Technical analysis - Page 48

July 9, 2025

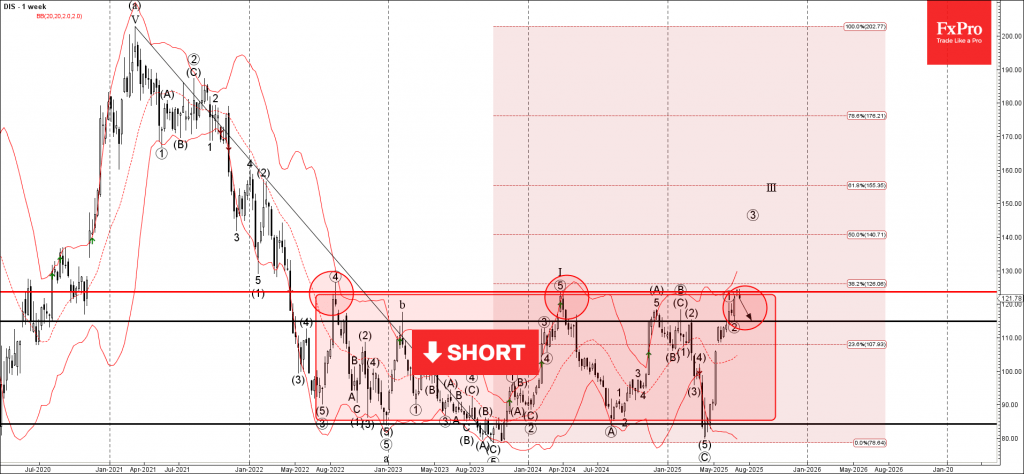

Disney: ⬇️ Sell – Disney reversed from multi-month resistance level 123.60 – Likely to fall to support level 114.90 Disney recently reversed from the strong multi-month resistance level 123.60 (which is the upper border of the sideways price range inside.

July 9, 2025

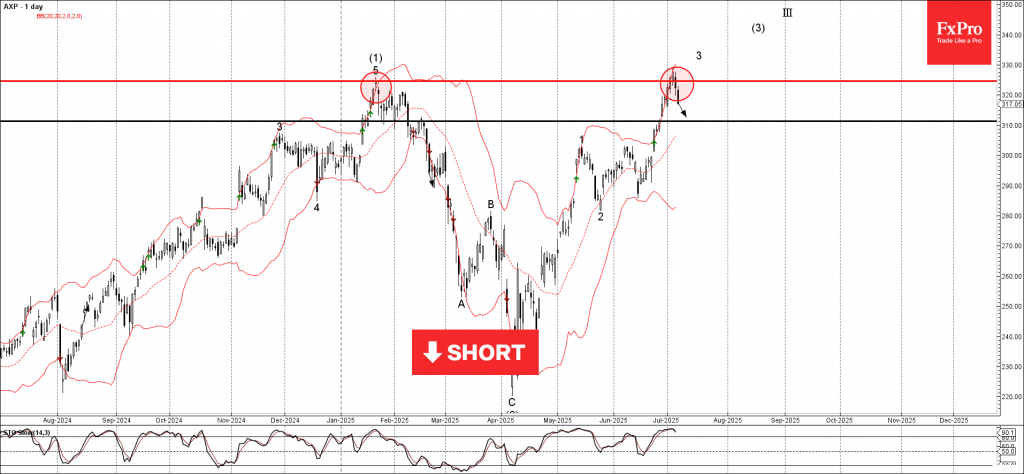

American Express: ⬇️ Sell – American Express reversed from key resistance level 325.00 – Likely to fall to support level 310.00 American Express recently reversed from the resistance area between the key resistance level 325.00 (which stopped the sharp daily.

