Technical analysis - Page 39

August 18, 2025

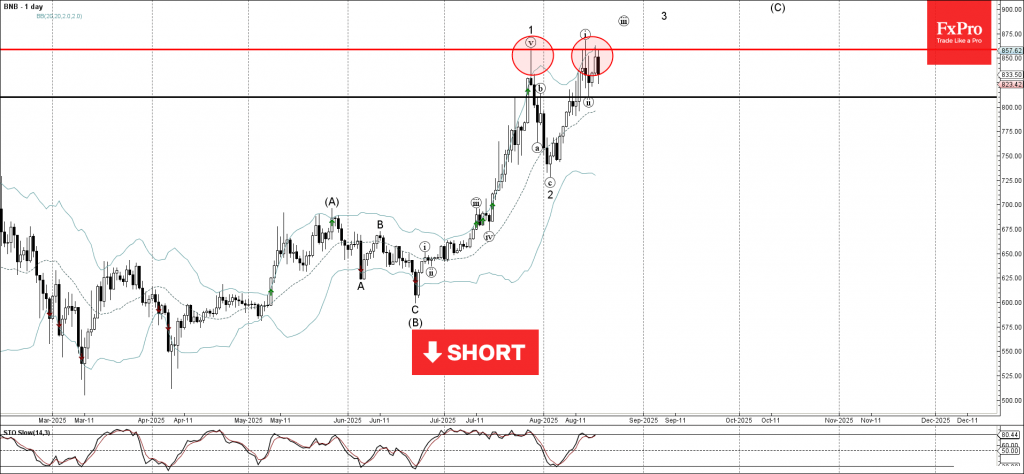

BNB: ⬇️ Sell – BNB reversed from strong resistance level 859.00 – Likely to fall to support level 810.00 BNB cryptocurrency recently reversed from the resistance zone located between the strong resistance level 859.00 and the upper daily Bollinger Band..

August 16, 2025

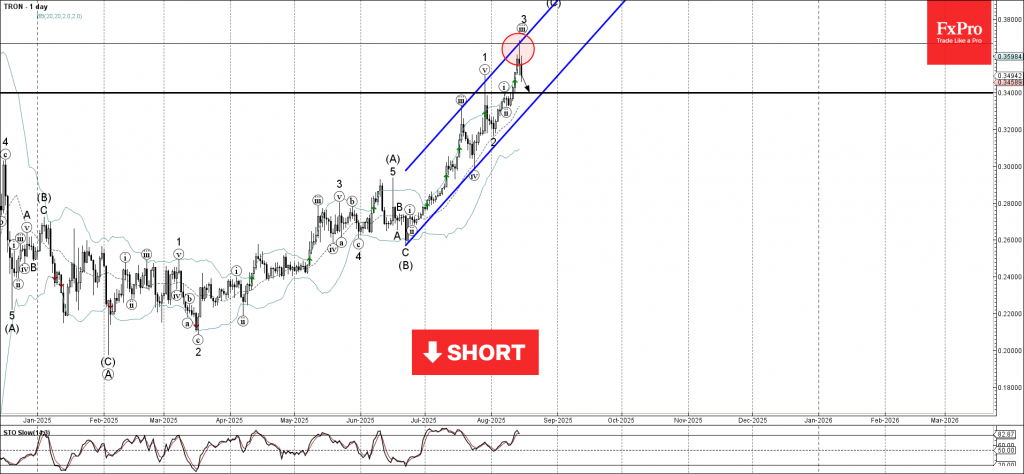

Tron: ⬇️ Sell – Tron reversed from a daily up channel – Likely to fall to support level 0.3400 Tron cryptocurrency recently reversed from the resistance trendline of the narrow daily up channel from the end of June – standing.

