Technical analysis - Page 50

June 30, 2025

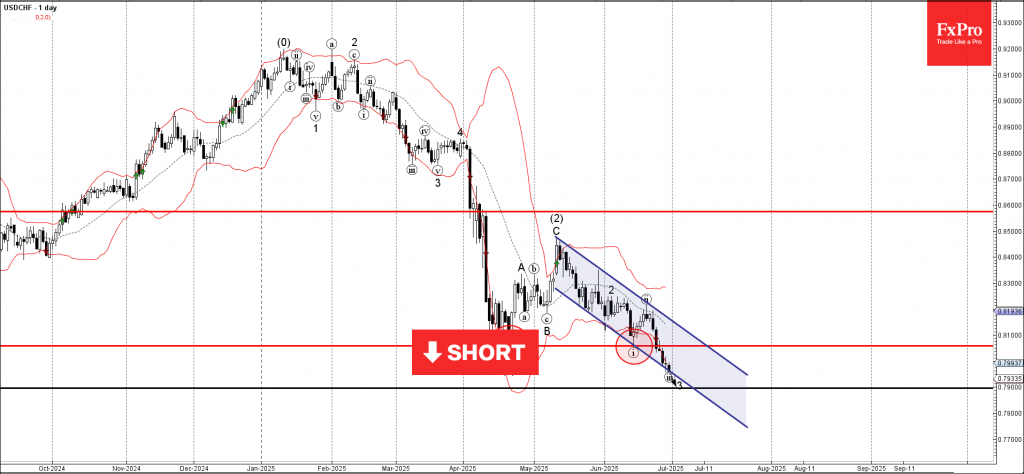

USDCHF: ⬇️ Sell – USDCHF falling inside a minor impulse wave – Likely to fall to support level 0.7900 USDCHF currency pair is falling strongly inside the minor impulse wave 3, which recently broke the daily down channel from the.

June 30, 2025

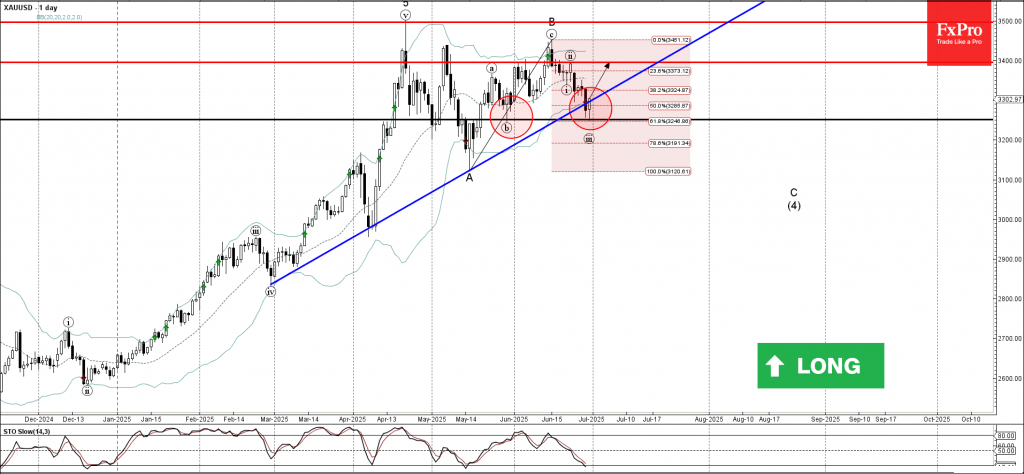

Gold: ⬆️ Buy – Gold reversed from support level 3250.00 – Likely to rise to resistance level 3400.00 Gold recently reversed up from the support level 3250.00 (which stopped wave (b) at the end of May, as can be seen.

