Technical analysis - Page 436

January 17, 2019

GBPCHF broke resistance area Further gains are likely GBPCHF continues to rise inside the impulse wave (c) – which previously broke the resistance area lying between the key resistance level 1.2600 (which reversed the pair multiple times in December) and.

January 17, 2019

Palladium broke resistance area Further gains are likely Palladium today broke sharply through the resistance area lying between the resistance level 1350.00 (previous upward target) and the two resistance trendlines of the two daily up channels from last December and.

January 16, 2019

Silver reversed from resistance area Further losses are likely Silver recently reversed down from the combined resistance area lying between the strong resistance level 15.65 (former multi-month support level from the start of 2017), upper weekly Bollinger Band and the.

January 16, 2019

EURUSD reversed from resistance area Further losses are likely EURUSD recently reversed down from the resistance area lying between the resistance level 1.1570, upper daily Bollinger Band and the 61.8% Fibonacci correction of the previous downward impulse (1) from the.

January 15, 2019

Sugar reversed from key resistance level 1.5280 Further losses are likely Sugar today broke the pivotal resistance level 1.5280 (top of the Falling Star from December) – which was proceeding by the breakout of the resistance trendline of the daily.

January 15, 2019

EURCAD reversed from key resistance level 1.5280 Further losses are likely EURCAD recently reversed down from the key resistance level 1.5280 – strengthened by the 50% Fibonacci correction of the previous upward impulse from the end of November. The downward.

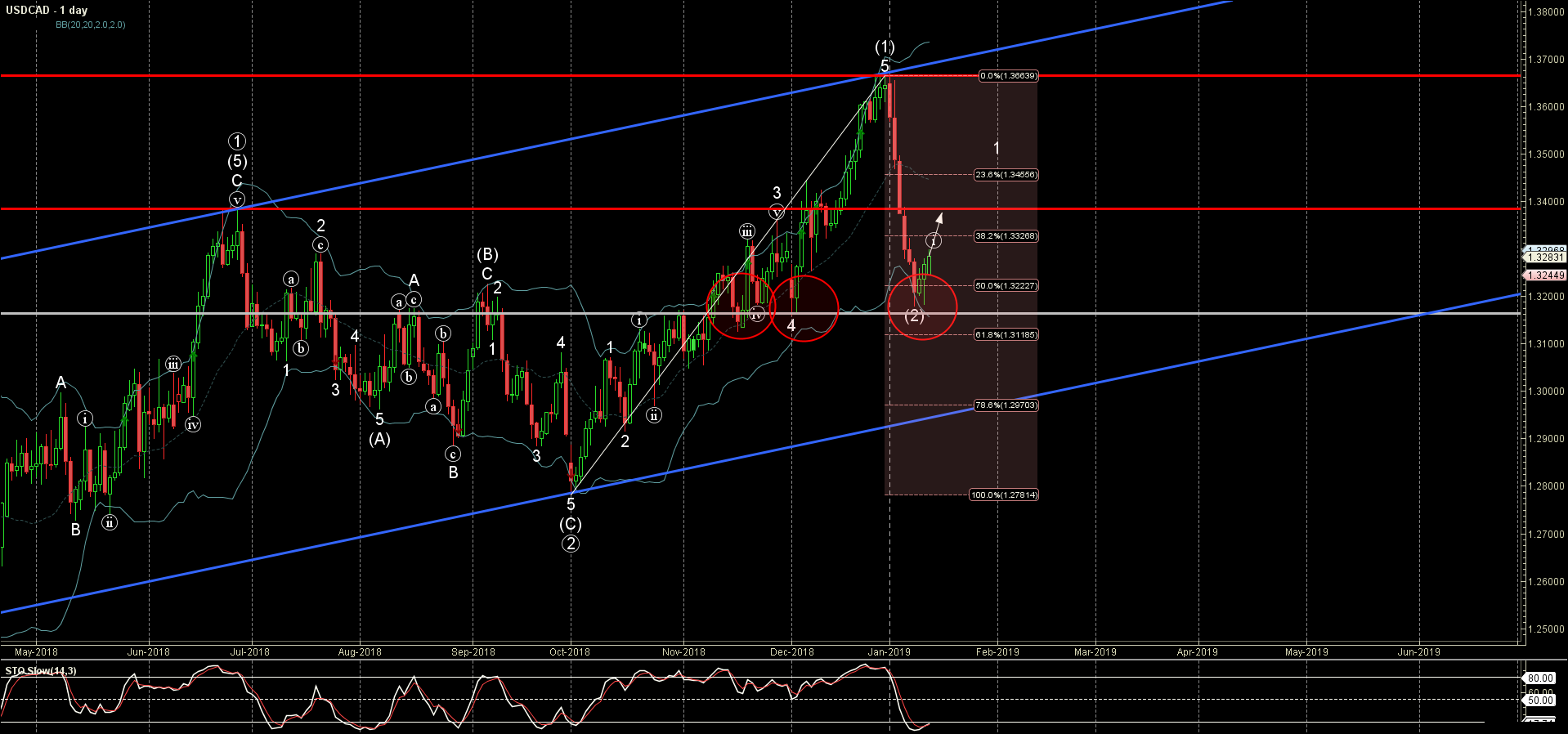

January 14, 2019

USDCAD reversed from support area Further gains are likely USDCAD recently reversed up from the support area lying between the strong support level 1.3160 (which also reversed the price in November and December), lower daily Bollinger Band and the 50%.