August 16, 2025

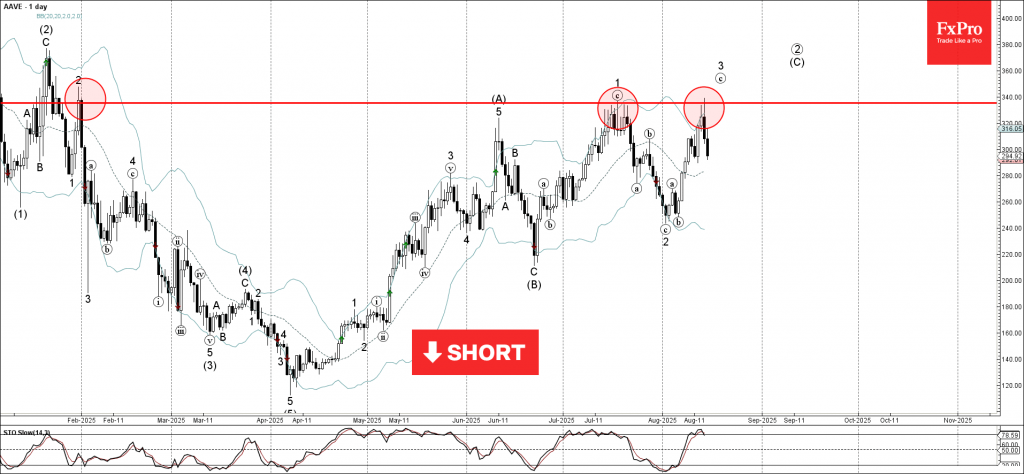

AAVE: ⬇️ Sell – AAVE reversed from a strong resistance level 335.00 – Likely to fall to support level 280.00 AAVE cryptocurrency recently reversed from a strong resistance level 335.00 (which stopped all upward impulses from February), standing near the.

August 15, 2025

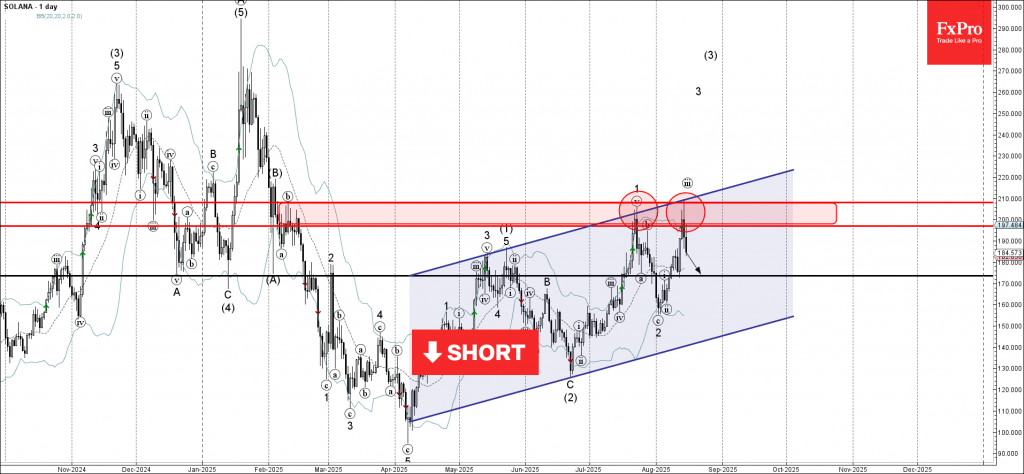

Solana: ⬇️ Sell – Solana reversed from resistance zone – Likely to fall to support level 173.55 Solana cryptocurrency recently reversed from the resistance zone located between the resistance levels 200.00 and 210.00, as can be seen from the daily.

August 15, 2025

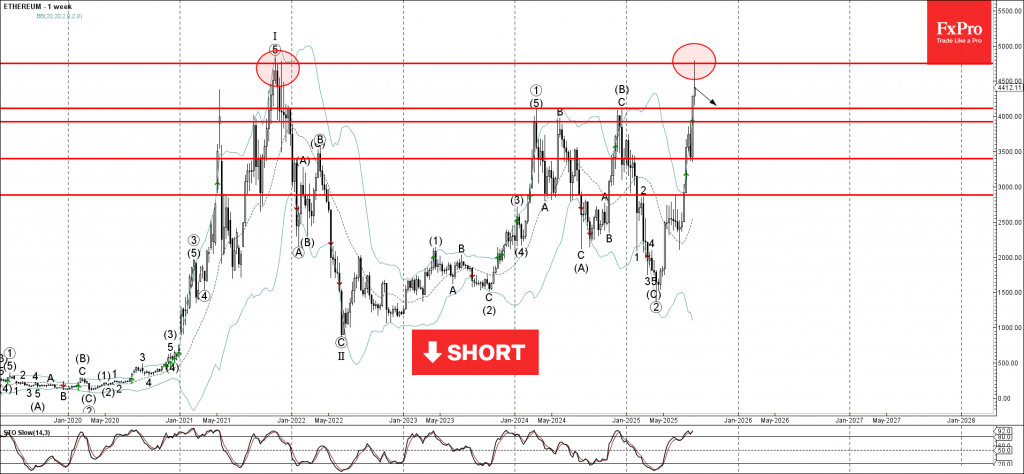

Ethereum: ⬇️ Sell – Ethereum reversed from the long-term resistance level 4755. – Likely to fall to support level 4115.00 Ethereum cryptocurrency recently reversed from the major long-term resistance level 4755.00 (which stopped the earlier sharp weekly uptrend at the.

