Technical analysis - Page 65

April 25, 2025

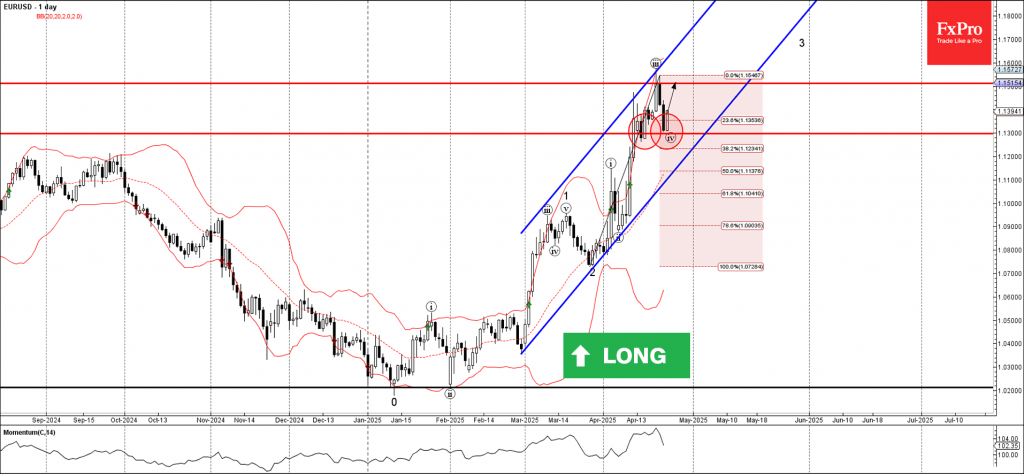

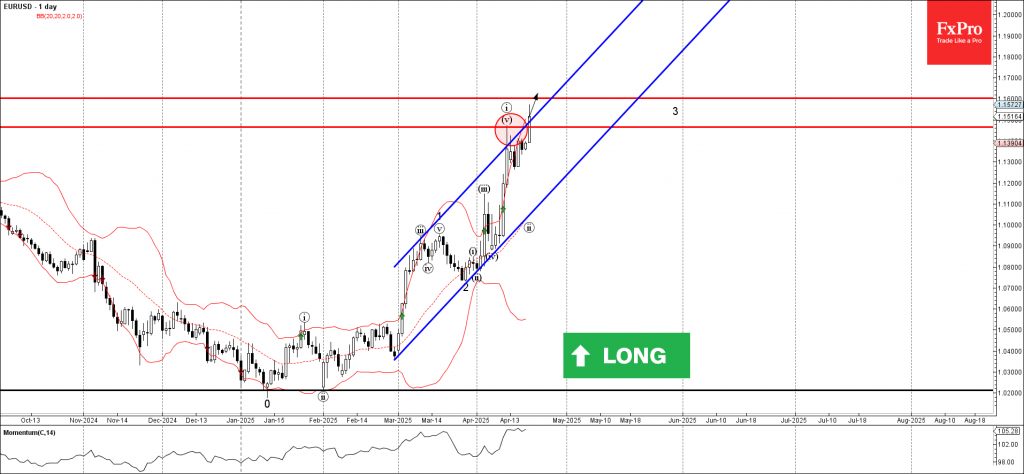

EURUSD: ⬆️ Buy – EURUSD reversed from support area – Likely to rise to resistance level 1.1510 EURUSD currency pair recently reversed up from the support area between the key support level 1.1300 (which also reversed the price at the.

