Technical analysis - Page 57

May 29, 2025

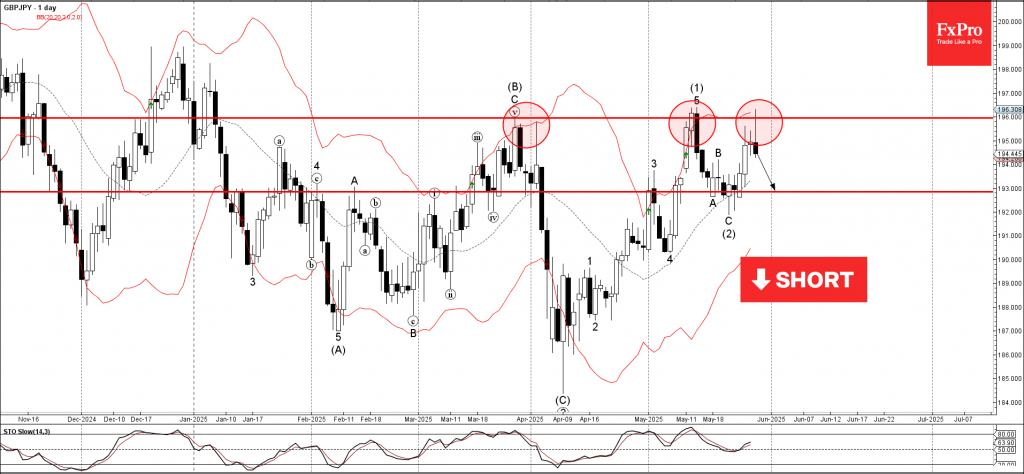

GBPJPY: ⬇️ Sell – GBPJPY reversed from the key resistance level 196.00 – Likely to fall to support level 193.00 GBPJPY currency pair recently reversed down from the key resistance level 196.00(which has been reversing the price from March) intersecting.

May 29, 2025

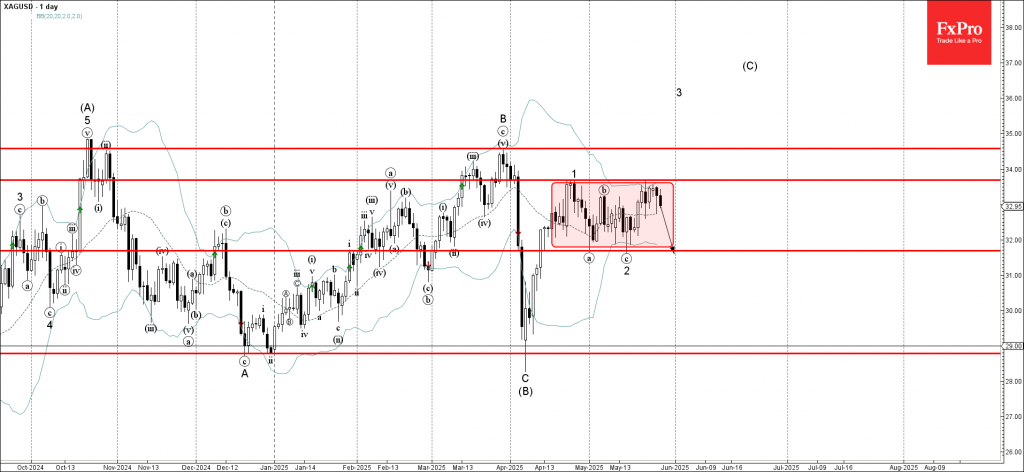

Silver: ⬇️ Sell – Silver reversed from resistance level 33.70 – Likely to fall to support level 31.70 Silver recently reversed from the resistance level 33.70 (which is the upper border of the sideways price range inside which the price.

