Technical analysis - Page 55

June 6, 2025

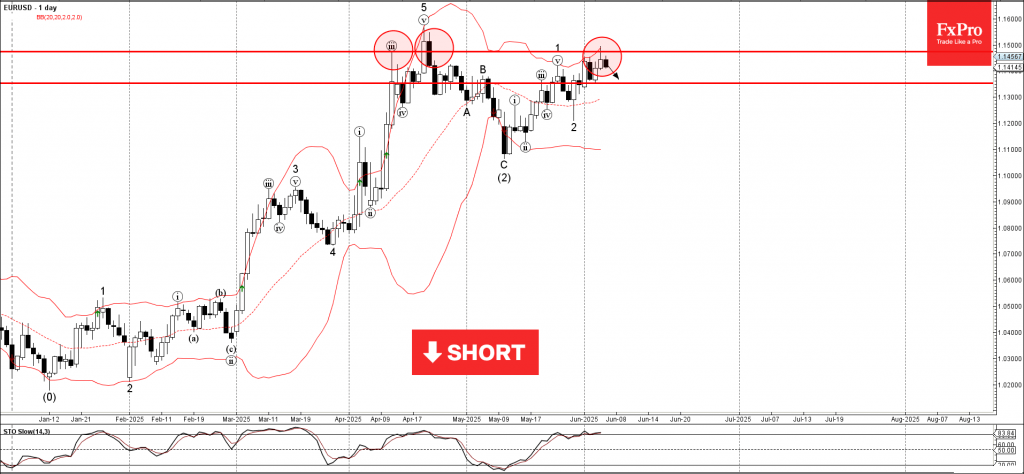

EURUSD: ⬇️ Sell – EURUSD reversed from the resistance zone – Likely to fall to support level 1.1350 EURUSD currency pair recently reversed down from the resistance zone located between the key resistance level 1.1475 (which has been reversing the price.

June 6, 2025

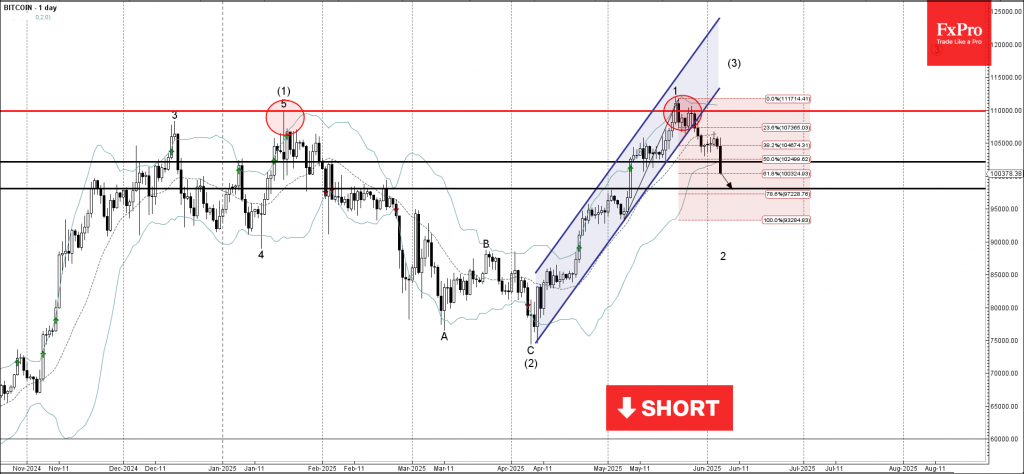

Bitcoin: ⬇️ Sell – Bitcoin broke support zone – Likely to fall to support level 98,000.00 Bitcoin cryptocurrency recently broke the support zone located between the key support level 102150.00 (which reversed the price multiple times from the start of May).

