Technical analysis - Page 406

August 26, 2019

EURNZD reversed from resistance area Further losses are likely EURNZD recently reversed down from the resistance area lying between the storing resistance level 1.7580 (top of the previous impulse wave 1) and the upper daily Bollinger Band. The downward reversal.

August 26, 2019

Sugar reversed from support area Further gains are likely Sugar recently reversed up from the support area located between the support level 11.40 (which has been reversing the price from May) and the lower daily Bollinger Band. The upward reversal.

August 23, 2019

Natural Gas reversed from resistance area Further losses are likely Natural Gas recently reversed down from the resistance area zone between the pivotal resistance level 2.200 (former strong support from June), upper daily Bollinger Band and the 38.2% Fibonacci correction.

August 23, 2019

AUDNZD reversed from resistance area Further losses are likely AUDNZD recently reversed down from the resistance area lying between the resistance level 1.0590 (previous upward target) and the upper daily Bollinger Band. The downward reversal from this resistance area stopped.

August 22, 2019

Copper reversed from resistance area Further losses are likely Copper recently reversed down from the resistance area lying between the resistance level 262.50 (former support from July) and the 38.2% Fibonacci correction of the previous downward impulse 1 from last.

August 22, 2019

GBPNZD broke resistance area Further gains are likely GBPNZD recently broke the resistance area lying between the resistance level 1.9060 (top of the previous (a)-wave) and the 61.8% Fibonacci correction of the previous downward impulse from June. The breakout of.

August 21, 2019

WTI broke daily down channel Further gains are likely WTI recently broke the resistance trendline of the daily down channel from July – which enclosed the previous short-term ABC correction C. The breakout of this down channel should accelerate the.

August 21, 2019

EURAUD broke support area Further losses are likely EURAUD recently broke the support area lying between the support level 1.6400 (former strong resistance from June) and the 38.2% Fibonacci correction of the previous upward impulse from July. The breakout of.

August 20, 2019

CADCHF reversed from resistance area Further losses are likely CADCHF recently reversed down from the resistance area lying between the resistance level 0.7380 (former support from May and June) and the 38.2% Fibonacci correction of the previous downward impulse from.

August 20, 2019

Cotton reversed from support area Further gains are likely Cotton recently reversed up from the support area lying between the multi-year support level 56.70 (which has been reversing the price from 2015) and the lower weekly Bollinger Band. The upward.

August 19, 2019

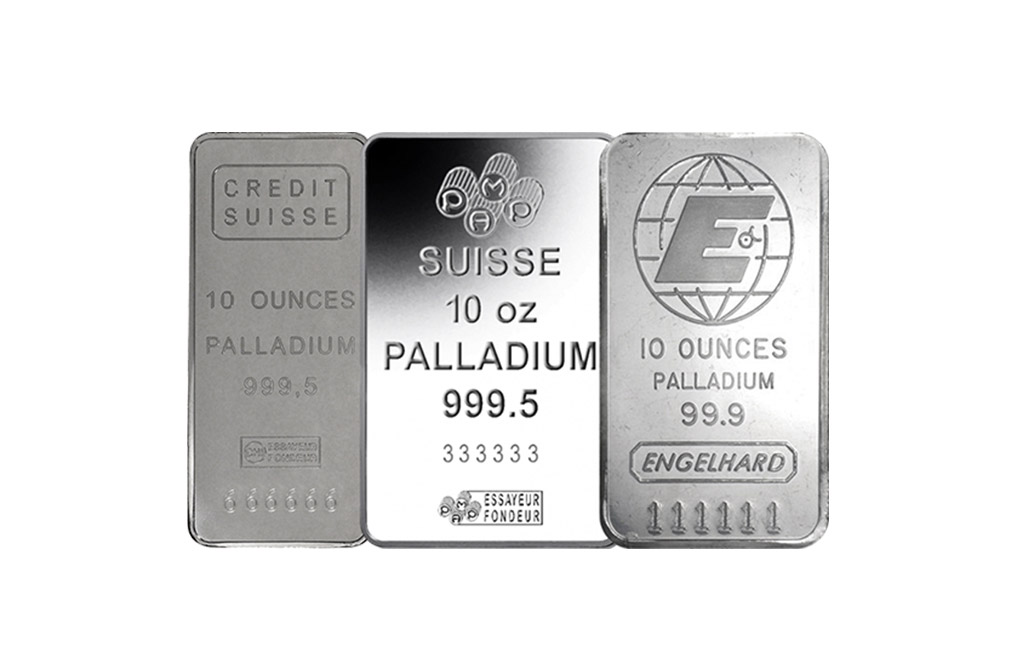

Palladium reversed from support area Further gains are likely Palladium recently reversed up from the support area located between the support level 1390.00 (former resistance May), lower daily Bollinger Band, support trendline from November and the 61.8% Fibonacci correction of.