July 8, 2025

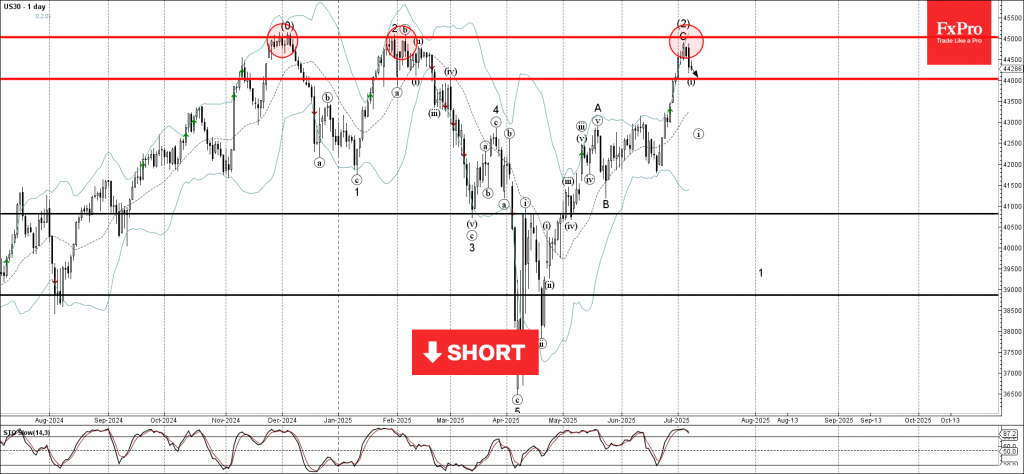

Dow Jones: ⬇️ Sell – Dow Jones reversed from long-term resistance level 45000.00 – Likely to fall to support level 44000.00 Dow Jones index recently reversed down from the resistance zone located between the long-term resistance level 45000.00 (which has.

July 8, 2025

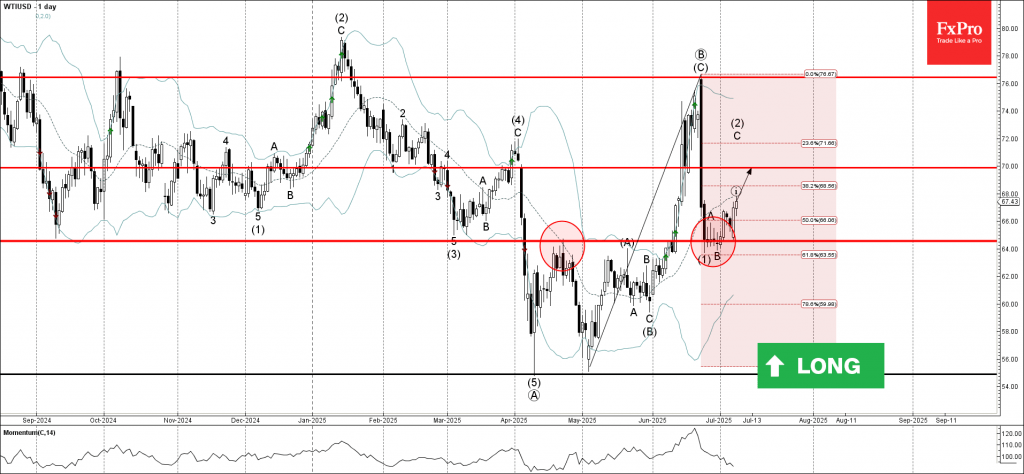

WTI crude oil: ⬆️ Buy – WTI crude oil reversed from the support zone – Likely to rise to resistance level 70.00 WTI crude oil recently reversed up from the support zone located between the key support level 64.55 (former.

