Technical analysis - Page 45

July 23, 2025

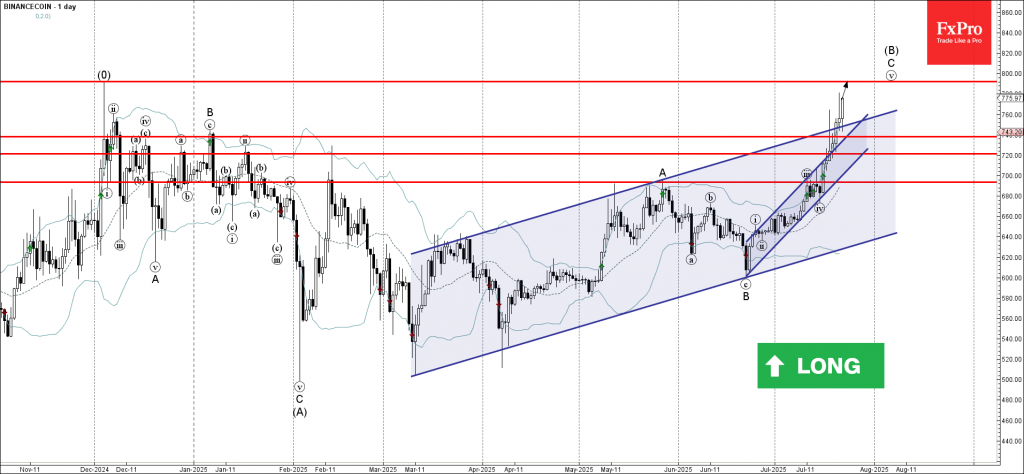

BNB: ⬆️ Buy – BNB rising inside sharp impulse wave C – Likely to rise to resistance level 792.00 BNB cryptocurrency continues to rise inside the sharp upward impulse wave C, which previously broke through the 3 strong resistance levels 693.00, 720.00.

July 22, 2025

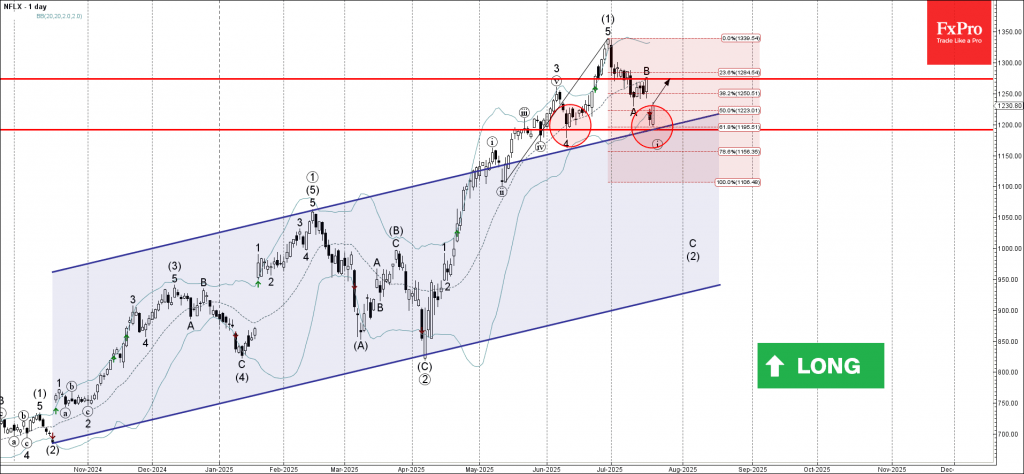

Netflix: ⬆️ Buy – Netflix reversed from support zone – Likely to rise to resistance level 1275.00 Netflix recently reversed up from the support zone between the support level 1200.00 (which stopped wave 4 at the start of June), lower daily Bollinger.

