Technical analysis - Page 66

April 18, 2025

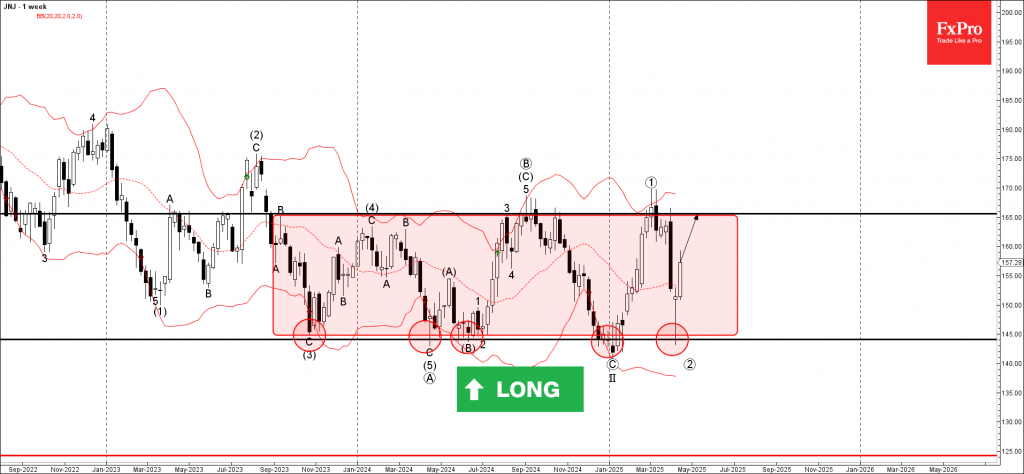

Johnson & Johnson: ⬆️ Buy – Johnson & Johnson rising inside weekly price range – Likely to test resistance level 165.60 Johnson & Johnson continues to rise in the primary upward impulse wave 3, which started earlier from the major.

April 18, 2025

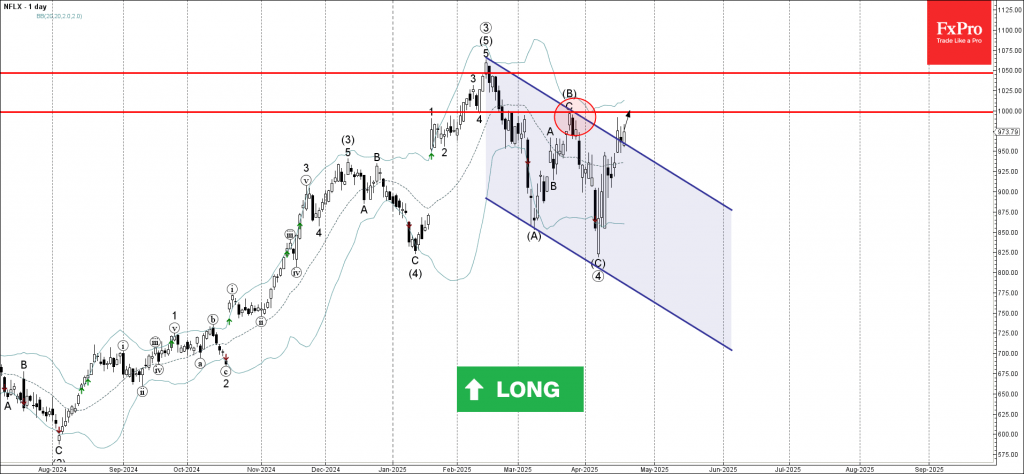

NFLX: ⬆️ Buy – NFLX broke weekly down channel – Likely to rise to resistance level 1000.00 NFLX recently broke the resistance trendline of the weekly down channel from February, which enclosed the previous primary ABC correction 4, as can.

