Technical analysis - Page 68

April 28, 2025

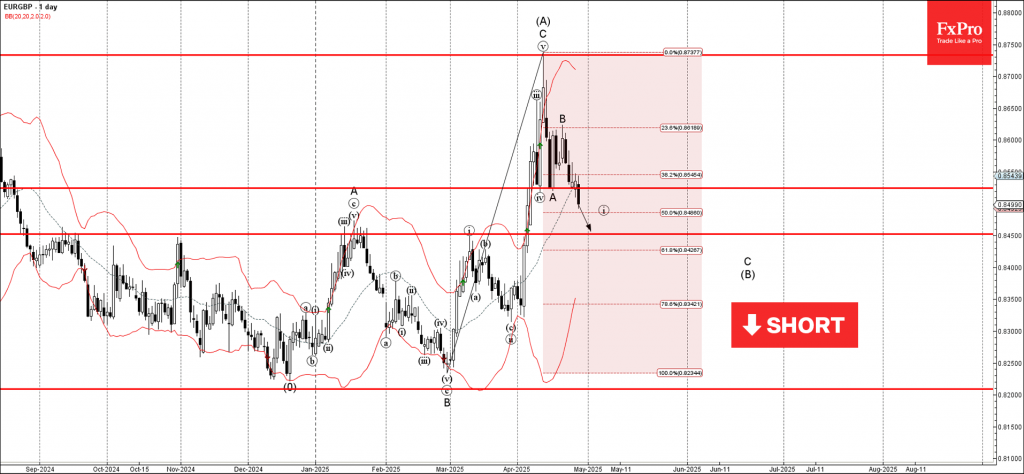

EURGBP: ⬇️ Sell – EURGBP broke support area – Likely to fall to support level 0.8450 EURGBP currency pair recently broke the support area between the key support level 0.8525 (which stopped the previous waves iv and A) and the.

April 28, 2025

EURJPY: ⬇️ Sell – EURJPY reversed from resistance area – Likely to fall to support level 161.25 EURJPY currency pair recently reversed down from the resistance area between the resistance level 164.00 (which has been reversing the price from January),.

April 25, 2025

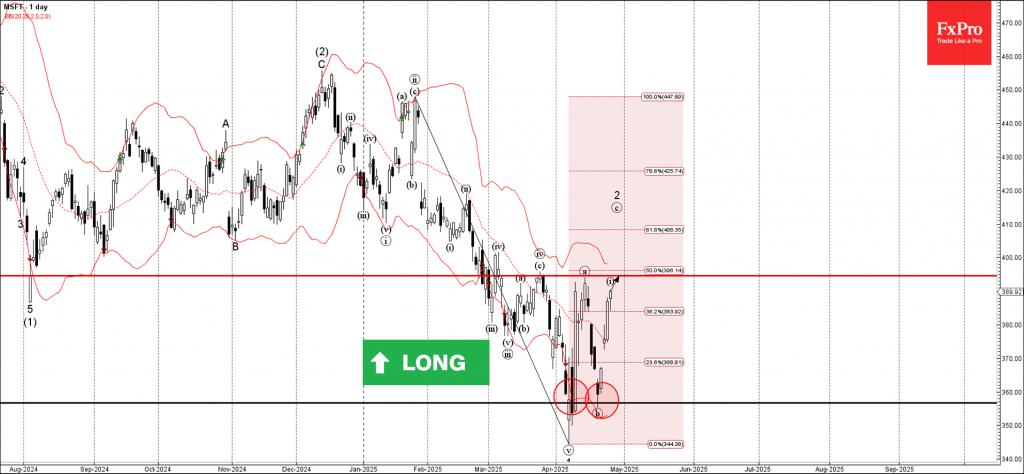

Microsoft: ⬆️ Buy – Microsoft rising inside impulse wave i – Likely to test resistance level 394.60 Microsoft continues to rise inside the minor impulse wave i which started earlier from the support area between the key support level 356.75.

