Technical analysis - Page 401

October 1, 2019

Ebay reversed from support zone Likely to rise to 41.40 Ebay recently reversed up from the support area lying between the pivotal support level 38.35 (which has been reversing the price from August) and the 50% Fibonacci correction of the.

October 1, 2019

NZDUSD broke support zone Likely to fall to 0.6150 NZDUSD today broke sharply through the support area lying between the support level 0.6270 and the support trendline of the wide daily down channel from March. The breakout of this support.

September 30, 2019

Platinum broke support zone Likely to fall to 890.00 Platinum today corrected sharply – breaking through the support area lying between the support level 920.00 and 50% Fibonacci correction of the previous upward impulse from August. The breakout of this.

September 30, 2019

EURUSD broke key support level 1.0930 Likely to fall to 1.0850 EURUSD recently broke through the support area lying between the key support level 1.0930 (low of waves (i) and (b)), the support trendline of the weekly down channel from.

September 27, 2019

GBPCAD falling inside the minor correction 2 Likely to fall to 1.6200 GBPCAD has been falling sharply in the last few trading sessions inside the minor correction 2 – which started earlier from the resistance area lying between the resistance.

September 27, 2019

Natural Gas falling inside weekly wave B Likely to fall to 2.200 Natural Gas has been under bearish pressure this week – after the earlier downward reversal from the resistance area lying between the resistance level 2.670 and the upper.

September 26, 2019

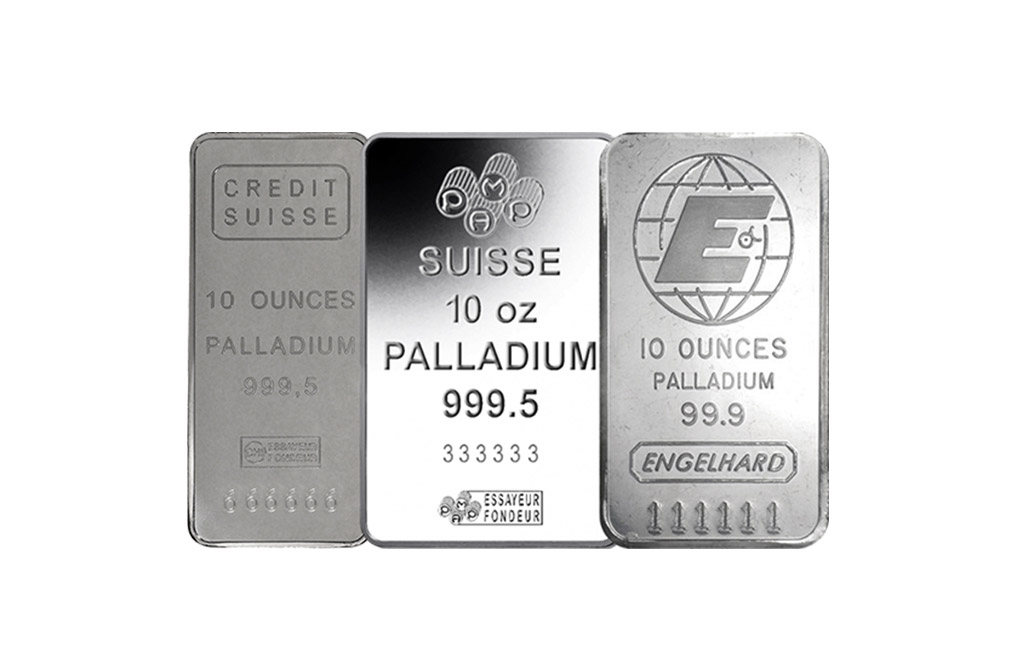

Palladium reversed from support area Likely to rise to 1645.00 Palladium recently reversed up from the support area lying between the round support level 1.600 (former multi-month resistance level which stopped the sharp uptrend in June) and the 38.2% Fibonacci.

September 26, 2019

NZDCHF reversed from support area Likely to rise to 0.6310 NZDCHF recently reversed up from the support area lying between the support level 0.6200 (which has reversed the price multiple times from the start of August) and the lower daily.

September 25, 2019

GBPUSD reversed from resistance area Likely to fall to 1.2300 GBPUSD recently reversed down from the resistance area lying between the resistance level 1.2540 (former monthly low from July), upper daily Bollinger Band and the 50% Fibonacci correction of the.

September 25, 2019

Baidu broke support level 100.00 Likely to fall to 93.40 Baidu recently broke below the round support level 100.00 (which stopped the earlier short-term impulse wave (i) at the start of September). The breakout of the support level 100.00 should.

September 24, 2019

Sugar broke resistance area Likely to rise to 11.65 Sugar recently broke through the resistance area lying between the resistance level 11.250 (former strong support from August), resistance trendline of the daily down channel from June and the 61.8% Fibonacci.