Technical analysis - Page 63

May 1, 2025

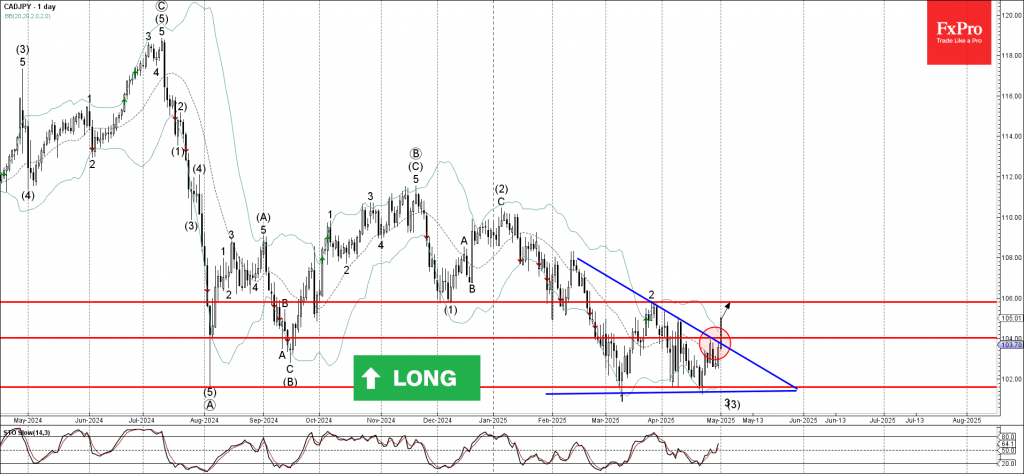

CADJPY: ⬆️ Buy – CADJPY broke the resistance zone – Likely to rise to resistance level 106.00 CADJPY currency pair recently broke the resistance zone between the resistance level 104.00 and the resistance trendline of the Descending Triangle from February..

May 1, 2025

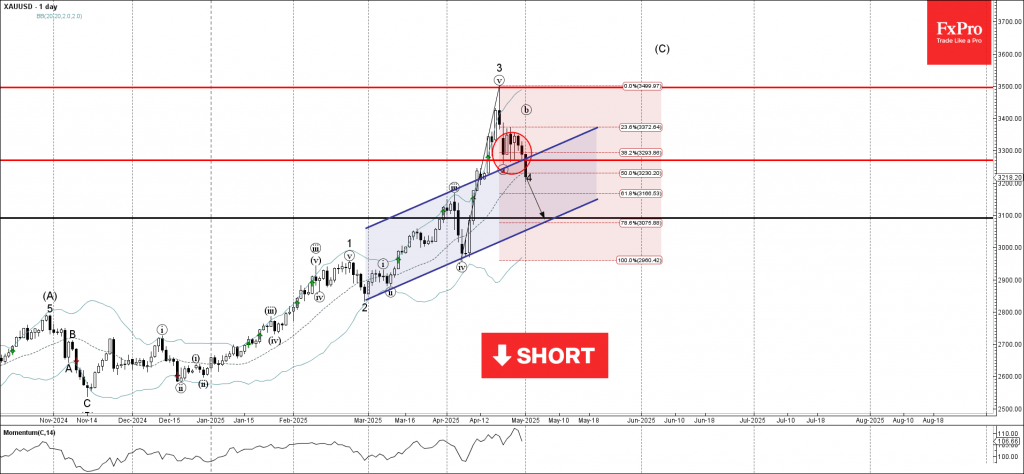

Gold: ⬇️ Sell – Gold broke support zone – Likely to fall to support level 3100.00 Gold recently broke the support zone between the support level 3270.00 (former low of wave a from the middle of April), upper trendline of.

