Technical analysis - Page 59

May 20, 2025

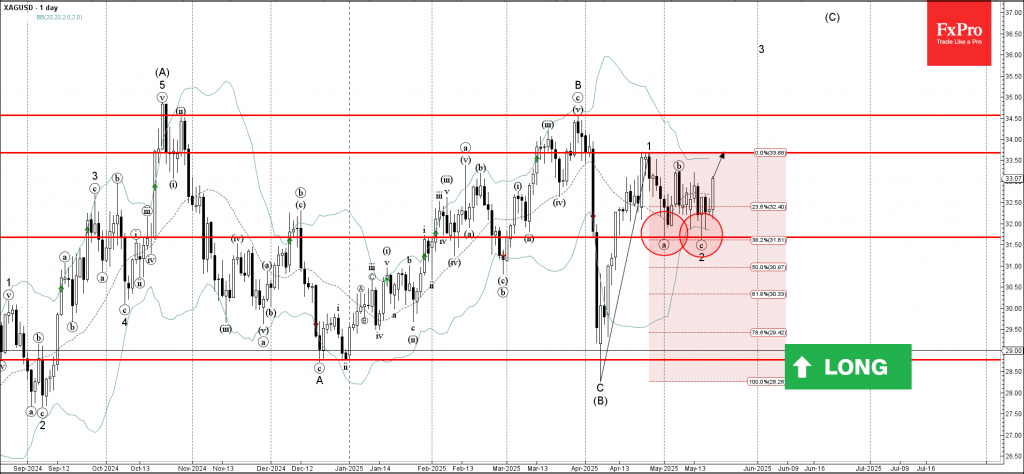

Silver: ⬆️ Buy – Silver reversed from support level 31.70 – Likely to rise to resistance level 33.50 Silver recently reversed from the pivotal support level 31.70 (which stopped the previous minor wave a at the end of April, as can be.

May 20, 2025

In today’s episode, we’re diving into why nothing seems to stop Bitcoin—not even a US credit downgrade or a $20M Coinbase breach! Retail traders are in full control, global risk appetite is booming, and BTC is riding the momentum. Plus,.

May 19, 2025

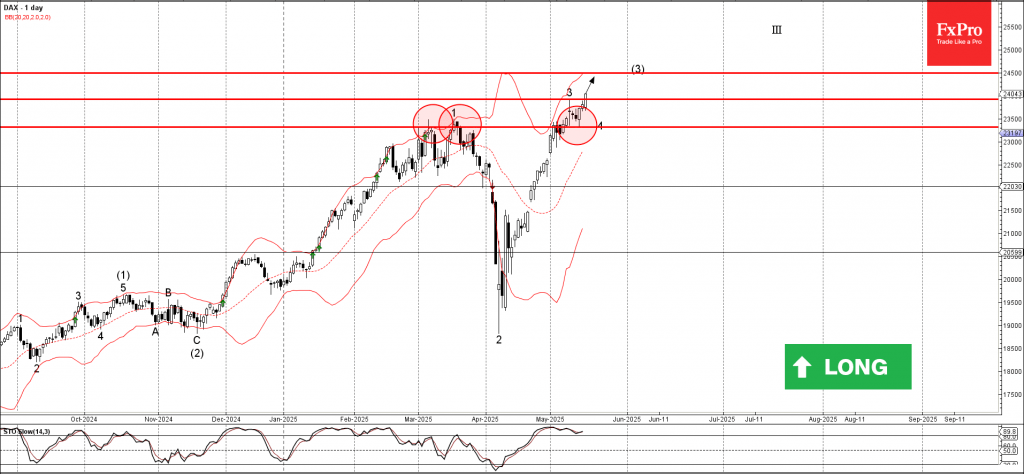

DAX: ⬆️ Buy – DAX reversed from the support level 23320.00 – Likely to rise to resistance level 24500.00 DAX index recently reversed from the key support level 23320.00 (former double top from March, as can be seen from the daily.

