Technical analysis - Page 438

December 31, 2018

WTI reversed from support area Further gains are likely WTI continues to rise after the earlier upward reversal from the support area lying between the long-term support level 42.50 (which has been reversing the price from the end of October).

December 31, 2018

GBPCHF reversed from support level 1.2400 Further gains are likely GBPCHF recently reversed up from the key support level 1.2400 (which also reversed the previous impulse wave 1 at the start of December, as can be seen below) – strengthened.

December 28, 2018

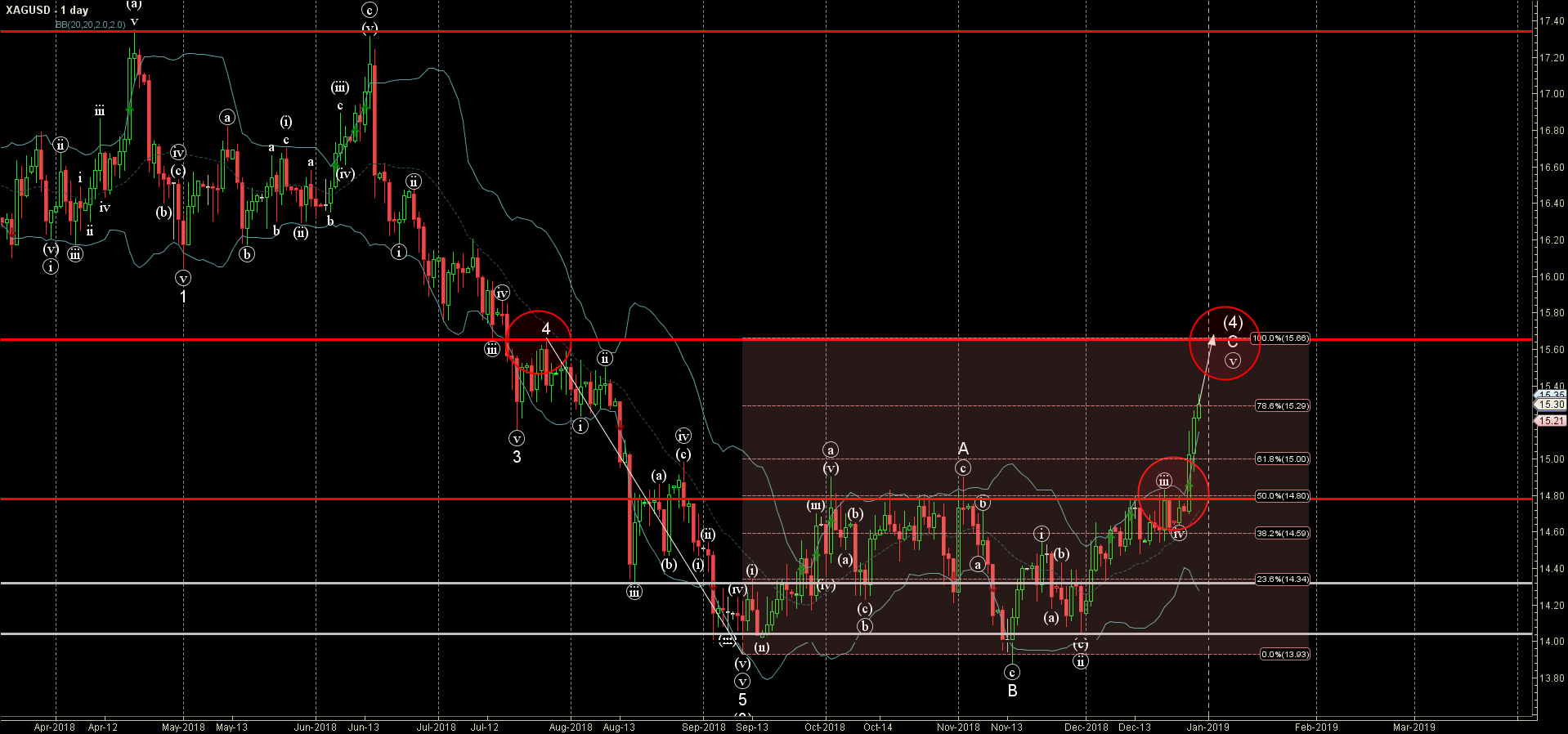

Silver broke resistance area Further gains are likely Silver recently broke through the resistance area lying between the resistance level 14.80 (which reversed the price multiple times from October) and the 50% Fibonacci correction of the previous downward impulse from.