May 1, 2025

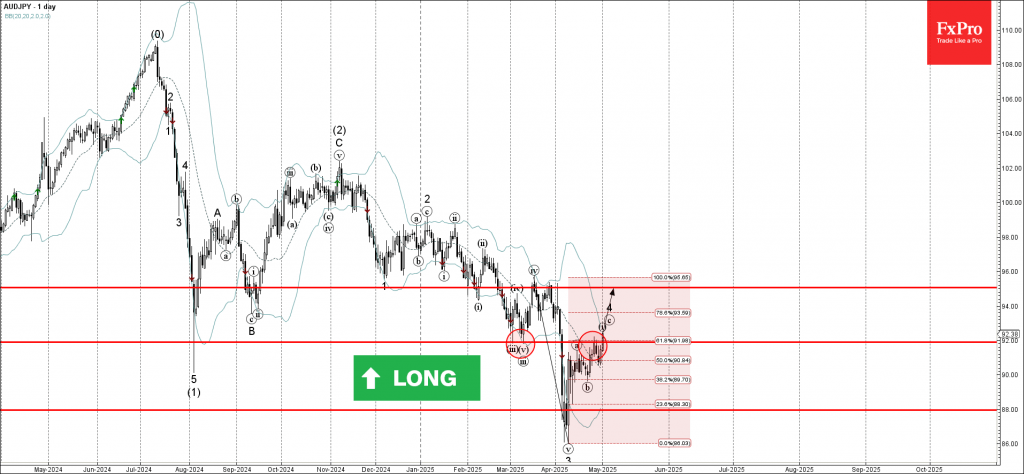

AUDJPY: ⬆️ Buy – AUDJPY broke the resistance zone – Likely to rise to resistance level 95.00 AUDJPY currency pair recently broke the resistance zone between the resistance level 92.00 (former strong support from the start of March and the.

May 1, 2025

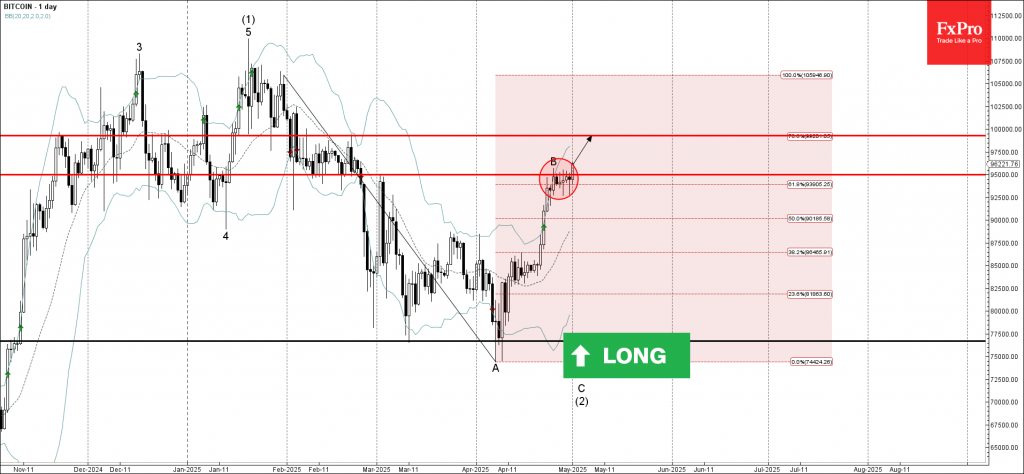

Bitcoin: ⬆️ Buy – Bitcoin broke key resistance level 95000.00 – Likely to rise to resistance level 99300.00 Bitcoin cryptocurrency recently broke the resistance zone between the key resistance level 95000.00 (which stopped the previous wave B at the end.