July 22, 2025

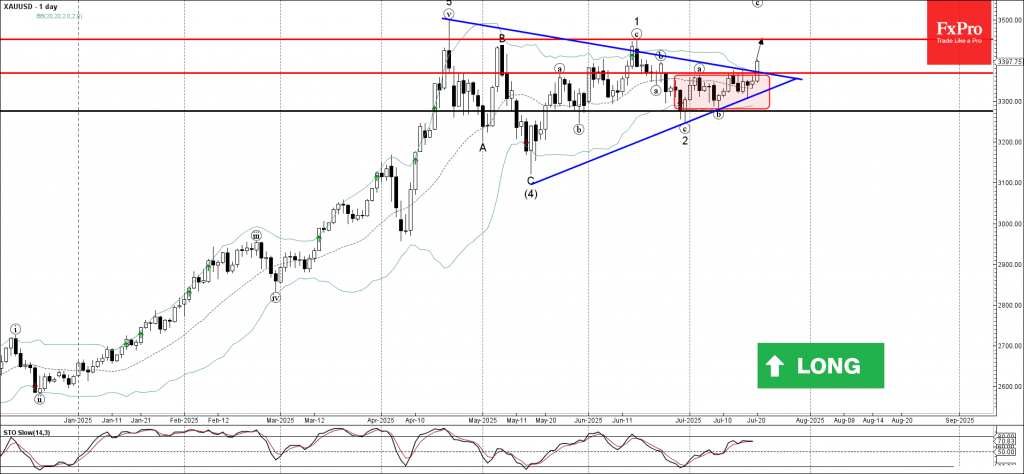

Gold: ⬆️ Buy – Gold broke resistance daily Triangle – Likely to rise to resistance level 3450.00 Gold recently broke the resistance zone between the resistance level 3370.00 (upper border of the narrow sideways price range inside which Gold has.

July 22, 2025

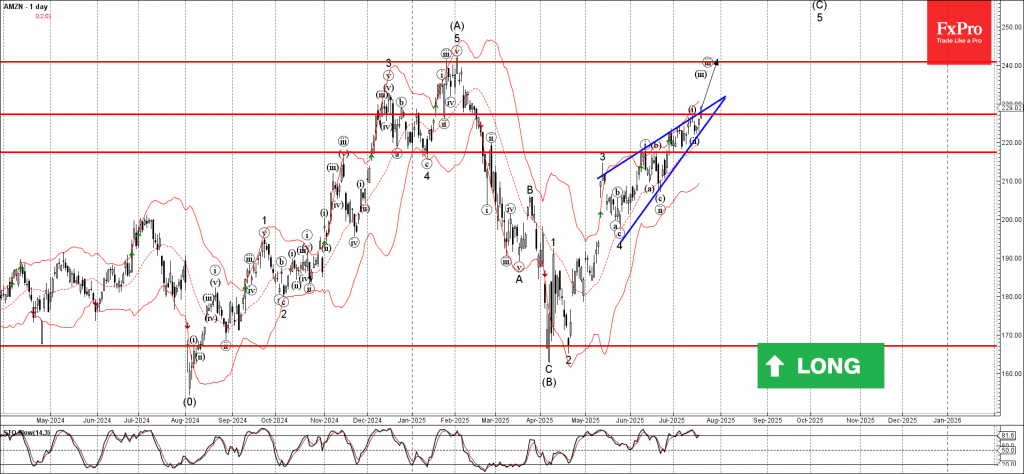

Amazon: ⬆️ Buy – Amazon broke resistance zone – Likely to rise to resistance 240.00 Amazon recently broke the resistance zone between the resistance level 227.30 (top of the previous impulse wave i) and the resistance trendline of the daily.

