Technical analysis - Page 47

July 11, 2025

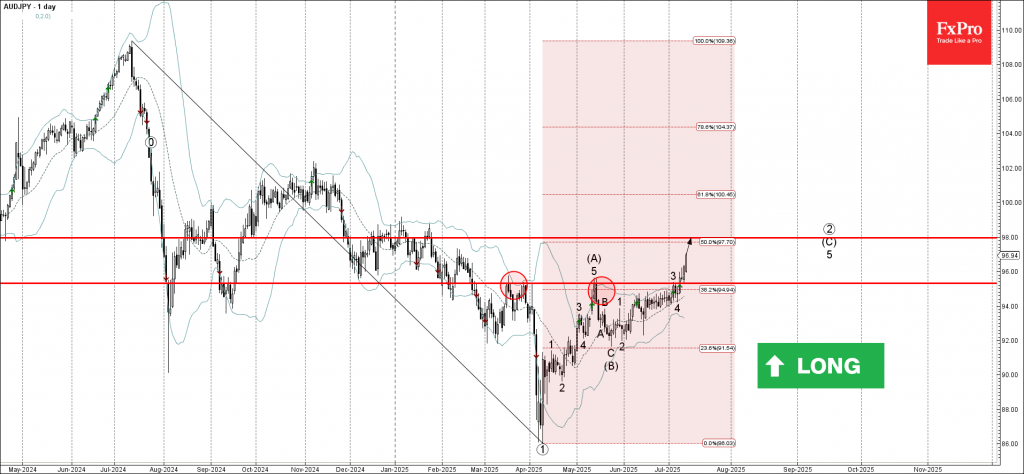

AUDJPY: ⬆️ Buy – AUDJPY broke resistance zone – Likely to rise to resistance level 98.00 AUDJPY currency pair recently broke the resistance zone between the resistance level 95.30 (which has been reversing the price from March) and the 38.2%.

July 11, 2025

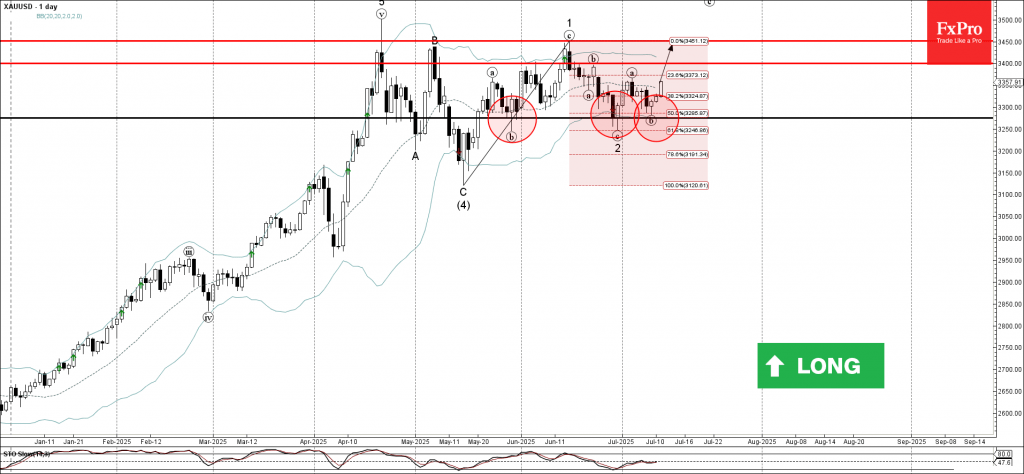

Gold: ⬆️ Buy – Gold reversed from support zone – Likely to rise to resistance levels 3400.00 and 3450.00 Gold recently reversed up from the support zone between the strong support level 3275.50 (which has been reversing the price from.

