Technical analysis - Page 62

May 22, 2025

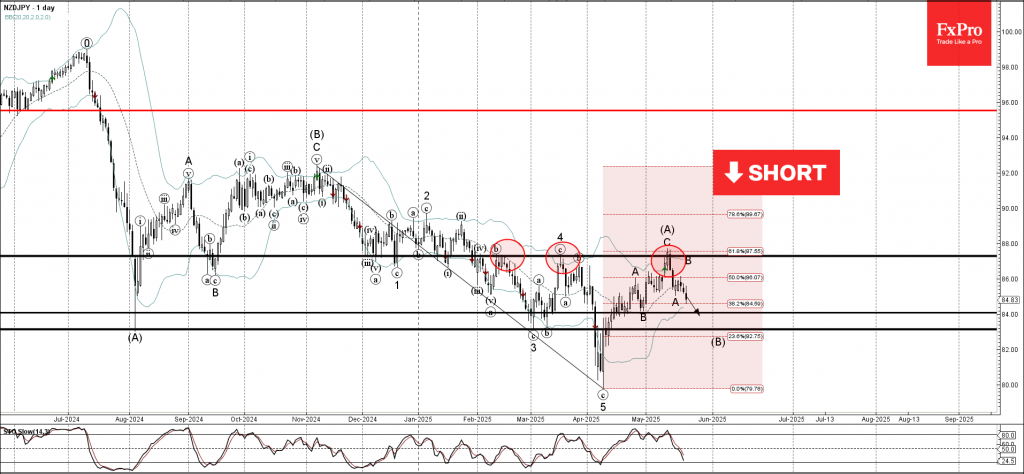

NZDJPY: ⬇️ Sell – NZDJPY reversed from resistance zone – Likely to fall to support level 84.00 NZDJPY currency pair recently reversed down from the resistance zone between the resistance level 87.30 (which has been reversing the price from February,.

May 22, 2025

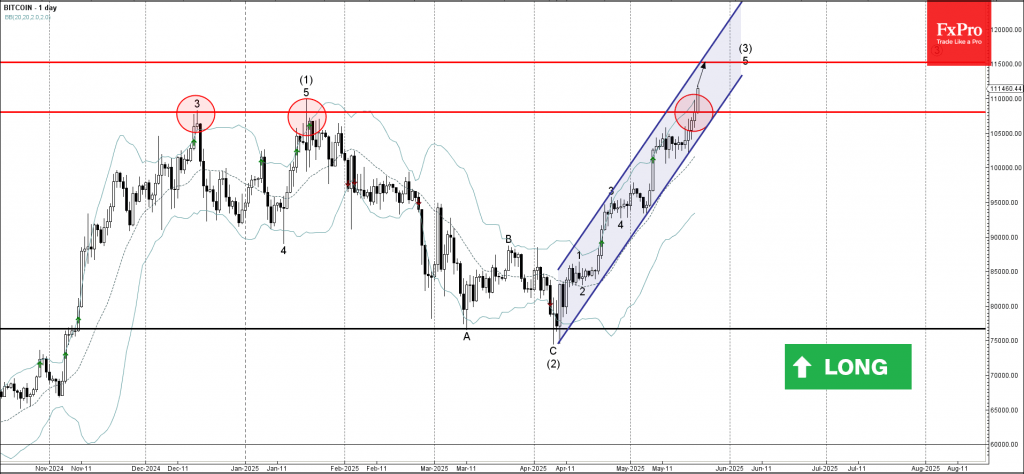

Bitcoin: ⬆️ Buy – Bitcoin broke key resistance level 108055.00 – Likely to rise to resistance level 115000.00 Bitcoin cryptocurrency pair recently broke above the key resistance level 108,055.00 (former monthly high from December and January, as can be seen.