July 22, 2025

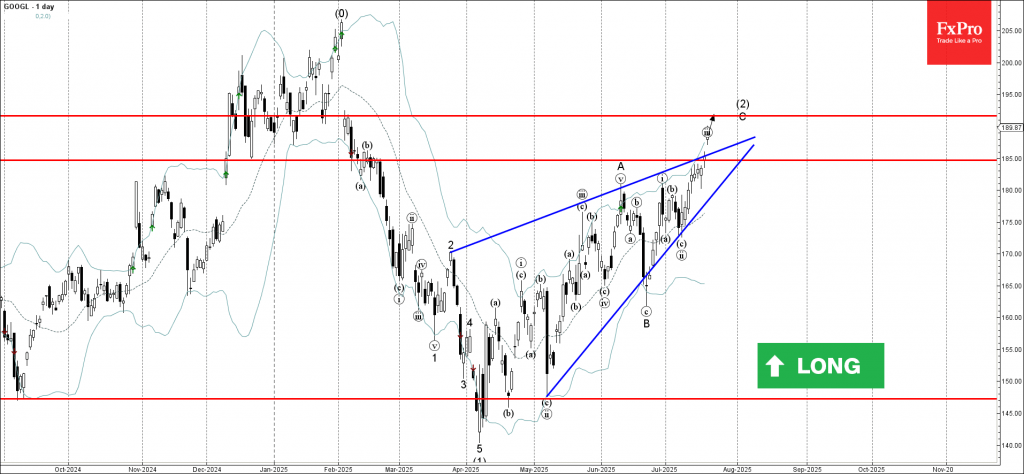

Google: ⬆️ Buy – Google broke resistance zone – Likely to rise to resistance 191.65 Google recently broke the resistance zone between the resistance level 185.00 and the upper trendline of the daily Rising Wedge from the start of May..

July 19, 2025

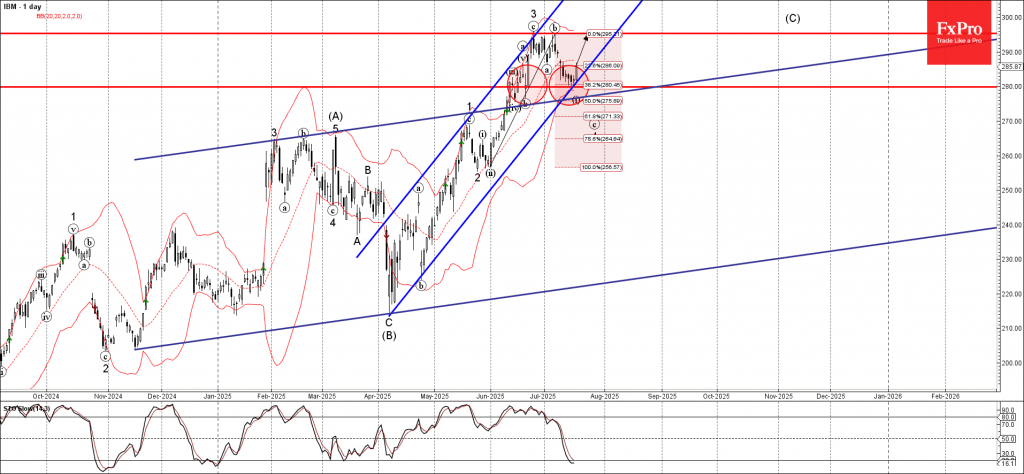

IBM: ⬆️ Buy – IBM reversed from support zone – Likely to rise to resistance 295.40 IBM recently reversed up from the support zone between the support level 280.00, upper trendline of the recently broken weekly up channel from 2024.