August 15, 2025

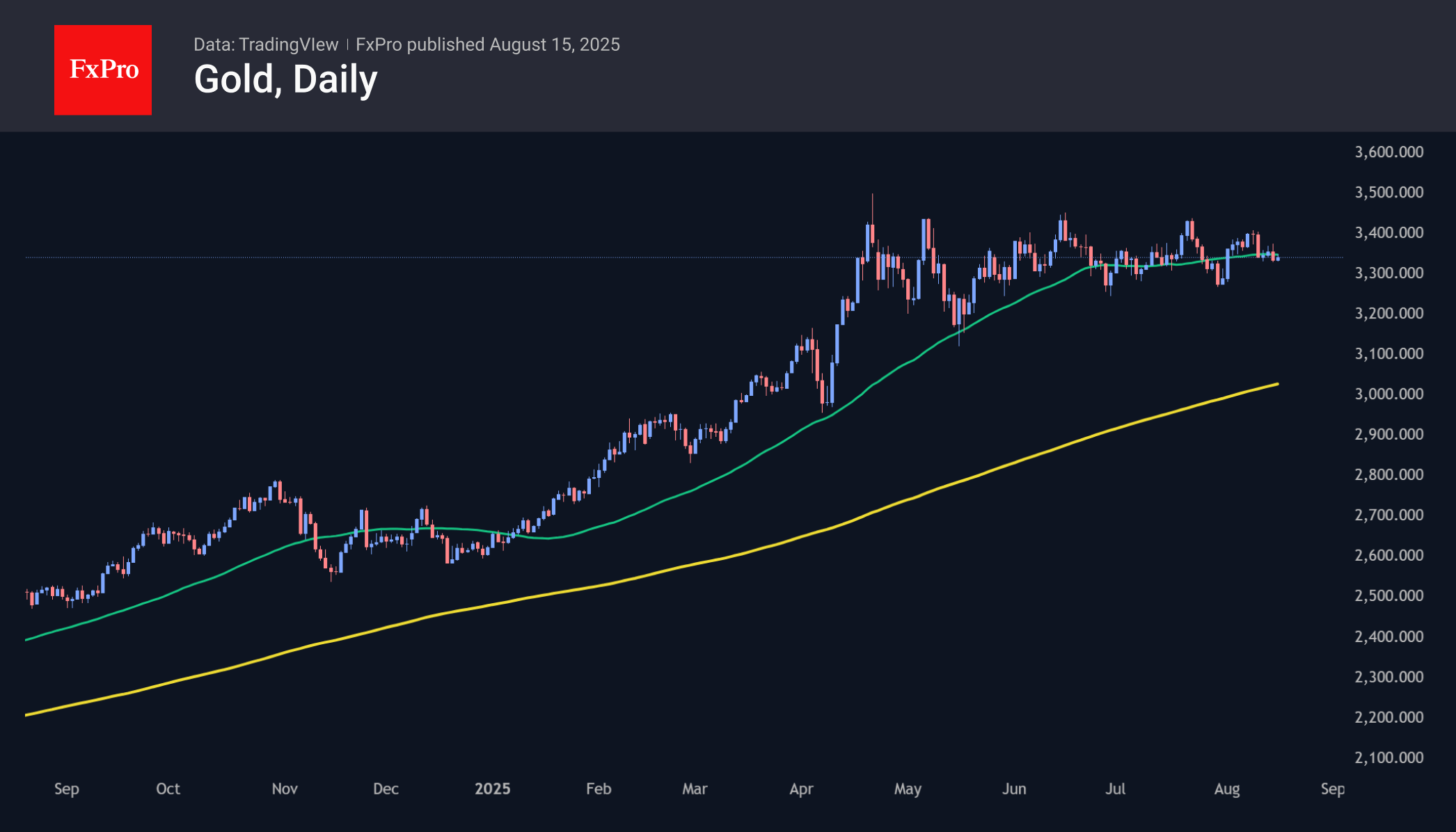

Gold hovers around $3,250–3,400 amid policy news; possible Fed rate cuts and dollar weakness may spark a new upward trend after consolidation. August could be pivotal for momentum.