May 22, 2025

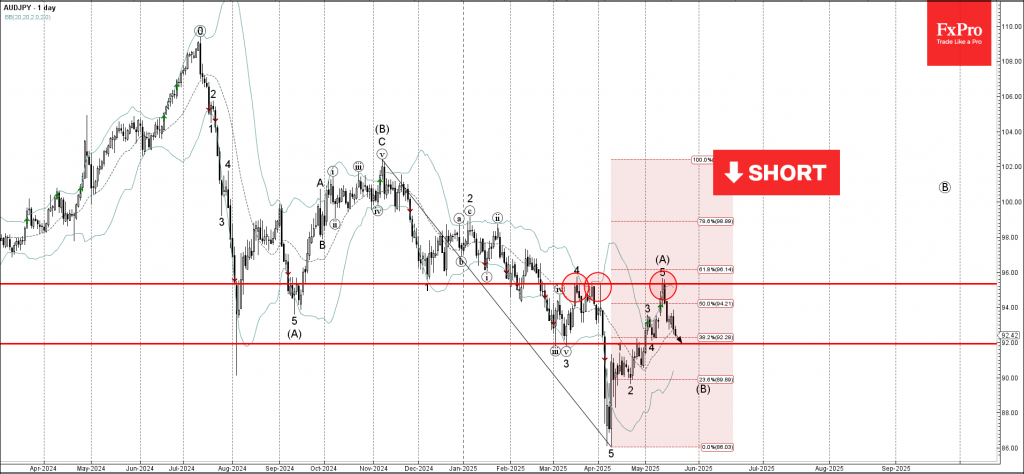

AUDJPY: ⬇️ Sell – AUDJPY reversed from key resistance level 95.30 – Likely to fall to support level 92.00 AUDJPY currency pair recently reversed down from the key resistance level 95.30 (which has been reversing the price from the middle.

May 22, 2025

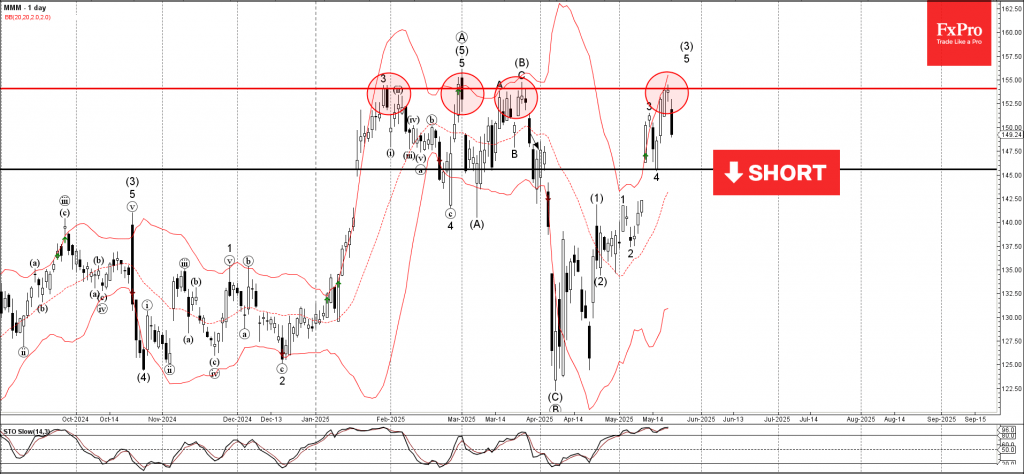

3M: ⬇️ Sell – 3M reversed from multi-month resistance level 154.00 – Likely to fall to support level 145.00 3M recently reversed down from the multi-month resistance level 154.00 (which has been reversing the price from the end of January).

May 22, 2025

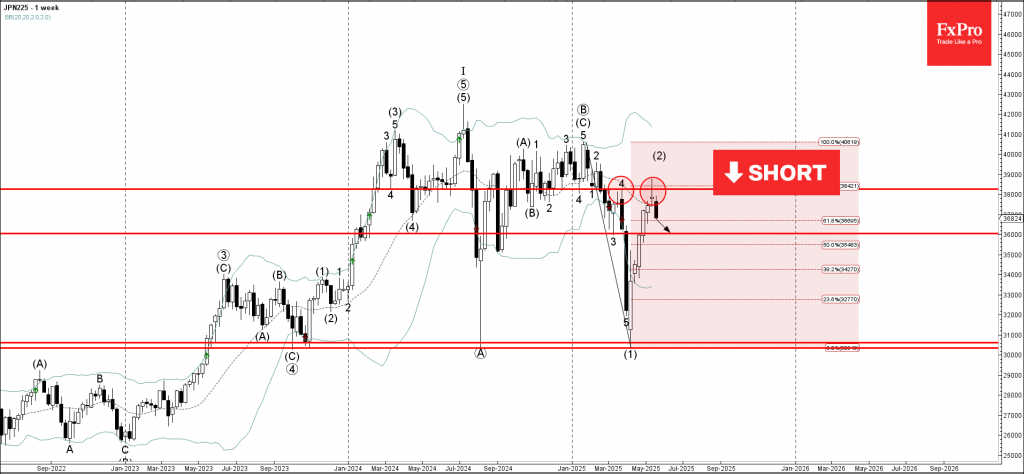

Nikkei 225: ⬇️ Sell – Nikkei 225 reversed from the resistance level 38280.00 – Likely to fall to support level 36000.00 Nikkei 225 index recently reversed down from the pivotal resistance level 38280.00 (former top of wave 4 from the.