July 19, 2025

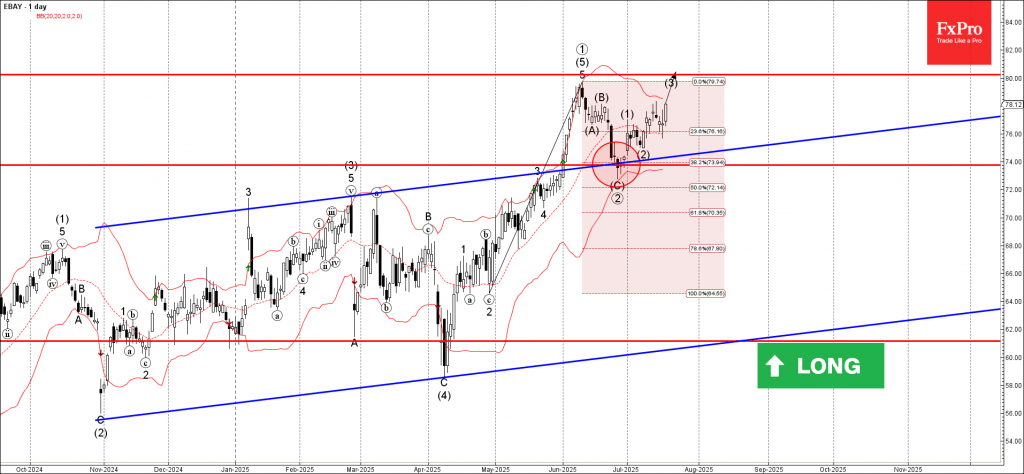

Ebay: ⬆️ Buy – Ebay rising inside impulse wave (3) – Likely to rise to resistance 80.00 Ebay continues to rise inside the impulse wave (3) of the long-term upward impulse wave 3 from the end of June. The active.

July 19, 2025

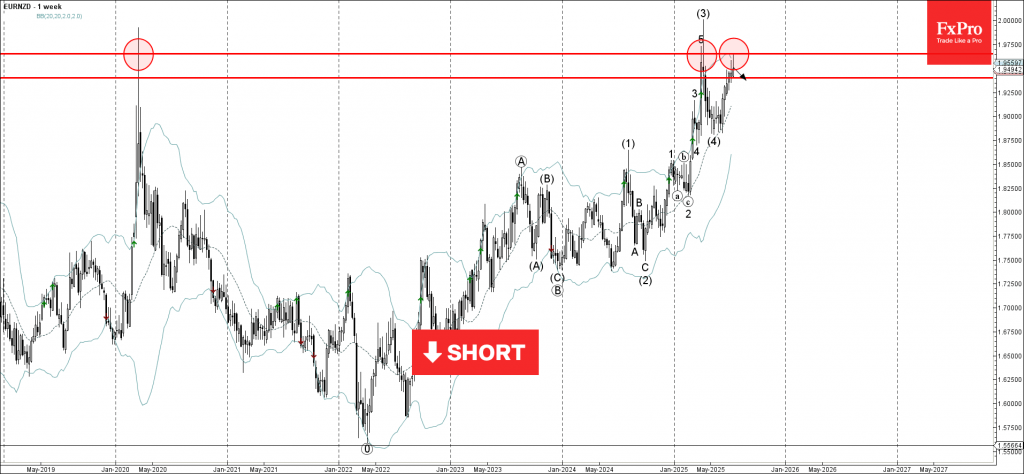

EURNZD: ⬇️ Sell – EURNZD reversed from the resistance area – Likely to fall to support level 1.9400 EURNZD currency pair recently reversed down from the resistance area between the major long-term resistance level 1.9655 (which has been reversing the.

July 18, 2025

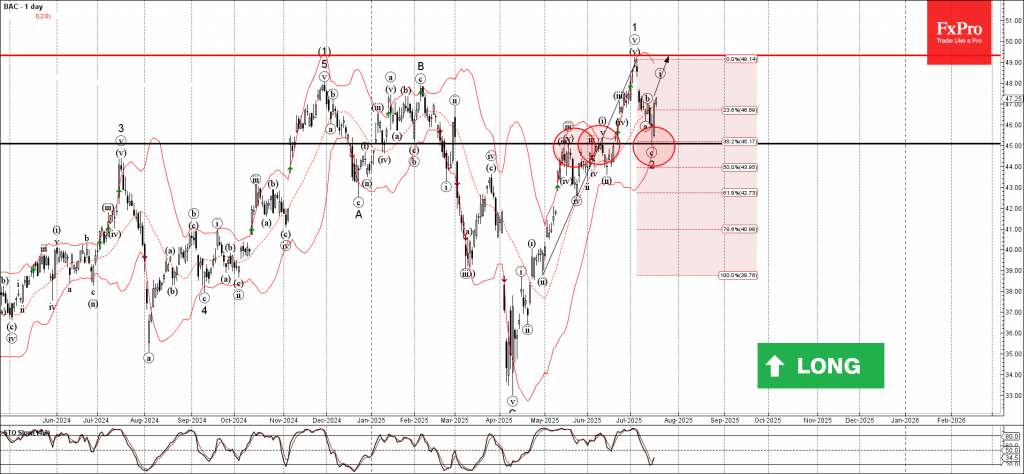

Bank of America: ⬆️ Buy – Bank of America reversed from support area – Likely to rise to resistance level 40550.00 Bank of America recently reversed up with the daily Morning Star from the support area located between the support.