August 15, 2025

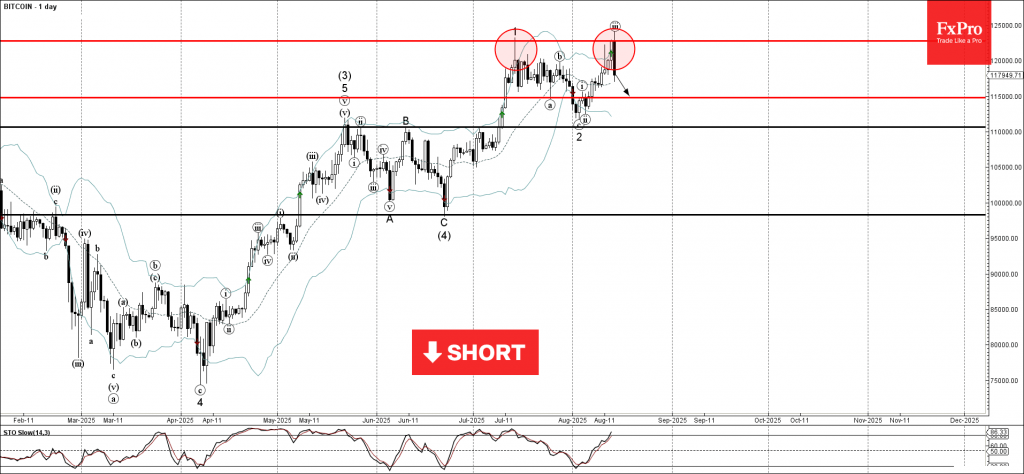

Bitcoin: ⬇️ Sell – Bitcoin reversed from the strong resistance 122770.00 – Likely to fall to support level 115000.00 Bitcoin today recently reversed down with the Bearish Engulfing from the strong resistance level 122770.00 (which stopped the previous minor impulse.

August 15, 2025

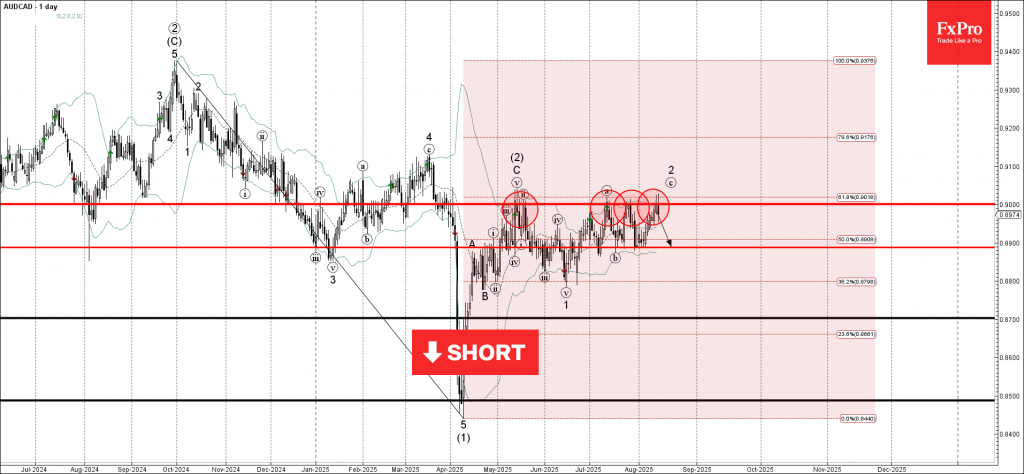

AUDCAD: ⬇️ Sell – AUDCAD reversed from the round resistance level of 0.9000 – Likely to fall to support level 0.8900 AUDCAD currency pair recently reversed from the round resistance level of 0.9000 (which has been steadily reversing the price.