June 28, 2025

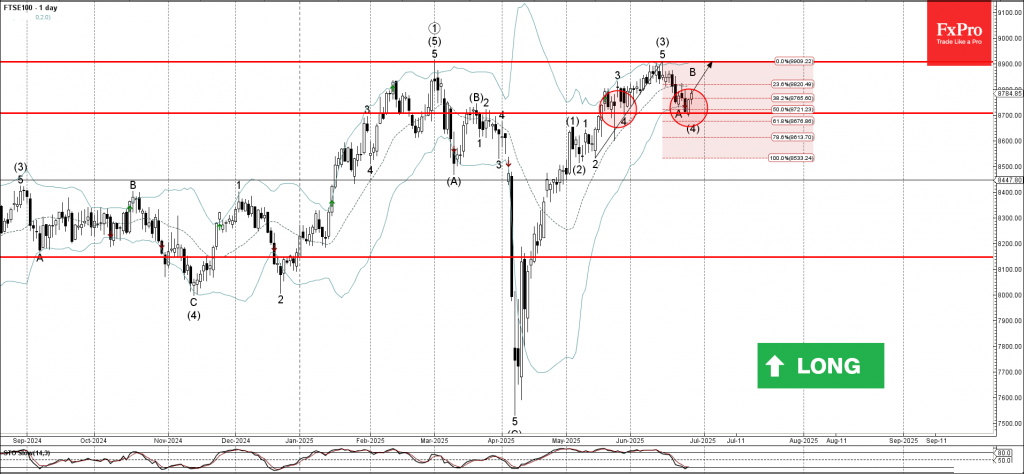

FTSE 100: ⬆️ Buy – FTSE 100 reversed from support level 8700.00 – Likely to rise to resistance level 8900.00 FTSE 100 index recently reversed up from the support level 8700.00 (which stopped wave 4 at the end of May,.

June 28, 2025

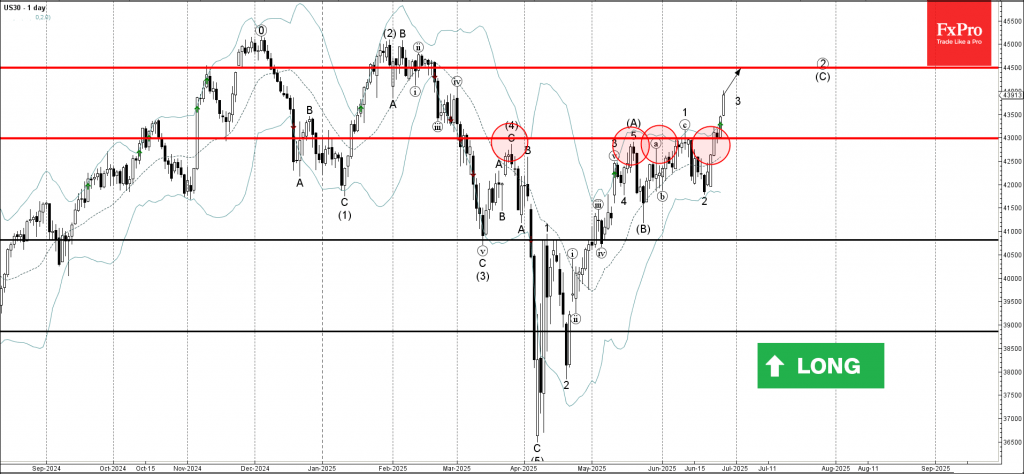

Dow Jones: ⬆️ Buy – Dow Jones broke pivotal resistance level 43000.00 – Likely to rise to resistance level 44500.00 Dow Jones index recently broke above the pivotal resistance level 43000.00 (which has been reversing the price from the end.