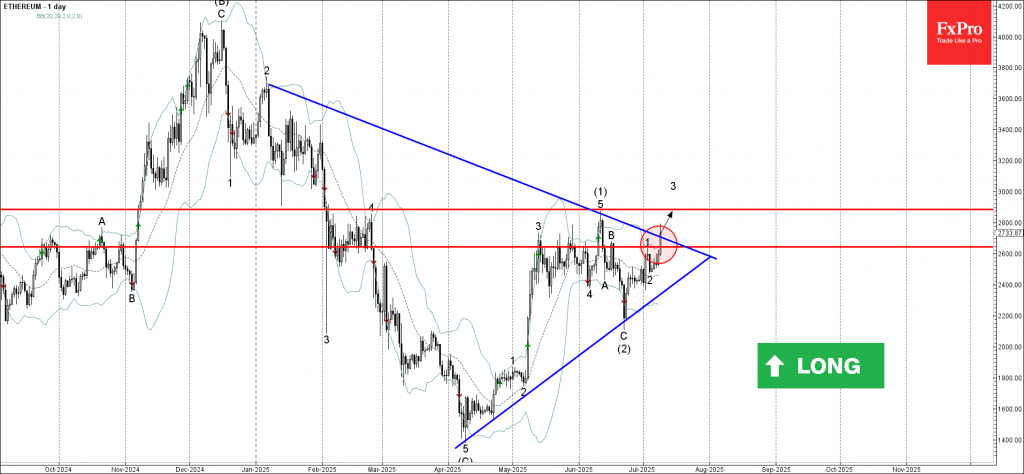

July 11, 2025

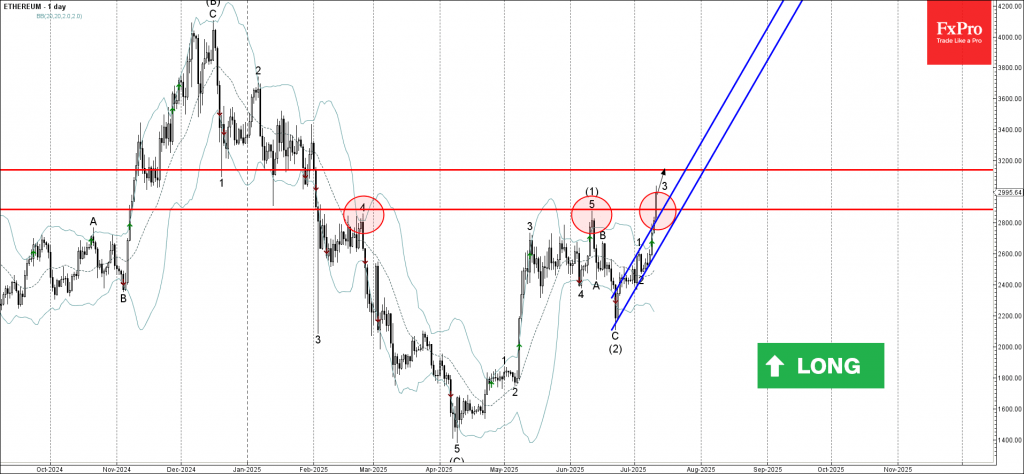

Ethereum: ⬆️ Buy – Ethereum broke resistance zone – Likely to rise to resistance level 3140.00 Ethereum cryptocurrency recently broke the resistance area lying at the intersection of the key resistance level 2885.00 (which has been reversing the price from.