May 29, 2025

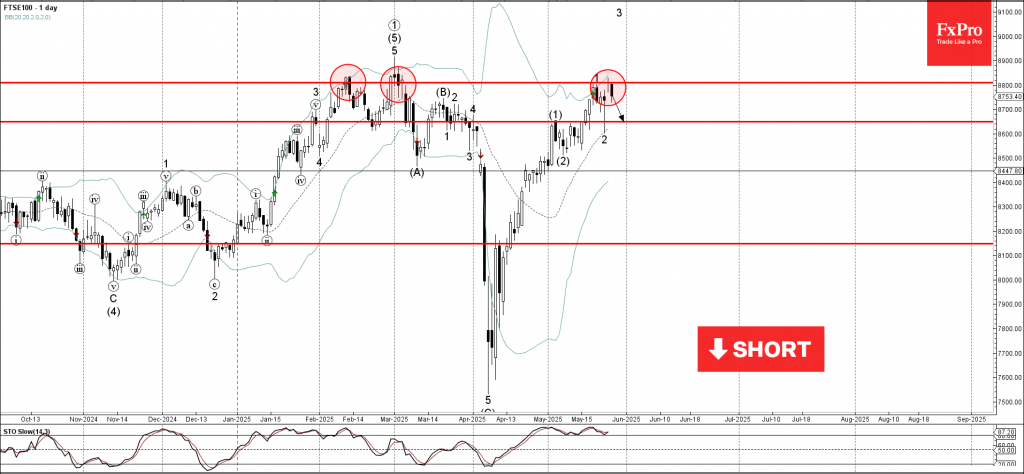

FTSE 100 index: ⬇️ Sell – FTSE 100 index reversed from key resistance level 8800.00 – Likely to fall to support level 8650,00 The FTSE 100 index recently reversed from the key resistance level 8800.00 (which has been steadily reversing.

May 28, 2025

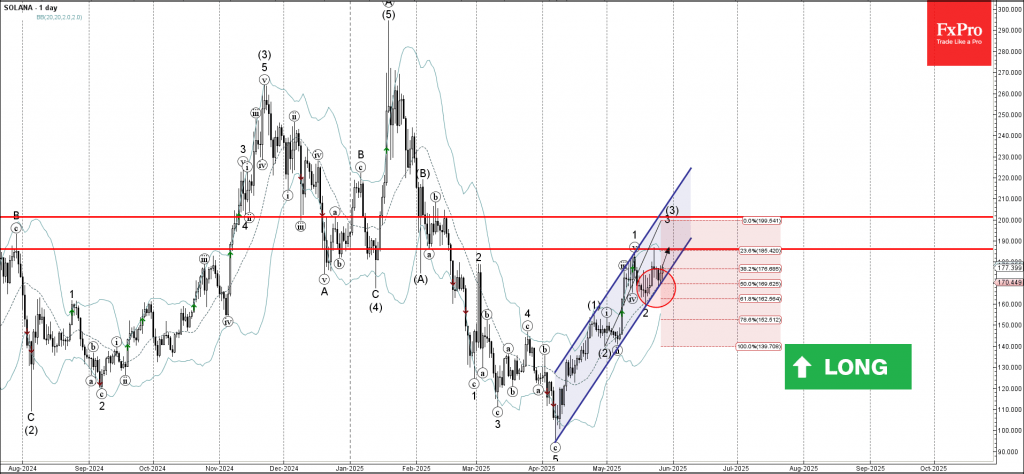

Solana: ⬆️ Buy – Solana rising inside daily up channel – Likely to reach resistance level 186.10 Solana cryptocurrency recently reversed up from the support trendline of the daily up channel from the start of April (coinciding with the 20-day.

