Technical analysis - Page 60

May 15, 2025

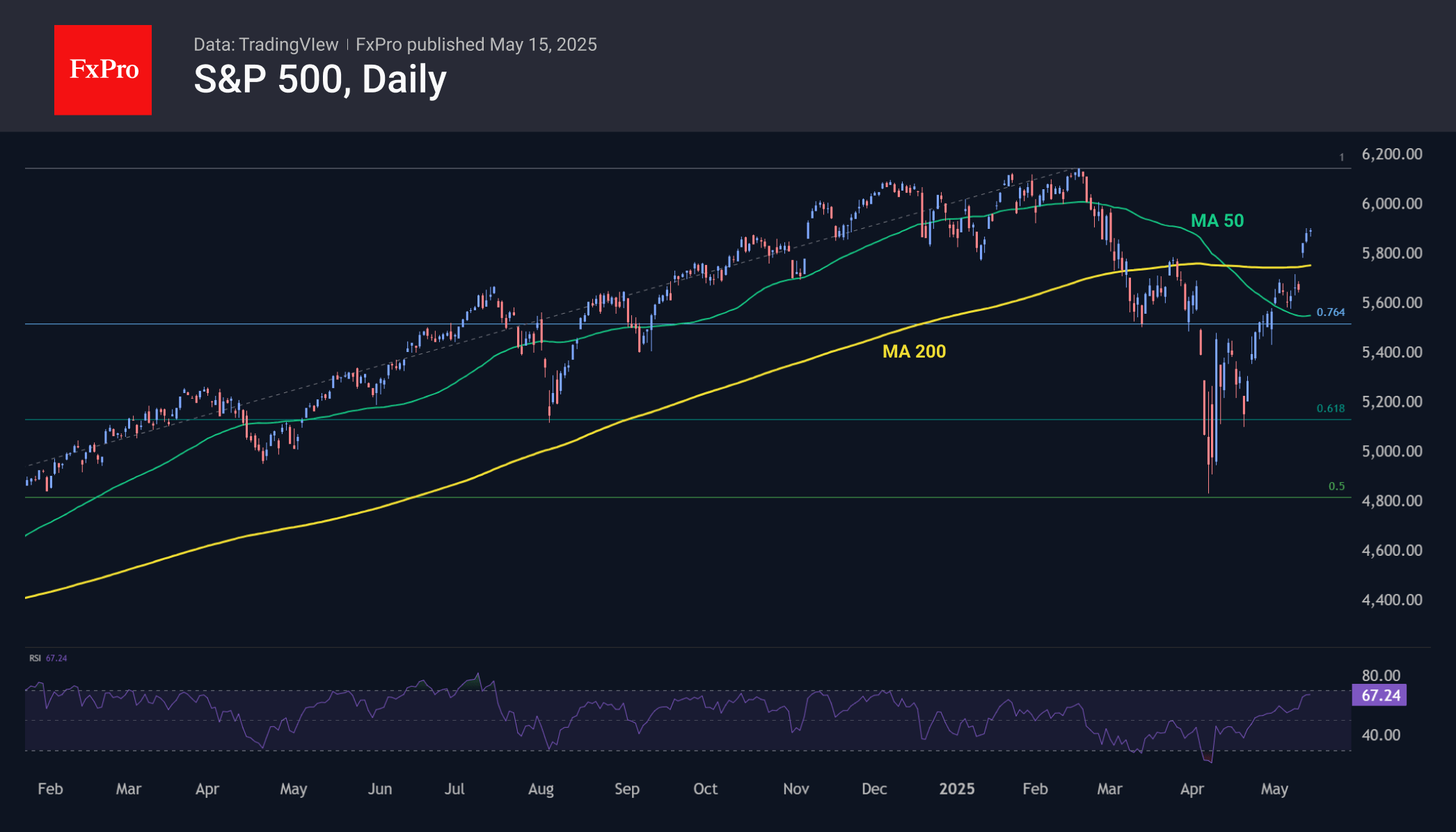

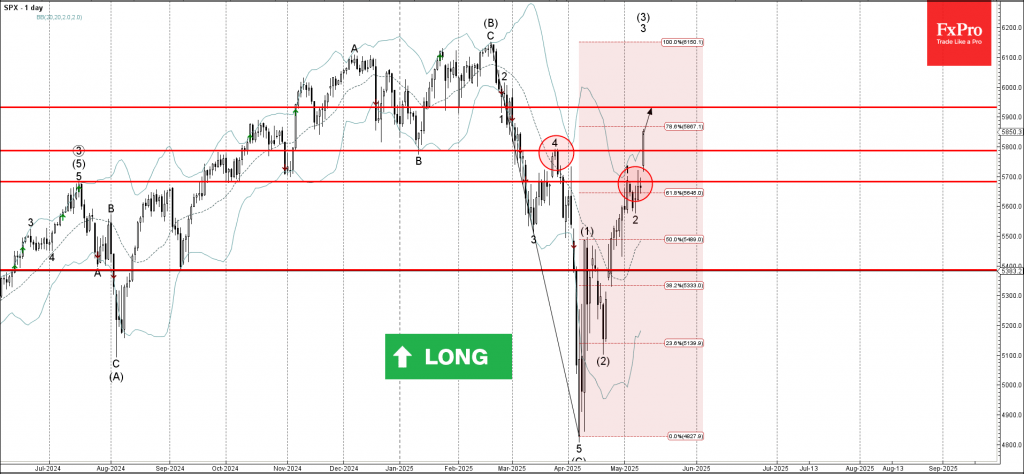

The S&P500 is heading towards 7500, with a potential pause at 6000. The market has seen strong recovery and technical indicators suggest positive trends ahead.

May 15, 2025

