Technical analysis - Page 408

August 8, 2019

Corn reversed from support zone Further gains are likely Corn recently reversed up from the support area located lying between the pivotal support level 1.6675 (former resistance from December), lower daily Bollinger Band and the 61.9% Fibonacci correction of the.

August 8, 2019

EURAUD reversed from resistance zone Further losses are likely EURAUD recently reversed down sharply from the resistance zone lying between the multi-month resistance level 1.6675 (monthly high from January) and the upper daily Bollinger Band. The downward reversal from this.

August 7, 2019

Silver broke strong resistance level 16.60 Further gains are likely Silver today broke the strong resistance level 16.60 – which formed the Tipple Top in July. The breakout of the resistance level 16.60 should accelerate the active impulse wave (iii).

August 7, 2019

AUDNZD reversed from support zone Further gains are likely AUDNZD recently reversed up sharply from the support zone lying between the round support level 1.0300 and the lower daily Bollinger Band. The price today broke the resistance trendline of the.

August 6, 2019

Copper reversed from long-term support level 255.00 Further gains are likely Copper today reversed up strongly from the long-term support level 255.00 – which has been reversing the price from last August . The support area near the support level.

August 6, 2019

NZDCHF reversed from key support level 0.6330 Further gains are likely NZDCHF today reversed up from the multi-month support level 0.6330 – which also stopped the strong downtrend in September. The support area near the support level 0.6330 was.

August 5, 2019

Gold broke resistance area Further gains are likely Gold today broke the resistance area lying between the resistance levels 1430.00 and 1450.00 – which has been reversing the price from the end of June. The breakout of this resistance area.

August 5, 2019

NZDJPY reversed from support level 69.00 Further gains are likely NZDJPY today reversed up from the support level 69.00 – which was set as the likely downward target in our earlier forecast for this currency pair. The support area near.

August 2, 2019

Silver falling inside impulse wave (c) Further losses are likely Silver recently reversed down 3 times from the powerful resistance level 16.00 – intersecting with the daily Upper Bollinger Band. The latest downward reversal from the resistance level 16.00 started.

August 2, 2019

NZDJPY broke key support level 70.35 Further losses are likely NZDJPY recently broke below the pivotal support level 70.35 – which reversed the price sharply in May and June. The breakout of the support level 70.35 accelerated the active impulse.

August 1, 2019

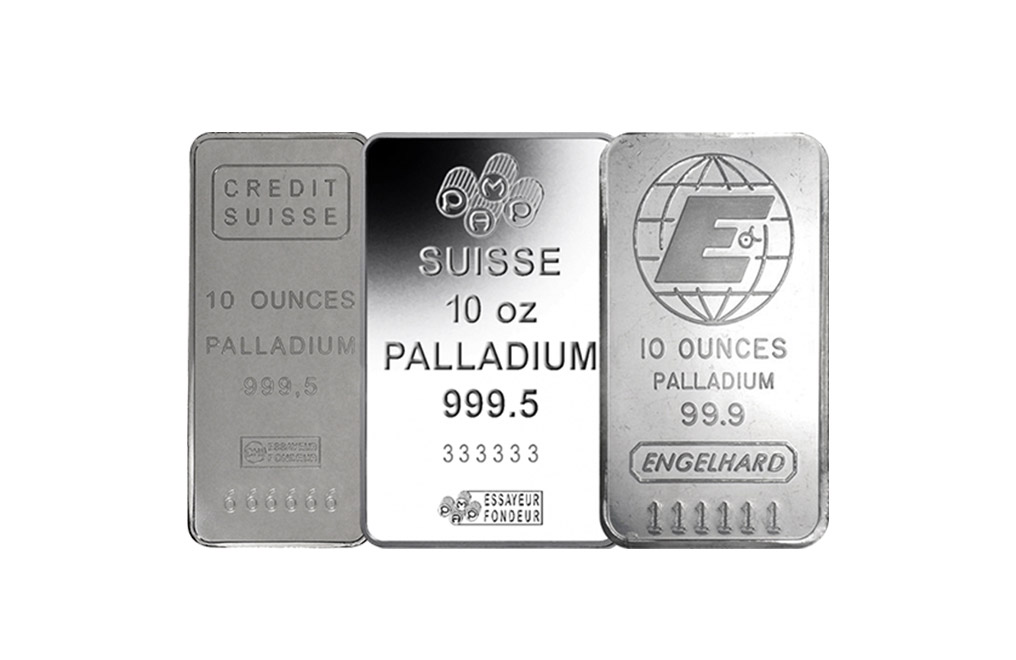

Palladium broke round support level 1500.00 Further losses are likely Palladium recently broke below the round support level 1500.00 – which reversed the price multiple times in July. The breakout of the support level 1500.00 accelerated the active short-term impulse.