December 28, 2018

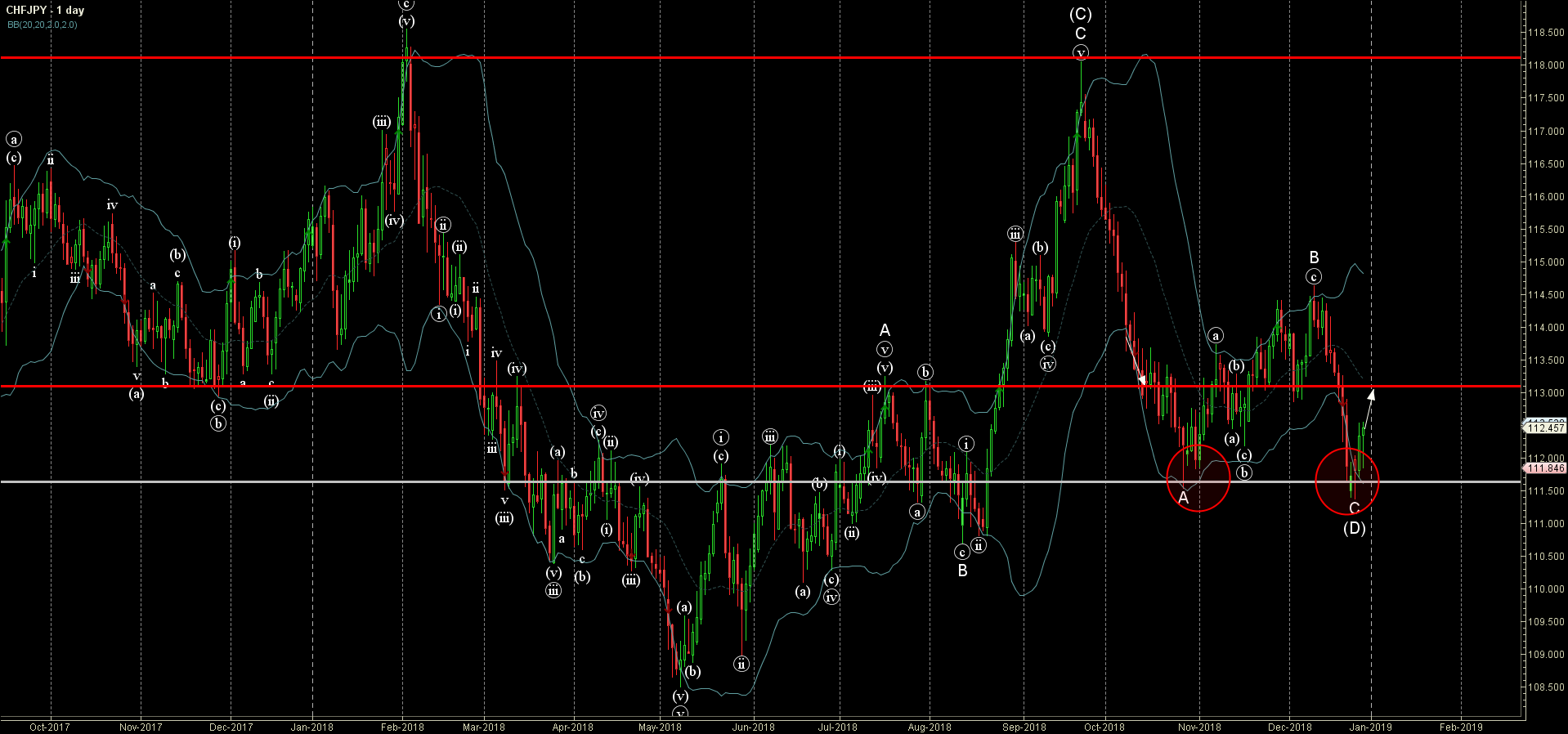

CHFJPY reversed from key support level 111.60 Further gains are likely CHFJPY continues to rise after the earlier upward reversal from the key support level 111.60 (which also reversed the A-wave of the previous medium-term ABC correction (D) in October)..

December 27, 2018

Gold broke resistance level 1260.00 Further gains are likely Gold recently broke the resistance level 1260.00 (which was set as the likely upward target in our earlier report for this pair) – intersecting with the resistance trendline of the daily.

December 27, 2018

USDCAD boke resistance level 1.3600 Further gains are likely USDCAD continues to rise after the earlier breakout of the resistance level 1.3600 (which was set as the likely upward target in our previous report for this pair). FxPro analyst said.

December 26, 2018

Copper reversed from support area Further gains are likely FxPro analyst said that Copper recently reversed up from the support zone located between the strong support level 265.00 (which reversed the A-wave of the earlier ABC correction (2) from September).

December 26, 2018

CADCHF reversed from support area Further gains are likely FxPro analyst said that CADCHF recently reversed up from the support area lying between the long-term support level 0.7250 (which previously reversed the price twice in March) and the lower daily.

December 24, 2018

Soy broke daily up channel Further losses are likely FxPro analyst said that Soy continues to fall inside the short-term corrective wave (ii), which started earlier from the resistance zone lying between the key resistance level 910.00 (monthly high from.

December 24, 2018

AUDUSD reversed from support area Further gains are likely FxPro analyst said that AUDUSD recently reversed up from the support area lying between the round support level 0.7000 (which stopped the weekly downtrend with the weekly Hammer in October) and.

December 21, 2018

NZDJPY broke the support zone Further losses are likely NZDJPY recently broke the support zone lying between the key support level 75.50 (former resistance from September) and the 50% Fibonacci correction of the previous sharp upward impulse form October. The.