May 19, 2025

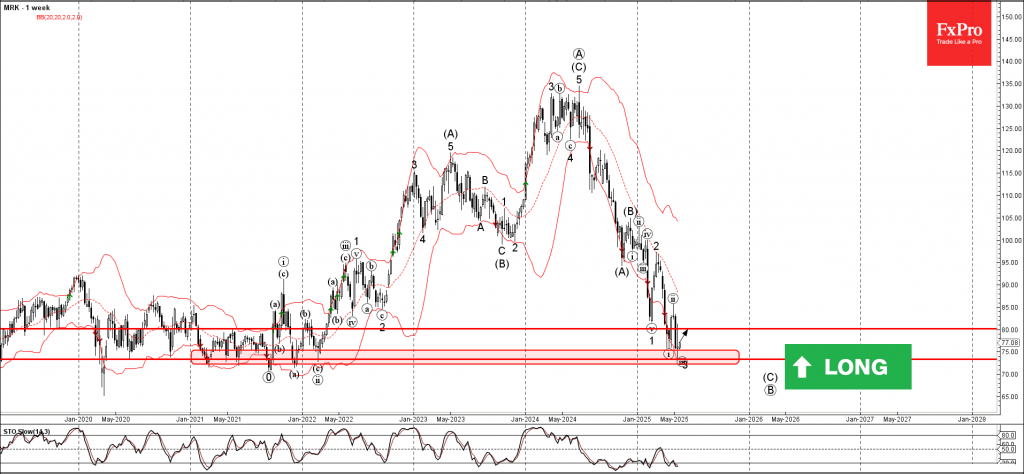

Merck: ⬆️ Buy – Merck reversed from support area – Likely to rise to resistance level 80.00 Merck recently reversed up from the support area between the long-term support level 73.35 (which has been reversing the price from the middle of 2020).

May 19, 2025

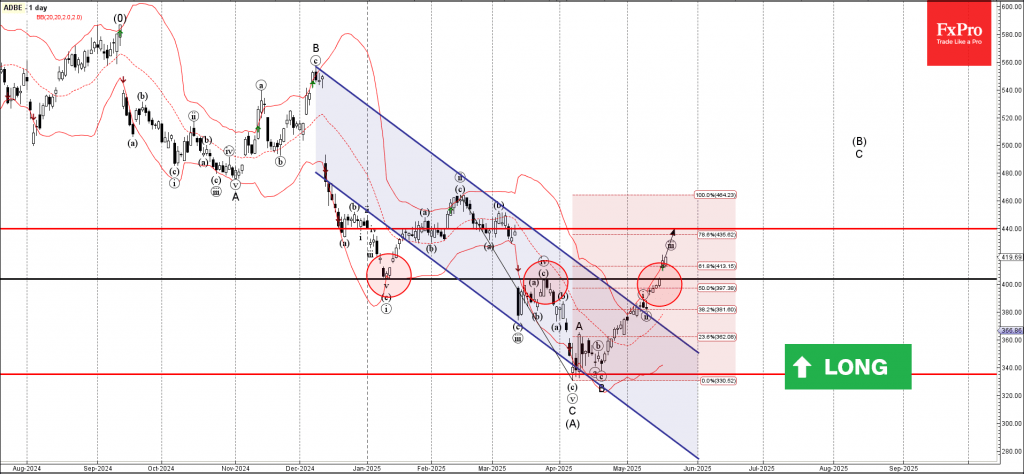

Adobe: ⬆️ Buy – Adobe broke resistance area – Likely to rise to resistance level 440.00 Adobe recently broke the resistance area between the resistance level 403.60 (which stopped the previous minor corrective wave iv) and the 50% Fibonacci correction.

May 19, 2025

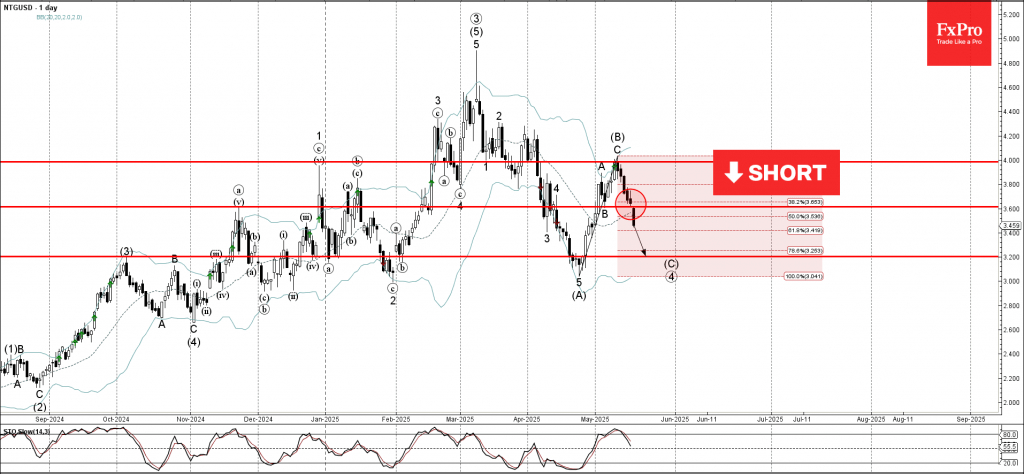

Natural Gas: ⬇️ Sell – Natural Gas broke support zone – Likely to fall to support level 240.00 Natural Gas recently broke the support zone between the support level 3.600 (which stopped the previous wave B) and the 50% Fibonacci.