May 1, 2025

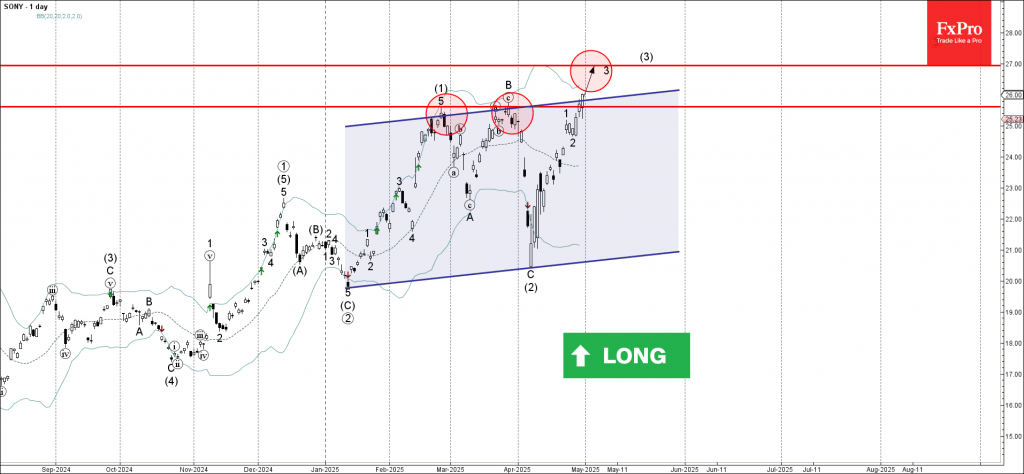

Sony: ⬆️ Buy – Sony broke resistance zone – Likely to rise to resistance level 27.00 Sony recently broke the resistance zone between the resistance level 25.60 (which stopped the previous waves (1) and B) intersecting with the resistance trendline.

May 1, 2025

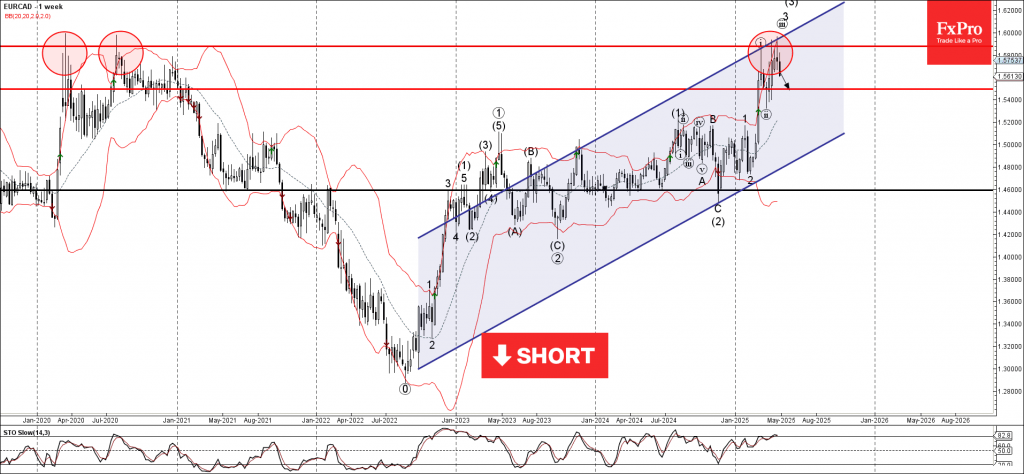

EURCAD: ⬇️ Sell – EURCAD reversed from resistance level 1.5880 – Likely to fall to support level 1.5495 EURCAD currency pair recently reversed down from the pivotal resistance level 1.5880 (which has been reversing the price from the start of.