April 24, 2025

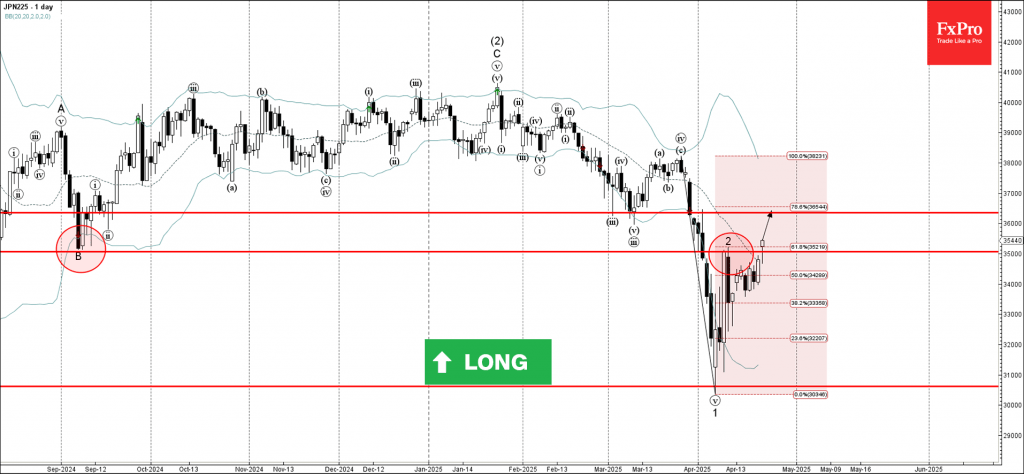

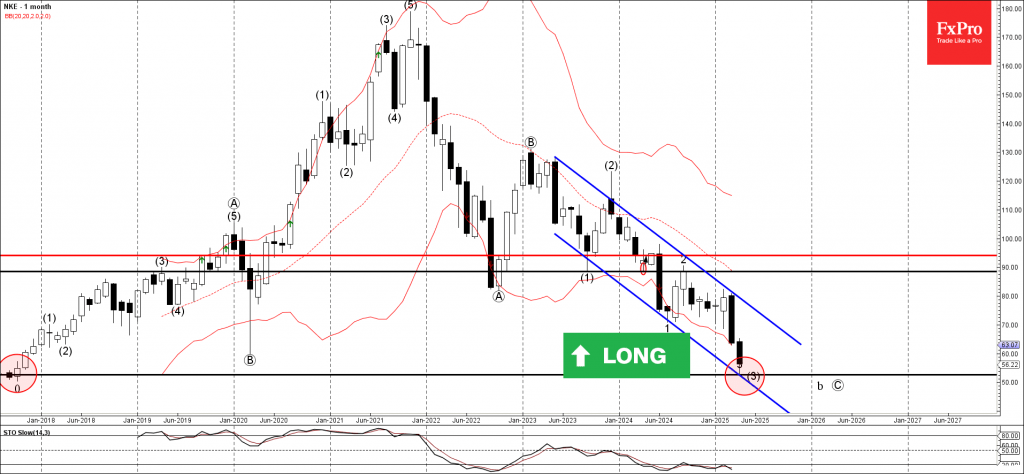

Nikkei 225: ⬆️ Buy – Nikkei 225 broke the resistance area – Likely to rise to resistance level 36355.00 Nikkei 225 index recently broke the resistance area between the pivotal resistance level 35000.00 (which stopped the previous correction 2, former.