July 11, 2025

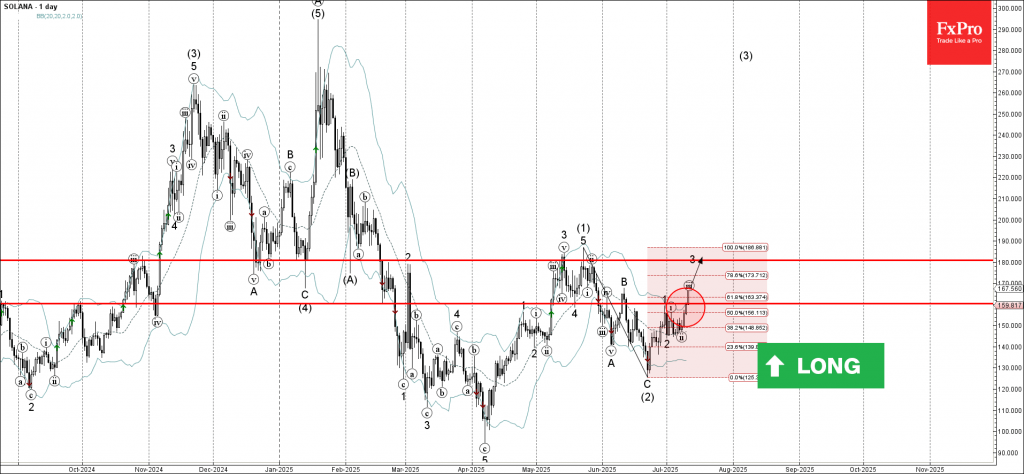

Solana: ⬆️ Buy – Solana broke resistance zone – Likely to rise to resistance level 180.00 Solana cryptocurrency recently broke the resistance zone between the resistance level 159.80 (which has been reversing the price from the start of June) and.

July 11, 2025

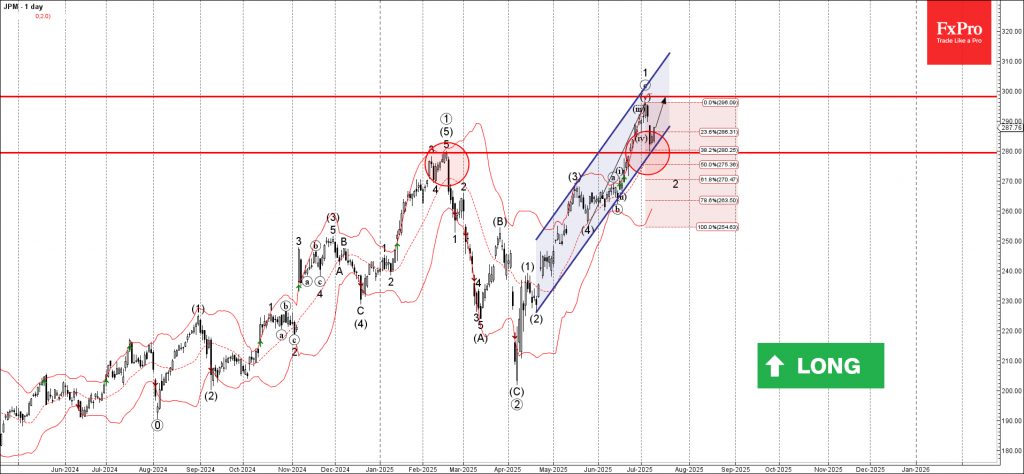

JPMorgan Chase: ⬆️ Buy – JPMorgan Chase reversed from support zone – Likely to rise to resistance level 296.00 JPMorgan Chase recently reversed up from the support zone between the support level 280.00 (former multi-month high from January), support trendline.

July 11, 2025

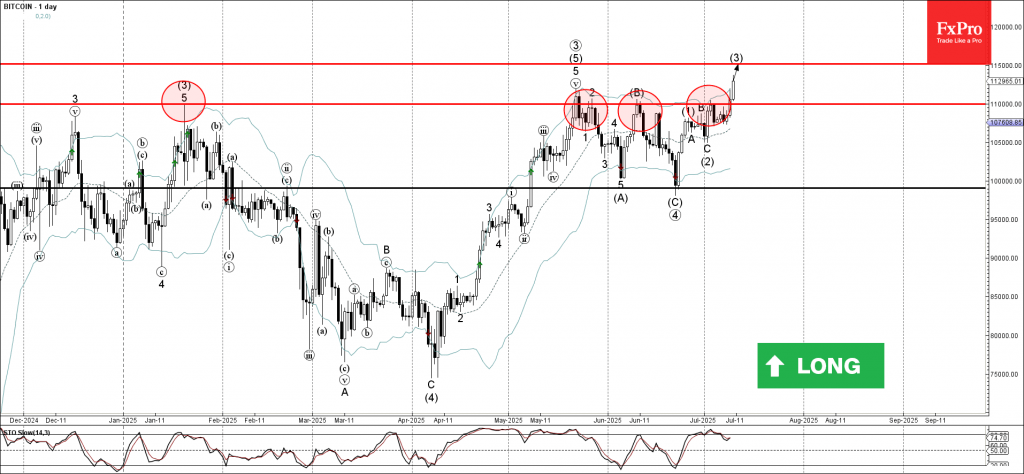

Bitcoin: ⬆️ Buy – Bitcoin broke round resistance level 110000.00 – Likely to rise to resistance level 115000.00 Bitcoin cryptocurrency recently broke the round resistance level 110000.00 (which stopped multiple upward impulse waves from the start of this year). The breakout.