July 8, 2025

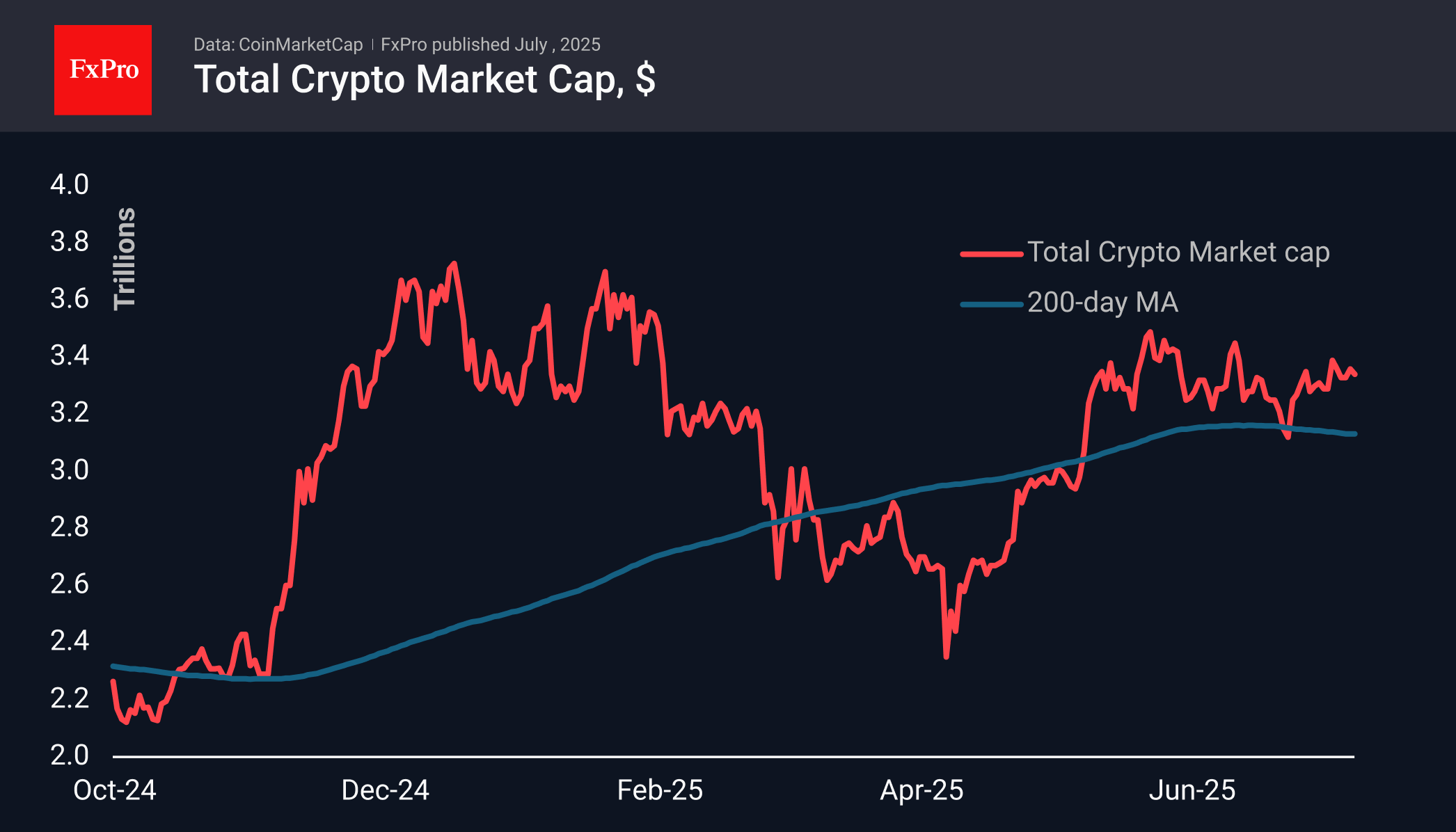

Cryptocurrency market capitalisation rises but dips in the last 24 hours to $3.35 trillion. Bitcoin hovers near $108.5K, with on-chain activity and volatility at a two-year low.

