Technical analysis - Page 421

April 24, 2019

Soy broke support area Further losses are likely Soy continues to fall after the recent breakout of the support area lying between the support level 870.00 (monthly low from December) and the 50% Fibonacci correction of the previous upward impulse.

April 23, 2019

EURUSD falling inside impulse wave 3 Further losses are likely EURUSD has been falling in the last few trading sessions inside the short-term impulse wave 3 which started earlier from the resistance area lying between the resistance level 1.1300, 100-day.

April 23, 2019

Corn broke support area Further losses are likely Corn continues to fall after the recent breakout of the support area lying between the key support level 1.0900 (previous sell target, which has been reversing the price from last September) and.

April 22, 2019

Brent crude oil rising inside impulse wave (C) Further gains are likely Brent crude oil continues to rise inside the medium-term impulse wave (C) which recently broke the resistance area lying at the intersection of the round resistance level.

April 22, 2019

EURAUD reversed from support area Further gains are likely EURAUD recently reversed up from the support area lying between the key support level 1.5720 (which has been reversing the price from January) and lower daily Bollinger Band. The upward reversal.

April 19, 2019

Platinum reversed from support area Further gains are likely Platinum recently reversed up from the support area lying at the intersection of the key support level 880.00 (former multi-month resistance level from October) and the 50% Fibonacci correction of the.

April 19, 2019

EURCHF reversed from resistance area Further losses are likely EURCHF recently reversed down from the resistance area lying at the intersection of the key resistance level 1.1430 (which has been reversing the price from February), 50% Fibonacci correction of the.

April 18, 2019

USDCHF broke multi-month resistance level 1.0100 Further gains are likely USDCHF today broke sharply above the key multi-month resistance level 1.0100 (which has been reversing the price from the end of last October, as can be seen below). The.

April 18, 2019

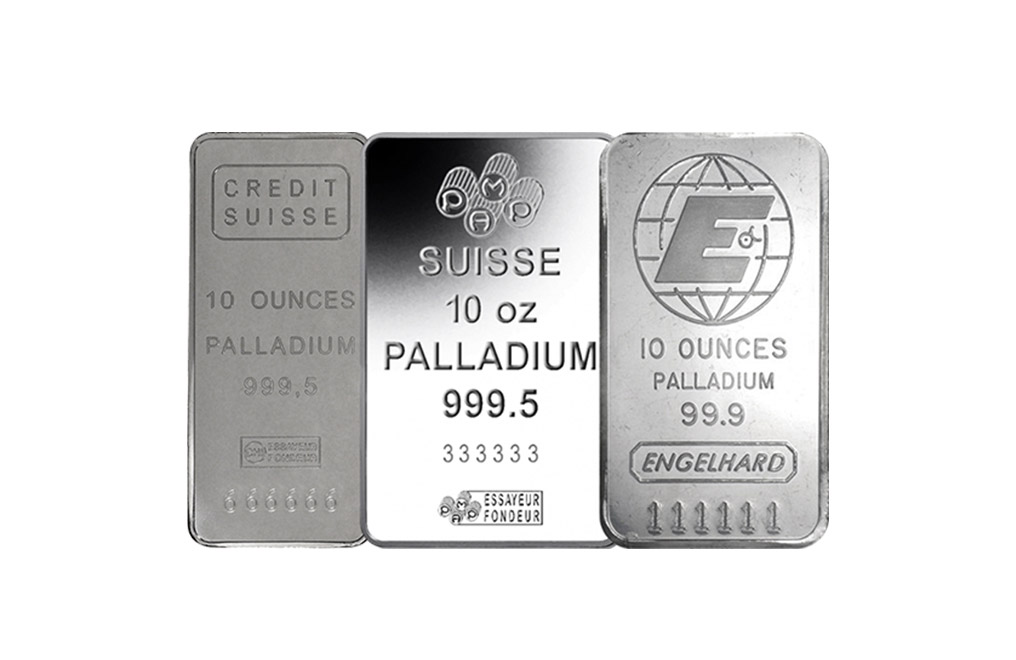

Palladium reversed from support area Further gains are likely Palladium recently reversed up from the support area lying at the intersection of the round support level 1300.00 (which has been reversing the price from January) and the lower daily Bollinger.

April 17, 2019

EURNZD broke resistance area Further gains are likely EURNZD today broke through the resistance area lying at the intersection of the resistance level 1.6770 (which has been reversing the price from February) and the 50% Fibonacci correction level of the.

April 17, 2019

Soy broke support area Further losses are likely Soy recently broke through the support area lying at the intersection of the support level 890.00 (which has been reversing the price from January) and the support trendline of the daily up.