Technical analysis - Page 362

April 15, 2020

NZDUSD reversed from resistance area Likely to fall to 0.5850 NZDUSD recently reversed down from the resistance area lying between the resistance level 0.6100, upper daily Bollinger Band and the 50% Fibonacci correction of the previous downward impulse from January..

April 15, 2020

WTI reversed from support area Likely to rise to 25.00 WTI today reversed up from the support area lying between the key support level 19.65 (which stopped the previous impulse waves iii and (iii)) and the lower daily Bollinger Band..

April 15, 2020

CADCHF reversed from resistance area Likely to fall to 0.6850 CADCHF recently reversed down from the resistance area lying between the pivotal resistance level 0.6950 (which stopped the previous impulse wave (iii) at the start of this month) and the.

April 14, 2020

EURNZD reversed from support area Likely to rise to 1.8240 EURNZD recently reversed up from the support area lying between the key support level 1.7880 (which also reversed the pair at the start of March), lower daily Bollinger Band and.

April 14, 2020

GBPUSD broke resistance area Likely to rise to 1.2800 GBPUSD recently broke the resistance area lying between the resistance level 1.250 (top of the previous correction (a)) and the 50% Fibonacci retracement of the previous downward impulse 3 from the.

April 14, 2020

Adobe approached resistance level 330.50 Likely to rise to 362.60 Adobe opened today with the sharp upward gap which brought the price to the key resistance level 330.50 (former support from the end of February). Adobe has been rising in.

April 14, 2020

Gold broke round resistance level 1700.00 Likely to rise to 1760.00 Gold continues to rise steadily after the earlier breakout of the key round resistance level 1700.00 (which stopped the previous sharp impulse wave 1). The breakout of the resistance.

April 13, 2020

Copper broke resistance area Likely to rise to 240.00 Copper recently broke through the resistance area lying between the key resistance level 225.00 and the 38.2% Fibonacci retracement of the previous downward impulse (i) from the start of March. The.

April 13, 2020

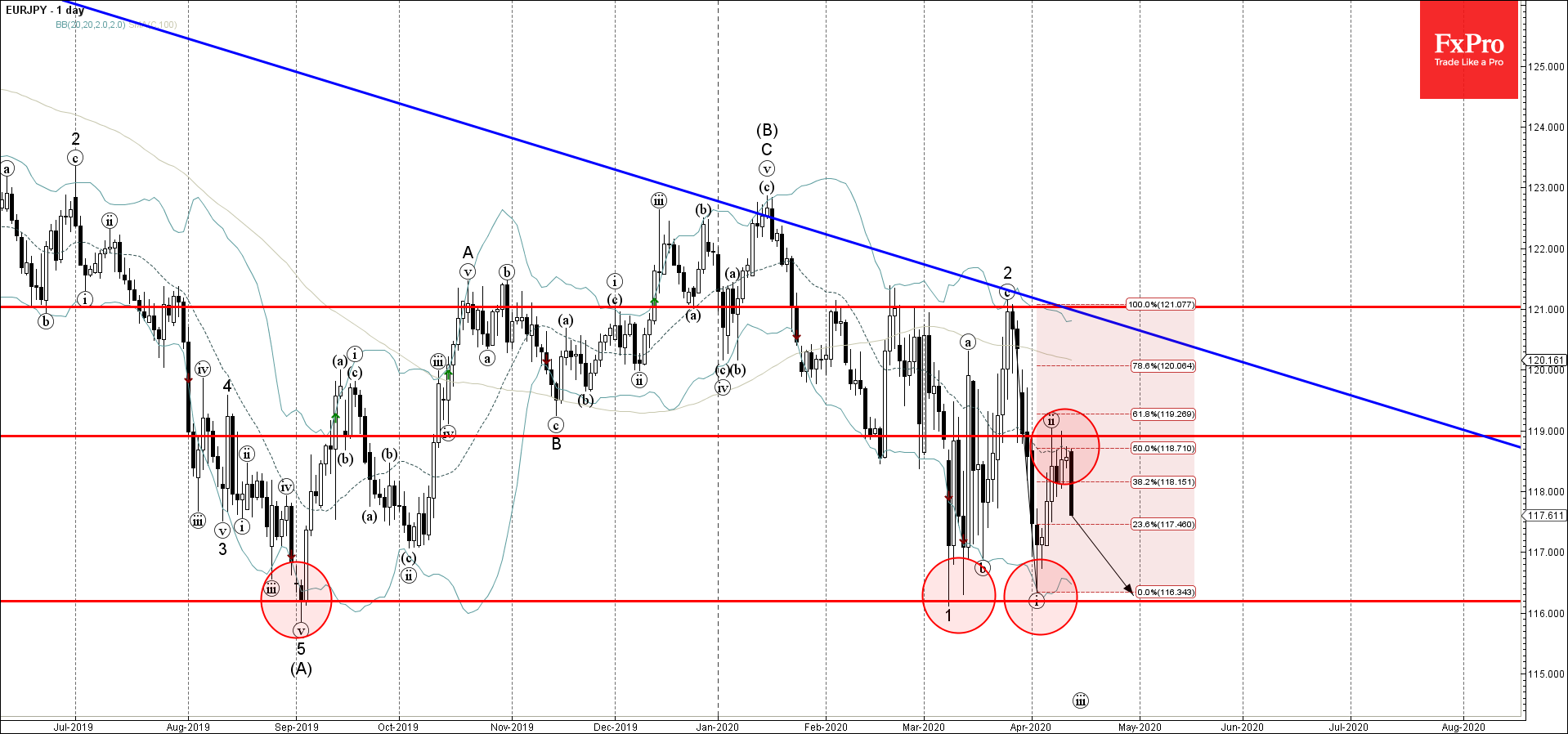

EURJPY reversed from resistance level 119.00 Likely to fall to 116.20 EURJPY recently reversed down from the key resistance level 119.00 intersecting with the 50% Fibonacci retracement of the previous downward impulse (i) from March. The downward reversal from the.

April 13, 2020

CADJPY reversed from resistance level 76.00 Likely to fall to 75.00 CADJPY recently reversed down from the resistance level 78,00 (which stopped the previous waves (B) and (1)). The resistance area near the resistance level 78,00 was strengthened by the.

April 13, 2020

AIG under bearish pressure Likely to fall to 22.50 AIG under bearish pressure after the recent downward reversal from the resistance area lying between the resistance level 27,50 (top of the previous wave B), upper daily Bollinger Band and the.