Technical analysis - Page 360

April 22, 2020

GBPAUD reversed from support area Likely to rise to 1.9800 GBPAUD recently reversed up from the support zone lying between the support level 1.9400 (which also reversed the price at the start of March), lower daily Bollinger Band, support trendline.

April 22, 2020

GBPCHF reversed from support area Likely to rise to 1.2100 GBPCHF recently reversed up from the support area lying between the round support level 1.900 (which was set as the likely downward target in our previous forecast for this currency.

April 22, 2020

Corn reversed from long-term support level 305.00 Likely to rise to 330.00 Corn recently reversed up from the support zone lying between the long-term support level 305.00 (which also reversed the price in the middle of 2016, as can be.

April 21, 2020

Bitcoin has fared better than stocks but worse than gold and U.S. Treasuries during the coronavirus pandemic, with investors ascribing its performance to speculative bets and bids to hedge against inflation linked to stimulus measures. Enthusiasts have laid out numerous.

April 21, 2020

NZDCAD reversed from resistance area Likely to fall to 0.8370 NZDCAD recently reversed down from the resistance area lying between the key resistance level 0.8535, upper daily Bollinger Band and the 61.8% Fibonacci correction of the previous downward impulse (1).

April 21, 2020

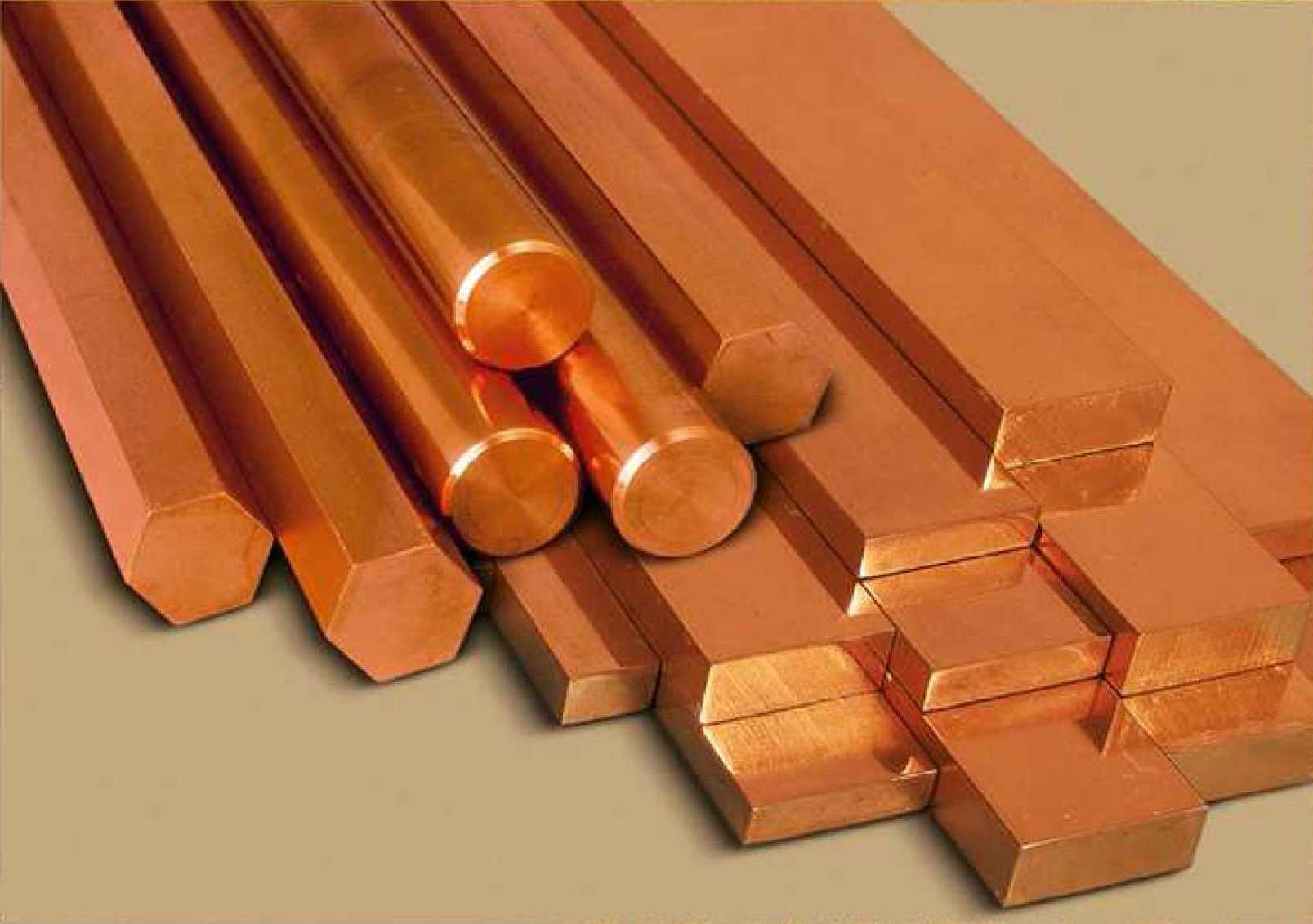

Copper broke daily up channel Likely to fall to 202.00 Copper earlier fell sharply breaking the support trendline of the narrow daily up channel from March – which accelerated the active impulse wave C. The recently approached the key support.

April 21, 2020

EURNZD reversed from support area Likely to rise to 1.8480 EURNZD recently reversed up from the support area lying between the support level 1.7845 (which stopped the previous wave A with the Bullish Engulfing) and the lower daily Bollinger Band..

April 21, 2020

HK50 reversed from resistance area Likely to fall to 23000.00 HK50 recently reversed down sharply from the resistance area lying between the key resistance level 25000.00 (former yearly low from 2019), upper daily Bollinger Band and the 50% Fibonacci correction.

April 20, 2020

GBPCHF broke resistance zone Likely to fall to 1.1890 GBPCHF recently reversed down from the resistance area located between the key resistance level 1.2100 (former strong support from October) and the 61.8% Fibonacci correction of the downward impulse from the.

April 20, 2020

Wheat broke daily down channel Likely to rise to 587.00 Wheat continues to rise after the earlier breakout of the resistance trendline of the sharp daily down channel from March (which encloses the previous ABC correction (2)). The breakout of.

April 20, 2020

GBPNZD falling inside daily correction Likely to fall to 2.0420 GBPNZD continues to fall inside the sharp downward correction which started earlier from resistance area located between the key resistance level 2.100 and the upper daily Bollinger Band. The downward.