April 18, 2025

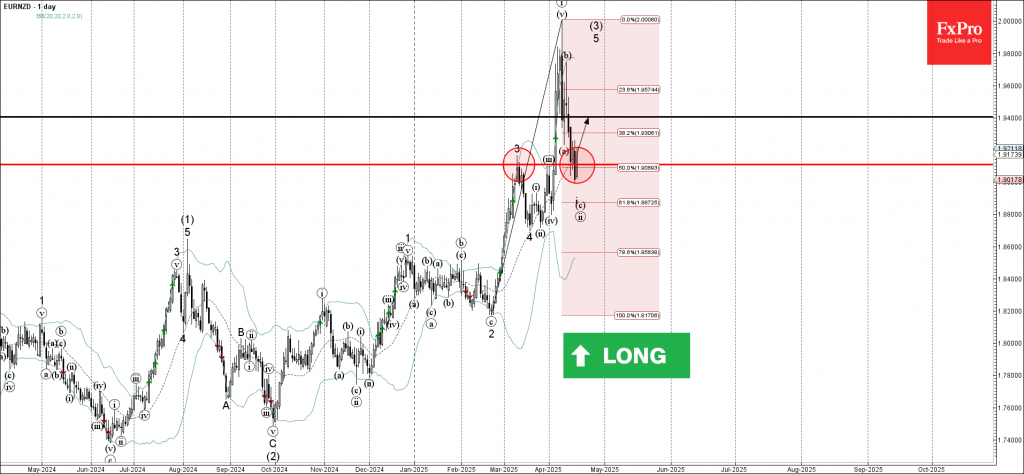

EURNZD: ⬆️ Buy – EURNZD reversed from support level 1.9100 – Likely to rise to resistance level 1.9400 EURNZD currency pair recently reversed up from the pivotal support level 1.9100 (former strong resistance from March) standing close to the 20-day.

April 18, 2025

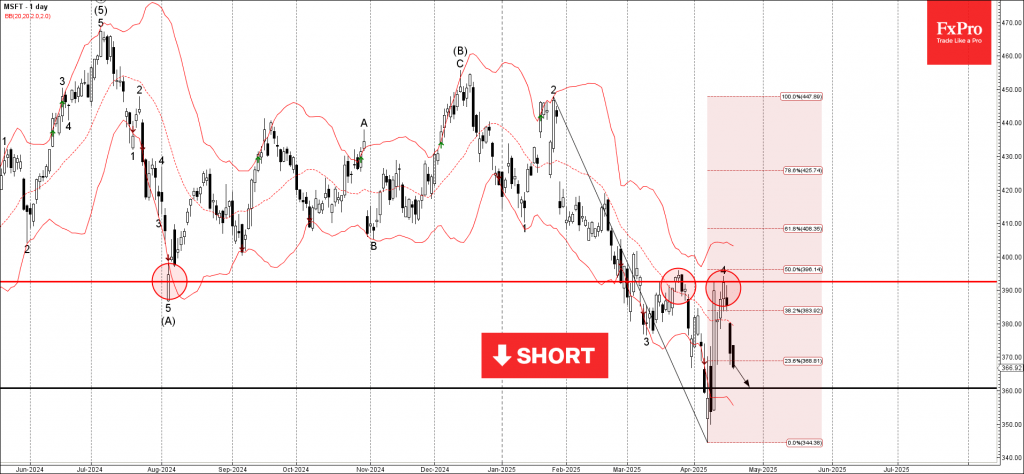

Microsoft: ⬇️ Sell – Microsoft falling inside impulse wave 5 – Likely to test support level 360.00 Microsoft continues to fall inside the minor impulse wave 5, which started recently from the key resistance level 392.50 (which also reversed the.

April 17, 2025

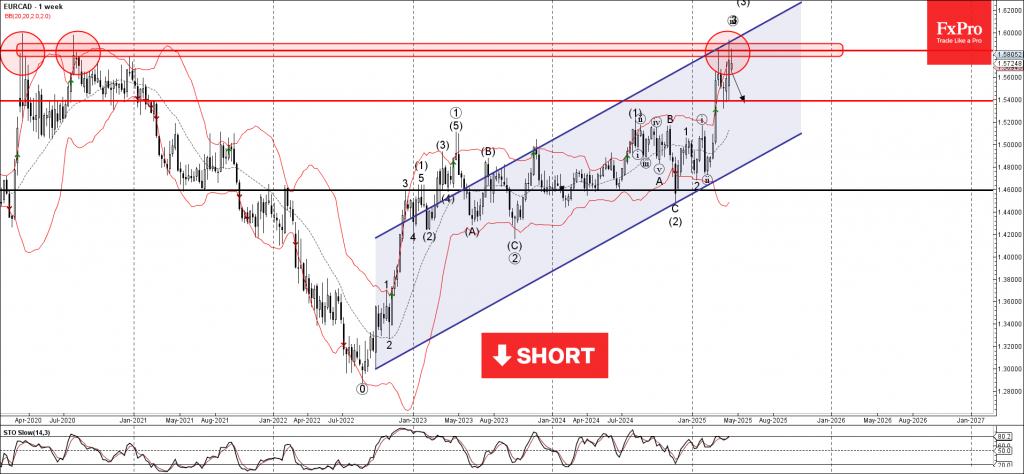

EURCAD: ⬇️ Sell – EURCAD reversed from long-term resistance level 1.5840 – Likely to fall to support level 1.5400 EURCAD currency pair recently reversed down from the long-term resistance level 1.5840 (which has been reversing the price from the start.

