Technical analysis - Page 46

July 17, 2025

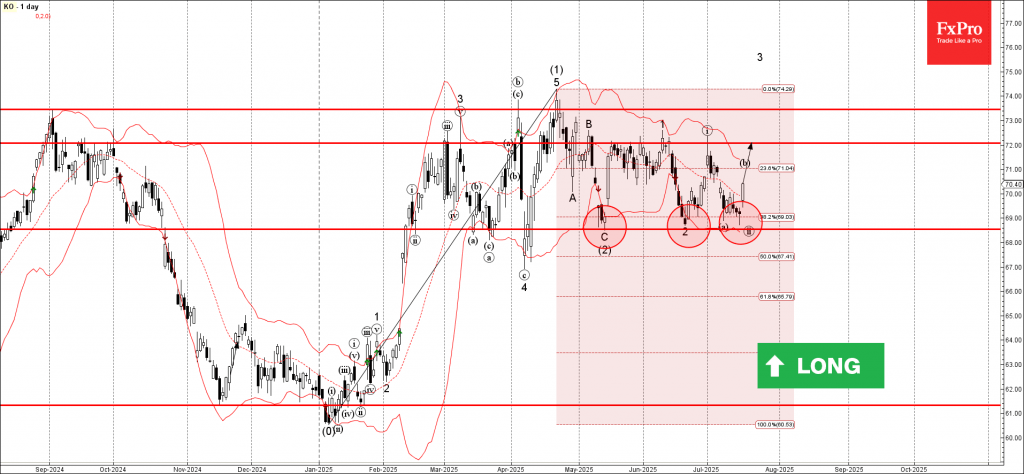

Coca-Cola: ⬆️ Buy – Coca-Cola reversed from the support area – Likely to rise to resistance level 72.00 Coca-Cola recently reversed from the support area between the key support level 68.55 (which has been reversing the price from May), lower.

July 17, 2025

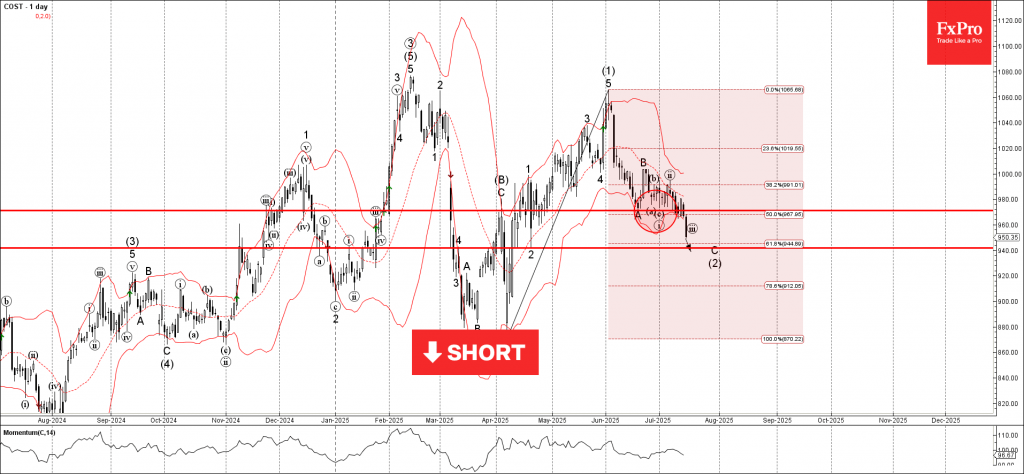

Costco: ⬇️ Sell – Costco broke the support area – Likely to fall to support level 940.00 Costco recently broke the support area located between the pivotal support level 970.00 and the 50% Fibonacci correction of the upward impulse from.