June 27, 2025

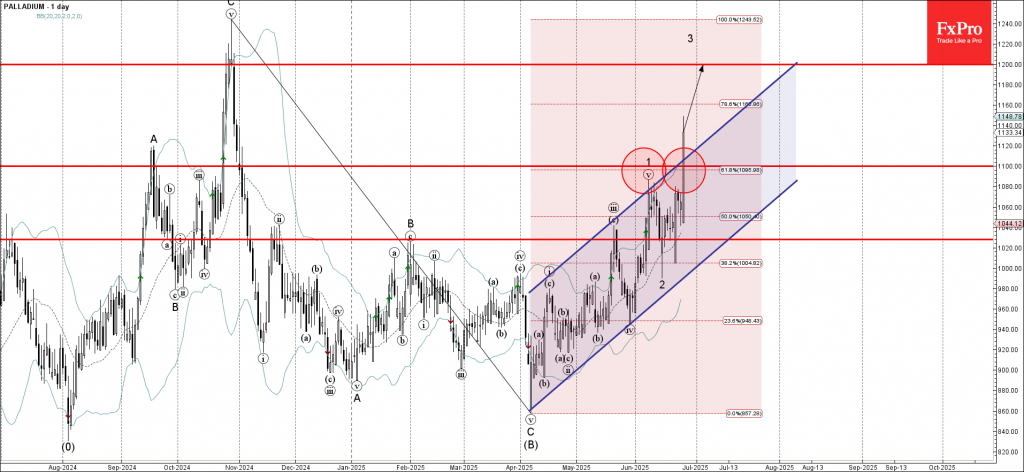

Palladium: ⬆️ Buy Palladium recently broke the resistance zone between the resistance level 1100.00, resistance trendline of the daily up channel from April and the 61.8% Fibonacci correction of the downtrend from October. The breakout of this resistance zone accelerated.

June 27, 2025

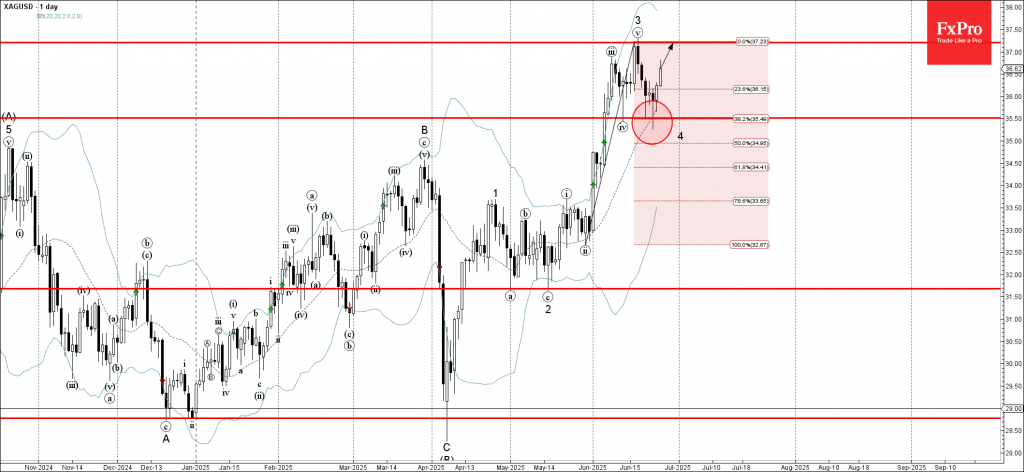

Silver: ⬆️ Buy – Silver reversed from key support level 35.50 – Likely to rise to resistance level 37.20 Silver recently reversed up from the key support level 35.50 (which stopped the previous minor correction iv at the start of.