April 30, 2025

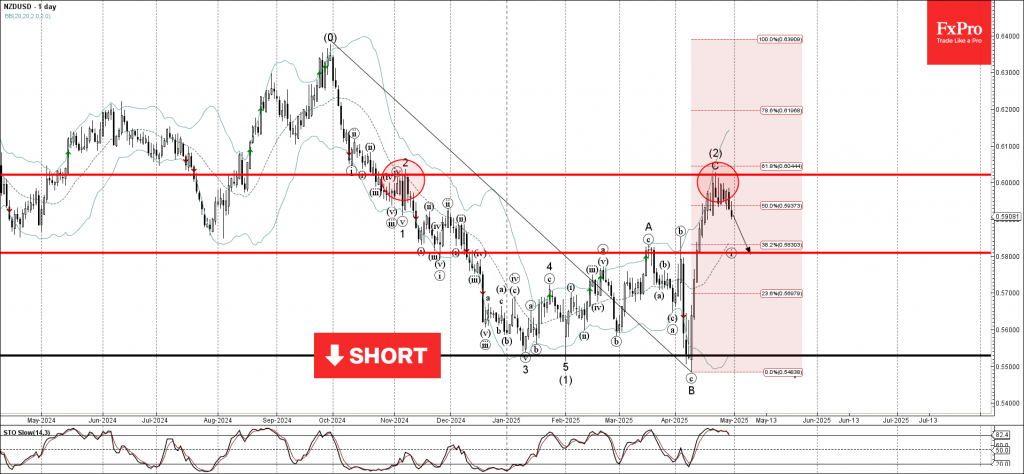

NZDUSD: ⬇️ Sell – NZDUSD reversed from the resistance level 0.6020 – Likely to fall to support level 0.5800 NZDUSD currency pair recently reversed down from the pivotal resistance level 0.6020 (former top of wave 2 from November) intersecting with.

April 30, 2025

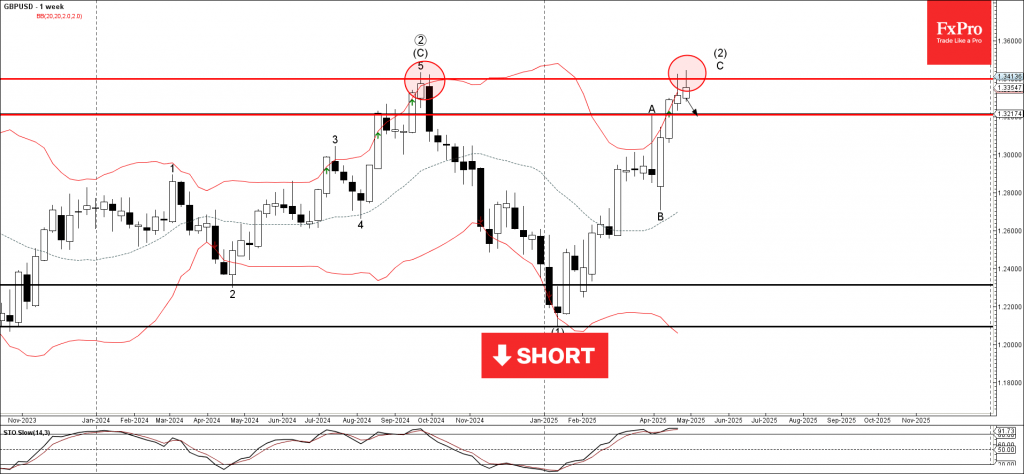

GBPUSD: ⬇️ Sell – GBPUSD reversed from the long-term resistance level 1.3430 – Likely to fall to support level 1.3200 GBPUSD currency pair recently reversed down from the long-term resistance level 1.3430 (previous yearly high from last year) standing close.

April 30, 2025

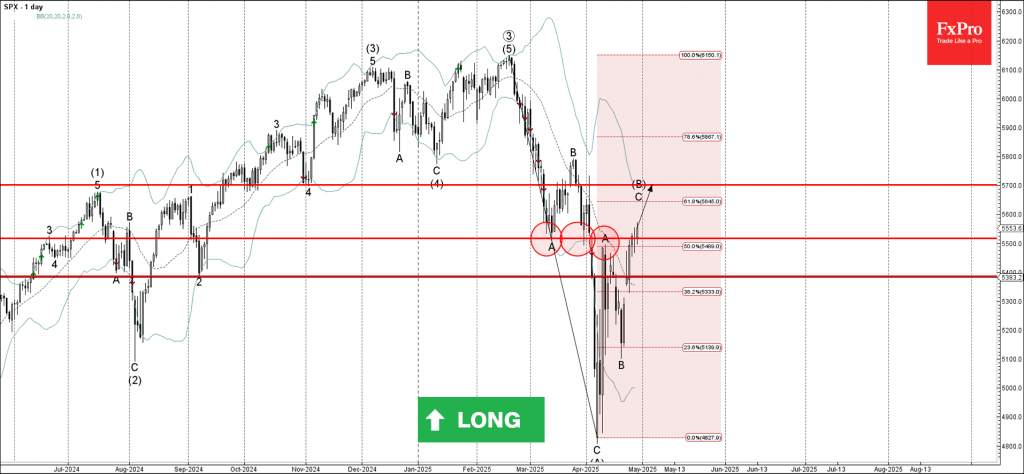

S&P 500 index: ⬆️ Buy – S&P 500 index broke key resistance level 5500.00 – Likely to rise to resistance level 5700.00 S&P 500 index recently broke the key resistance level 5500.00 (former support from March, which also stopped A-wave.

