Technical analysis - Page 415

June 13, 2019

Wheat broke key resistance level 109.60 Further gains are likely Wheat recently broke the key resistance level 109.60 – which stopped the previous sharp waves 2 and (1) – as can be seen below. The breakout of the resistance level.

June 12, 2019

Corn reversed from powerful support level 410. Further gains are likely Corn recently reversed up sharply from the powerful support level 410.00 (former multi-month high from May of 2018). The upward reversal from this support area completed the previous ABC.

June 12, 2019

CHFJPY reversed from resistance area Further losses are likely CHFJPY recently reversed down from the resistance area lying between the key resistance level 109.60, upper daily Bollinger Band and the 50% Fibonacci correction of the previous downward impulse from April..

June 11, 2019

Cotton reversed from resistance area Further losses are likely Cotton recently reversed down from the resistance area lying between the key resistance level 69.40 (former monthly low from February) and the upper daily Bollinger Band. The downward reversal from this.

June 11, 2019

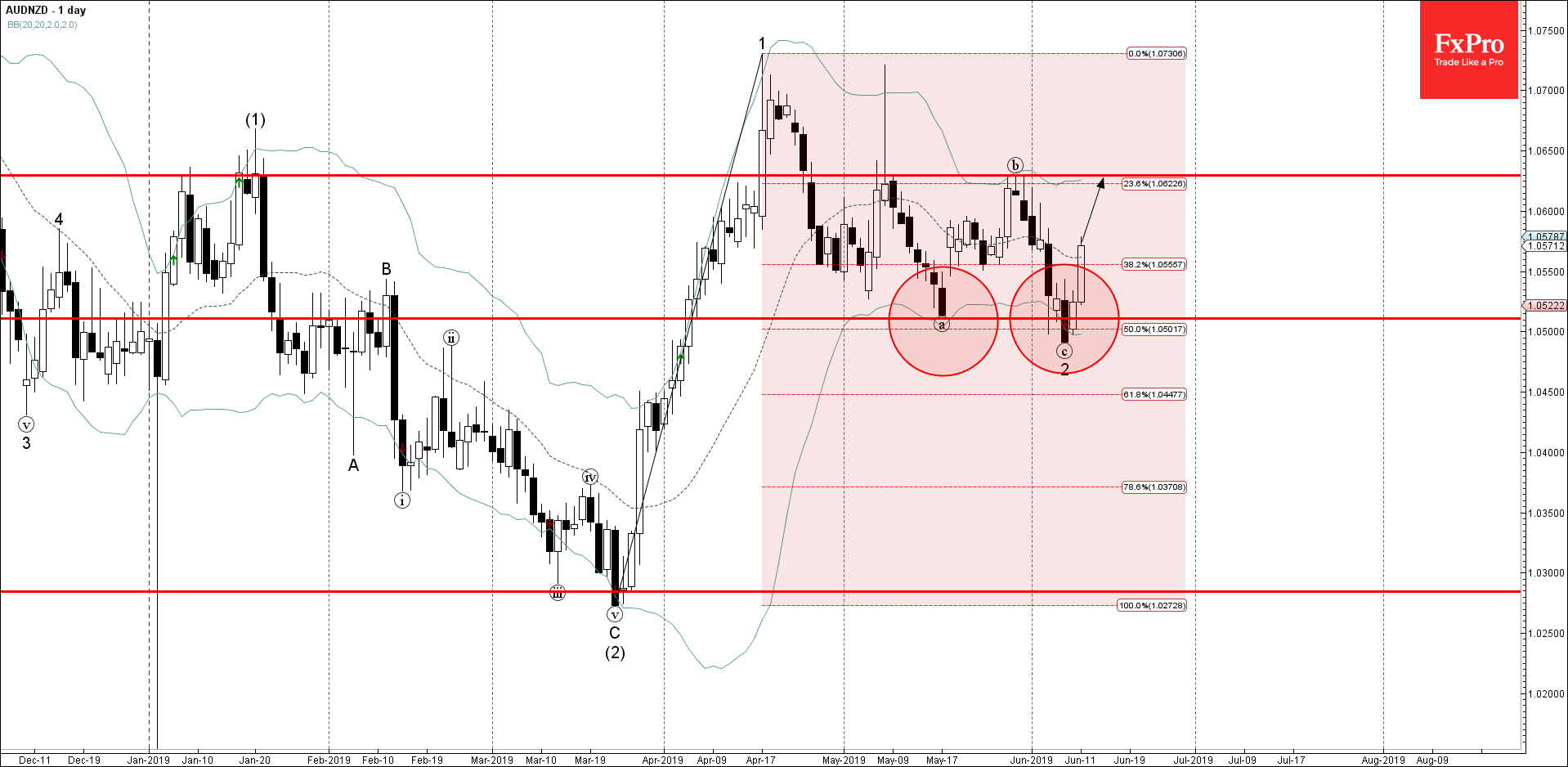

AUDNZD reversed from support area Further gains are likely AUDNZD recently reversed up from the support area lying between the key support level 1.0510 (monthly low from May) and the upper daily Bollinger Band. The upward reversal from this support.

June 10, 2019

GBPCAD broke support area Further losses are likely GBPCAD recently broke sharply through the support area lying between the key support level 1.6970 (former monthly low from February – which created daily Hammer in May) and the support trendline of.

June 10, 2019

Gold reversed from resistance area Further losses are likely Gold recently reversed down from the resistance area lying between the key resistance level 1346.00 (which stopped the earlier extended wave (a) in the middle of February) and the upper daily.

June 7, 2019

Corn reversed from resistance zone Further losses are likely Corn recently reversed down from the resistance zone lying between the resistance trendline of the weekly up channel from July of 2016, upper daily Bollinger Band and the multi-year resistance level.

June 7, 2019

NZDCAD reversed from resistance zone Further losses are likely NZDCAD recently reversed down from the resistance zone lying between the key resistance level 0.9800 (former strong support from January and February) and the upper daily Bollinger Band. The downward reversal.

June 7, 2019

Natural Gas broke key support area Further losses are likely Natural Gas recently broke through the key support area lying between the support levels 2.538 and 2.687 (which has been repeatedly reversing the price from October of 2016). The breakout.

June 5, 2019

Silver broke daily down channel Further gains are likely Silver recently broke the resistance trendline of the daily down channel from the middle of February. The breakout of this down channel accelerated the active impulse wave 1 – which belongs.