Technical analysis - Page 77

March 4, 2025

– EURGPB reversed from support area – Likely to rise to resistance level 0.8300 EURGPB currency pair recently reversed from the support area set between the multi-month support level 0.8235 (which created the Double Bottom in December) and the lower.

March 4, 2025

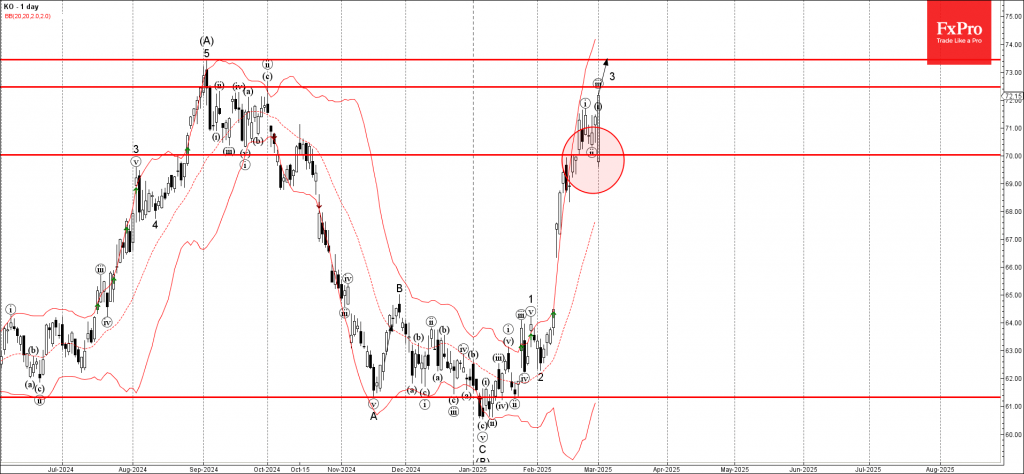

Coca-Cola recently reversed up sharply from the round support level 70.00, former resistance from October. The upward reversal from the support level 70.00 continues the active short-term impulse wave 3 of the sharp impulse wave (3) from January.

March 4, 2025

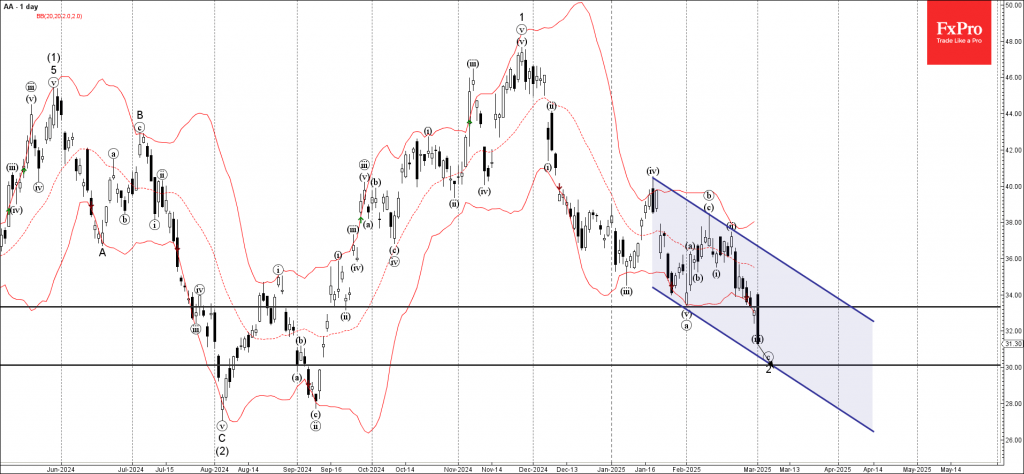

– Alcoa broke key support level 33.35 – Likely to fall to support level 30.00 Alcoa recently broke the key support level 33.35, which stopped the previous wave b of the active ABC correction 2 from the end of November –.

March 3, 2025

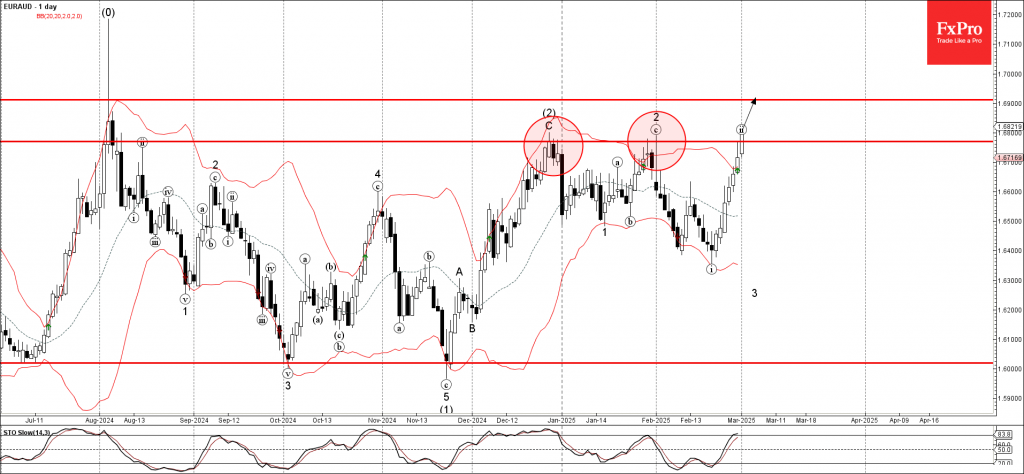

– EURAUD broke key resistance level 1.6770 – Likely to rise to resistance level 1.6900 EURAUD currency pair today broke sharply above the key resistance level 1.6770, which stopped the earlier waves (2) and 2, as can be seen below..