April 25, 2025

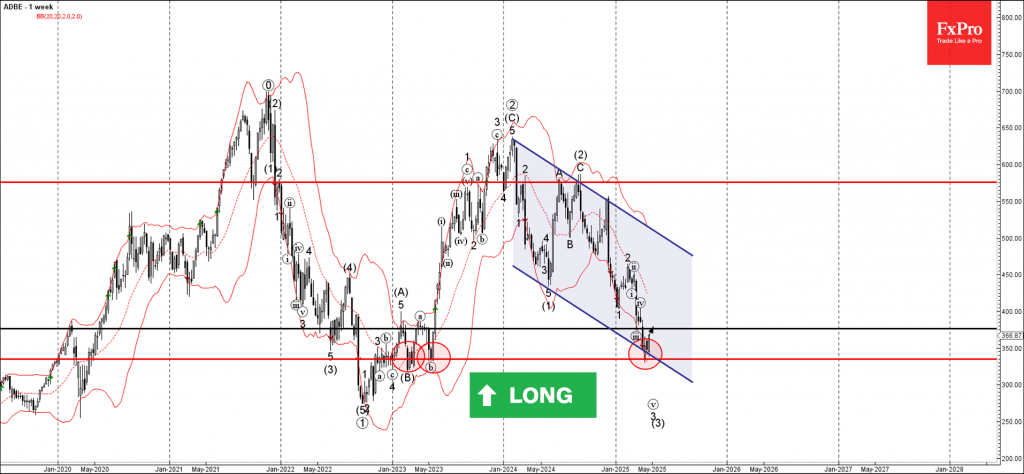

Adobe: ⬆️ Buy – Adobe reversed from the support zone – Likely to rise to the resistance level 376.40 Adobe recently reversed sharply from the support area between the key support level 335.00 (which has been reversing the price from.

April 25, 2025

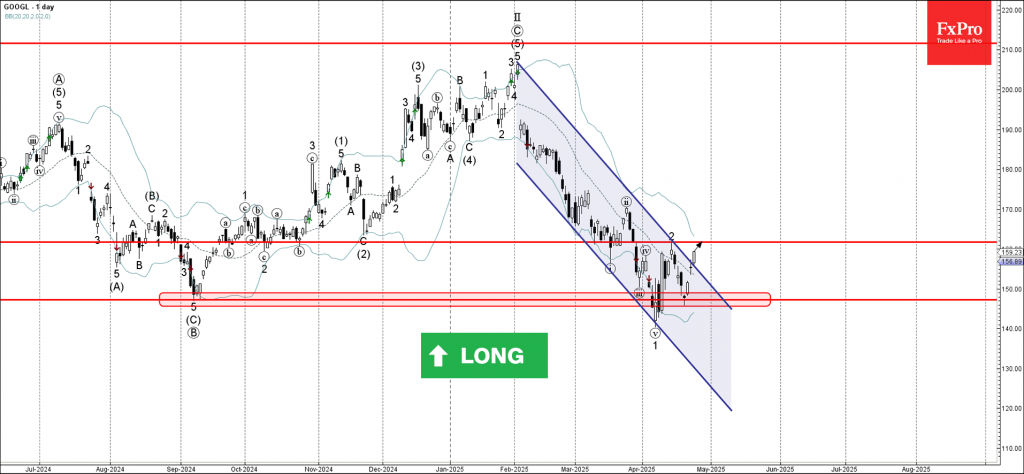

Google: ⬆️ Buy – Google reversed from the support zone – Likely to rise to the resistance level 161.75 Google recently reversed sharply from the support zone between the long-term support level 147.30 (which has been reversing the price from.

April 25, 2025

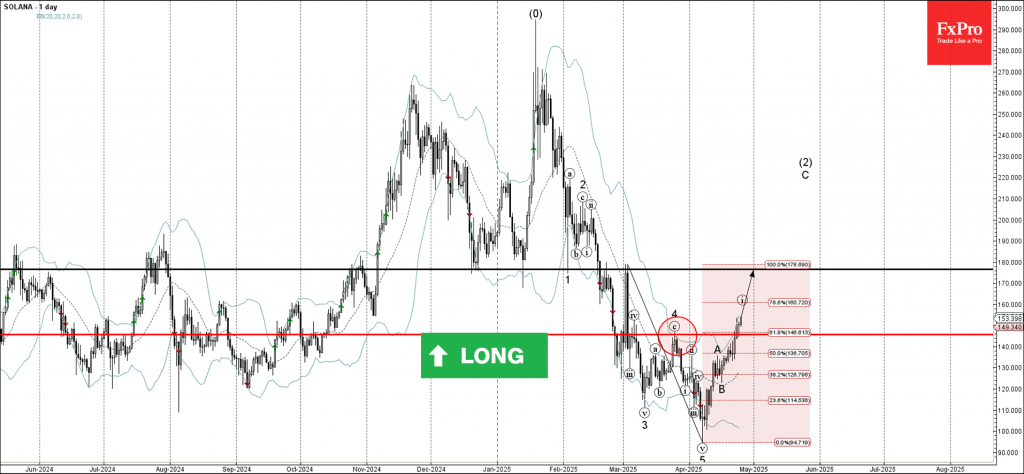

Solana: ⬆️ Buy – Solana broke resistance zone – Likely to rise to resistance level 176.45 Solana cryptocurrency recently broke the resistance zone between the key resistance level 145.75 (top of the previous correction A from March) and the 61.8%.