April 17, 2025

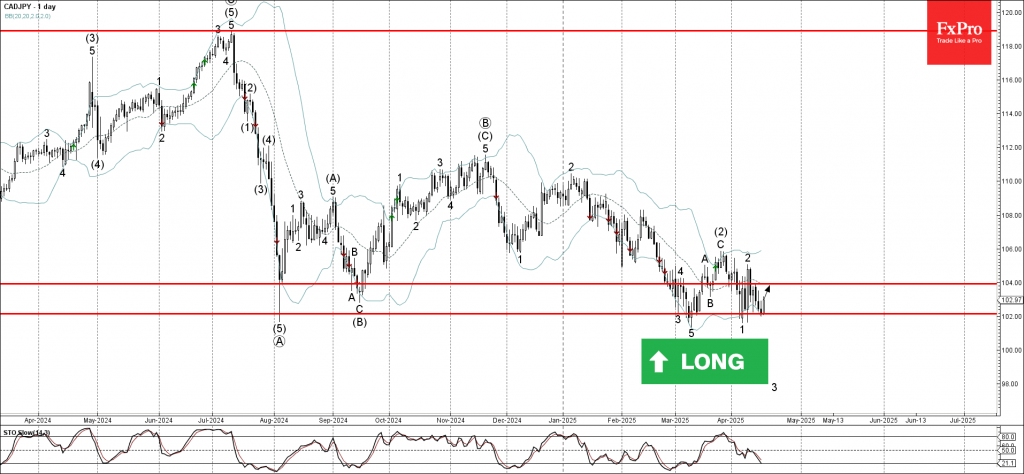

CADJPY: ⬆️ Buy – CADJPY reversed from key support level 102.00 – Likely to rise to the resistance level 104.00 CADJPY currency pair recently reversed up from the key support level 102.00 (which has been reversing the price since August.

April 17, 2025

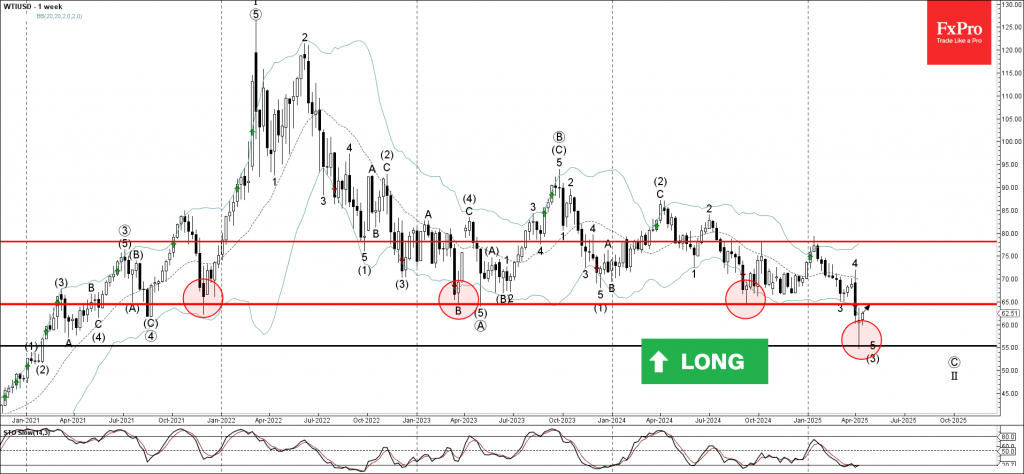

WTI crude oil: ⬆️ Buy – WTI crude oil reversed from key support level 55,00 – Likely to rise to resistance level 65.00 WTI crude oil recently reversed up from the key support level 55,00 standing close to the lower.