July 17, 2025

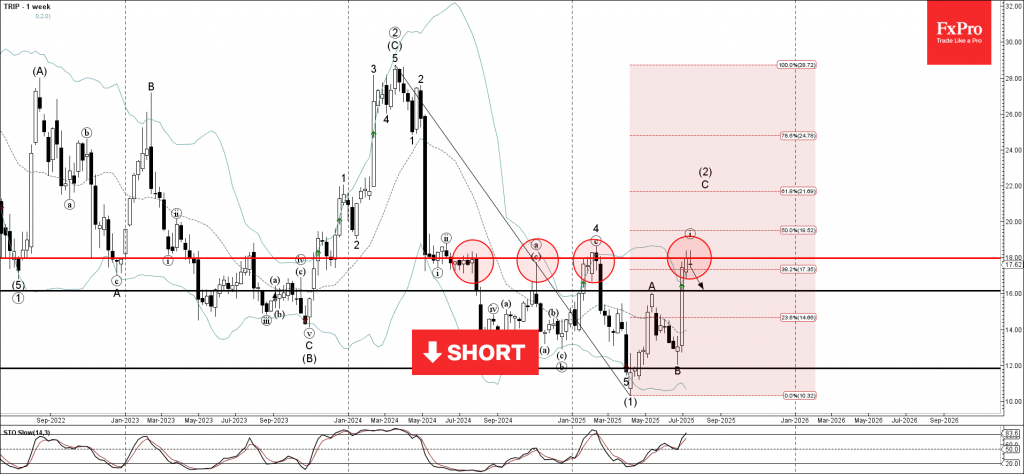

Trip: ⬇️ Sell – Trip reversed from resistance area – Likely to fall to support level 16.00 Trip recently reversed down from the resistance area located at the intersection of the strong resistance level 18.00, upper weekly Bollinger Band and.

July 16, 2025

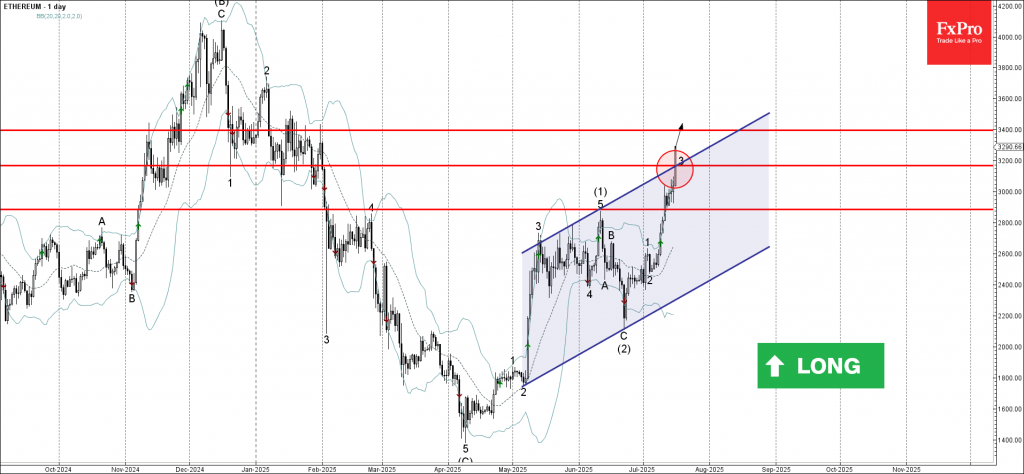

Ethereum: ⬆️ Buy – Ethereum broke resistance area – Likely to rise to resistance level 3400.00 Ethereum cryptocurrency recently broke the resistance area located at the intersection of the resistance level 3200.00 and the resistance trendline of the daily up.