March 3, 2025

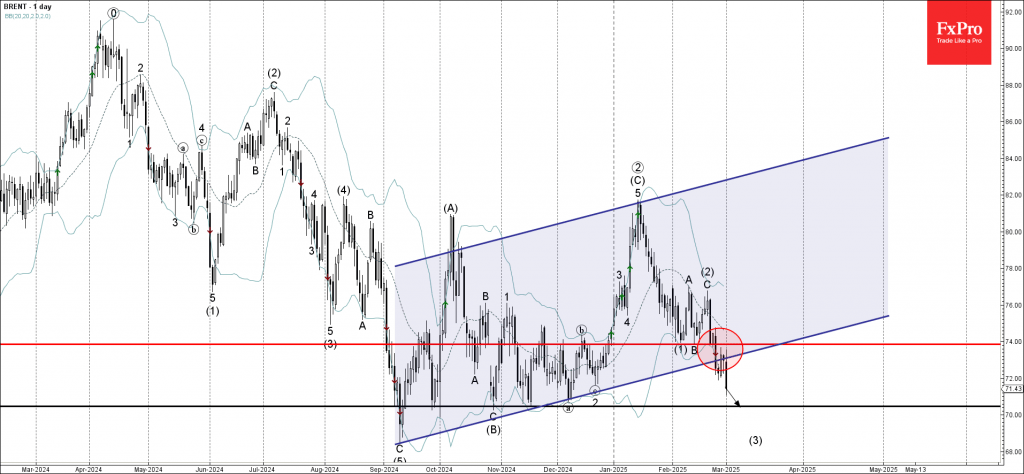

– Brent broke support zone – Likely to fall to support level 70.50 Brent recently broke the support zone between the support level 74.00 and the support trendline of the daily up channel from September. The breakout of this support.

March 1, 2025

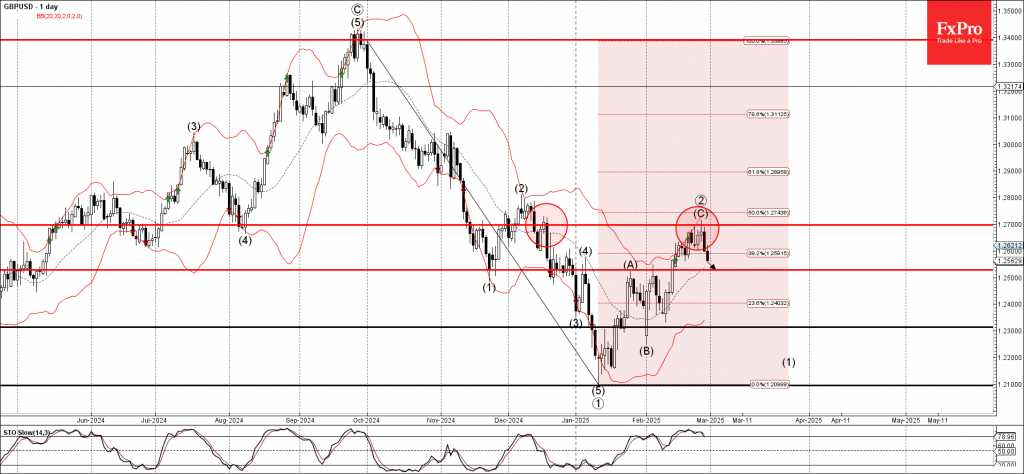

– GBPUSD reversed from the resistance zone – Likely to fall to support level 1.2530 GBPUSD currency pair recently reversed from the resistance zone between the resistance level 1.2700, the upper daily Bollinger Band and the 50% Fibonacci correction of.