April 30, 2025

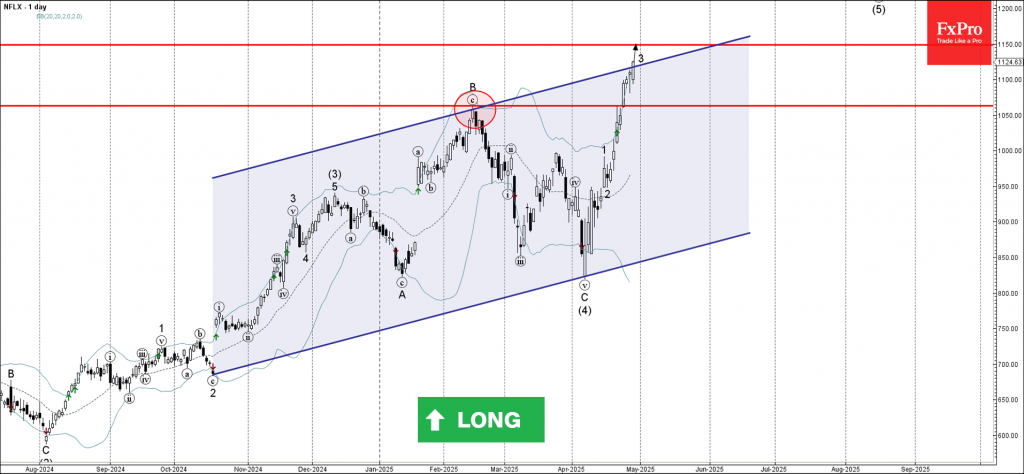

Netflix : ⬆️ Buy – Netflix broke key resistance level 1063.40 – Likely to rise to resistance level 1150.00 Netflix recently broke the key resistance level 1063.40 (former multi-month high from February, which stopped the B-wave of the previous ABC correction (B)). The.

April 29, 2025

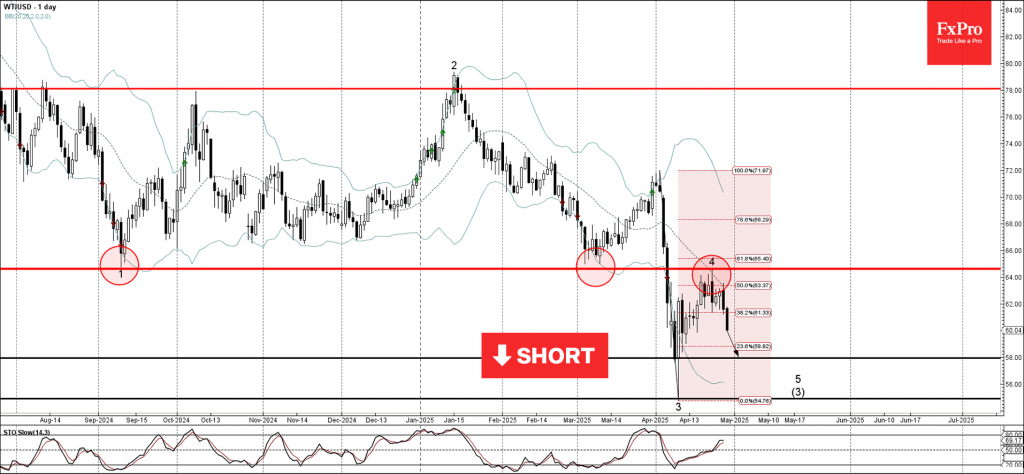

WTI: ⬇️ Sell – WTI reversed from the resistance area – Likely to fall to support level 58.00 WTI crude oil recently reversed from the resistance area between the resistance level 64.60 (former multi-month low from September 2024), the 20-day.