April 25, 2025

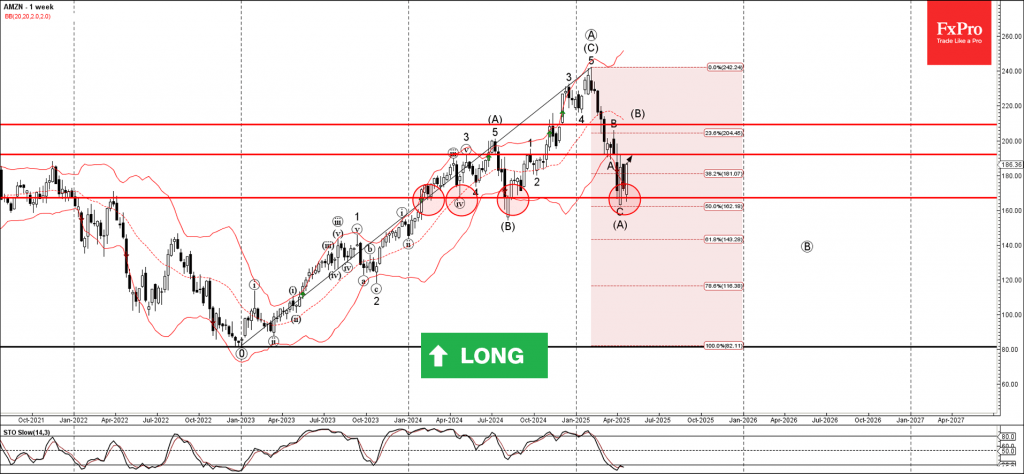

Amazon: ⬆️ Buy – Amazon reversed from support zone – Likely to rise to resistance level 192.00 Amazon recently reversed up sharply from the powerful support zone between strong support level 167.00 (which has been reversing the price from the.

April 25, 2025

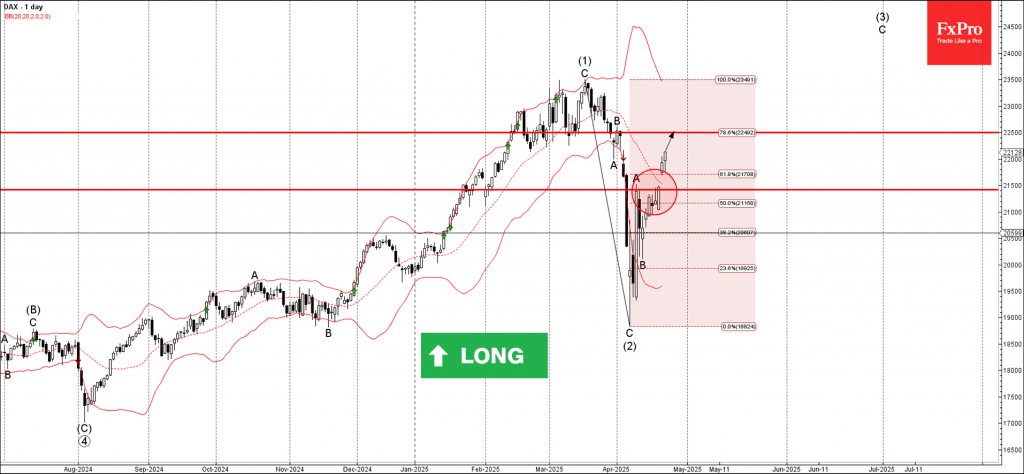

DAX: ⬆️ Buy – DAX broke resistance area – Likely to rise to resistance level 22500.00 DAX index is under the bullish pressure after it broke the resistance area between resistance level 21500.00 (top of the previous correction A) and.

