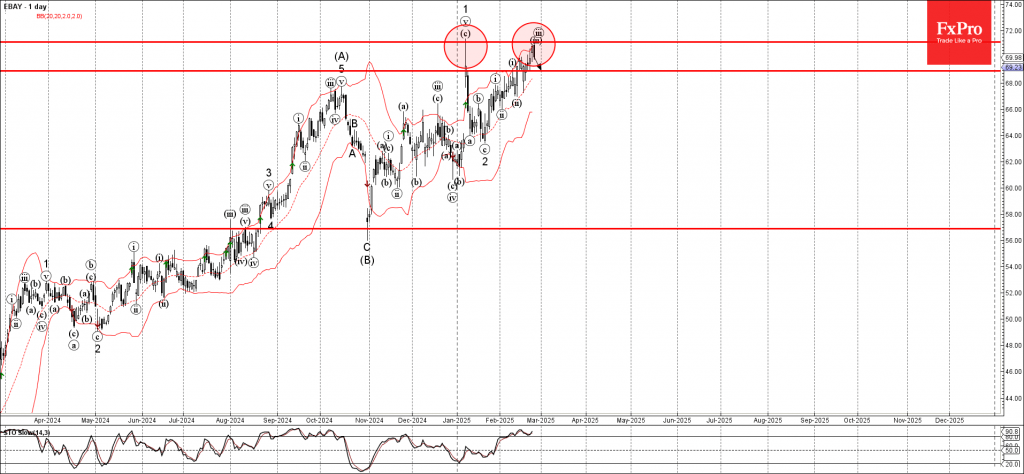

– Ebay reversed from the resistance level 71.15 – Likely to fall support level 69.00 Ebay recently reversed down from the resistance level 71.15 (which stopped the previous sharp impulse wave 1 at the start of February) standing close to.

February 26, 2025

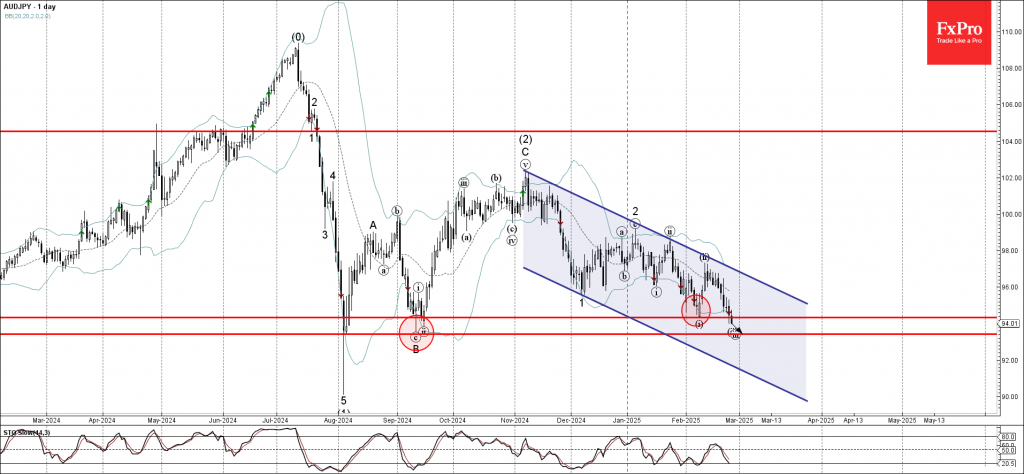

– AUDJPY broke support level 94.35 – Likely to fall support level 93.45 AUDJPY currency pair recently broke the support level 94.35 (the low of the previous minor impulse wave i from the start of February). The breakout of the support level.

February 26, 2025

– IBM reversed from resistance level 264.40 – Likely to fall to support level 247.25 IBM recently reversed down exactly from the strong resistance level 264.40 (top of the previous impulse wave iii from the start of February). The downward reversal from.

February 26, 2025

– Costco reversed from support level 1025.00 – Likely to rise to resistance level 1080.00 Costco recently reversed up from the support level 1025.00 (which stopped wave iv at the start of February) intersecting with the 20-day, moving average and the.

February 26, 2025

– Solana reversed from support level 134.15 – Likely to rise to the resistance level 155.30 Solana cryptocurrency today reversed sharply from the key support level 134.15 (former Double Bottom from October) standing well below the lower daily Bollinger Band..

February 26, 2025

– WTI crude oil broke support zone – Likely to fall to support level 67.00 WTI crude oil recently broke the support zone between the round support level 70.00 (which reversed the price multiple times from the start of February),.

February 25, 2025

– Nasdaq-100 falling inside sideways price range – Likely to reach support level 20820.00 Nasdaq-100 index recently reversed from the resistance level 22190.00 (the upper border of the sideways price range inside which the index moved from December) intersecting with.

February 25, 2025

– USDCAD reversed from the support area – Likely to rise to resistance level 1.4380 USDCAD currency pair recently reversed from the support area between the pivotal support level 1.4180 (former monthly high from November), 61.8% Fibonacci retracement of the.