Technical analysis - Page 41

August 8, 2025

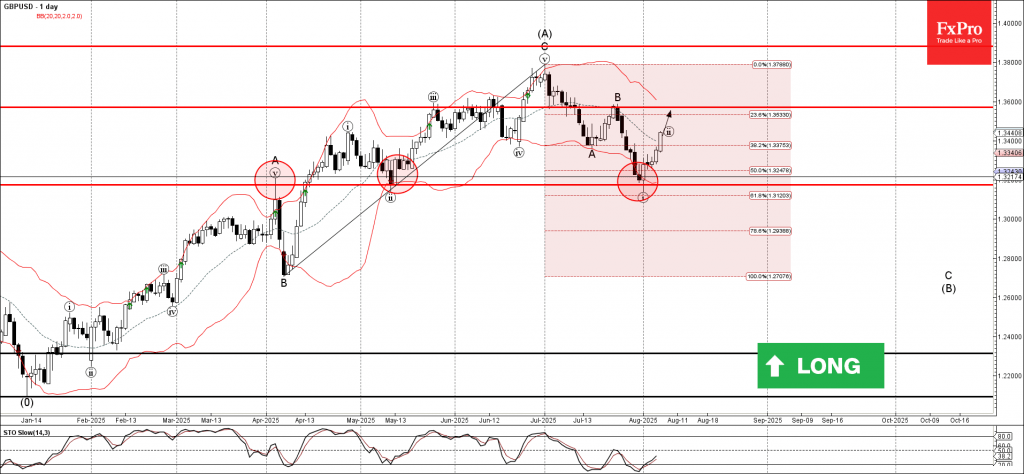

GBPUSD: ⬆️ Buy – GBPUSD reversed from the support area – Likely to rise to resistance level 1.3600 GBPUSD currency pair recently reversed from the support area between the strong support level of 1.3175 (former resistance from April) and the.

August 8, 2025

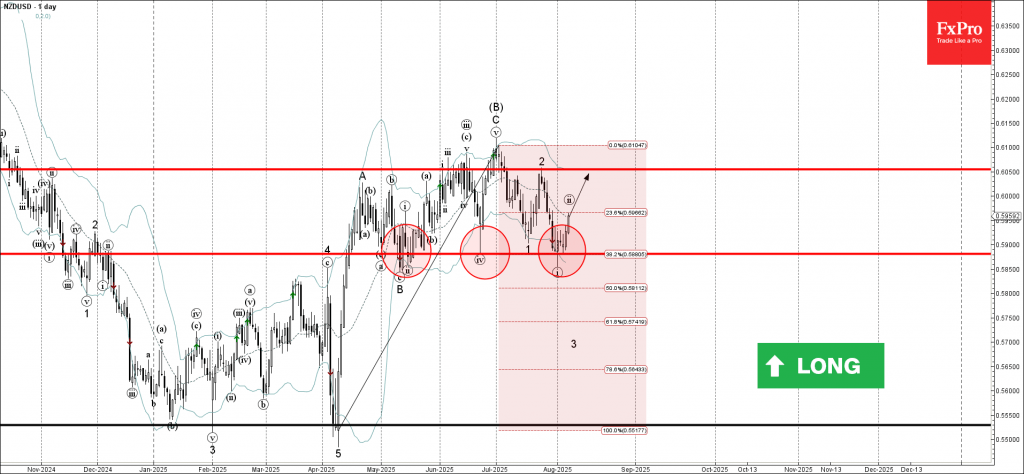

NZDUSD: ⬆️ Buy – NZDUSD reversed from the support area – Likely to test resistance level 0.6050 NZDUSD currency pair recently reversed from the support area between the strong support level of 0.5880 (which has been reversing the price from.