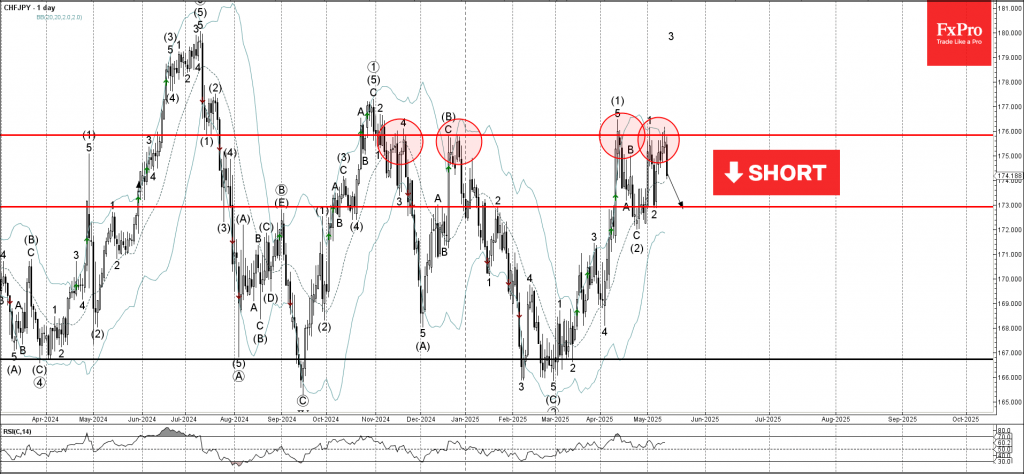

CHFJPY: ⬇️ Sell – CHFJPY reversed from the resistance level 176.00 – Likely to fall to support level 173.00 CHFJPY currency pair recently reversed from the pivotal resistance level 176.00, which has been repeatedly reversing the price since November. The.