July 17, 2025

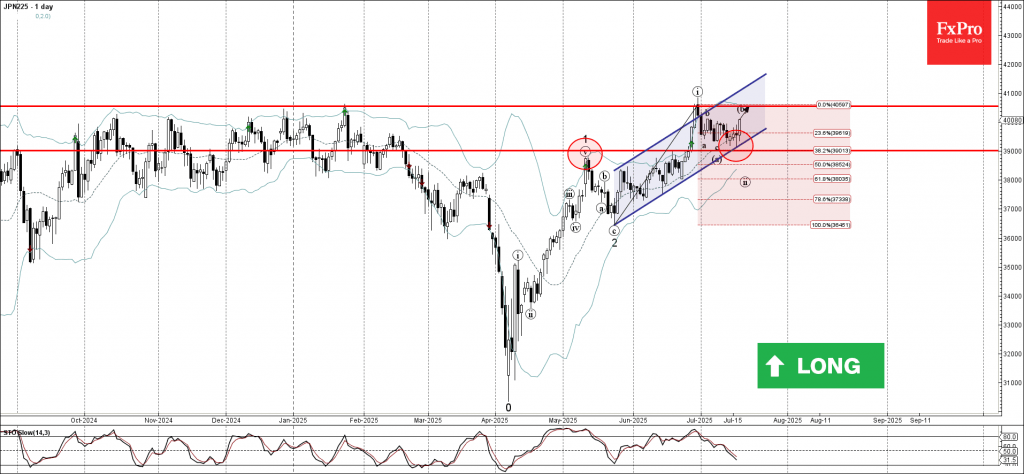

Nikkei 225: ⬆️ Buy – Nikkei 225 reversed from support area – Likely to rise to resistance level 40550.00 Nikkei 225 index recently reversed up with the daily Doji from the support area located between the key support level 39000.00.

July 17, 2025

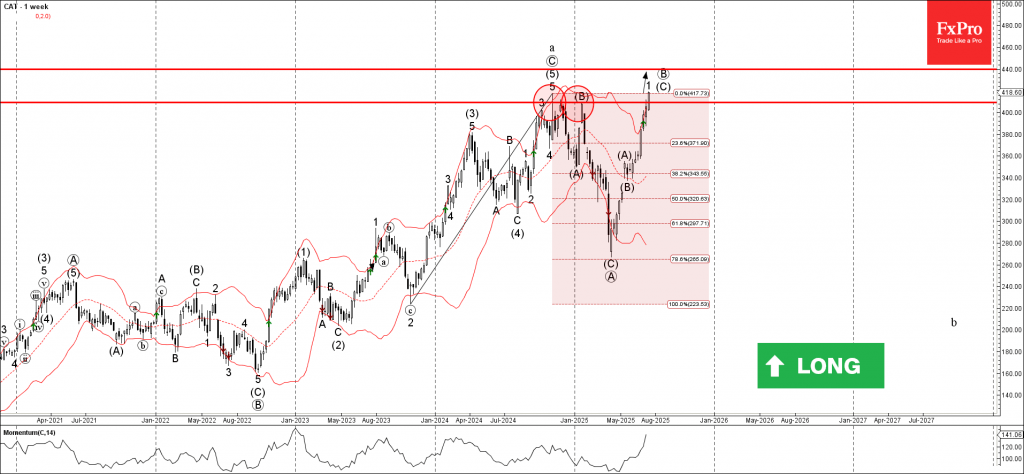

Caterpillar: ⬆️ Buy – Caterpillar broke long-term resistance level 410.00 – Likely to rise to resistance level 440.00 Caterpillar recently broke above the major long-term resistance level 410.00, which has been reversing the price from the end of 2024, as.