March 1, 2025

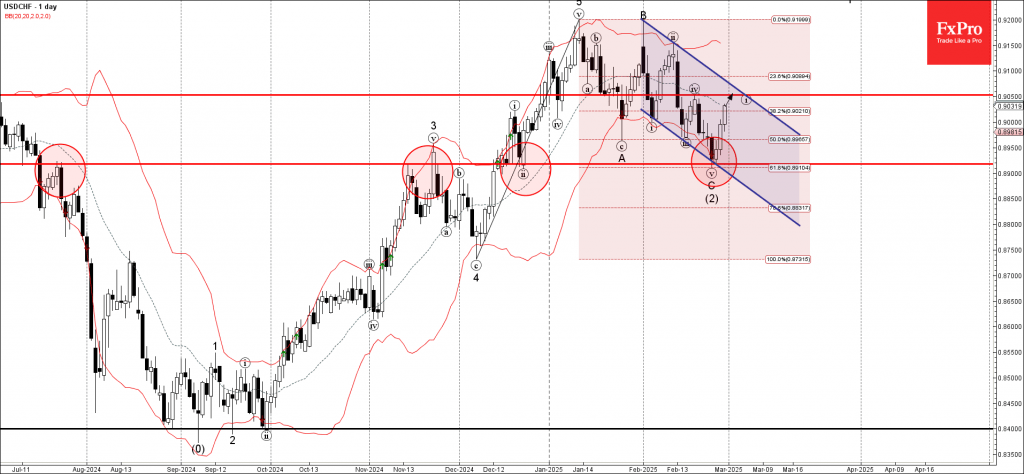

– USDCHF reversed from support zone – Likely to rise to resistance level 0.9050 USDCHF currency pair recently reversed from the support zone between the support level 0.8920 (which has been reversing the price from November), support trendline of the.

February 28, 2025

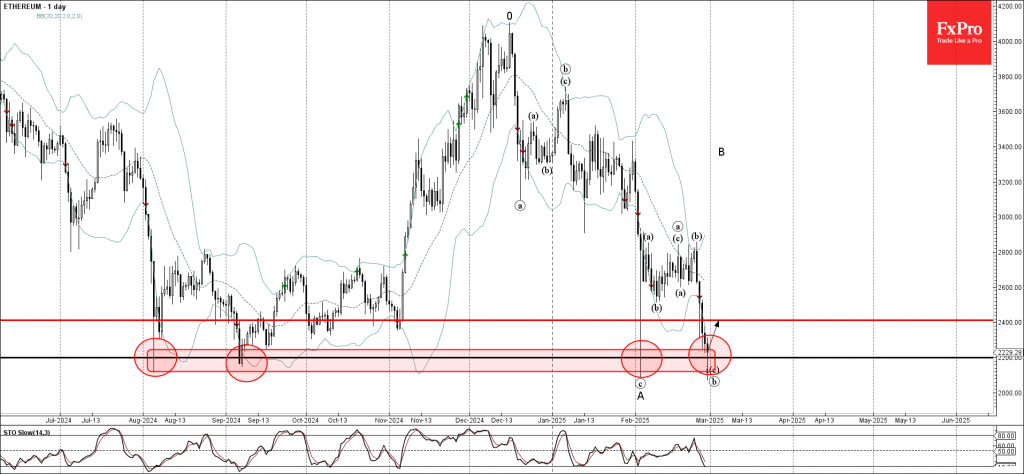

– Ethereum reversed from support zone – Likely to rise to resistance level 2400.00 Ethereum recently reversed from the support zone between the major long-term support level 2200.00 (which has been reversing the price from August) and the lower daily.

February 28, 2025

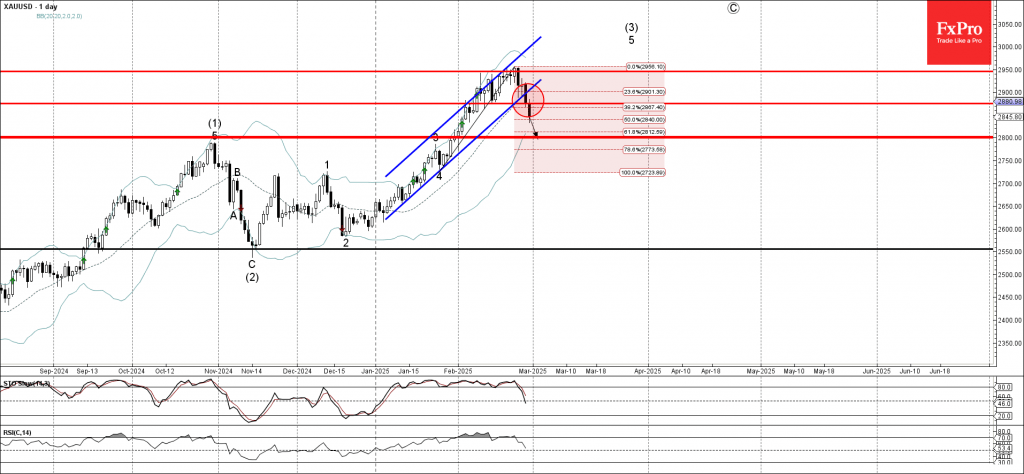

– Gold broke the support zone – Likely to fall support level 2800.00 Gold recently broke the support zone between the key support level 2875.00 (which has been reversing the price from the start of February), the support trendline of.

February 28, 2025

– Ferrari reversed from round resistance level 500.00 – Likely to fall support level 440.00 Ferrari recently reversed down from the resistance zone between the round resistance level 500.00 (previous yearly high from 2024) and the upper weekly Bollinger Band..

February 28, 2025

– S&P 500 index broke support zone – Likely to fall support level 5800.00 S&P 500 index recently broke the support zone between the key support level 5925.00 (low of the previous waves a and c), the support trendline of.