May 15, 2025

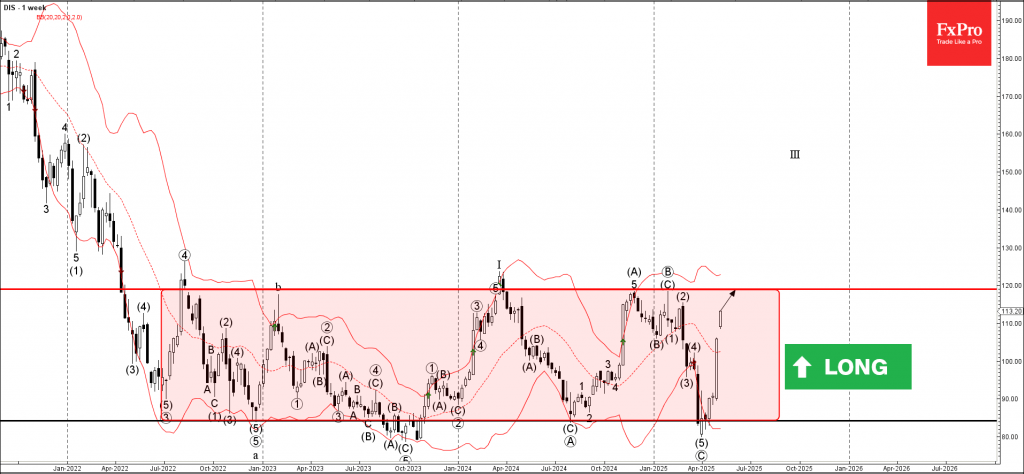

Disney: ⬆️ Buy – Disney rising inside impulse wave (1) – Likely to reach resistance level 119,00 Disney continues to rise inside the sharp weekly upward impulse wave (1), which started earlier from the long-term support level 84.30 (which has.

May 14, 2025

AUDJPY: ⬇️ Sell – AUDJPY reversed from resistance area – Likely to fall to support level 93.20 AUDJPY currency pair recently reversed from the resistance area between the key resistance level 95.30 (former monthly high from March), upper daily Bollinger.

May 14, 2025

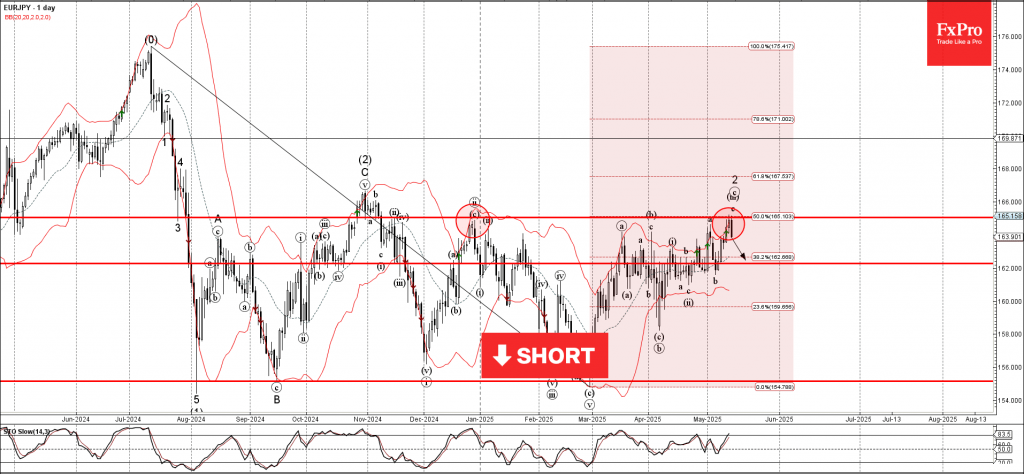

EURJPY: ⬇️ Sell – EURJPY reversed from resistance area – Likely to fall to support level 162.00 EURJPY currency pair recently reversed down from the resistance area between the pivotal resistance level 165.00 (which has been reversing the price from.