July 16, 2025

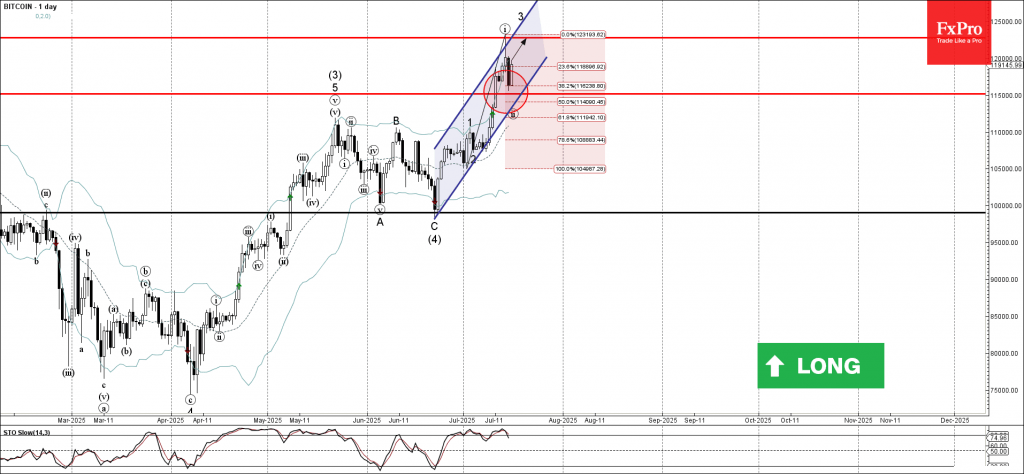

Bitcoin: ⬆️ Buy – Bitcoin reversed from a support area – Likely to rise to resistance level 122770.00 Bitcoin cryptocurrency recently reversed up from the support area located between the key support level 115000.00 and the support trendline of the.

July 16, 2025

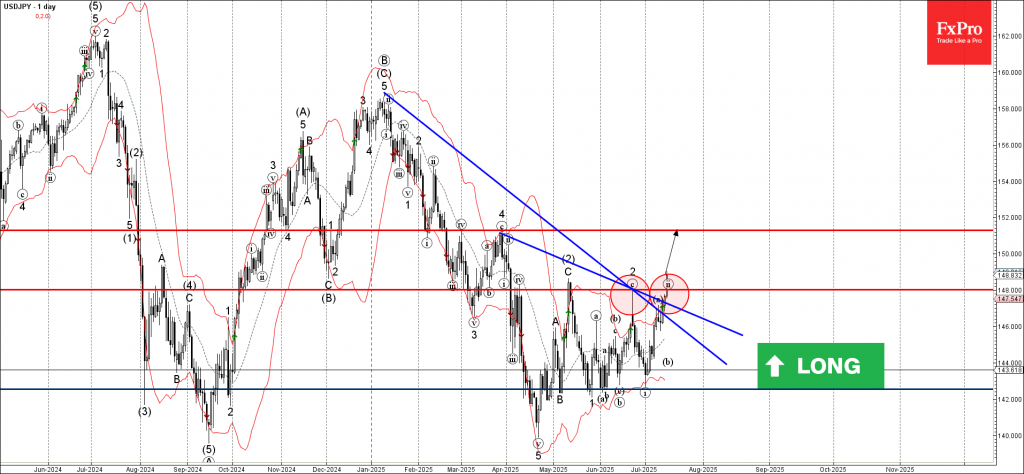

USDJPY: ⬆️ Buy – USDJPY broke the resistance area – Likely to rise to resistance level 151.30 USDJPY currency pair recently broke the resistance area located at the intersection of the resistance level 148.00 and the two resistance trendlines from.