July 7, 2025

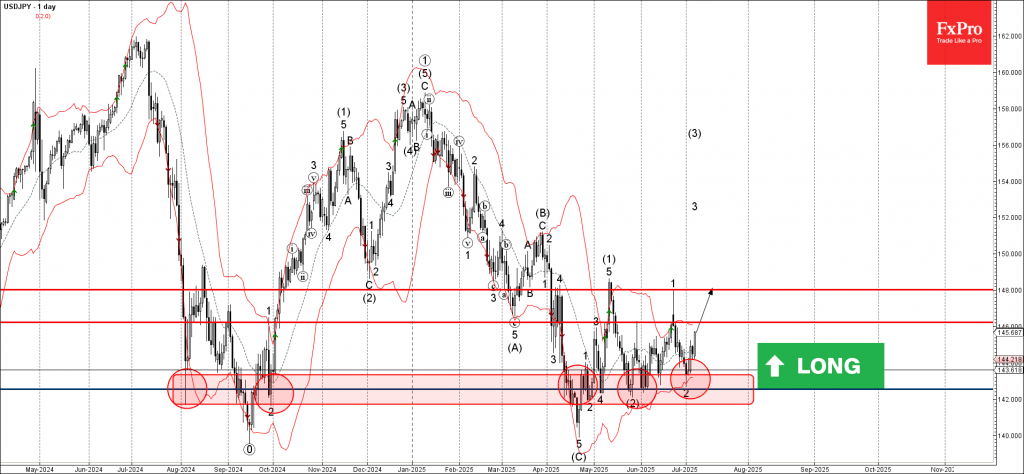

USDJPY: ⬆️ Buy – USDJPY reversed from long-term support level 142.50 – Likely to rise to resistance level 148.00 USDJPY currency pair recently reversed up from the support zone located between the long-term support level 142.50 (which has been steadily.

July 7, 2025

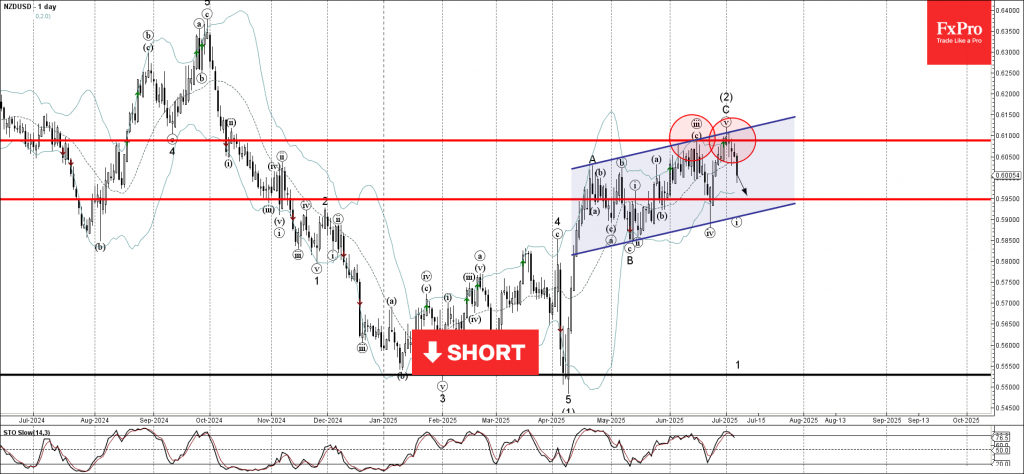

NZDUSD: ⬇️ Sell – NZDUSD reversed from resistance level 0.6100 – Likely to fall to support level 0.5950 NZDUSD currency pair recently reversed down from the key resistance level 0.6100 (which has been steadily reversing the price from October, as.

