Technical analysis - Page 417

May 27, 2019

Wheat reversed from support area Further gains are likely Wheat recently reversed up from the support area lying between the pivotal support level 473.00 (former major resistance from last June) and the 38.2% Fibonacci correction of the previous upward impulse.

May 27, 2019

USDCHF reversed from support area Further gains are likely USDCHF recently reversed up from the support area lying between the parity, support trendline from September and the lower daily Bollinger Band. This support area was further strengthened by the 38.2%.

May 24, 2019

EURCHF broke support area Further losses are likely EURCHF recently broke through the support area lying between the key support level 1.1300 and the 61.8% Fibonacci correction of the previous upward impulse from March. The breakout of this support area.

May 24, 2019

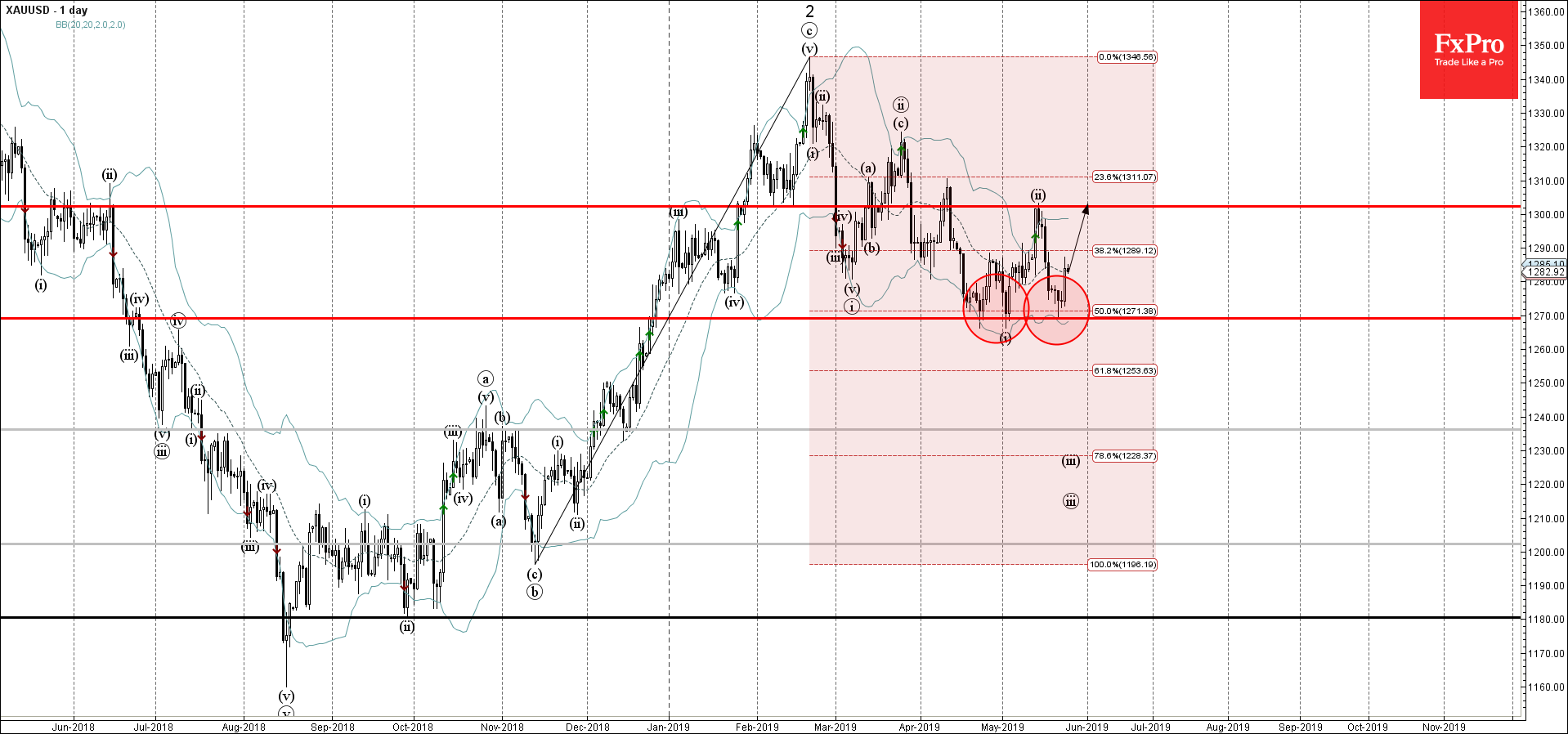

Gold reversed from support area Further gains are likely Gold recently reversed up from the support area lying between the pivotal support level 1270.00 (which has been reversing the price from the end of April) and the lower daily Bollinger.

May 23, 2019

WTI broke support area Further losses are likely WTI recently broke through the support area lying between the round support level 60.00 (former resistance from March) and the support trendline of the daily up channel from February. The breakout of.

May 23, 2019

EURCAD reversed from support area Further gains are likely EURCAD recently reversed up from the support area lying between the key support level 1.4920 (which has been reversing the price from the start of December) and the lower daily Bollinger.

May 22, 2019

USDCAD reversed from support area Further gains are likely USDCAD today reversed up with the daily Hammer from the support area lying between the key support level 1.3390 (which has been reversing the price from the start of May) and.

May 22, 2019

Platinum broke key support level 815.00 Further losses are likely Platinum recently broke the key support level 815.00, which reversed the price at the start of March, as can be seen below. The breakout of this support level 815.00 accelerated.

May 21, 2019

CADJPY rising inside impulse wave (3) Further gains are likely CADJPY continues to rise inside the weekly upward impulse wave (3) – which started earlier from the support area lying between the long-term support level 81.00 (which has been reversing.

May 21, 2019

Wheat broke resistance level 473.00 Further gains are likely Wheat continues to rise after the recent breakout of the resistance area lying between the key resistance level 473.00 (monthly high from March and April) and the 50% Fibonacci correction of.

May 20, 2019

GBPAUD broke key support level 1.8500 Further losses are likely GBPAUD opened this week with the sharp downward gap, which broke the key support level 1.8500 (low of the previous short-term impulse wave (i)). The breakout of the support level.