May 17, 2025

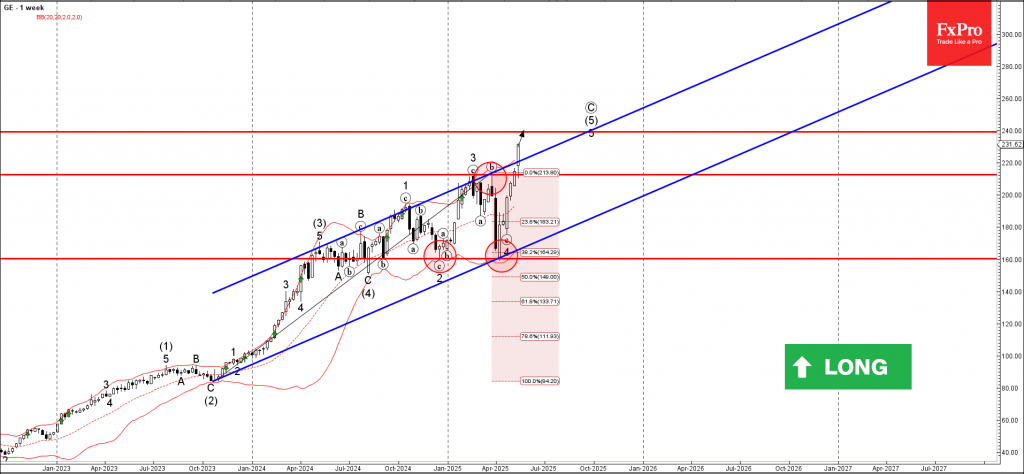

General Electric: ⬆️ Buy – General Electric broke resistance zone – Likely to rise to resistance level 240.00 General Electric recently broke the resistance zone between the key resistance level 212.00 (which stopped the previous waves 3 and b) and.

May 17, 2025

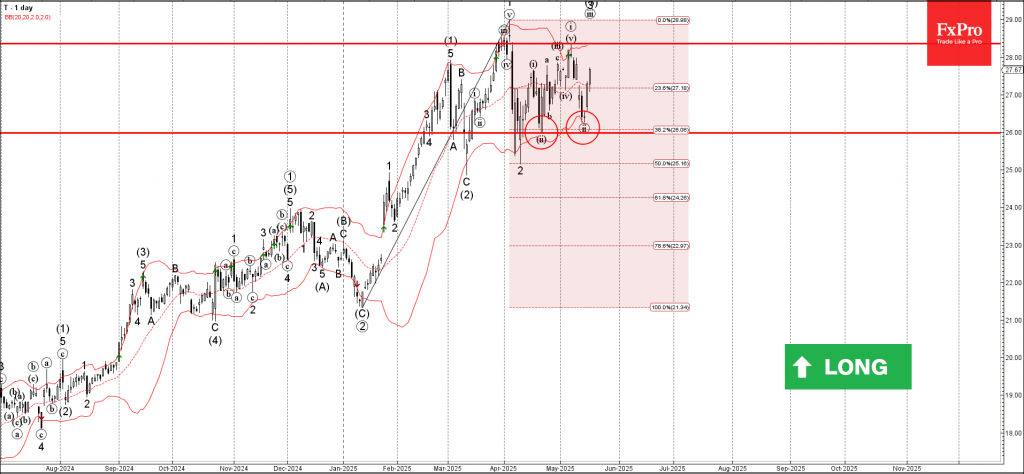

AT&T: ⬆️ Buy – AT&T reversed from support zone – Likely to rise to resistance level 28.35 AT&T recently reversed up with the daily Morning Star from the support zone between the key support level 26.00, 38.2% Fibonacci correction of.

