Technical analysis - Page 448

October 8, 2018

CHFJPY broke key support level 114.00 Further losses are likely CHFJPY today broke below the key support level 114.00 (which stopped the previous waves (a) and (iv) in September, as can be seen below). The breakout of this support level.

October 5, 2018

EURGBP broke support area Further losses are likely EURGBP recently broke though the support area lying between the key support level 0.8860 (which has been reversing the price from the start of August) and the support trendline of the daily.

October 5, 2018

Sugar broke resistance area Further gains are likely Sugar has been rising sharply in the last few days after the earlier breakout the resistance area lying between the resistance level 11.70 (monthly high from September) and the resistance trendline of.

October 4, 2018

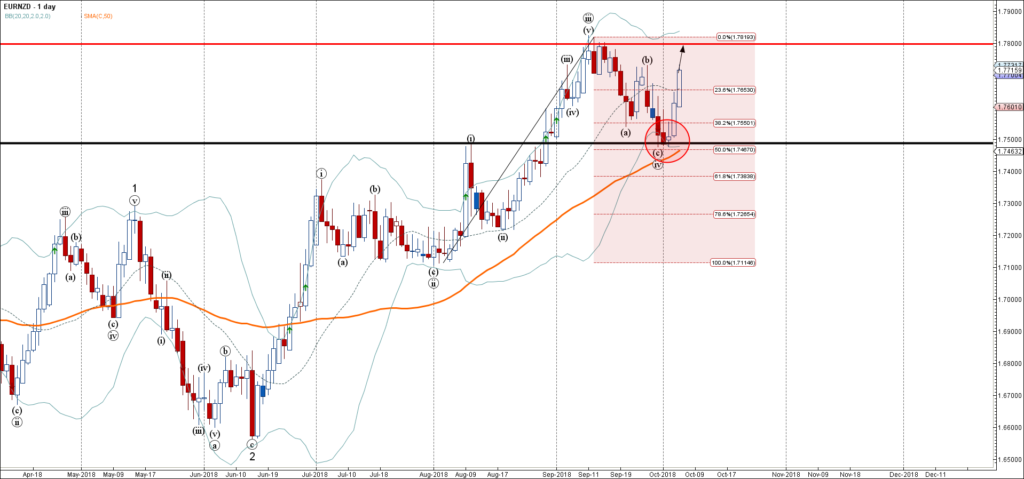

EURNZD reversed from support area Further gains are likely EURNZD recently reversed up from the support area lying between the pivotal support level 1.7500 (former strong resistance level from August), lower daily Bollinger Band and the 50% Fibonacci correction of.

October 4, 2018

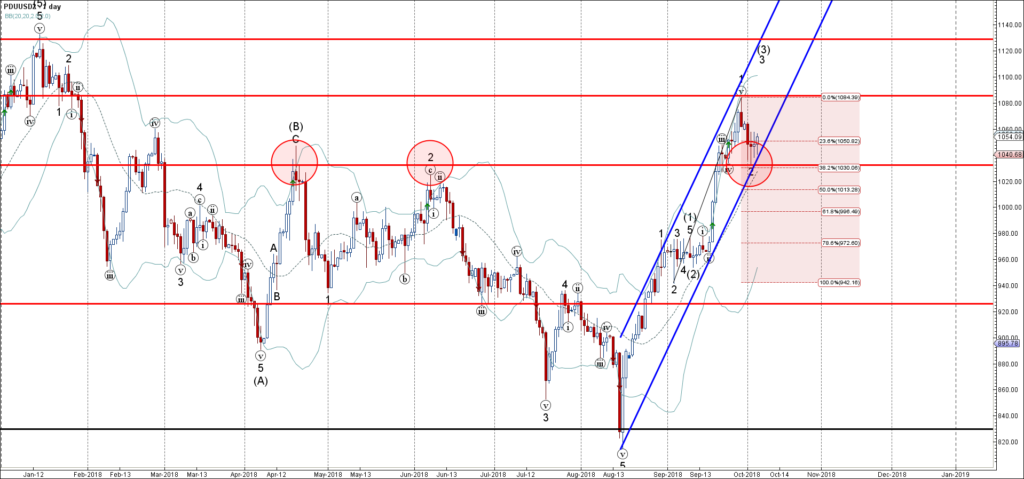

• Palladium reversed from support area • Further gains are likely Palladium recently reversed up from the support zone located between the support level 1030.00, support trendline of the narrow daily up channel from August and the 38.2% Fibonacci correction.