May 14, 2025

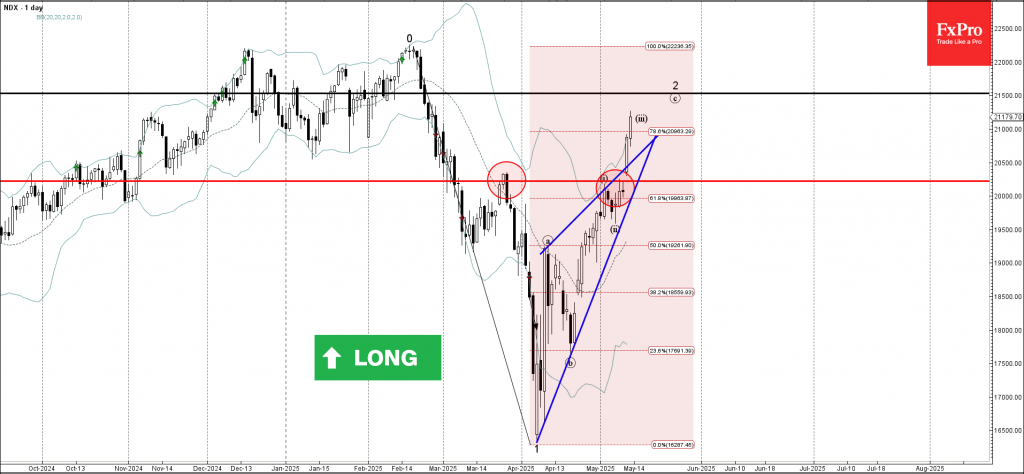

Nasdaq-100: ⬆️ Buy – Nasdaq-100 broke resistance area – Likely to rise to resistance level 21500.00 Nasdaq-100 index recently broke the resistance area between the resistance level 20220.00 (which has been reversing the index from March) and the resistance trendline.

May 14, 2025

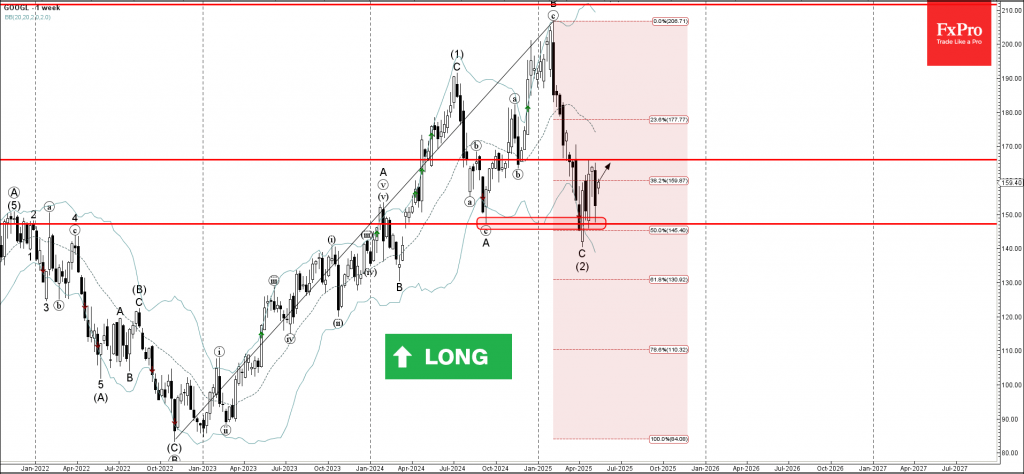

Google: ⬆️ Buy – Google reversed from support area – Likely to rise to resistance level 166.15 Google recently reversed up from the support area between the key support level 147.30 (which has been reversing the price from July), lower.