June 6, 2025

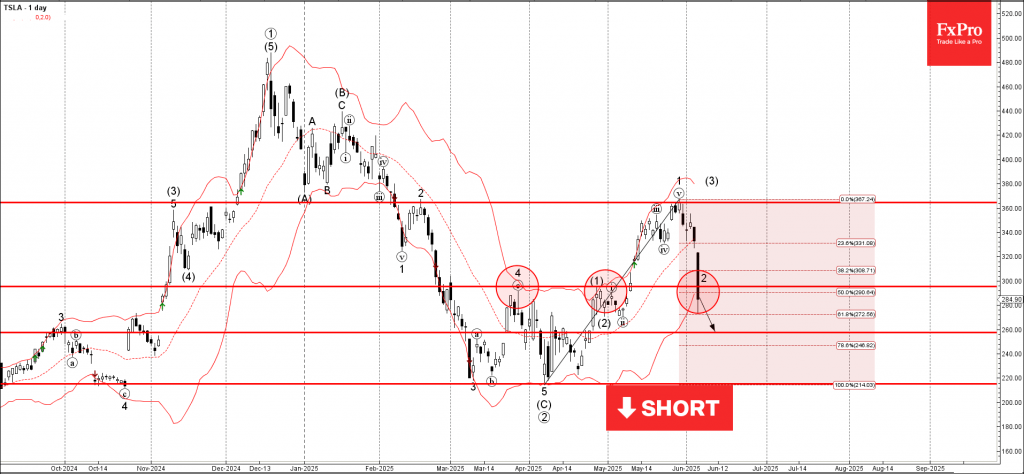

Tesla: ⬇️ Sell – Tesla broke the support zone – Likely to fall to support level 260.00 Tesla recently broke the support zone located between the support level 294.00 (former resistance from April and March) and the 50% Fibonacci correction of the.

June 5, 2025

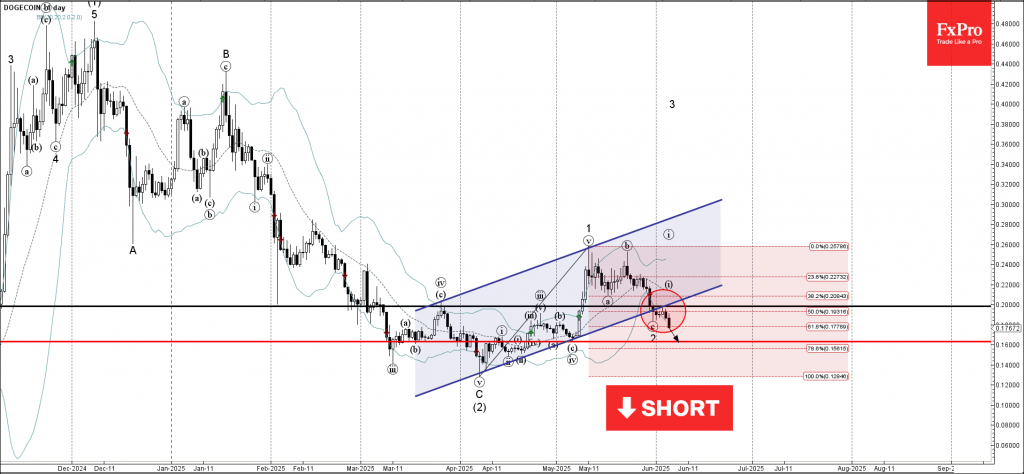

Dogecoin : ⬇️ Sell – Dogecoin broke key round support level 0.2000 – Likely to fall to support level 0.1600 Dogecoin cryptocurrency is under bearish pressure after the earlier breakout of the key round support level 0.2000 (former strong resistance.