April 24, 2025

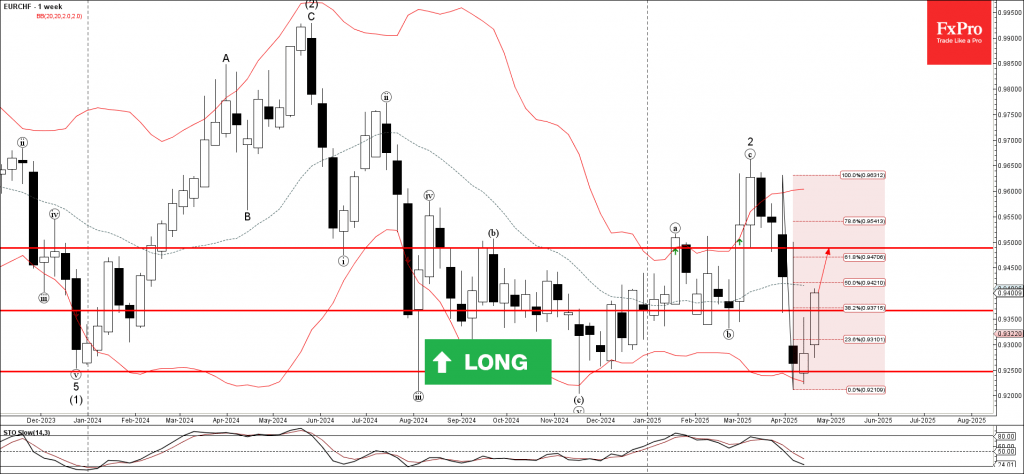

EURCHF: ⬆️ Buy – EURCHF broke the resistance area – Likely to rise to resistance level 0.9500 EURCHF currency pair recently broke the resistance area between the resistance level 0.9365 (former strong support from the start of 2025) and the.

April 23, 2025

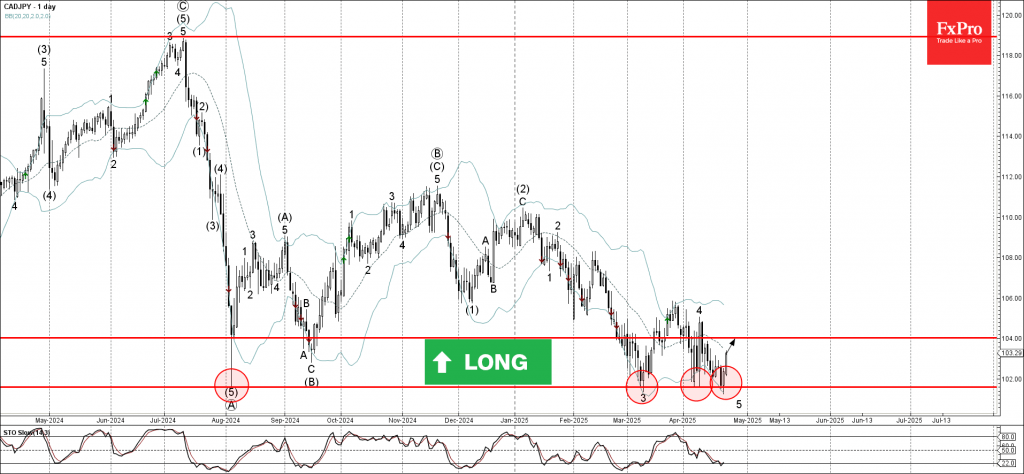

CADJPY: ⬆️ Buy – CADJPY reversed from strong support area – Likely to rise to resistance level 104.00 CADJPY currency pair recently reversed from the strong support area between the long-term support level 101.60 (which stopped the sharp downtrend in.