July 11, 2025

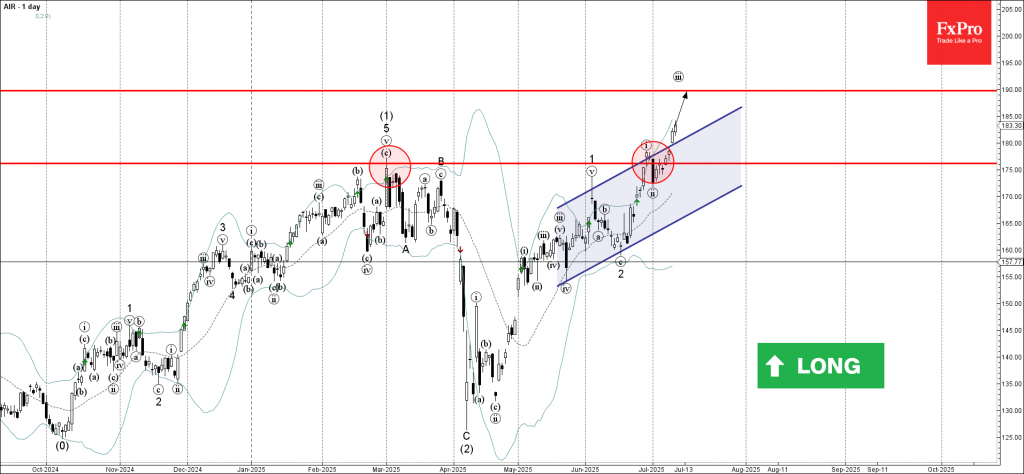

Airbus: ⬆️ Buy – Airbus broke resistance zone – Likely to rise to resistance level 190.00 Airbus recently broke the resistance zone lying between the resistance level 175.00 (which started the earlier sharp downward correction in March, as can be seen from.

July 11, 2025

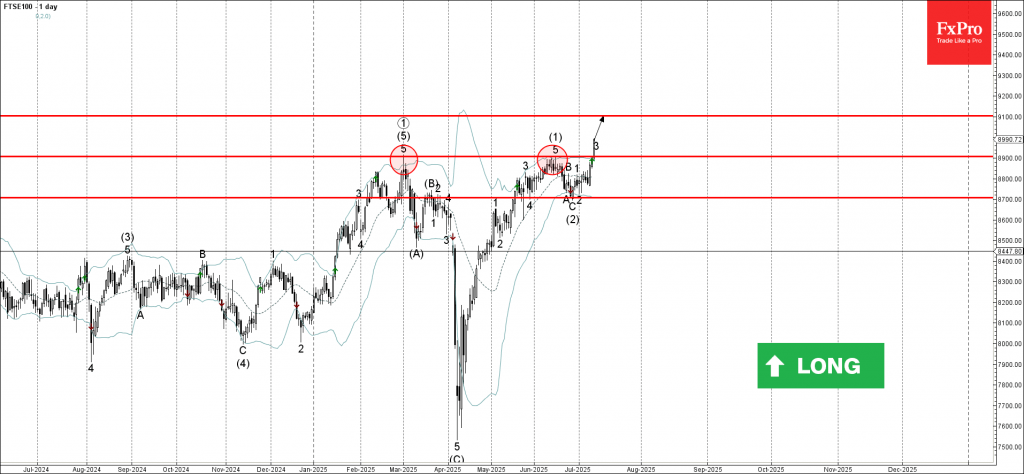

FTSE 100: ⬆️ Buy – FTSE 100 broke key resistance level 8900.00 – Likely to rise to resistance level 9100.00 FTSE 100 index recently broke above the key resistance level 8900.00 (which has been reversing the price from March, as.