July 16, 2025

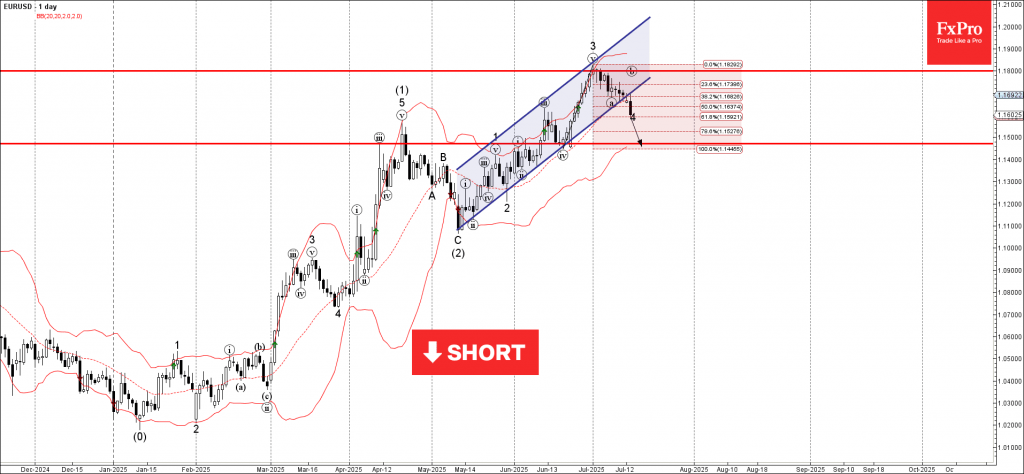

EURUSD: ⬇️ Sell – EURUSD broke daily up channel – Likely to fall to support level 1.1470 EURUSD currency pair recently broke the support area located at the intersection of the support trendline of the daily up channel from May.

July 16, 2025

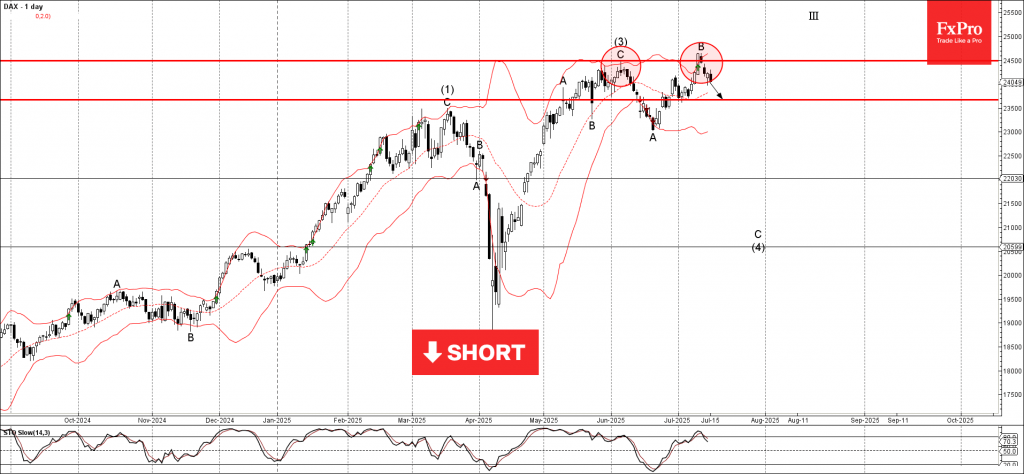

DAX: ⬇️ Sell – DAX reversed from the resistance area – Likely to fall to support level 23675.00. DAX index recently reversed down the resistance area between the pivotal resistance level 24500.00 (former top of wave 3 from June) and.

July 16, 2025

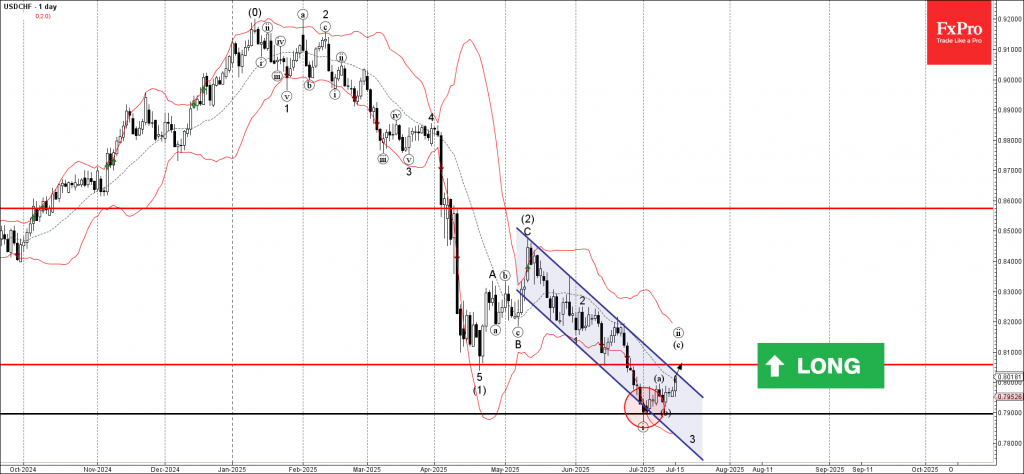

USDCHF: ⬆️ Buy – USDCHF reversed from support zone – Likely to rise to resistance level 0.8055 USDCHF currency pair recently reversed from the support zone lying at the intersection of the support level 0.7900, lower daily Bollinger Band and.

