Technical analysis - Page 368

March 24, 2020

EURGBP reversed from multi-year resistance level 0.9270 Likely to fall to 0.9270 EURGBP recently reversed down from the strong multi-year resistance level 0.9270 (which stopped three weekly uptrends from the end of 2016, as can be seen from the weekly.

March 24, 2020

EURAUD reversed from round resistance level 2.0000 Likely to fall to 1.8000 EURAUD recently reversed down sharply from the key round resistance level 2.0000 – standing well outside of the upper weekly Bollinger Band. The downward reversal from the resistance.

March 23, 2020

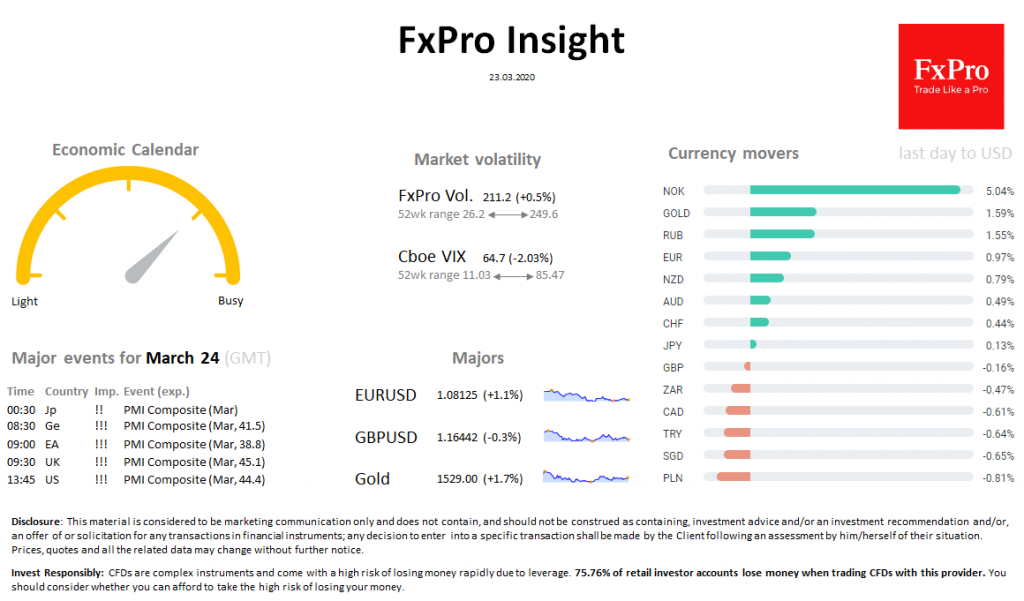

Market overview On the news from the US, American indices rush from growth to decline. Last minutes, SPX returned to negative territory amid a slipping stimulus package in the US Congress. SPX -1.6%, to lows since the end of 2016..

March 23, 2020

Gold reversed from support area Likely to rise to 1550.00 Gold recently reversed up from the support area lying between the key support level 1450.00 (which has been reversing the price from September), lower daily Bollinger Band and the 61.8%.

March 23, 2020

EURNZD reversed from resistance area Likely to fall to 1.8500 EURNZD recently reversed down sharply from the resistance area lying between the round resistance level 1.9000, upper daily Bollinger Band and the resistance trendline of the weekly up channel from.

March 23, 2020

EURJPY reversed from support area Likely to rise to 120.00 EURJPY recently reversed up from the support area lying between the powerful support level 116.00 (which stopped the previous sharp downtrend in September) and the lower daily Bollinger Band. The.

March 23, 2020

Pfizer approached key support level 28.25 Likely to correct up to 30.00 Pfizer recently fell sharply breaking through the round support level 30.00 (which stopped the earlier downward correction (B) at the end of 2016). The price is currently trading.

March 20, 2020

Ebay broke support area Likely to fall to 26.00 Ebay recently broke the support area lying between the key support level 33.20 (which reversed the price at the start of this month) and the 50% Fibonacci correction of the previous.

March 20, 2020

Soy revered from support area Likely to rise to 866.00 Soy recently revered up sharply from the support area lying between the pivotal support level 820.00 (which reversed the price in May of 2019), lower daily Bollinger Band and the.

March 20, 2020

CADCHF forming second weekly Hammer Likely to rise to 0.7000 CADCHF is in the process of forming the second consecutive weekly Japanese candlesticks reversal pattern Hammer which started when the price reversed up from the key support level 0.6700 earlier.

March 20, 2020

EURCAD reversed from resistance area Likely to fall to 1.5150 EURCAD recently reversed down from the resistance area lying between the key resistance level 1.5600 (which reversed the price twice in 2018) and the resistance level 1.5800 (top of the.