June 5, 2025

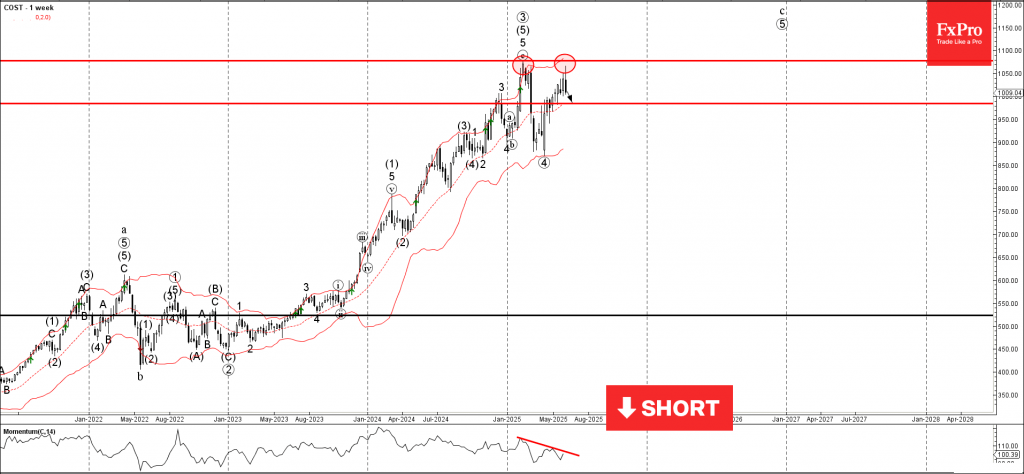

Costco: ⬇️ Sell – Costco reversed from the resistance zone – Likely to fall to support level 985.00 Costco recently reversed down sharply from the resistance zone located between the key resistance 1080.00 (which stopped the previous impulse wave 5) and the.

June 5, 2025

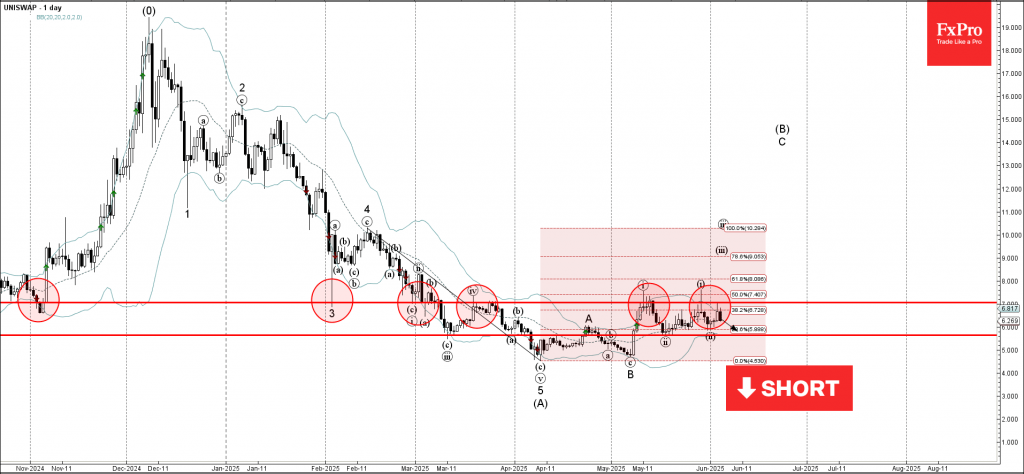

Uniswap coin: ⬇️ Sell – Uniswap coin reversed from resistance level 7.00 – Likely to fall to support level 5.640 Uniswap coin recently reversed down from the pivotal resistance level 7.00 (former strong support from February, which has been reversing.