April 25, 2025

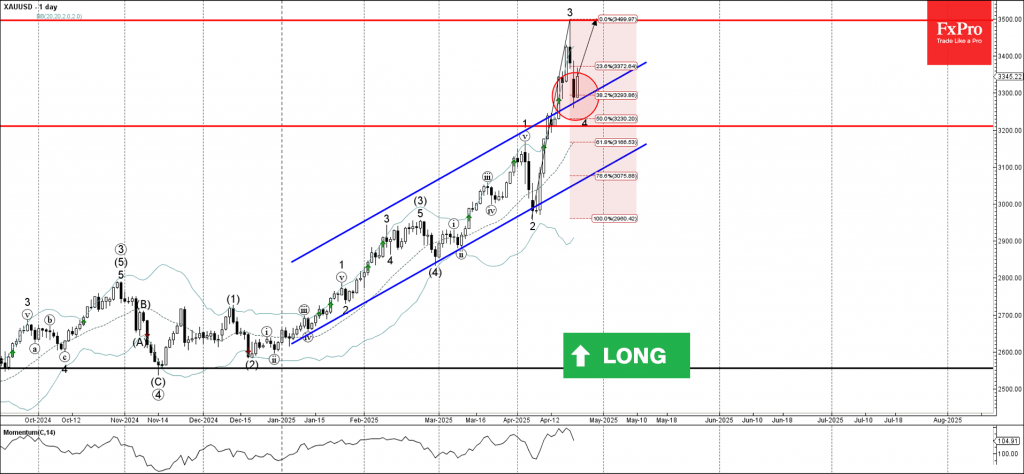

Gold: ⬆️ Buy – Gold reversed from support area – Likely to rise to resistance level 3500.00 Gold recently reversed up from the support area between the upper trendline of the daily up channel from January and the 38.2% Fibonacci.

April 25, 2025

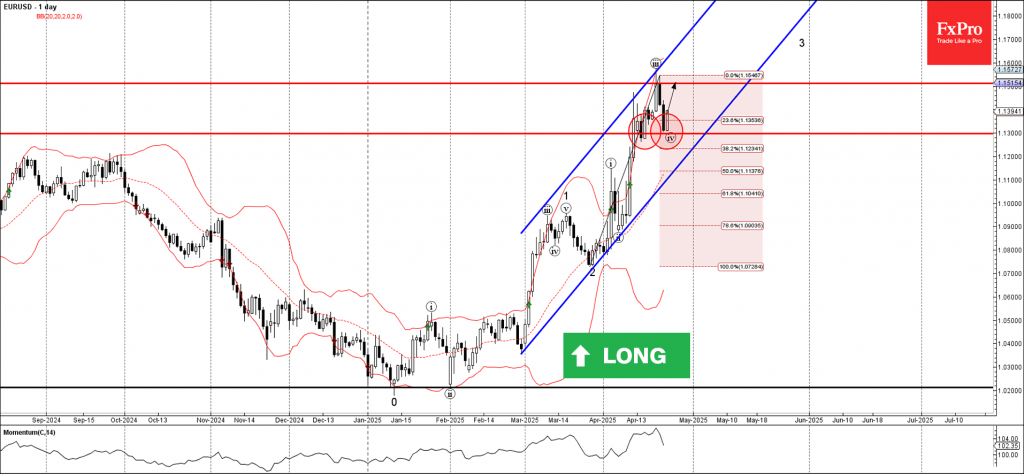

EURUSD: ⬆️ Buy – EURUSD reversed from support area – Likely to rise to resistance level 1.1510 EURUSD currency pair recently reversed up from the support area between the key support level 1.1300 (which also reversed the price at the.

April 24, 2025

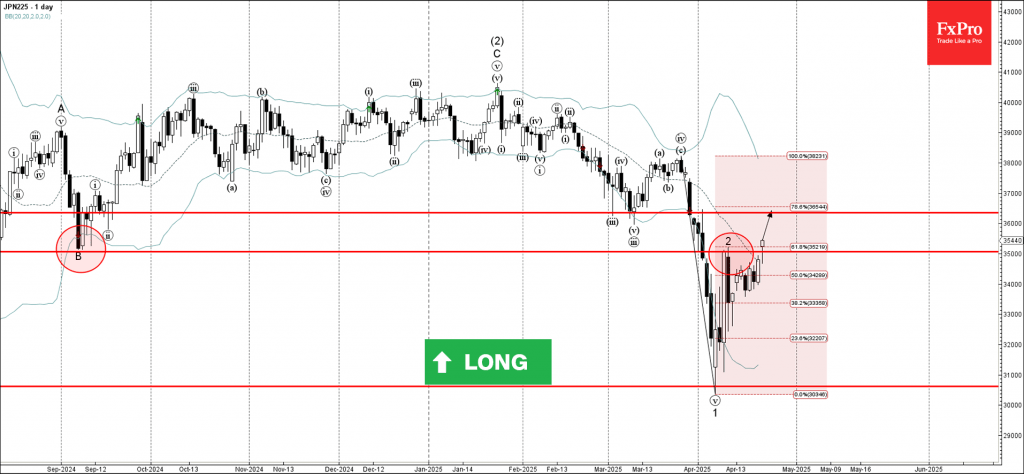

Nikkei 225: ⬆️ Buy – Nikkei 225 broke the resistance area – Likely to rise to resistance level 36355.00 Nikkei 225 index recently broke the resistance area between the pivotal resistance level 35000.00 (which stopped the previous correction 2, former.