August 7, 2025

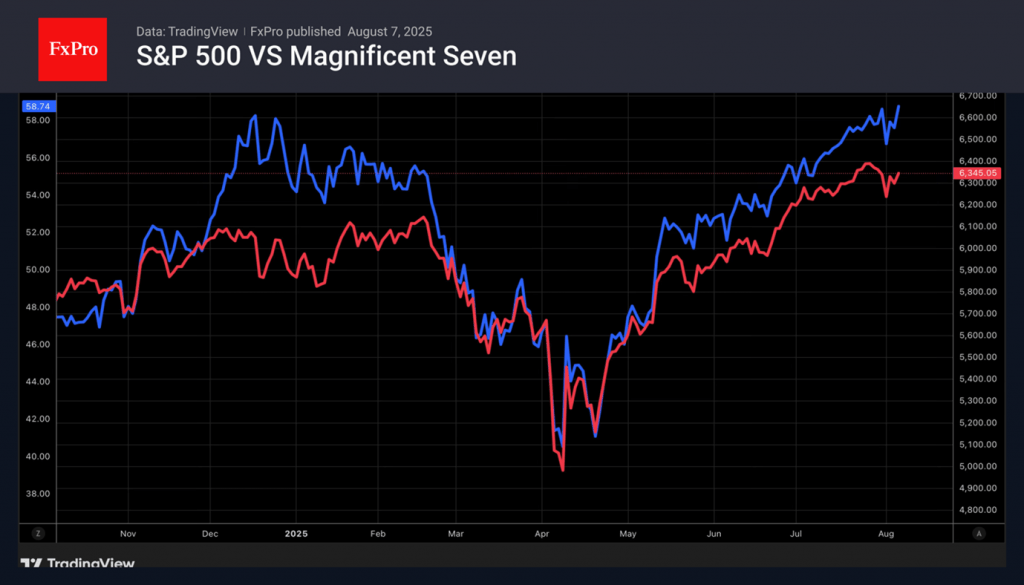

The S&P 500 rebounded from a dip due to disappointing employment data, as investors buy in using the FOMO strategy. The Magnificent Seven's strong profits are driving the market.

August 7, 2025

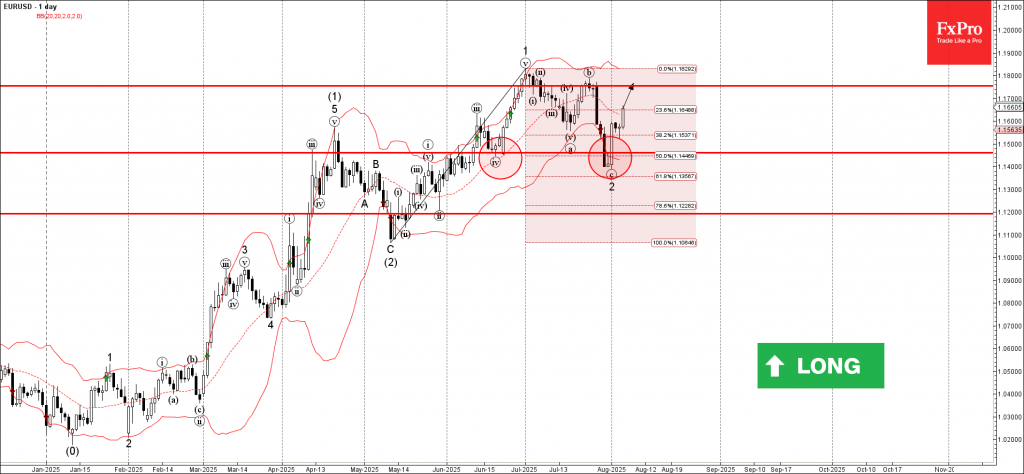

EURUSD: ⬆️ Buy – EURUSD reversed from support area – Likely to rise to resistance level 1.1755 EURUSD currency pair recently reversed from the support area between the strong support level of 1.1500 (former low of wave iv from June),.

