Technical analysis - Page 405

September 3, 2019

Brent Crude Oil falling inside impulse wave (iii) Further losses are likely Brent Crude Oil continues to fall inside the minor impulse wave (iii), which started earlier from the resistance area lying between the resistance level 61.00, upper daily Bollinger.

September 3, 2019

EURUSD broke support area Further losses are likely EURUSD recently broke the support area lying between the round support level 1.1000 and the support trendline of the daily down channel from January – which encloses the active impulse sequence ③..

September 2, 2019

EURAUD reversed from resistance area Further losses are likely EURAUD recently reversed down sharply through the resistance area lying between the long-term resistance level 1.6675, upper daily Bollinger Band and the resistance trendline of the daily up channel from April..

September 2, 2019

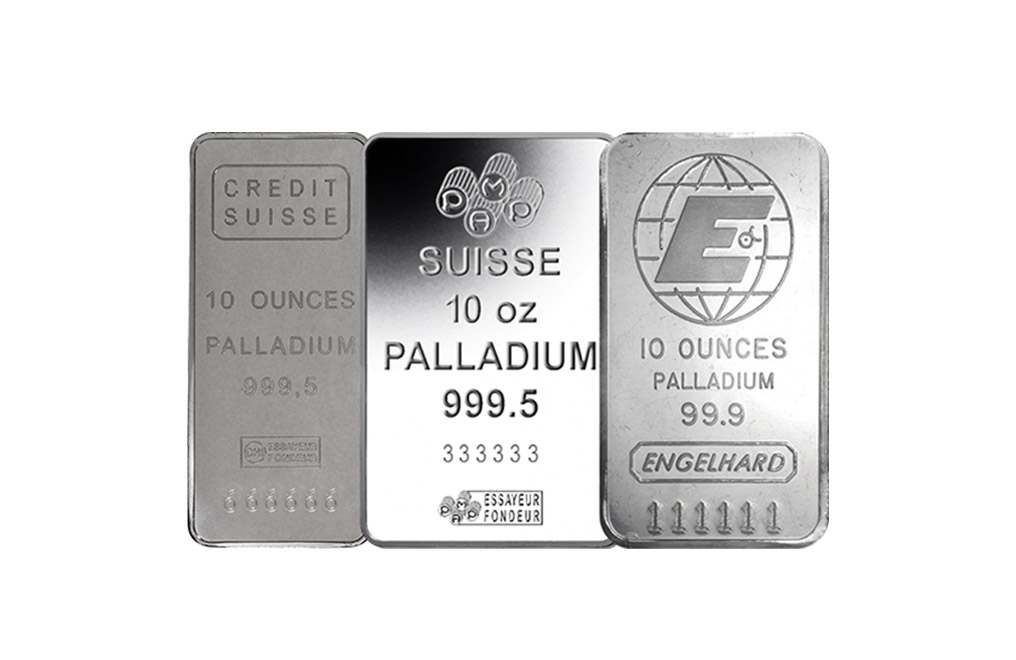

Palladium broke resistance area Further gains are likely Palladium recently broke the resistance area lying between the round resistance level 1.5000 (previous upward target) and the 50% Fibonacci correction of the previous downward impulse from July. The breakout of this.

August 30, 2019

NZDCAD broke daily down channel Further losses are likely NZDCAD recently broke below the support trendline of the extended daily down channel from March – which encloses the active long-term ABC correction ②. The breakout of this down channel follows.

August 30, 2019

Platinum broke resistance area Further gains are likely Platinum recently broke sharply through the resistance area lying between the strong resistance level 915.00 (multi-month high from April) and the resistance trendline of the wide daily up channel from June. The.

August 29, 2019

AUDCHF reversed from support area Further gains are likely AUDCHF recently reversed up from the support area lying between the support level 0.6520 (which reversed the price twice from the start of August), support trendline of the daily down channel.

August 29, 2019

Natural Gas broke resistance area Further gains are likely Natural Gas recently broke the resistance area lying between the resistance level 2.230 (which reversed earlier waves (a) and (b)), resistance trendline of the daily down channel from May and the.

August 28, 2019

Corn broke the key support level 357.00 Further losses are likely Corn recently broke the key support level 357.00 – which stopped the previous sharp short-term impulse wave 1 earlier this month. The breakout of the support level 357.00 continues.

August 28, 2019

EURGBP reversed from support area Further gains are likely EURGBP recently reversed up from the support area lying between the support level 0.9030 (former resistance from July and January), support trendline of the daily up channel from May and the.

August 27, 2019

CADCHF broke resistance area Further gains are likely CADCHF recently broke the resistance zone lying between the resistance level 0.7400 (former support from March) and the 38.2% Fibonacci correction of the previous downward impulse from July. The breakout of this.