Technical analysis - Page 62

May 7, 2025

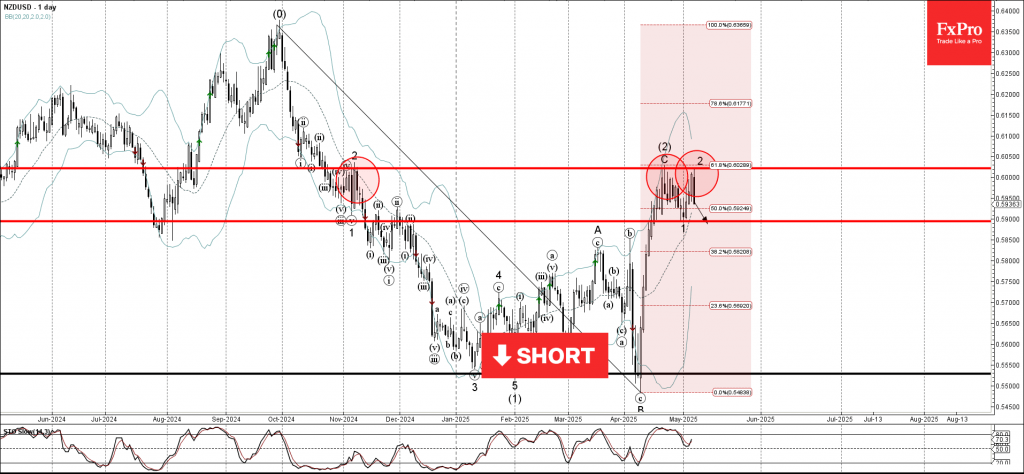

NZDUSD: ⬇️ Sell – NZDUSD reversed from the resistance zone – Likely to fall to support level 0.5900 NZDUSD currency pair recently reversed down from the resistance zone between the key resistance level 0.6020 (which has been reversing the price.

May 7, 2025

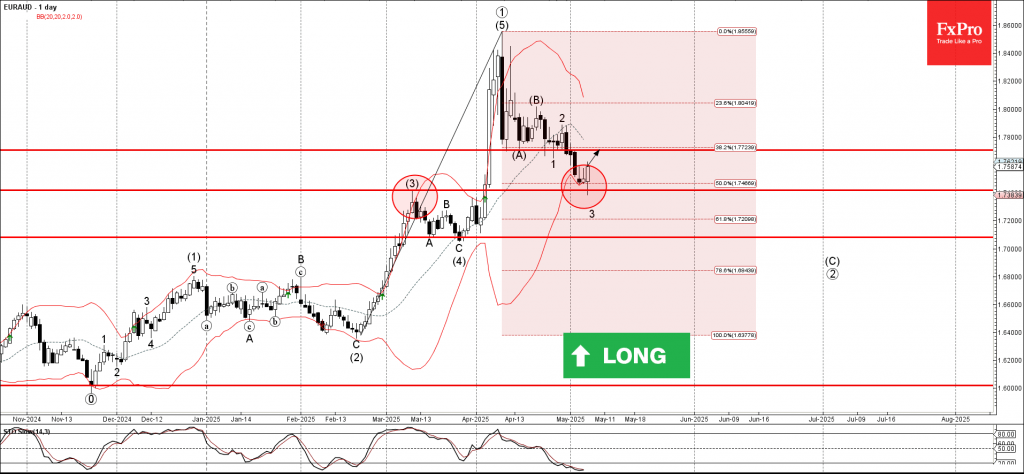

EURAUD: ⬆️ Buy – EURAUD reversed from the support zone – Likely to rise to resistance level 1.7700 EURAUD currency pair recently reversed from the support zone between the support level 1.7415 (former resistance from the start of March), the.

May 7, 2025

DAX: ⬇️ Sell – DAX reversed from key resistance level 23435,00 – Likely to fall to support level 22700.00 DAX index recently reversed down from the key resistance level 23435,00 (which stopped the previous impulse wave (1) in the middle.