August 15, 2025

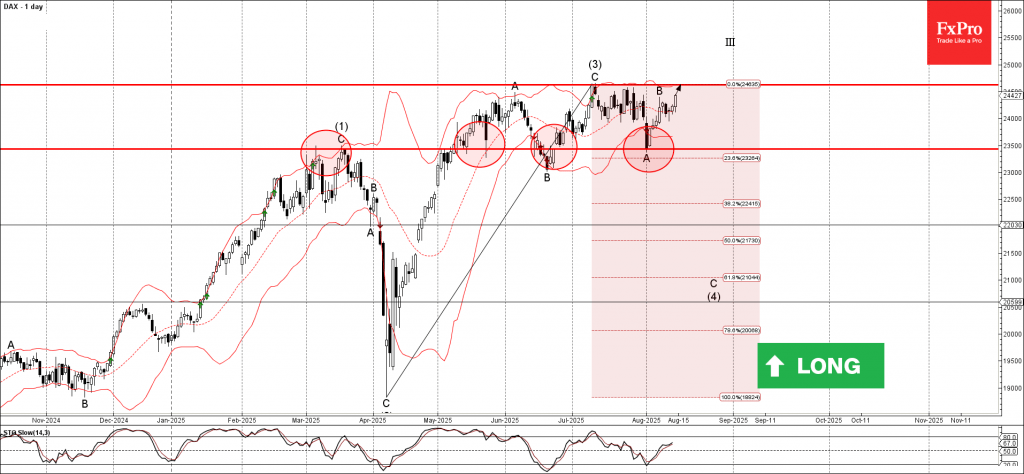

DAX: ⬆️ Buy – DAX reversed from the support level of 23500.00 – Likely to reach resistance level 24625.00 DAX index recently reversed up from the support level of 23500.00 (which has been reversing the price from May), standing near.

August 15, 2025

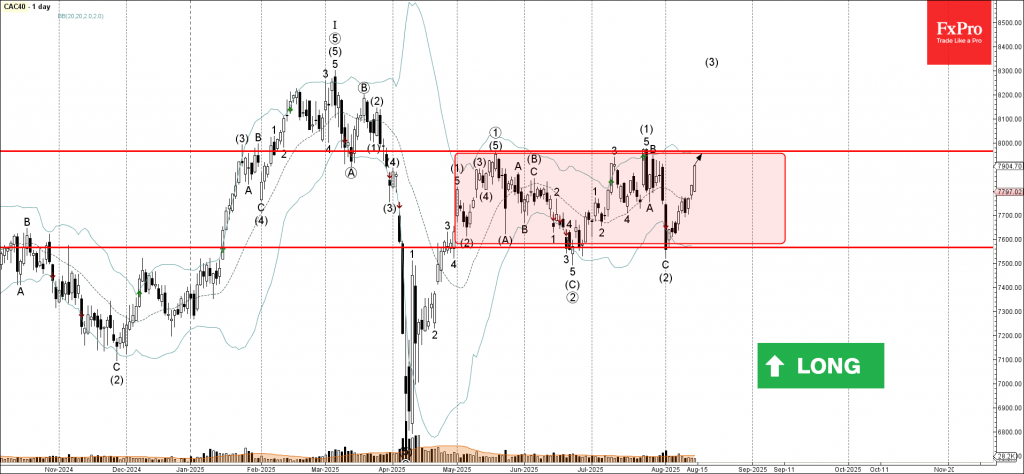

CAC40: ⬆️ Buy – CAC40 rising inside intermediate impulse wave (3) – Likely to reach resistance level 7965.00 The CAC40 index continues to rise within the intermediate impulse wave (3), which began earlier from the support level of 7565.00 (the.

August 14, 2025

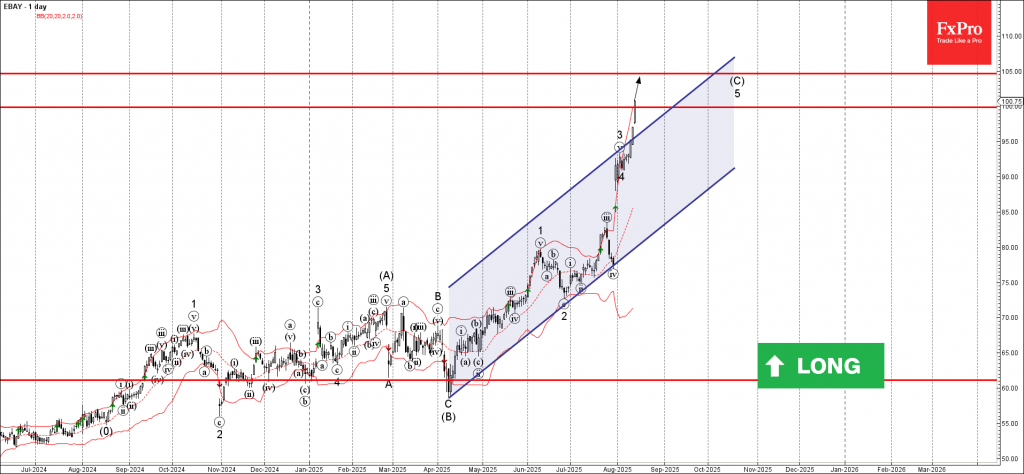

Ebay: ⬆️ Buy – Ebay broke the round resistance level 100.00 – Likely to rise to resistance 105.00 Ebay recently broke the round resistance level 100.00, the breakout of which was preceded by the breakout of the resistance trendline of.