April 23, 2025

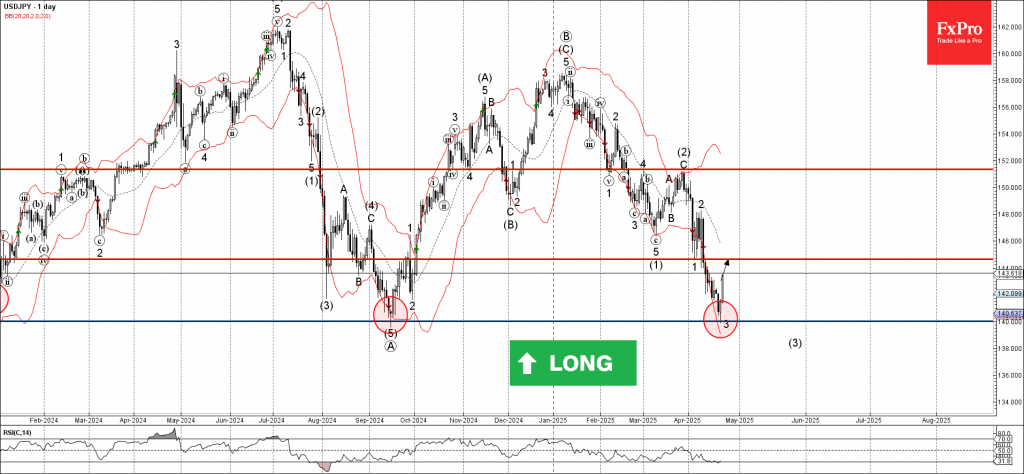

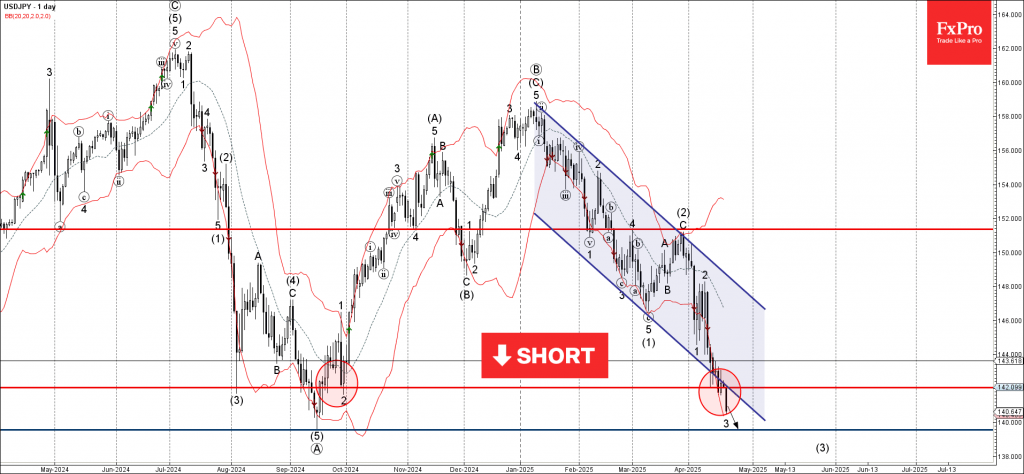

USDJPY: ⬆️ Buy – USDJPY reversed from the support area – Likely to rise to the resistance level 144.65 USDJPY currency pair recently reversed up from the support area between the long-term support level 140.00 (former multi-month low from September).

April 22, 2025

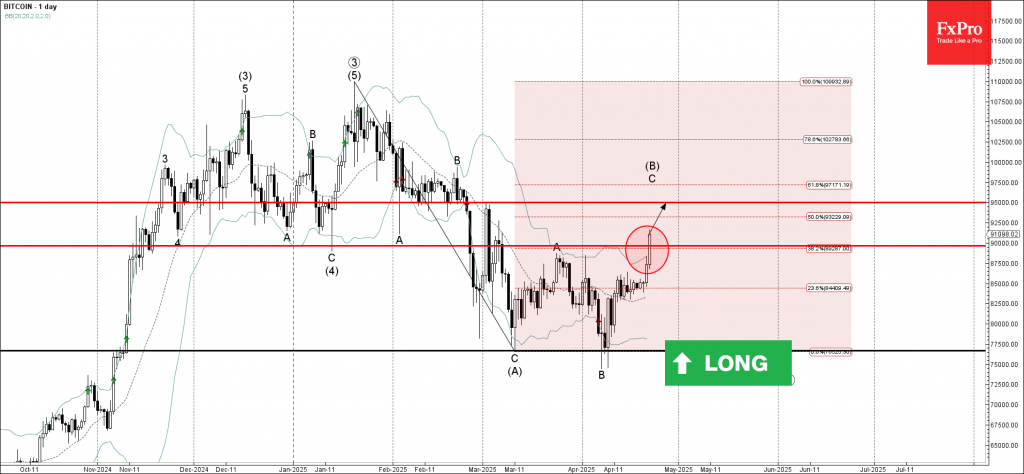

Bitcoin: ⬆️ Buy – Bitcoin broke round resistance level 90000.00 – Likely to rise to resistance level 95000.00 Bitcoin cryptocurrency today broke the resistance area between the round resistance level 90000.00 and the 38.2% Fibonacci correction of the downward wave.