June 5, 2025

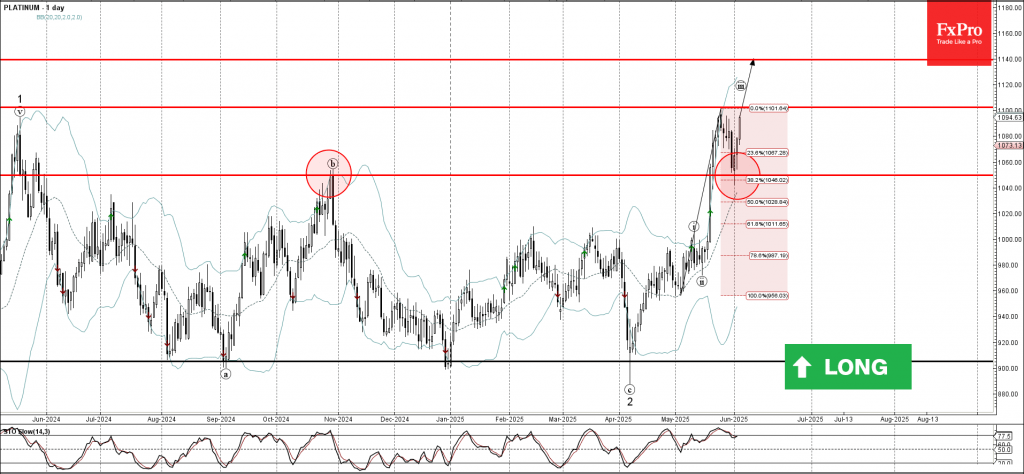

Platinum: ⬆️ Buy – Platinum reversed from support zone – Likely to rise to resistance level 1100.00 Platinum recently reversed up from the support zone between the support level 1050.00 (former multi-month high from October) and the 38.2% Fibonacci correction.

June 4, 2025

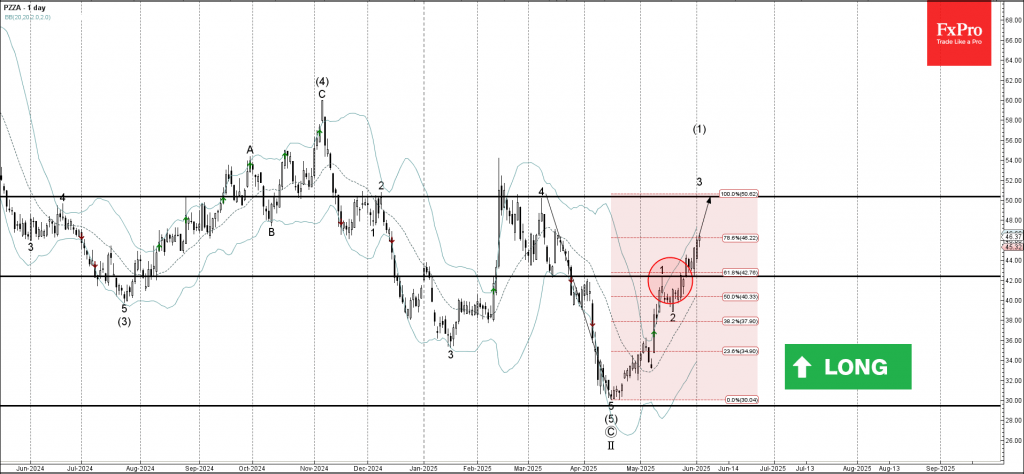

PZZA: ⬆️ Buy – PZZA broke resistance zone – Likely to rise to resistance level 50.00 PZZA recently broke the resistance zone between the resistance level 42.00 (top of the earlier impulse wave 1) and the 61.8 % Fibonacci correction.

June 4, 2025

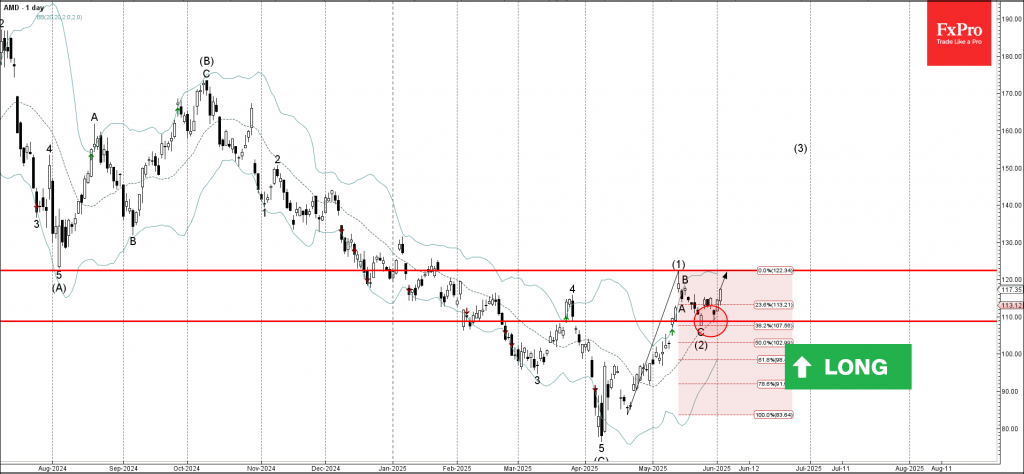

AMD: ⬆️ Buy – AMD reversed from the support zone – Likely to rise to the resistance level 122.45 AMD recently reversed up from the support zone between the support level 110.00 (low of the previous correction (2)), the 20-day.