October 3, 2018

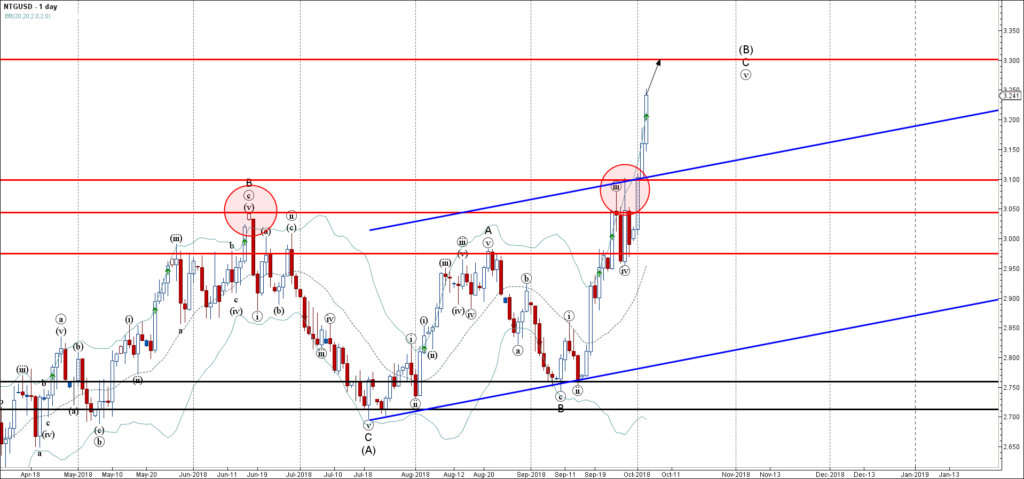

Natural Gas rising inside accelerated impulse wave C Further gains are likely Natural Gas continues to rise sharply after the earlier breakout of the resistance area lying between the key resistance levels 3.050 (top of wave B from June) and.

October 3, 2018

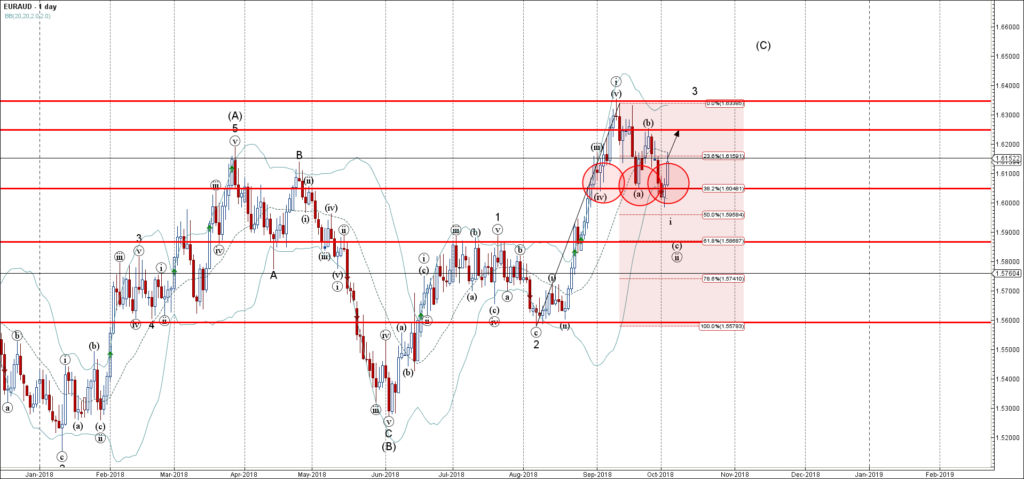

EURAUD reversed from support area lying Further gains are likely EURAUD recently reversed up sharply from the support area lying between the key support level 1.6050 (which has been reversing the price from the start of September) and the lower.

October 1, 2018

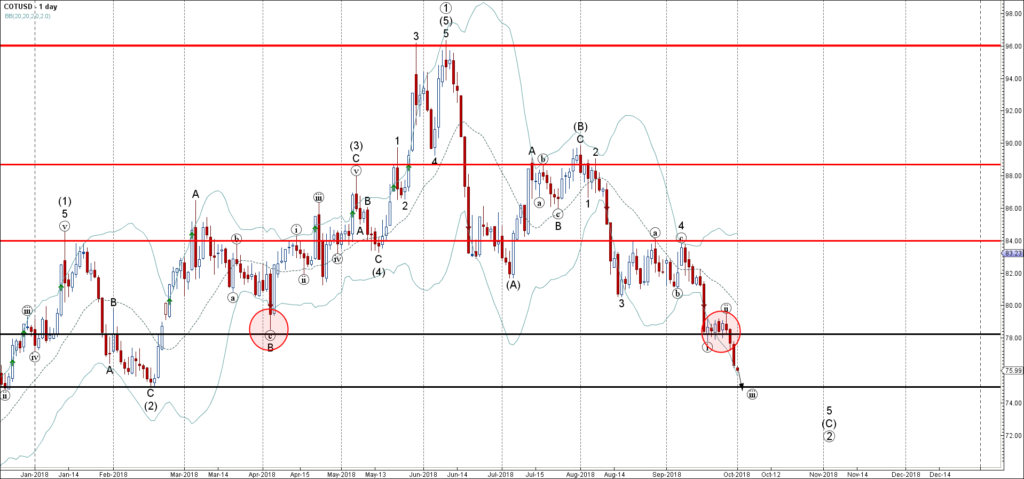

Cotton broke multi-month support level 78.20 Further losses are likely Cotton recently broke through the strong, multi-month support level 78.20 (which has been steadily reversing the price from the start of April). The breakout of the support level 78.20 accelerated.

October 1, 2018

NZDCAD broke key support level 0.8500 Further losses are likely NZDCAD opened this week with the sharp downward gap which broke through the key support level 0.8500 (which stopped the sharp downward impulse wave (i) at the start of September)..

September 28, 2018

EURCAD broke support area Further losses are likely EURCAD continues to fall after the earlier breakout of the support area lying between the key support level 1.5100 (which stopped the previous corrective wave A in the middle of September, as.

September 28, 2018

Palladium broke long-term resistance level 1050.00 Further gains are likely Palladium continues to rise after the earlier breakout of the strong, long-term resistance level 1050.00 (which has been reversing the price from the start of February). The breakout of the.