Technical analysis - Page 437

January 9, 2019

WTI rising inside corrective wave ② Further gains are likely WTI continues to rise inside the long-term corrective wave ② which started previously from the support area lying between the long-term support level 42.50 (which has been reversing the price.

January 9, 2019

USDCAD falling inside weekly wave (2) Further losses are likely USDCAD continues to fall inside the medium-term corrective wave (2) – which started earlier from the resistance area lying between the key resistance level 1.3700 (strong resistance from 2017), upper.

January 8, 2019

EURCAD broke support area Further losses are likely EURCAD recently broke through the support area lying between the key support level 1.5300 (former resistance from September and December) and the 50% Fibonacci correction of the previous sharp upward impulse from.

January 8, 2019

Palladium broke key resistance level 1200.0 Further gains are likely Palladium continues to rise after the earlier breakout of the key resistance level 1200.0 (which was set as the likely upward target in our previous forecast for this instrument). The.

January 7, 2019

AUDUSD reversed from major support area Further gains are likely AUDUSD recently reversed up from the major support area lying between the long-term area support level 0.6800 (which stopped the weekly downtrend at the start of 2016) and the lower.

January 7, 2019

Soy broke resistance area Further gains are likely Soy continues to rise after the earlier breakout of the resistance area lying between the key resistance level 923.0 (which also stopped the previous waves 3 and 5, as can be seen.

January 4, 2019

EURGBP reversed from resistance area Further losses are likely EURGBP recently reversed down from the resistance zone lying between the strong resistance level 0.9080 (which has been reversing the price from the end of August, as can be seen below),.

January 4, 2019

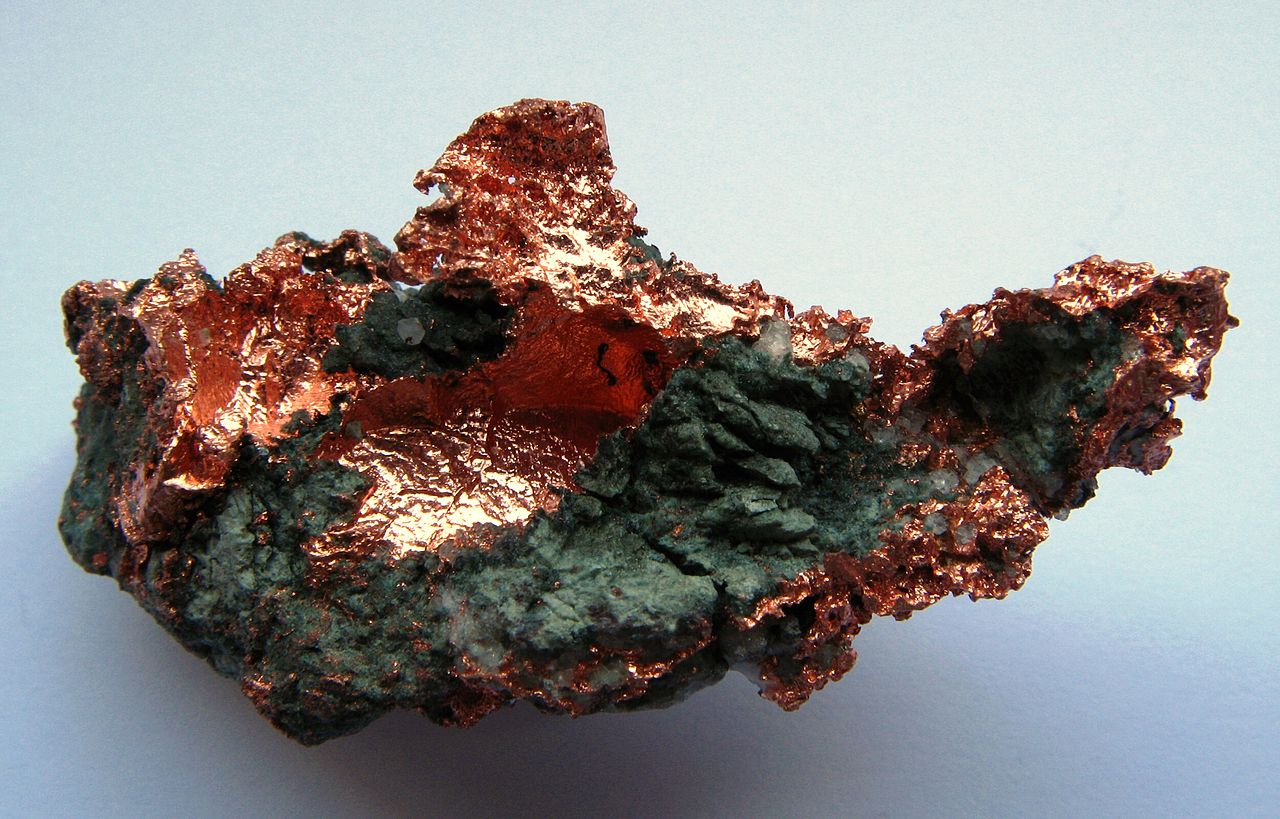

Copper reversed from support area Further gains are likely Copper recently reversed up from the support area lying between the key support level 255.00 (which also stopped the sharp downtrend in the middle of August, as can be seen below).

January 3, 2019

Sugar broke support area Further losses are likely Sugar recently broke through the support area lying between the key support level 12.20 (which has been reversing the price from the end of November) and the 50% Fibonacci correction of the.

January 3, 2019

NZDJPY broke multi-month support level 72.20 Further losses are likely NZDJPY recently broke through the powerful multi-month support level 72.20 (which has been steadily reversing the price from the middle of August, as can be seen below). The breakout of.

January 2, 2019

CADJPY broke long-term support level 81.00 Further losses are likely CADJPY opened this year with the sharp downward impulse, which broke through the long-term support level 81.00 (which previously reversed the price sharply in April of 2017 and in January)..