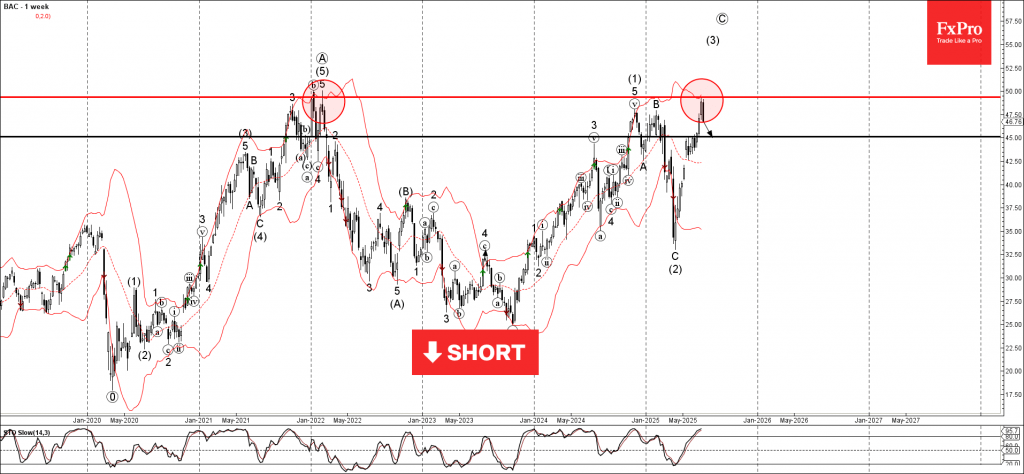

July 10, 2025

Bank of America: ⬇️ Sell – Bank of America reversed from resistance area – Likely to fall to support level 45.00 Bank of America recently reversed down from the resistance area located between the long-term resistance level 50.00 (which started.

July 10, 2025

Ethereum: ⬆️ Buy – Ethereum broke the resistance area – Likely to rise to resistance level 2885.00 Ethereum cryptocurrency recently broke the resistance area located between the resistance level 2645.00 (which stopped wave 1 at the start of July) and.

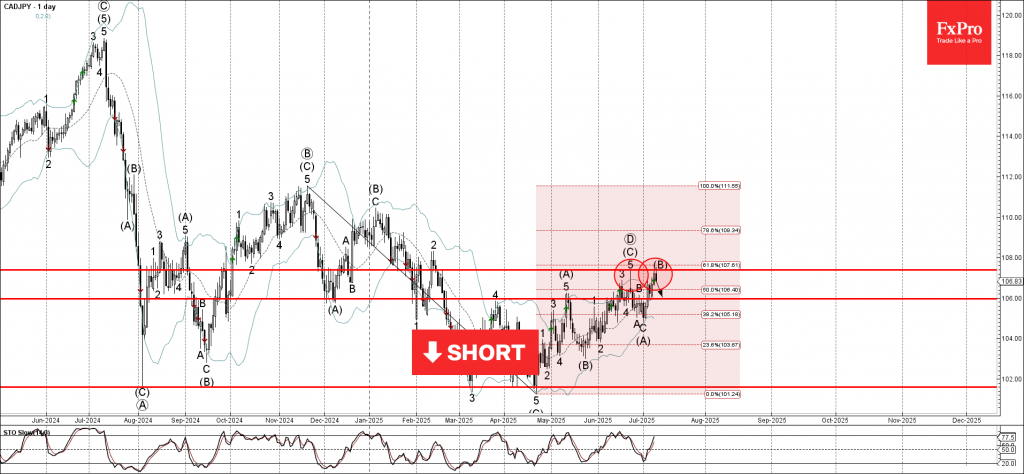

July 9, 2025

CADJPY: ⬇️ Sell – CADJPY reversed from resistance area – Likely to fall to support level 106.00 CADJPY currency pair recently reversed from the resistance area located between the resistance level 107.40 (former monthly high from June), upper daily Bollinger.