May 14, 2025

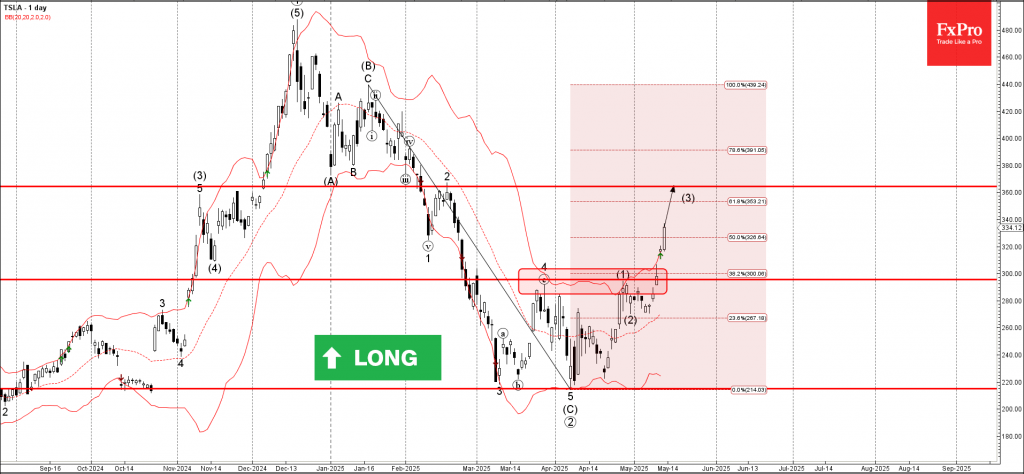

Tesla: ⬆️ Buy – Tesla broke resistance area – Likely to rise to resistance level 360.00 Tesla recently broke the resistance area between the round resistance level 300.00 (which stopped the previous waves 4 and (1)) and the 38.2% Fibonacci.

May 14, 2025

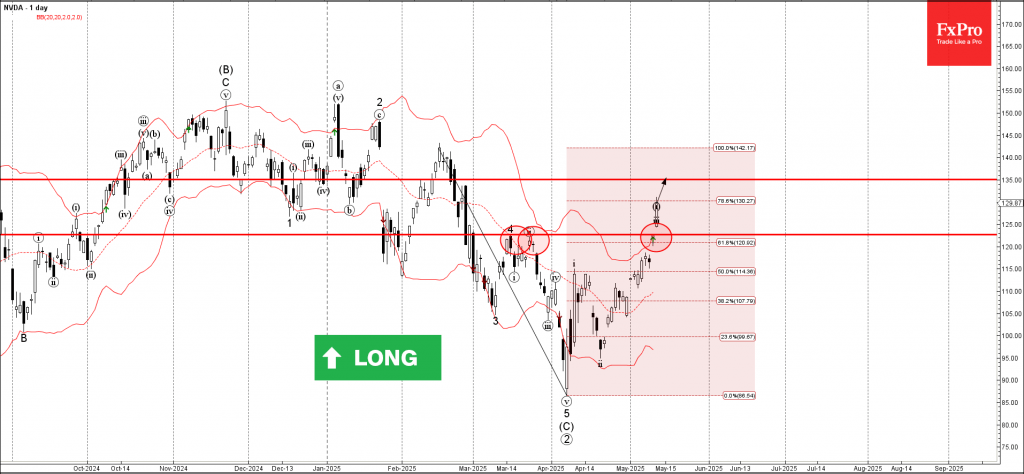

Nvidia: ⬆️ Buy – Nvidia broke resistance area – Likely to rise to resistance level 135.00 Nvidia recently broke the resistance area between the resistance level 122.65 (which reversed waves 4 and ii in March) and the 61.8% Fibonacci correction.