June 26, 2025

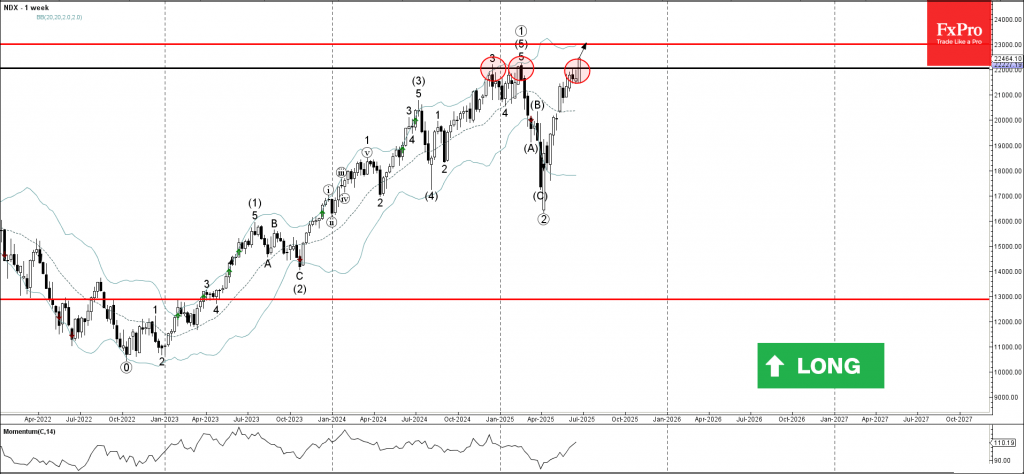

Nasdaq-100: ⬆️ Buy – Nasdaq-100 broke major resistance level 22100.00 – Likely to rise to resistance level 23000.00 Nasdaq-100 index recently broke above the major resistance level 22100.00 (which has been steadily reversing the index from the end of 2024.

June 26, 2025

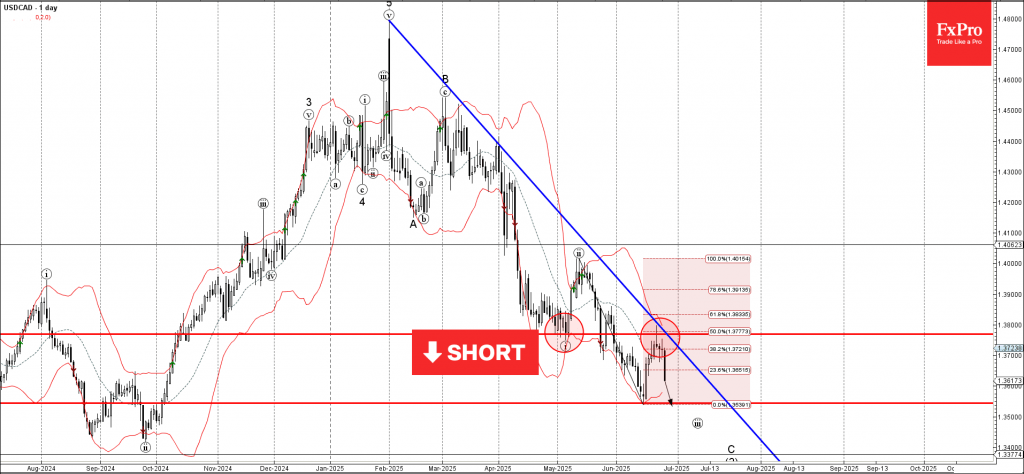

USDCAD: ⬇️ Sell – USDCAD reversed from the resistance zone – Likely to fall to support level 1.3545 USDCAD currency pair recently reversed down from the resistance zone between the resistance level 1.3770 (former support from the start of May),.

June 26, 2025

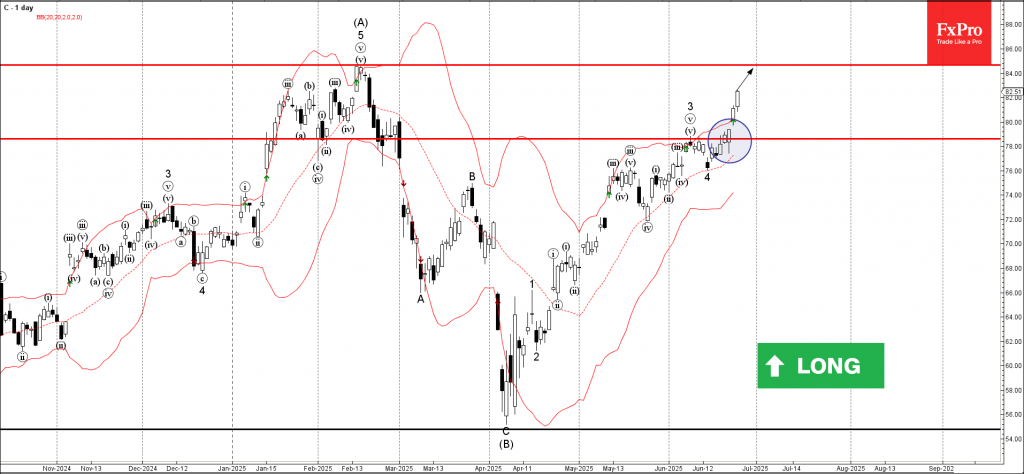

Citigroup: ⬆️ Buy – Citigroup rose above the resistance level 78.60 – Likely to rise to resistance level 84.65 Citigroup recently rose above the resistance level 78.60, which stopped the previous minor impulse wave 3 at the start of June. The.