May 22, 2025

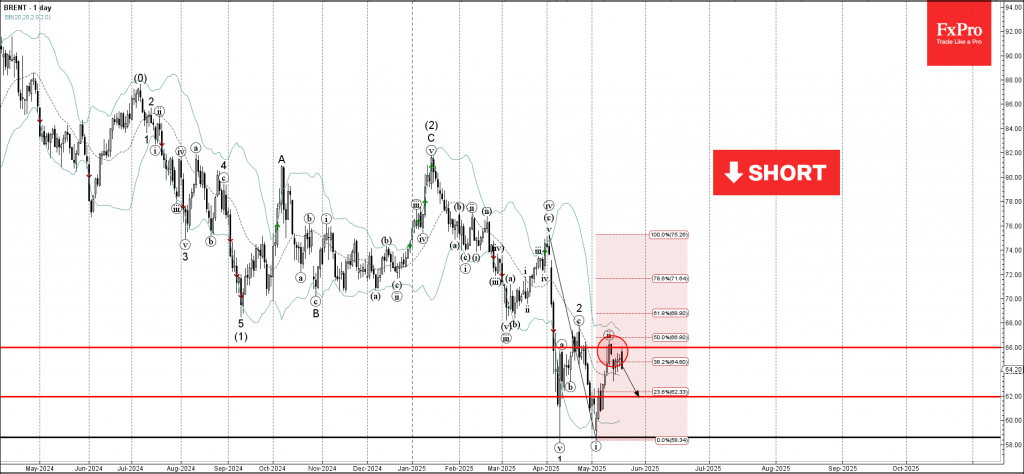

Brent crude oil: ⬇️ Sell – Brent crude oil reversed from key resistance level 66.00 – Likely to fall to support level 62.00 Brent crude oil recently reversed down from the key resistance level 66.00, which has been reversing the.

May 21, 2025

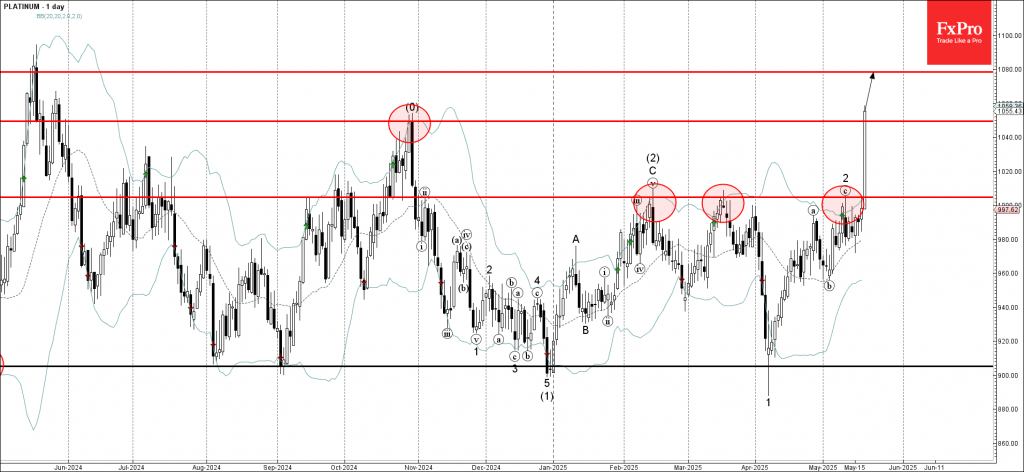

Platinum: ⬆️ Buy – Platinum broke the resistance level 1005.00 – Likely to rise to resistance level 1080.00 Platinum recently broke the resistance level 1005.00, former monthly high from February and March, as can be seen from the daily Platinum.