July 4, 2025

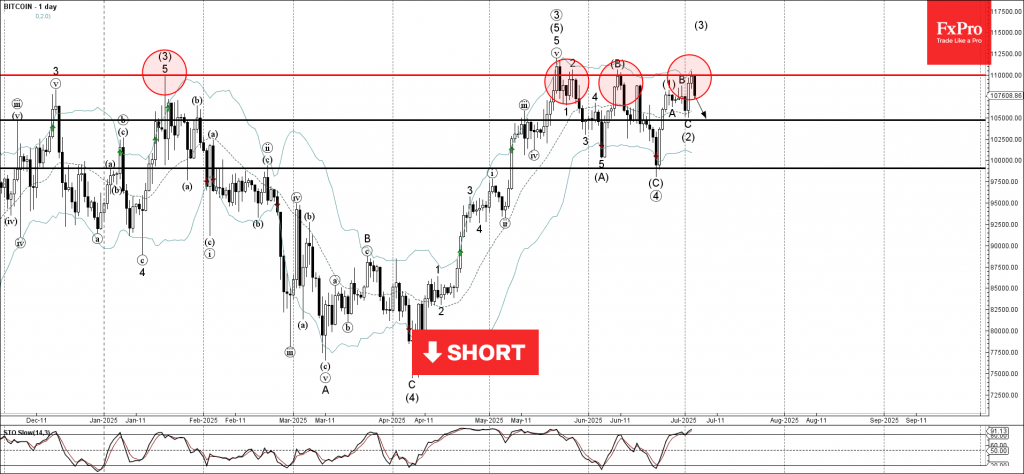

Bitcoin: ⬇️ Sell – Bitcoin reversed from long-term resistance level 110000.00 – Likely to fall to support level 105000.00 Bitcoin cryptocurrency recently reversed down from the major long-term resistance level 110000.00 (which has been steadily reversing the price from the.

July 4, 2025

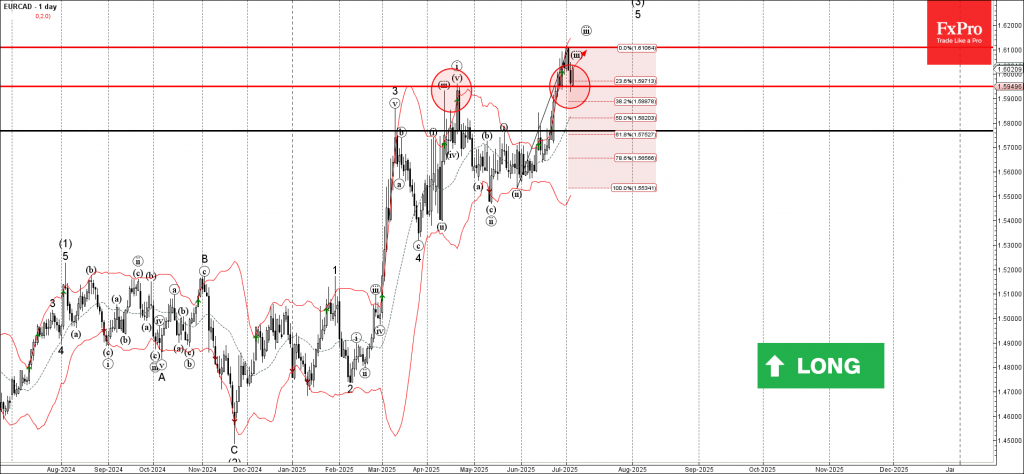

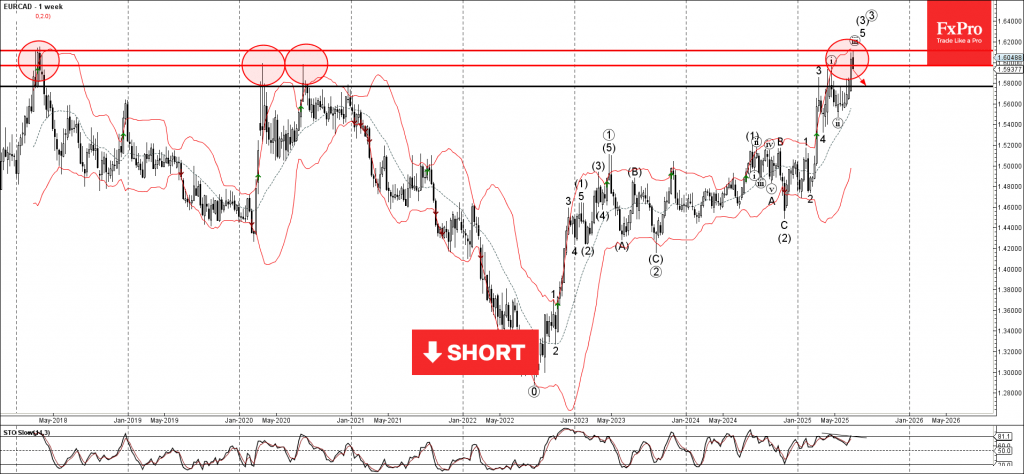

EURCAD: ⬆️ Buy – EURCAD reversed from support level 1.5950 – Likely to rise to resistance level 1.6100 EURCAD currency pair recently reversed up from the strong support level 1.5950 (former double top from April, acting as the support after.