May 7, 2025

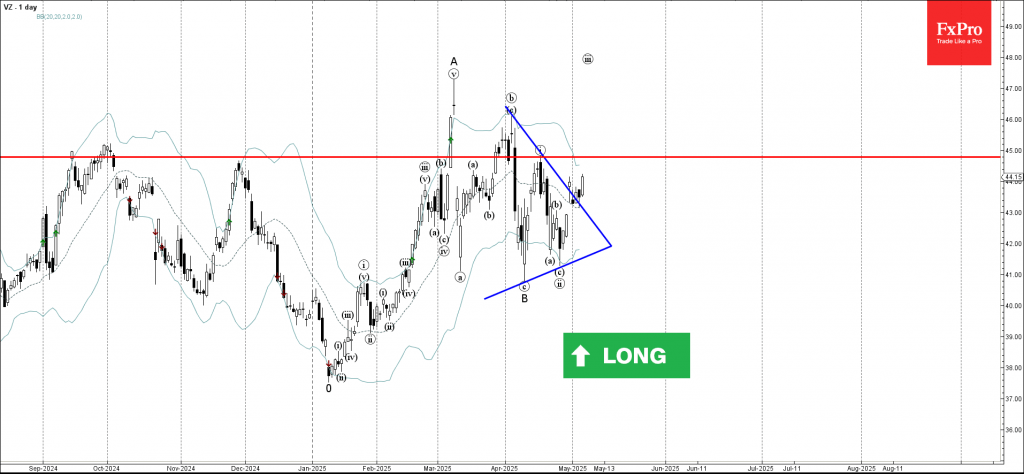

Verizon: ⬆️ Buy – Verizon broke daily Triangle – Likely to rise to resistance level 44.80 Verizon recently broke the resistance trendline of the daily Triangle from the start of April (which has enclosed the previous waves B, i and ii). The.

May 6, 2025

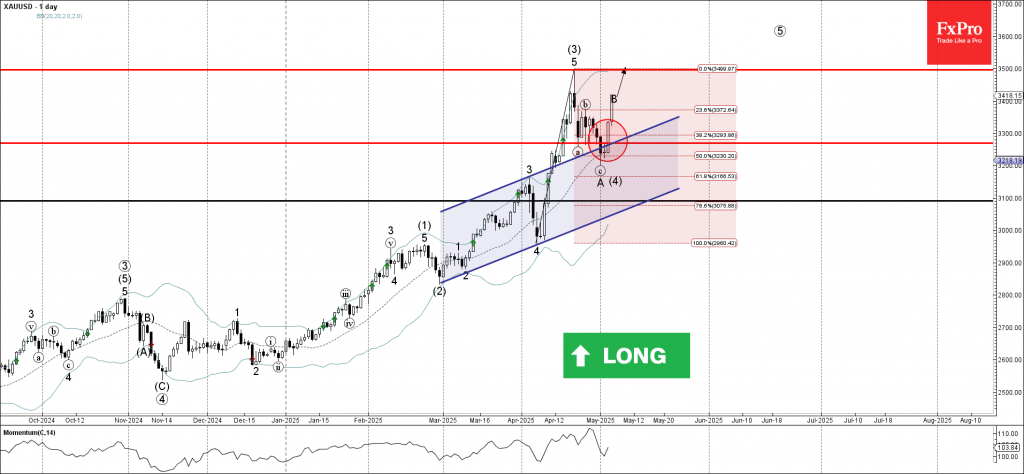

Gold: ⬆️ Buy – Gold reversed from support level 3270,00 – Likely to rise to resistance level 3500.00 Gold recently reversed up the support area between the support level 3270,00 (low of the previous correction a), 20–day moving average and.

May 6, 2025

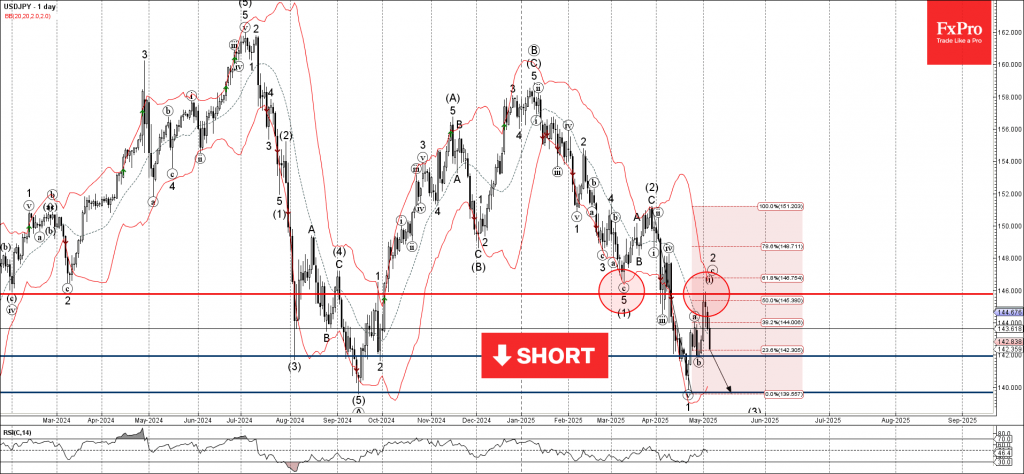

USDJPY: ⬇️ Sell – USDJPY reversed from resistance zone – Likely to fall to support level 140.00 USDJPY currency pair recently reversed from the resistance zone between the resistance level 146.00 (former strong support from March) and the 50% Fibonacci.