May 28, 2025

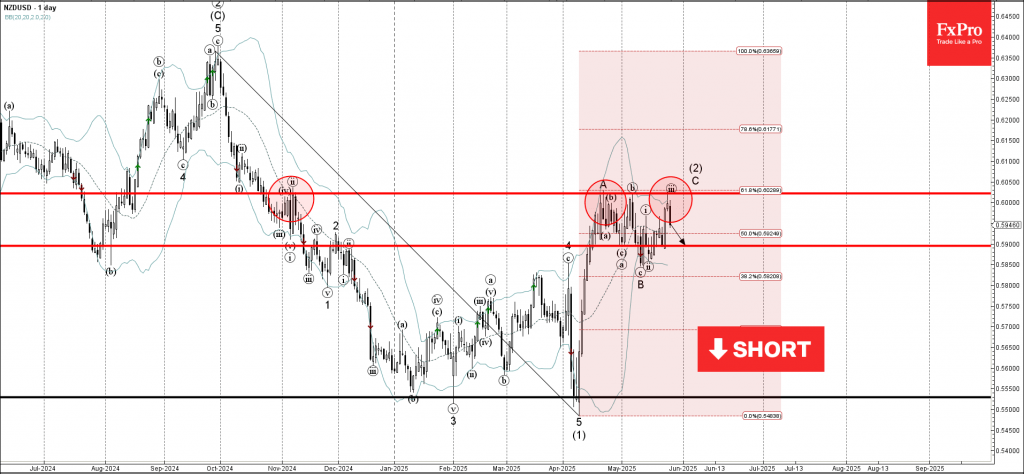

NZDUSD: ⬇️ Sell – NZDUSD reversed from the pivotal resistance level 0.6020 – Likely to fall to support level 0.5900 NZDUSD currency pair recently reversed down from the pivotal resistance level 0.6020 (which has been reversing the price from November)..

May 28, 2025

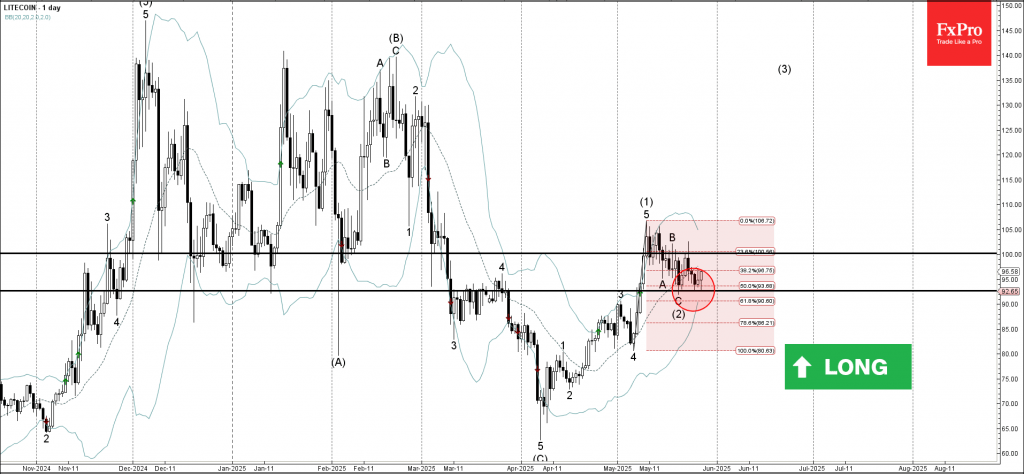

Litecoin: ⬆️ Buy – Litecoin reversed from key support level 92.65 – Likely to rise to resistance level 100,00 Litecoin cryptocurrency recently reversed from the key support level 92.65 (which stopped the previous minor correction (2) earlier in May). The.