August 7, 2025

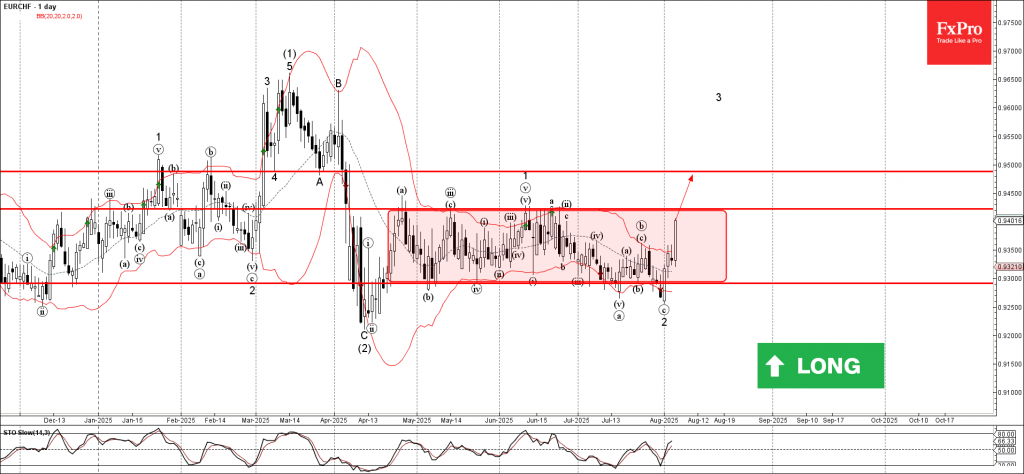

EURCHF: ⬆️ Buy – EURCHF rising inside sideways price range – Likely to test resistance level 0.9420 EURCHF currency pair recently reversed from the support area between the strong support level of 0.9300 (lower border of the sideways price range.

August 7, 2025

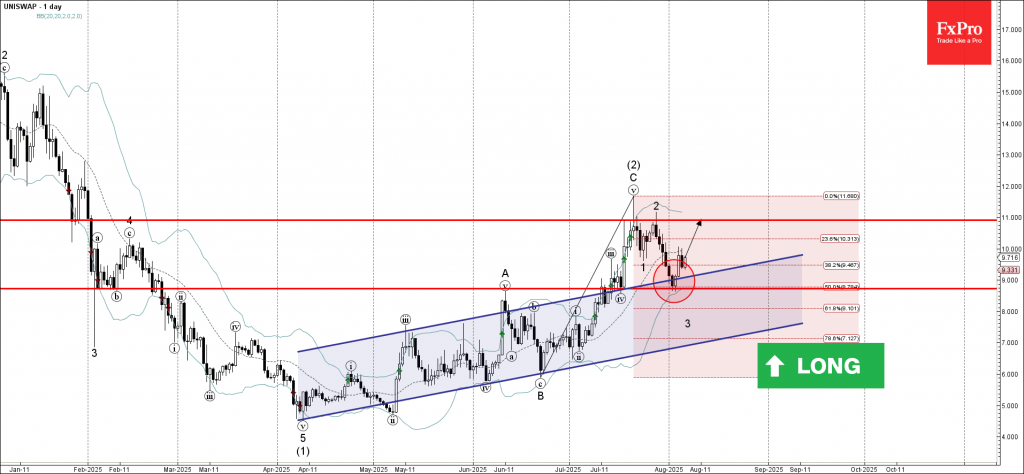

Uniswap: ⬆️ Buy – Uniswap reversed from the support zone – Likely to rise to resistance level 11.00 Uniswap cryptocurrency recently reversed up from the support zone between the support level of 8.730 (former resistance from June) and the lower.