May 21, 2025

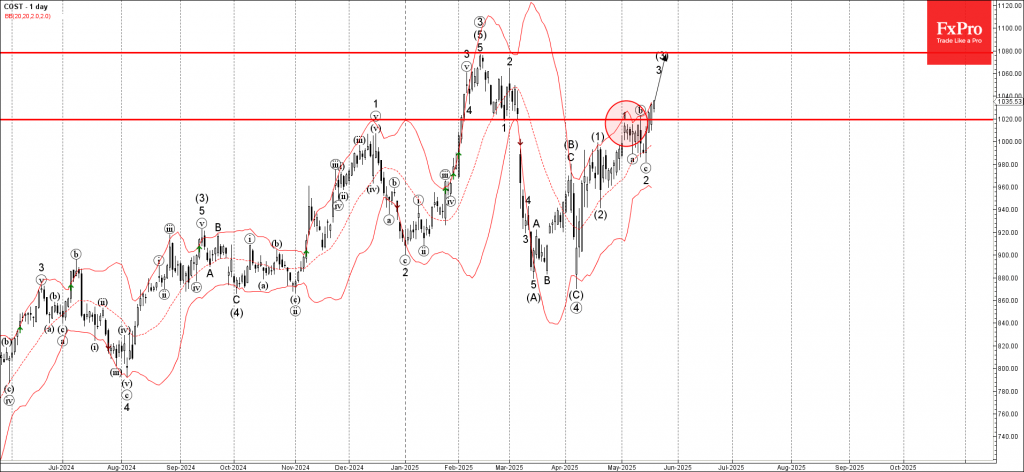

Costco: ⬆️ Buy – Costco broke resistance level 1020.00 – Likely to rise to resistance level 1080.00 Costco recently broke the resistance level 1020.00, which stopped the previous waves 1 and (b), as can be seen from the daily Costco chart below..

May 20, 2025

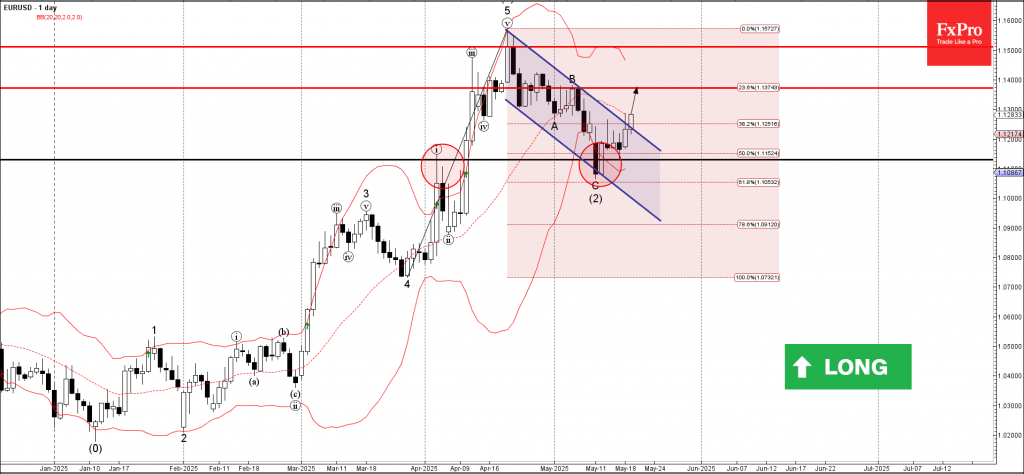

EURUSD: ⬆️ Buy – EURUSD broke daily down channel – Likely to rise to resistance level 1.1370 EURUSD currency pair continues to rise inside the minor impulse wave (3), which started earlier from the strong support level 1.1130 intersecting with the support.

May 20, 2025

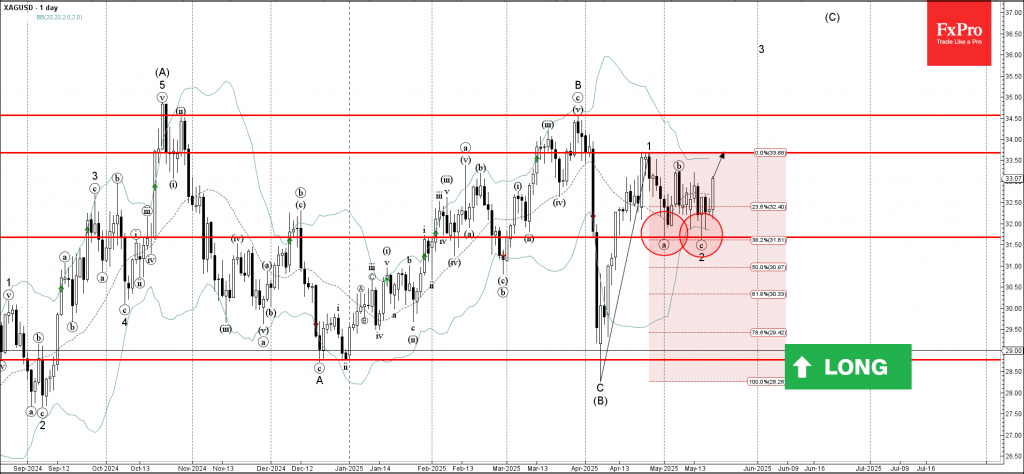

Silver: ⬆️ Buy – Silver reversed from support level 31.70 – Likely to rise to resistance level 33.50 Silver recently reversed from the pivotal support level 31.70 (which stopped the previous minor wave a at the end of April, as can be.

May 20, 2025

In today’s episode, we’re diving into why nothing seems to stop Bitcoin—not even a US credit downgrade or a $20M Coinbase breach! Retail traders are in full control, global risk appetite is booming, and BTC is riding the momentum. Plus,.