July 4, 2025

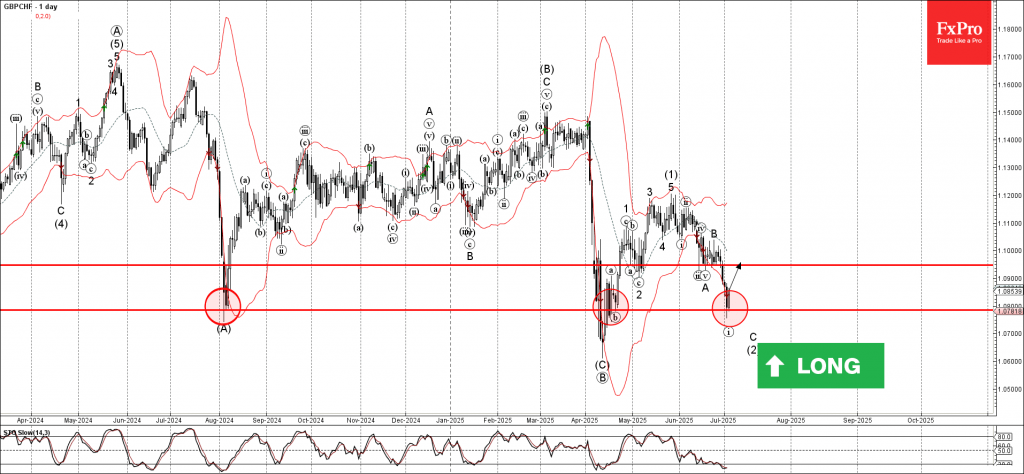

GBPCHF: ⬆️ Buy – GBPCHF reversed from strong support level 1.0785 – Likely to rise to resistance level 1.0950 GBPCHF currency pair recently reversed up from the strong support level 1.0785 (which has been steadily reversing the price from last.

July 4, 2025

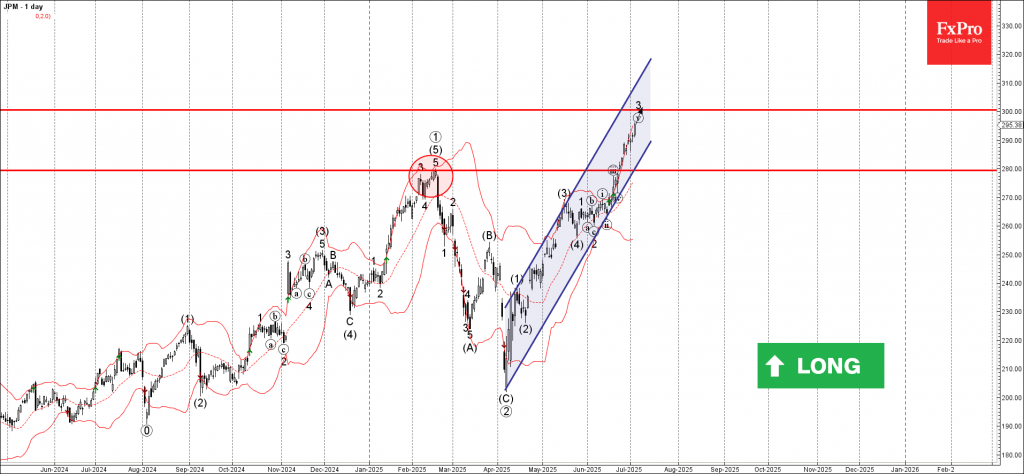

JPMorgan: ⬆️ Buy – JPMorgan broke key resistance level 280.00 – Likely to rise to resistance level 300.00 JPMorgan recently broke above the key resistance level 280.00 (which stopped the earlier sharp upward impulse wave (5) in February). The breakout.