May 16, 2025

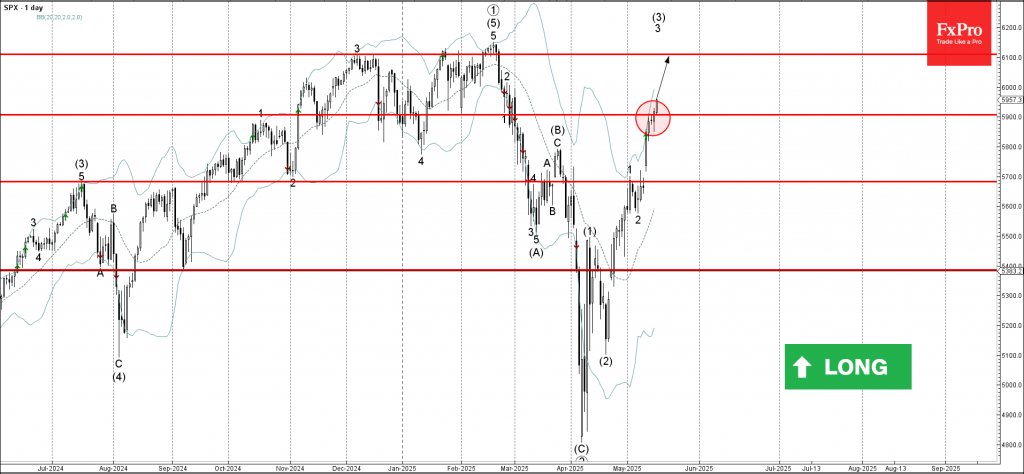

S&P 500: ⬆️ Buy – S&P 500 broke the resistance level 5900.00 – Likely to rise to resistance level 6100.00 S&P 500 index recently broke the resistance level 5900.00, the former support from January and February. The breakout of the.

May 16, 2025

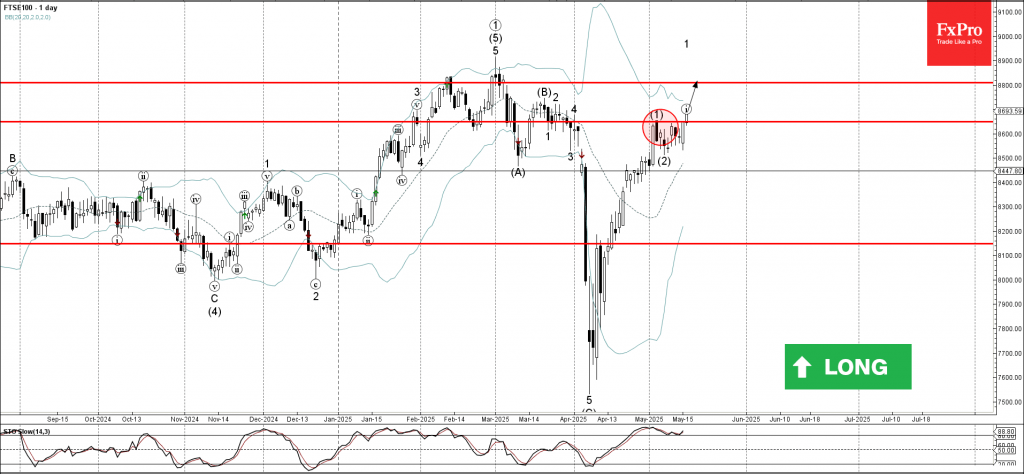

FTSE 100: ⬆️ Buy – FTSE 100 broke the resistance level 8650.00 – Likely to rise to resistance level 8800.00 The FTSE 100 index recently broke the resistance level 8650.00, which stopped the previous medium-term impulse wave (1) at the.

May 16, 2025

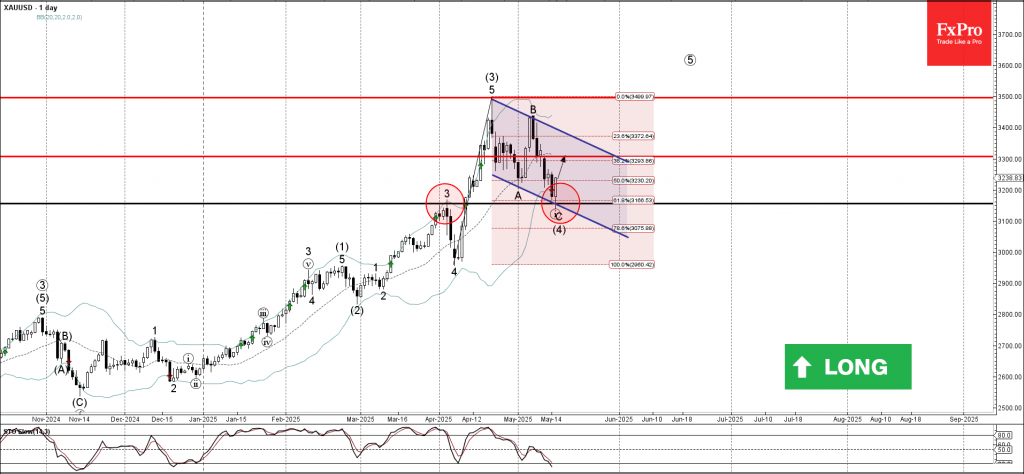

Gold: ⬆️ Buy – Gold reversed from support zone – Likely to rise to resistance level 3300.00 Gold recently reversed up from the support zone located between the pivotal support level 3155.00 (former top of the impulse wave 3 from.