April 17, 2025

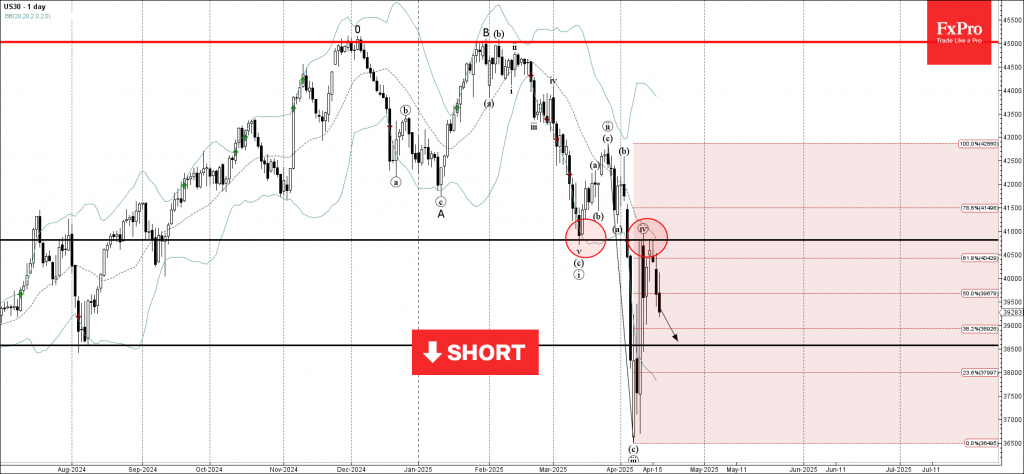

Dow Jones: ⬇️ Sell – Dow Jones reversed from the resistance zone – Likely to fall to support level 38500.00 Dow Jones index recently reversed down from the resistance zone between the resistance level 40815,00 (former strong support from the.

April 17, 2025

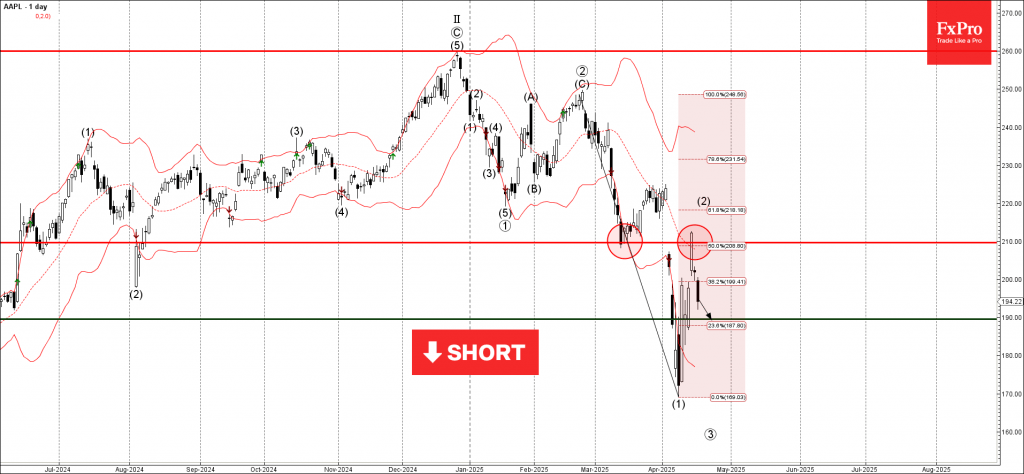

Apple: ⬇️ Sell – Apple reversed from resistance level 210.00 – Likely to fall to support level 190.00 Apple earlier reversed down from the resistance zone between the resistance level 210.00 (former support from the start of March), 20-day moving.

April 17, 2025

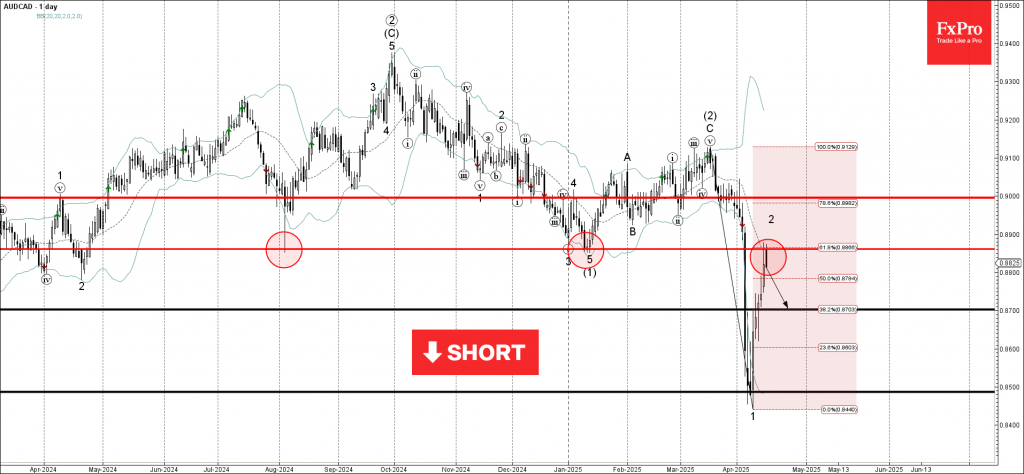

AUDCAD: ⬇️ Sell – AUDCAD reversed from resistance zone – Likely to fall to support level 0.8700 AUDCAD recently reversed down from the resistance zone between the resistance level 0.8860 (former support from August and January), 20-day moving average and.

April 16, 2025

Gold: ⬆️ Buy – Gold broke resistance zone – Likely to rise to the resistance level 3300.00 Gold recently broke the resistance zone between the resistance level 3200.00 and the resistance trendline of the daily up channel from January. The.