August 7, 2025

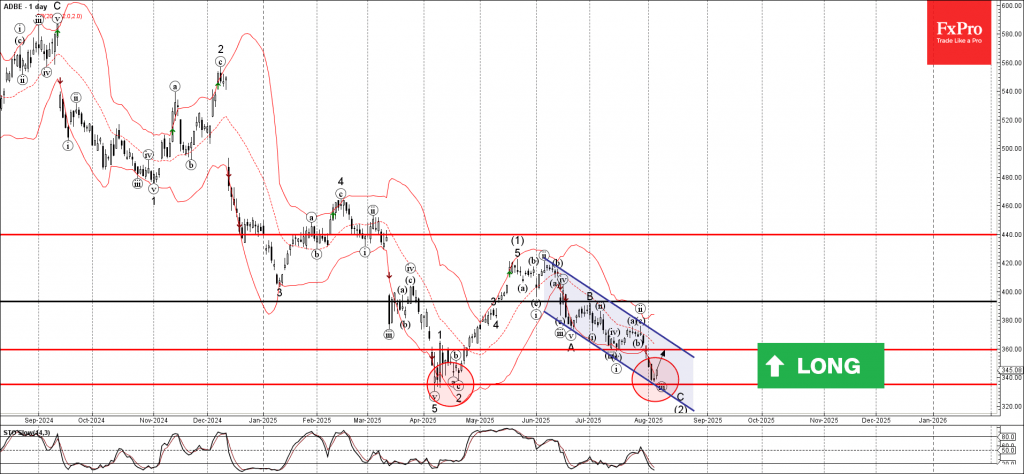

Adobe: ⬆️ Buy – Adobe reversed from strong support level of 335.00 – Likely to rise to resistance level 360.00 Adobe recently reversed up from the support zone between the strong support level of 335.00 (which stopped the sharp daily.

August 5, 2025

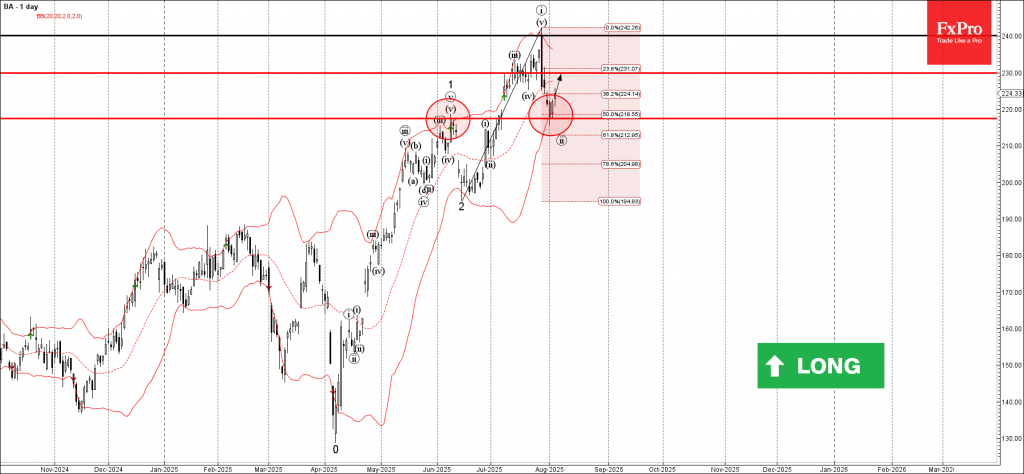

Boeing: ⬆️ Buy – Boeing reversed from the support zone – Likely to rise to resistance level 230.00 Boeing recently reversed up from the support zone between the pivotal support level of 217.50 (former top of wave 1 from June) and the.

August 5, 2025

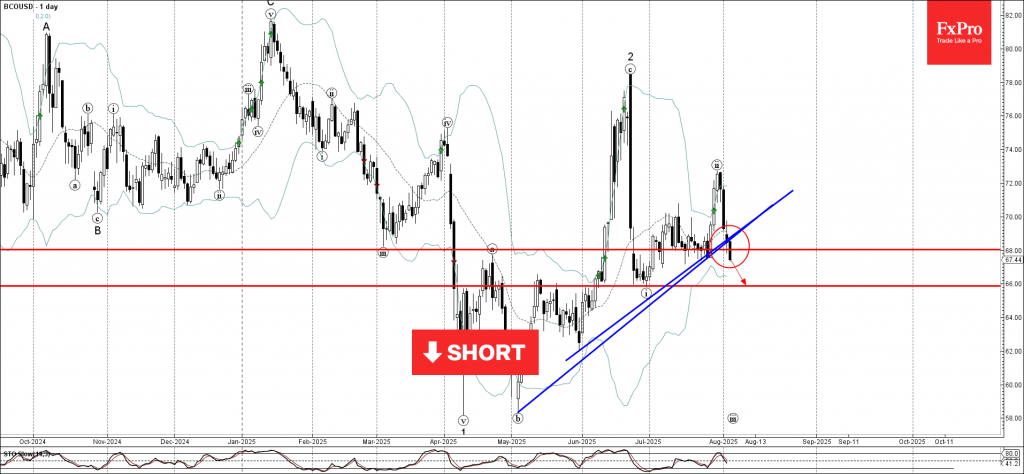

Brent Crude Oil: ⬇️ Sell – Brent Crude Oil broke support zone – Likely to fall to support level 66.00 Brent Crude Oil recently broke the support zone between the key support level of 68.00 (which reversed the price multiple.