April 22, 2025

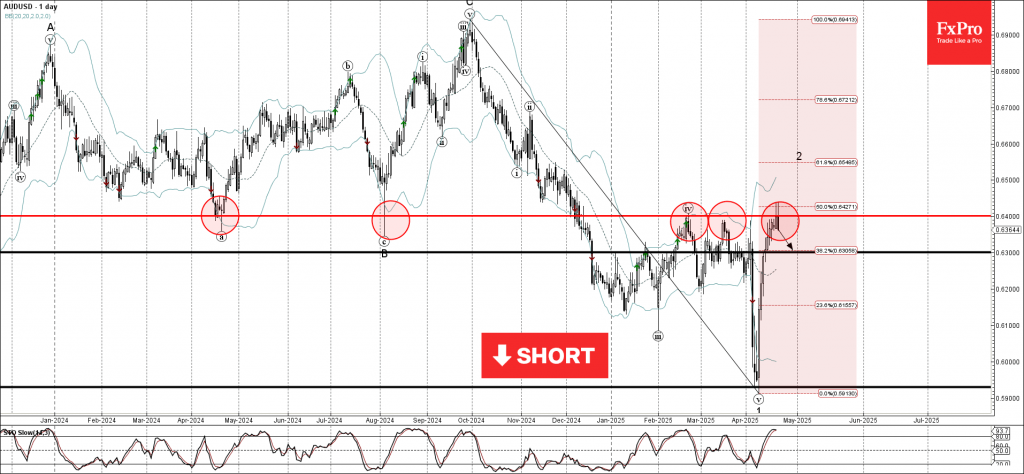

AUDUSD: ⬇️ Sell – AUDUSD reversed from the key resistance level 0.6400 – Likely to fall to support level 0.6300 AUDUSD currency pair recently reversed from the resistance area between the key resistance level 0.6400 (former major support from 2024).