May 6, 2025

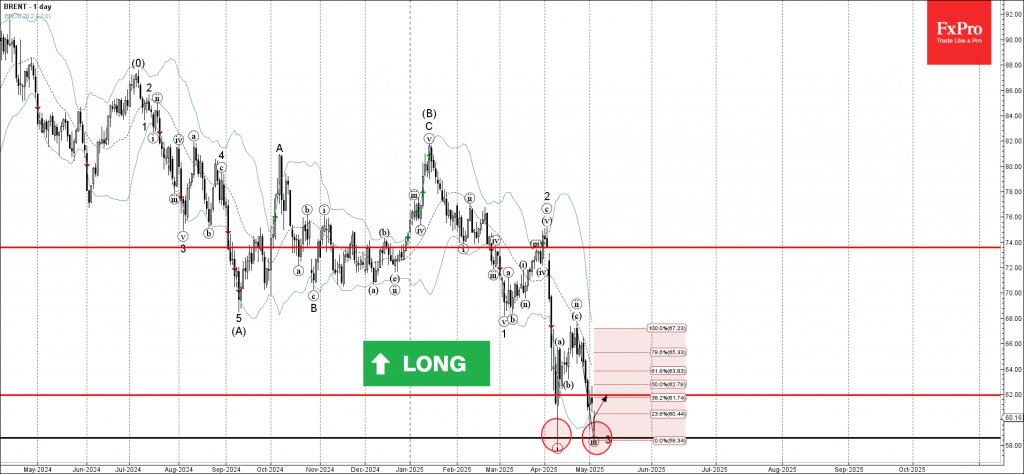

Brent crude oil: ⬆️ Buy – Brent crude oil reversed from support zone – Likely to rise to resistance level 62.00 Brent crude oil recently reversed up sharply from the support zone between the key support level 58.60 (which stopped.

May 6, 2025

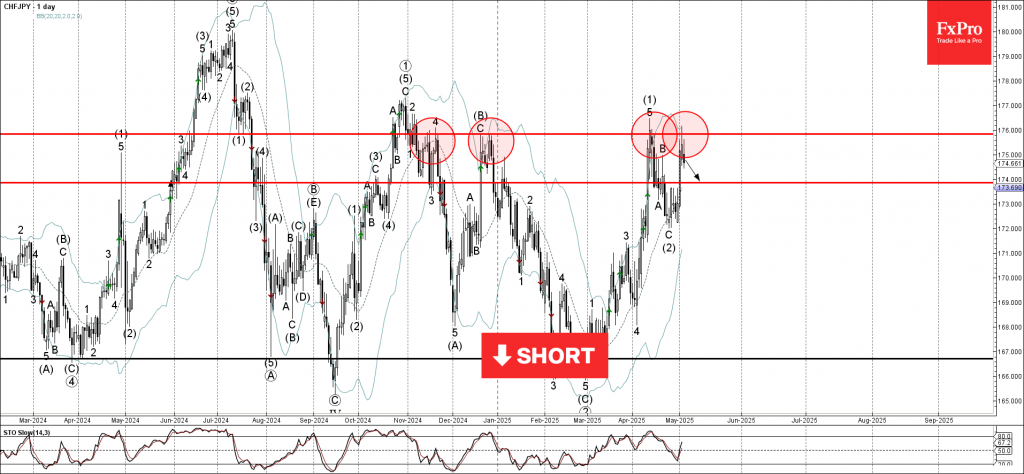

CHFJPY: ⬇️ Sell – CHFJPY reversed from the resistance zone – Likely to fall to support level 174.00 CHFJPY currency pair recently reversed down from the resistance zone between the pivotal resistance level 175.85 (which has been steadily reversing the price.