August 5, 2025

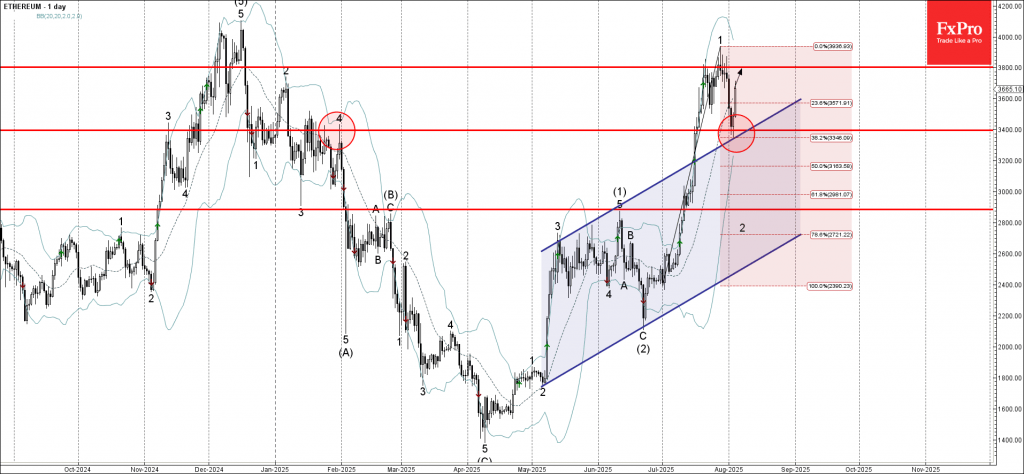

Ethereum: ⬆️ Buy – Ethereum reversed from the key support level 3400.00 – Likely to rise to resistance level 3800.00 The Ethereum cryptocurrency recently reversed from the support zone between the key support level of 3400.00 (formerly a resistance level.

August 5, 2025

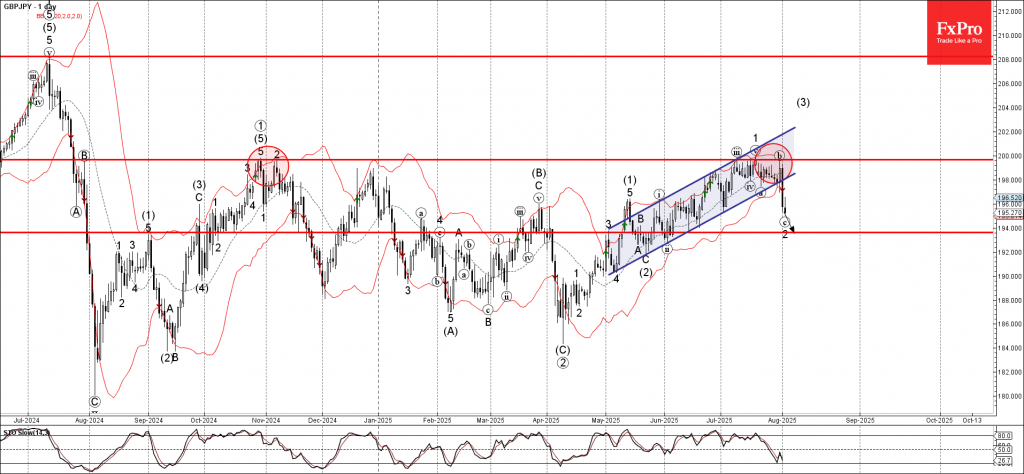

GBPJPY: ⬇️ Sell – GBPJPY reversed from the resistance zone – Likely to fall to support level 194.00 GBPJPY currency pair recently reversed from the resistance zone between the round resistance level 200.00 (which has been reversing the price from.