July 15, 2025

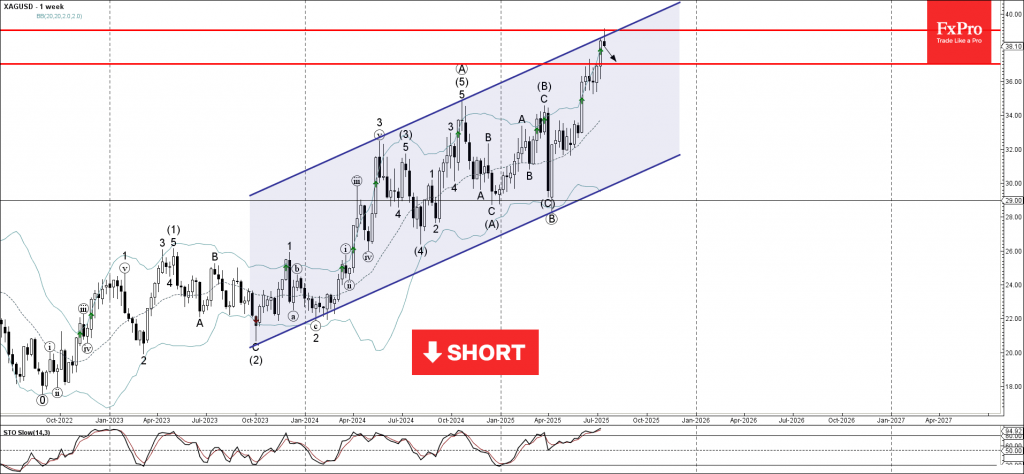

Silver: ⬇️ Sell – Silver reversed from resistance zone – Likely to fall to support level 37.00 Silver recently reversed down from the resistance zone lying at the intersection of the resistance level 39.00, upper weekly Bollinger Band and the.

July 15, 2025

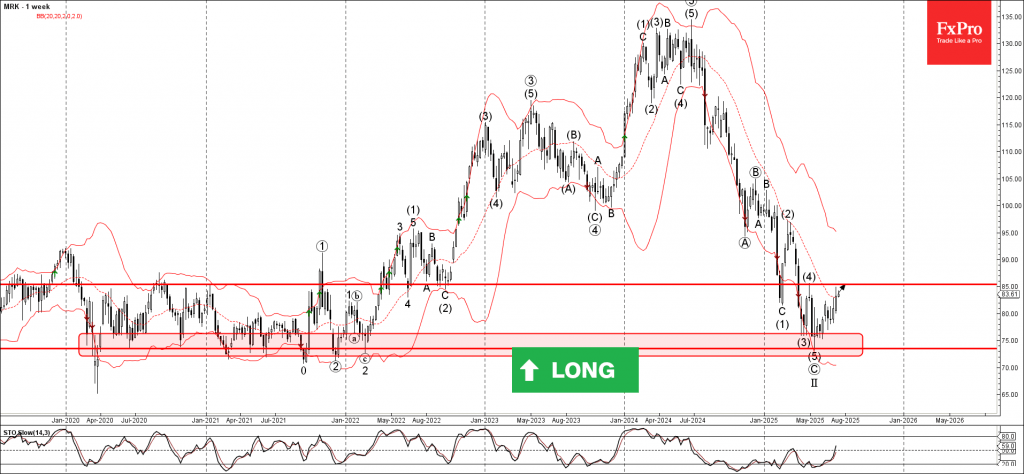

MRK: ⬆️ Buy – MRK reversed from the support zone – Likely to rise to resistance level 85.00 MRK recently reversed up from the support zone surrounding the long-term support level 73.45 (which has been reversing the price from the.