May 28, 2025

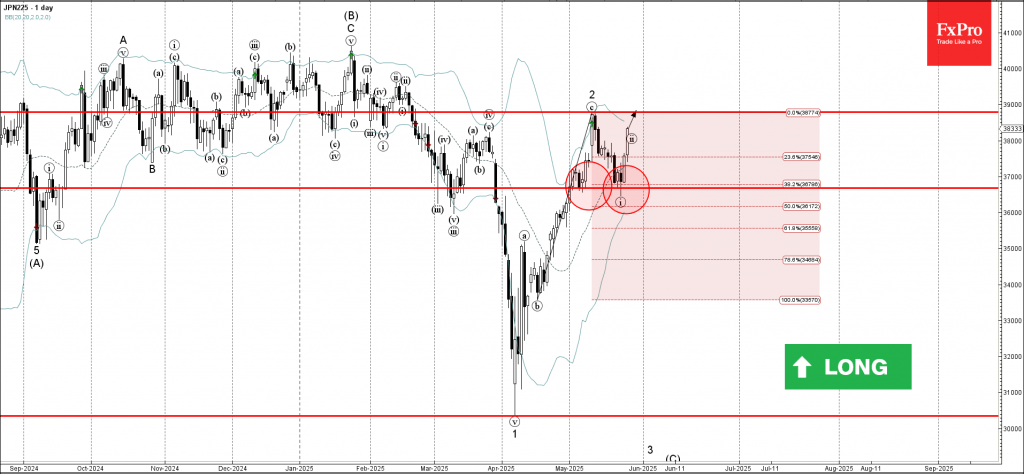

Nikkei 225: ⬆️ Buy – Nikkei 225 reversed from support level 36675,00 – Likely to rise to resistance level 38800,00 Nikkei 225 index recently reversed up from the pivotal support level 36675,00 (which formed the daily Japanese candlesticks reversal pattern.

May 27, 2025

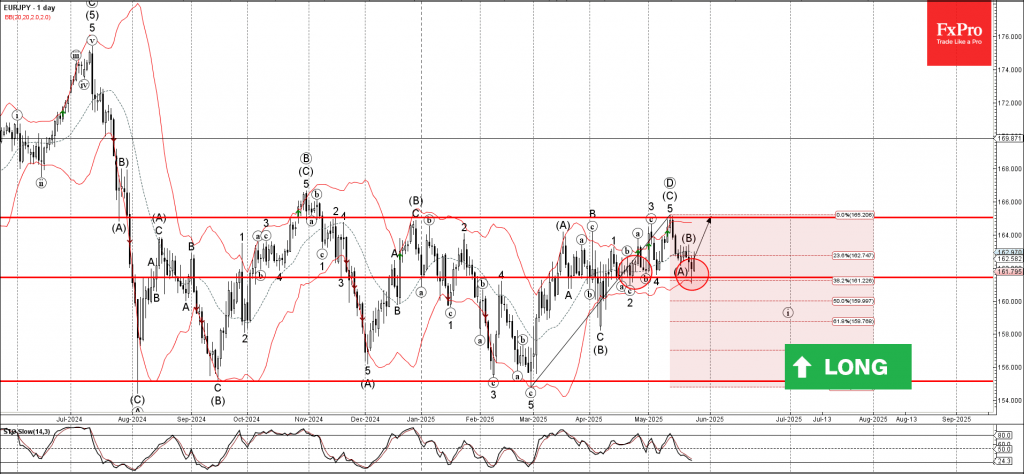

EURJPY: ⬆️ Buy – EURJPY reversed from key support level 161.40 – Likely to rise to resistance level 165.00 EURJPY currency pair recently reversed up from the key support level 161.40 (which has been reversing the price from the middle.

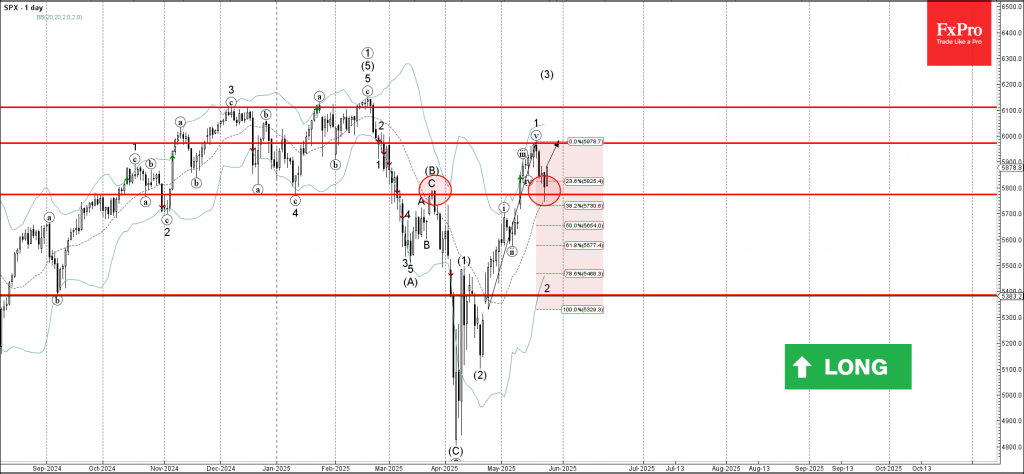

May 27, 2025

S&P 500: ⬆️ Buy – S&P 500 reversed from support level 5775,00 – Likely to rise to resistance level 5970,00 S&P 500 index recently reversed up from the pivotal support level 5775,00 (former resistance from March, which formed the daily.