May 13, 2025

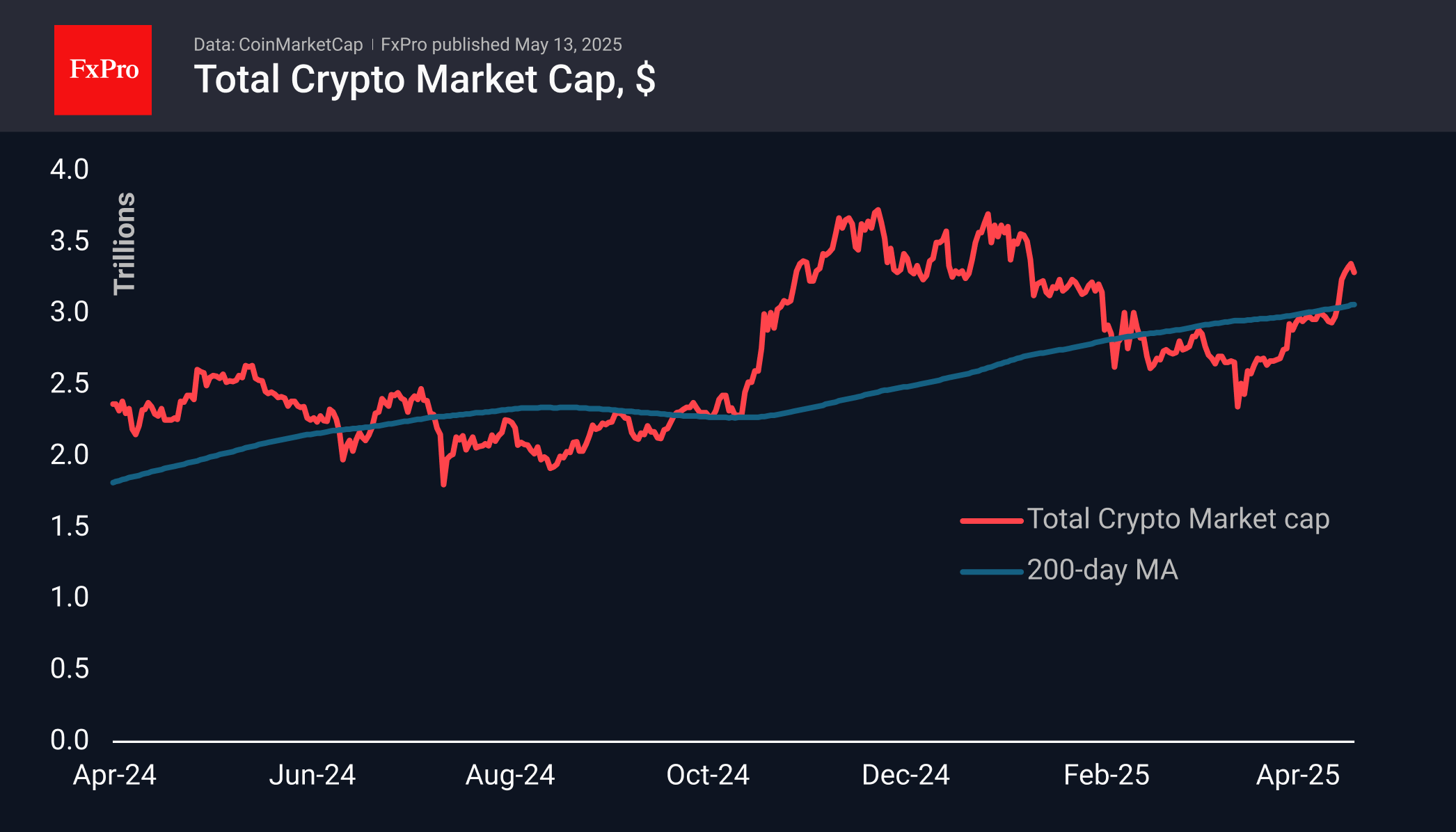

The crypto market saw profit-taking despite overall positivity. Market cap fell to $3.29 trillion in 24 hours. Bitcoin stays near highs with potential for growth. BTC investments increase while altcoins gain capital flow.

May 13, 2025

S&P 500 index: ⬆️ Buy – S&P 500 index broke resistance area – Likely to rise to resistance level 5930.00 S&P 500 index recently broke the resistance area between the resistance levels 5800.00 (top of wave 4 from March), 5700.00.