June 26, 2025

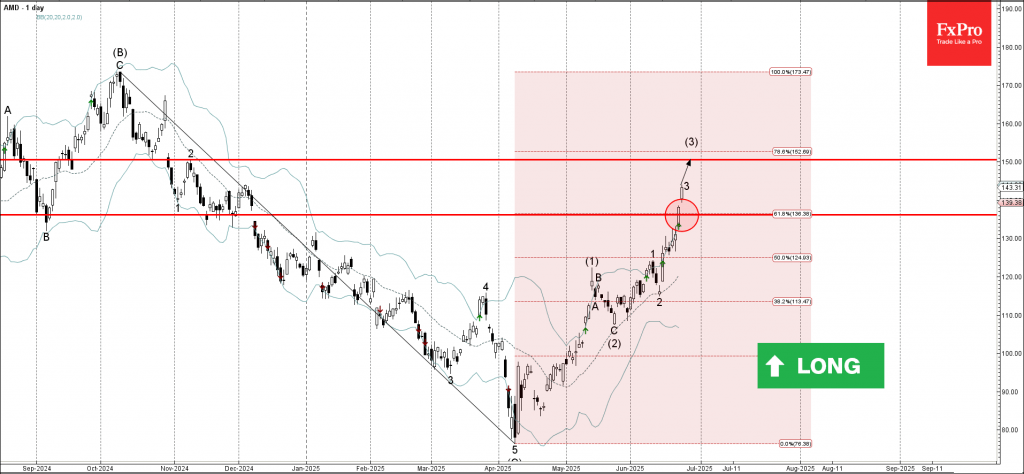

AMD: ⬆️ Buy – AMD rose above the resistance level 136.16 – Likely to rise to resistance level 150.00 AMD recently broke the resistance zone between the resistance level 136.16 (former strong support from 2024) and the 61.8% Fibonacci correction of the.

June 26, 2025

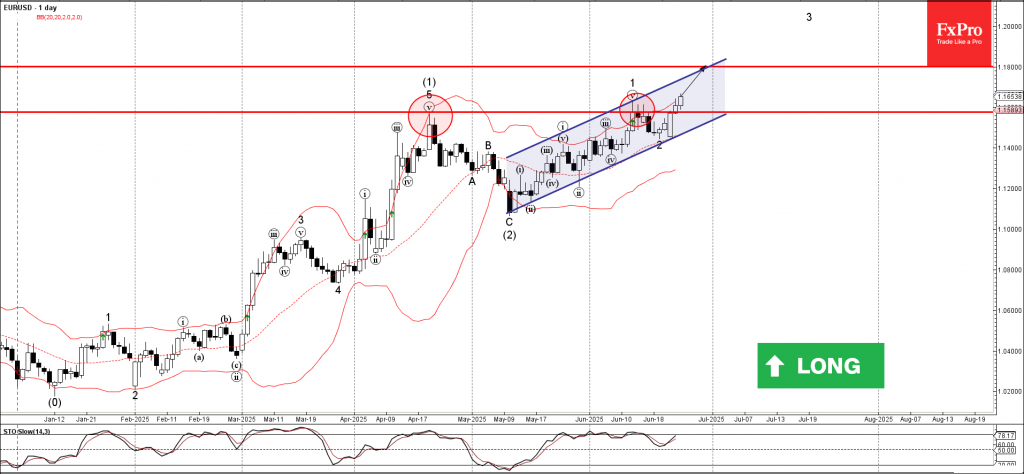

EURUSD: ⬆️ Buy – EURUSD broke resistance level 1.1575 – Likely to rise to resistance level 1.1800 EURUSD currency pair recently broke the resistance level 1.1575 , which is the former monthly high from the middle of April. The breakout.