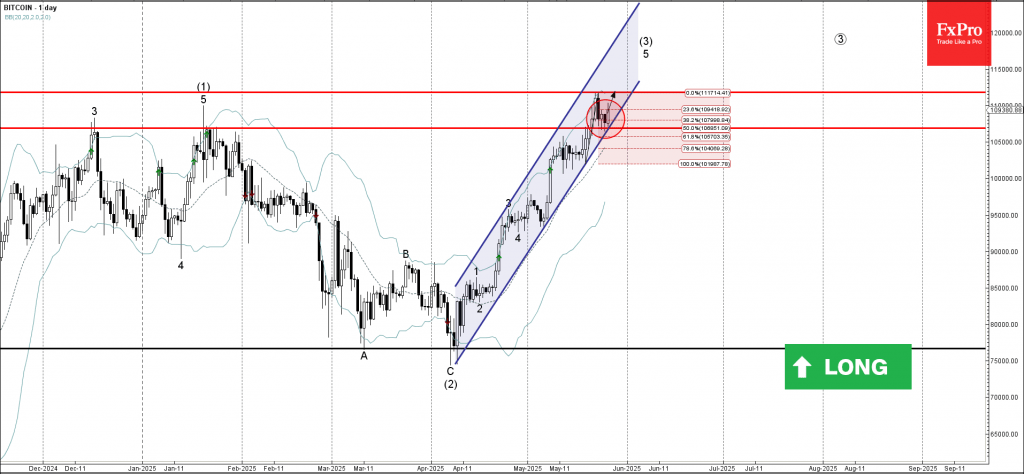

May 27, 2025

Bitcoin: ⬆️ Buy – Bitcoin reversed from support level 106850,00 – Likely to rise to resistance level 111830.00 Bitcoin cryptocurrency pair recently reversed up from the support level 106850,00 (which has been reversing the price during the last few trading.

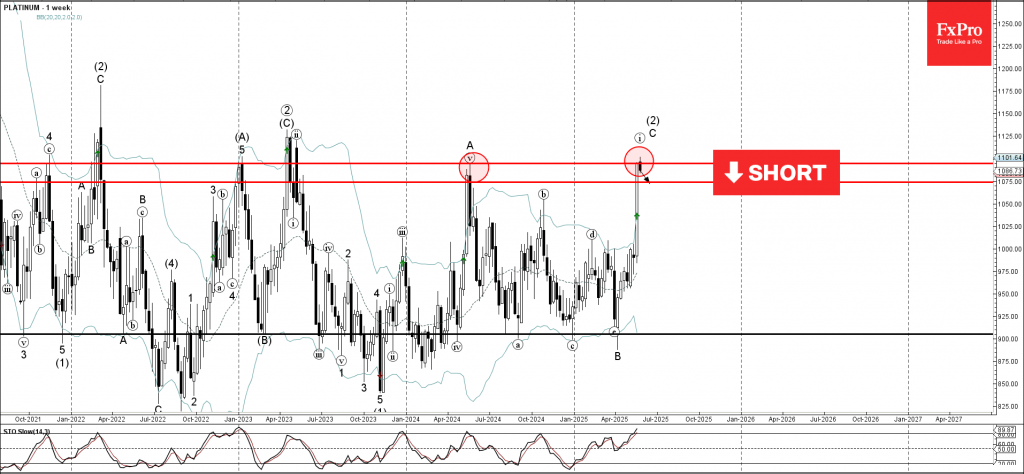

May 27, 2025

Platinum: ⬇️ Sell – Platinum reversed from long-term resistance level 1095,00 – Likely to fall to support level 1075.00 Platinum recently reversed down from the major long-term resistance level 1095,00 (former yearly high from 2024), which stopped the previous weekly.