April 22, 2025

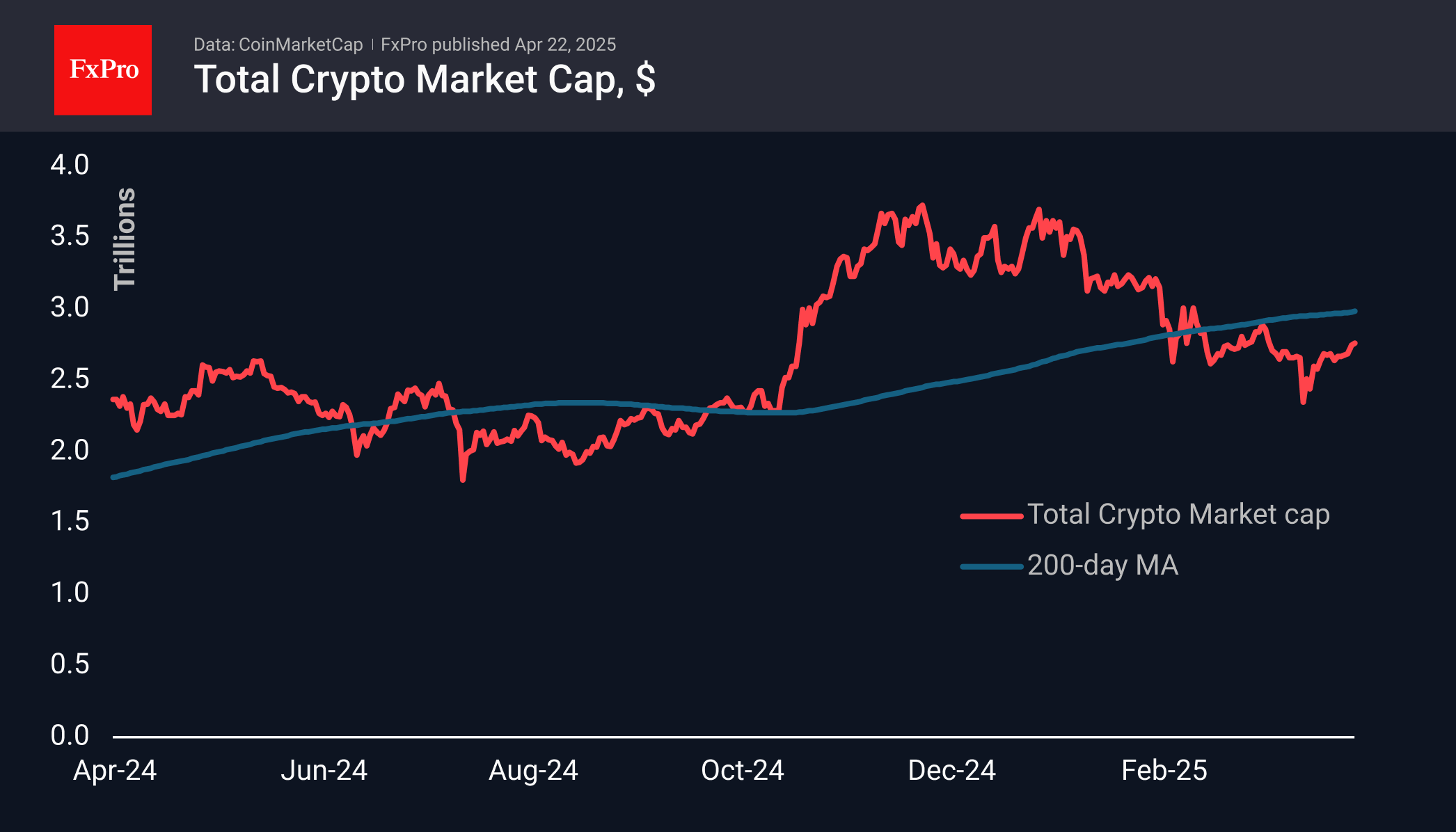

Market Overview The crypto market has gained around 2% over the past seven days, with most of the increase coming at the start of this week. With a market capitalisation of $2.76 trillion, the crypto market has reached the upper.

April 22, 2025

Nike: ⬆️ Buy – Nike reversed from the long-term support level 52.60 – Likely to rise to resistance level 60.00 Nike recently reversed from the strong support area between the long-term support level 52.60 (which has been reversing the price.

April 22, 2025

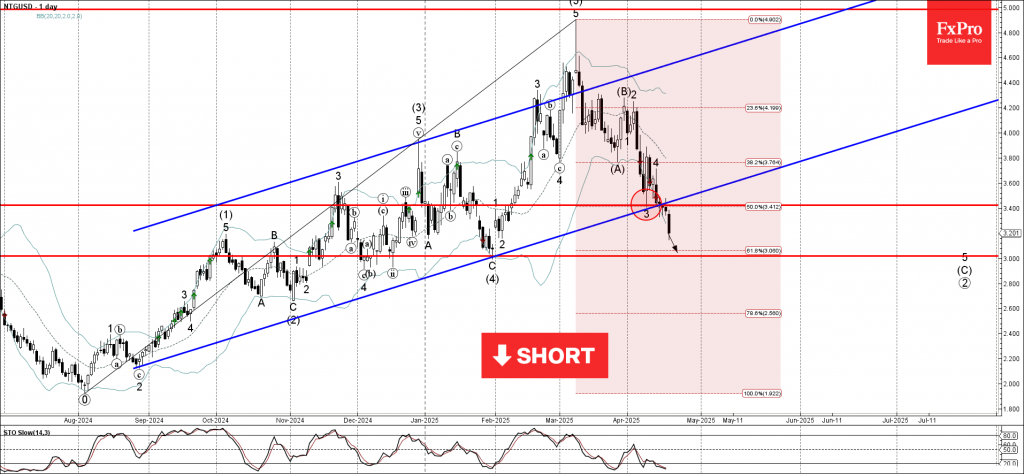

Natural gas: ⬇️ Sell Natural gas recently broke the support area between the support trendline of the weekly up-channel from last August, support level 3.4 and the 50% Fibonacci correction of the daily uptrend from August. The breakout of this.

April 21, 2025

EURUSD: ⬆️ Buy – EURUSD broke the resistance area – Likely to test resistance level 1.1600 EURUSD currency pair recently broke the resistance area between the resistance trendline of the daily up channel from the end of February and the.