June 3, 2025

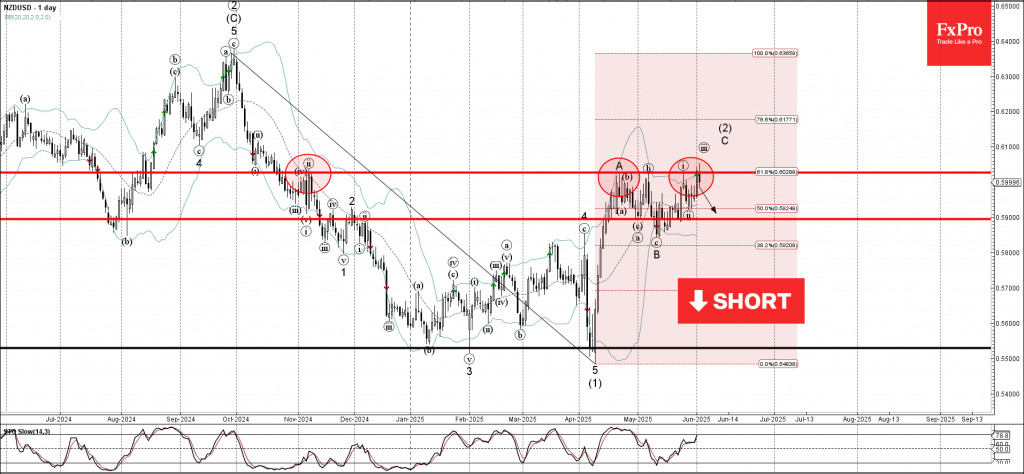

NZDUSD: ⬇️ Sell – NZDUSD reversed from the resistance zone – Likely to fall to support level 0.5900 NZDUSD currency pair recently reversed down from the resistance zone between the resistance level 0.6030 (which has been reversing the price from.

June 3, 2025

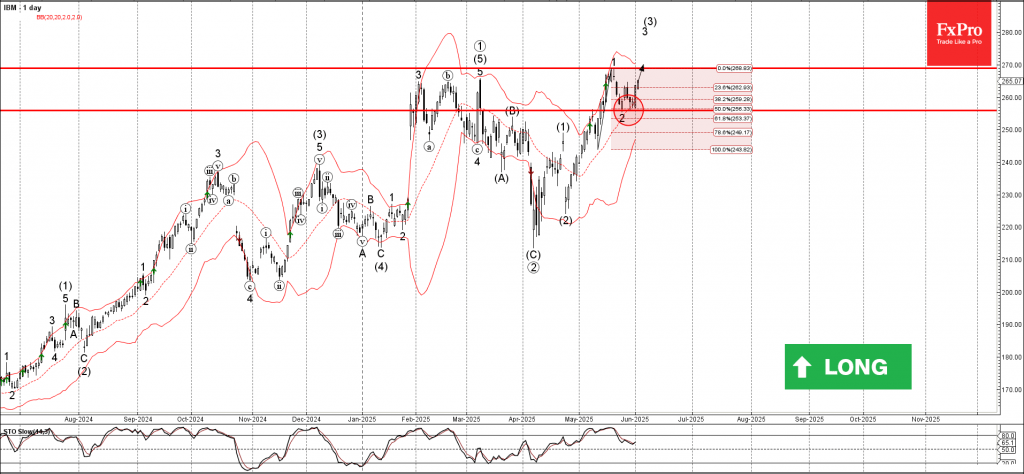

IBM: ⬆️ Buy – IBM reversed from the support zone – Likely to rise to the resistance level 270.00 IBM recently reversed up from the support zone between the support level 255.90 (low of the previous correction 2), the 20-day.