Technical analysis - Page 416

June 4, 2019

Sugar reversed from support area Further gains are likely Sugar recently reversed up from the support area lying between the key support level 11.75 (former monthly low from January), lower daily Bollinger Band and the 61.8% Fibonacci correction of the.

June 4, 2019

CADCHF reversed from support area Further gains are likely CADCHF recently reversed up from the support area lying between the key support level 0.7380, lower daily Bollinger Band and the 61.8% Fibonacci correction of the previous upward impulse from December..

June 3, 2019

EURCHF reversed from support area Further gains are likely EURCHF today reversed up from the key support area lying at the intersection of the multi-month support level 1.1180, support trendline of the daily down channel from October and the lower.

June 3, 2019

Gold broke round resistance level 1300.00 Further gains are likely Gold recently broke the round resistance level 1300.00 (which stopped the (a)-wave of the active ABC wave (iii) in the middle of June, as can be seen below). The breakout.

May 31, 2019

Palladium rising inside intermediate impulse wave (3) Further gains are likely Palladium continues to rise inside the intermediate impulse wave (3), which started earlier from the support area surrounding the key support level 1290.00. This support area was.

May 31, 2019

GBPJPY broke key support level 138.00 Further losses are likely GBPJPY recently broke the key support level 138.00 (which reversed the price a few times from the start of January). The breakout of the support level 138.00 should.

May 30, 2019

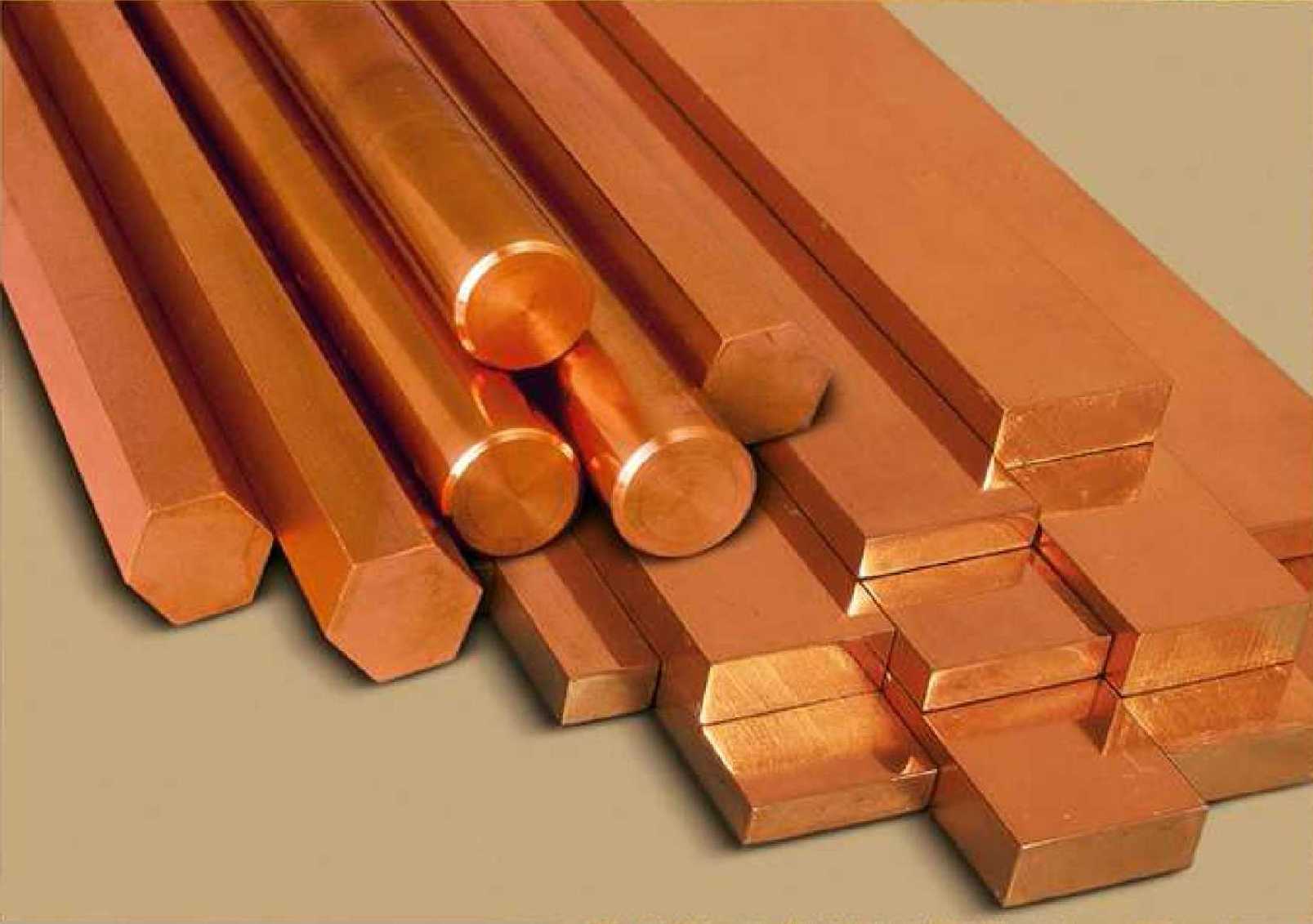

Copper broke key support level 265.00 Further losses are likely Copper today broke the key support level 265.00 (which has been reversing the price from the end of January). The breakout of the support level 265.00 should accelerate the active.

May 30, 2019

CADJPY reversed from support area Further gains are likely CADJPY recently reversed up from the support area lying between the support level 81.00 (low of the previous wave (ii)), lower daily Bollinger Band and the support trendline of the daily.

May 29, 2019

Wheat broke resistance zone Further gains are likely Wheat opened today with the runaway upward gap breaking through the resistance zone lying at the intersection of the resistance levels – 50% Fibonacci correction of the weekly downward impulse from last.

May 29, 2019

USDJPY trading inside support area Further gains are likely USDJPY is currently trading inside the support area lying between the support level 109.20 (low of the previous wave (2)) and the lower daily Bollinger Band. This support area is further.

May 28, 2019

AUDCAD reversed from support area Further gains are likely AUDCAD recently reversed up with the daily Morning Star from the support area lying between the support level 0.9210 and the lower daily Bollinger Band. This support area was further strengthened.