May 3, 2025

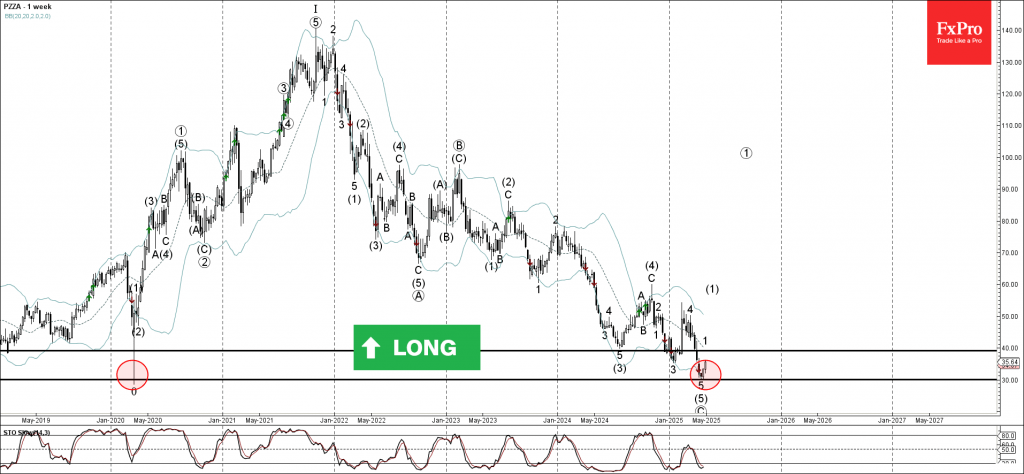

PZZA: ⬆️ Buy – PZZA reversed from the support zone – Likely to rise to resistance level 40.00 PZZA recently reversed from the support zone between the long-term support level 30.00 (which started the sharp weekly uptrend at the start.

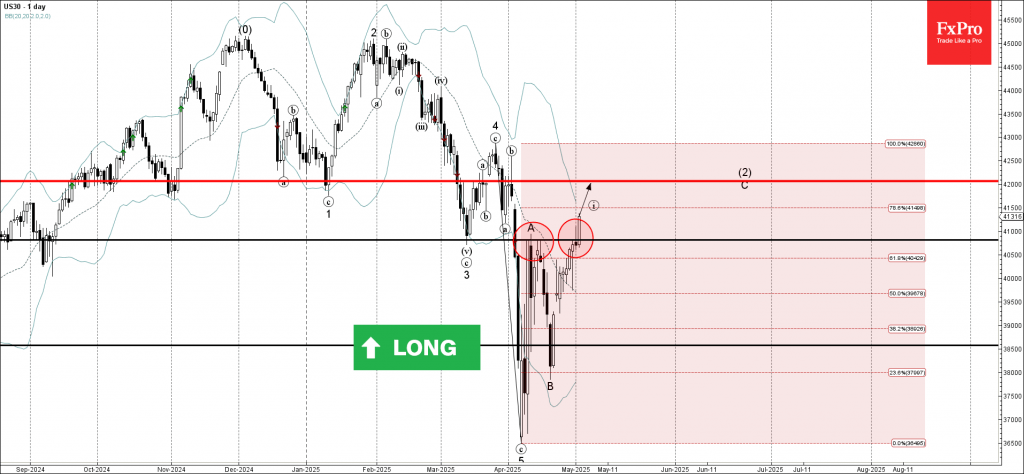

May 2, 2025

Dow Jones: ⬆️ Buy – Dow Jones broke resistance zone – Likely to rise to resistance level 42000.00 Dow Jones index recently broke the resistance zone between the pivotal resistance level 40815 (former support from March and the top of wave A.

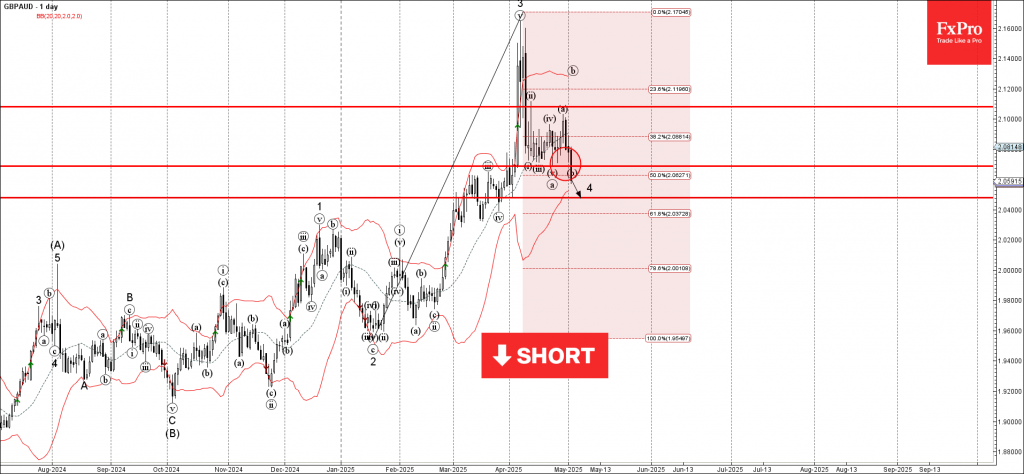

May 2, 2025

GBPAUD: ⬇️ Sell – GBPAUD broke support zone – Likely to fall to support level 2.0475 GBPAUD currency pair recently broke the support zone between the pivotal support level 2.0685 (which stopped the previous waves i, iii, v) and the.