Technical analysis - Page 74

March 17, 2025

EURNZD: ⬇️ Sell – EURNZD reversed from long-term resistance level 1.9160 – Likely to fall to support level 1.8640 EURNZD currency pair recently reversed down from the long-term resistance level 1.9160, which stopped the sharp weekly uptrend at the start.

March 17, 2025

AUDUSD: ⬆️ Buy – AUDUSD broke resistance level 0.6350 – Likely to rise to resistance level 0.6400 AUDUSD currency pair today broke the resistance level 0.6350, which is the top of the previous upward correction from the start of this.

March 17, 2025

Market Picture The crypto market is consolidating in the $2.70 trillion area, near the bottom of the trading range of the last several days. This makes one wary of the near future. Technically, the market is consolidating under its 200-day.

March 14, 2025

USDCAD: ⬇️ Sell – USDCAD reversed from key resistance level 1.4500 – Likely to fall to support level 1.4300 USDCAD currency pair recently reversed from the key resistance level 1.4500, which has been reversing the price since the middle of.

March 14, 2025

Solana: ⬆️ Buy – Solana reversed from the long-term support level 113.75 – Likely to rise to the resistance level 130.60 Solana cryptocurrency recently reversed from the major long-term support level 113.75, which has been reversing the price from last.

March 14, 2025

Adobe: ⬇️ Sell – Adobe broke round support level 400.00 – Likely to fall to support level 360.00 Adobe recently broke with the sharp downward gap the round support level 400.00, which stopped wave 5 of the previous impulse wave.

March 14, 2025

Apple: ⬇️ Sell – Apple broke support area – Likely to fall to support level 200.00 Apple recently broke the support area between the strong support level 220.00 (which has been reversing the price from October) and the 61.8% Fibonacci.

March 14, 2025

Gold: ⬆️ Buy – Gold broke resistance level 2962.00 – Likely to rise to resistance level 3000.00 Gold rose sharply after breaking above the resistance level 2962.00 (top of the previous sharp upward impulse wave 3 from the end of.

March 14, 2025

EURGBP: ⬇️ Sell – EURGBP reversed from key resistance level 0.8450 – Likely to fall to support level 0.8340 EURGBP currency pair recently reversed down with the daily Shooting Star from the resistance area between the key resistance level 0.8450.

March 13, 2025

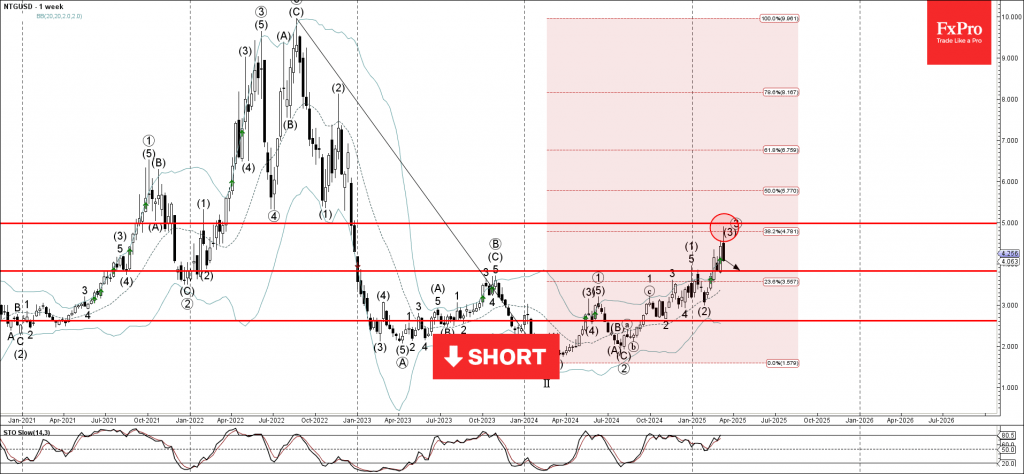

Natural gas: ⬇️ Sell – Natural gas reversed from round resistance level 5.0000 – Likely to fall to support level 3.815 Natural gas recently reversed from the resistance area between the round resistance level 5.0000, the upper weekly Bollinger Band.

March 13, 2025

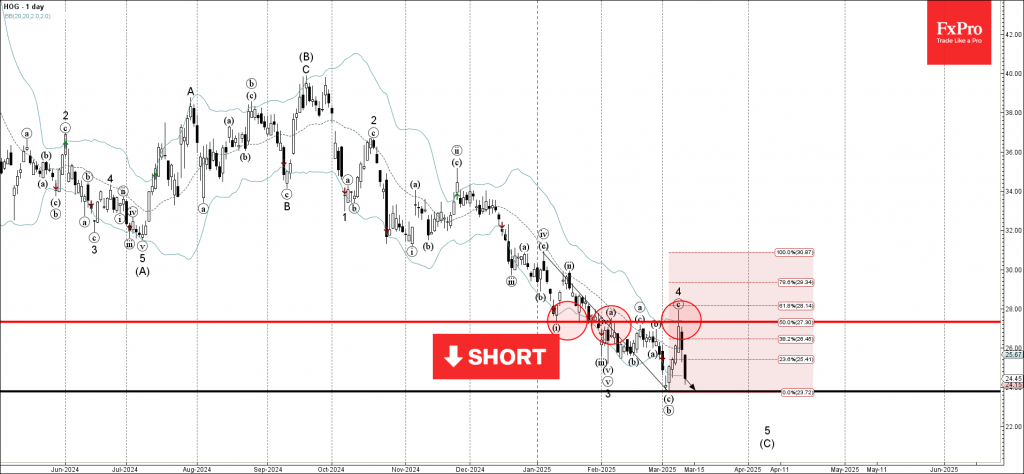

Harley-Davidson: ⬇️ Sell – Harley-Davidson reversed from resistance level 27.35 – Likely to fall to support level 23.80 Harley-Davidson recently reversed from the resistance area between the key resistance level 27.35 (former double bottom from January), upper daily Bollinger Band.