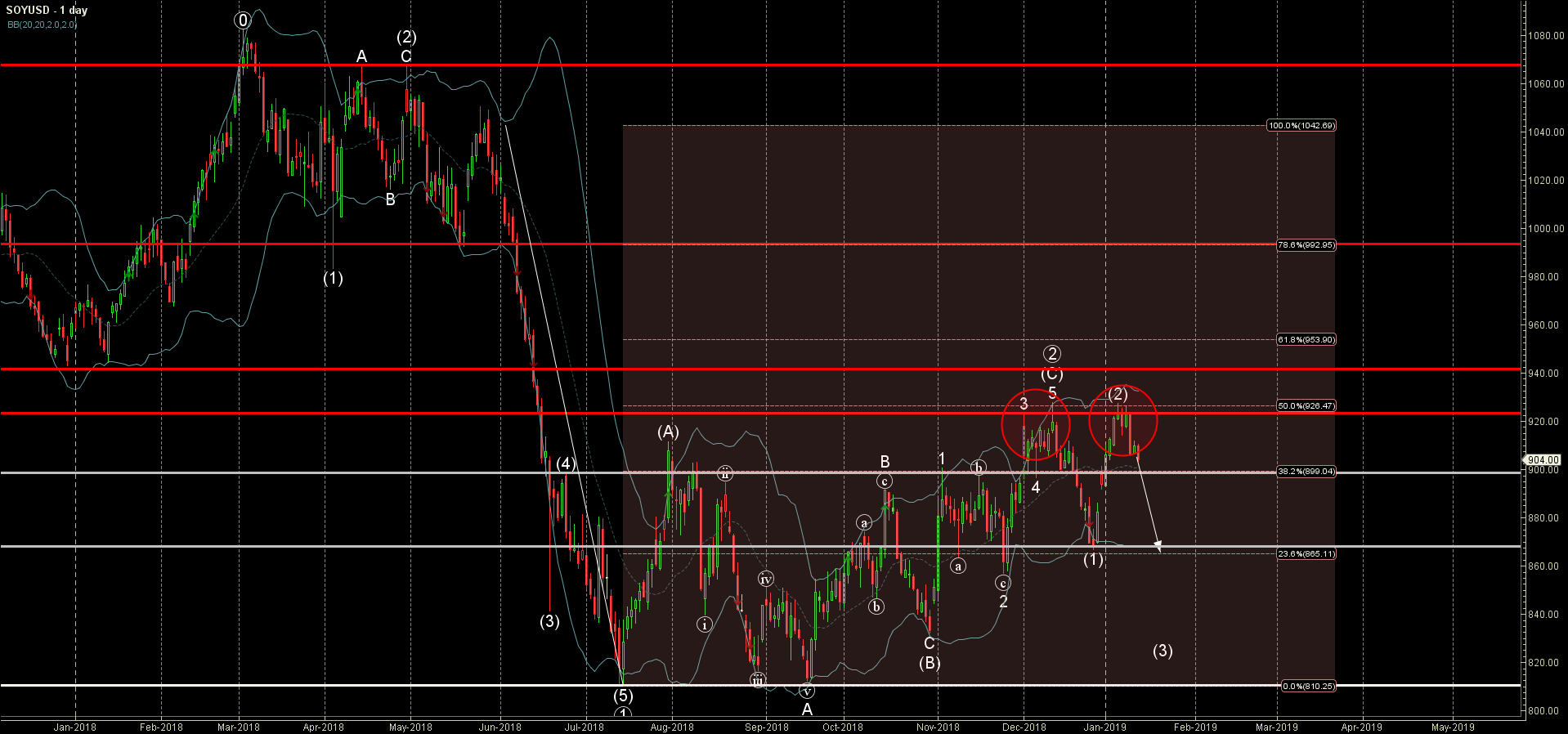

January 14, 2019

Soy reversed from resistance area Further losses are likely Soy recently reversed down from the resistance area lying between the strong resistance level 920.00 (which also reversed the price twice in December), upper daily Bollinger Band and the 50% Fibonacci.

January 11, 2019

Palladium broke resistance area Further gains are likely Palladium recently broke through the resistance area lying between the resistance level 1270.00 (upward target set in our previous forecast for this instrument) and the resistance trendline of the daily up channel.

January 11, 2019

AUDCHF reversed from support area Further gains are likely AUDCHF recently reversed up from the key support area lying between the support level 0.6870 (which reversed the price twice in September) and the lower daily Bollinger Band. The upward reversal.

January 10, 2019

GBPAUD reversed from resistance area Further losses are likely GBPAUD recently reversed down from the strong resistance area located between the long-term resistance level 1.8600 (which has been reversing the price from the start of 2018) and the upper weekly.