Technical analysis - Page 35

September 4, 2025

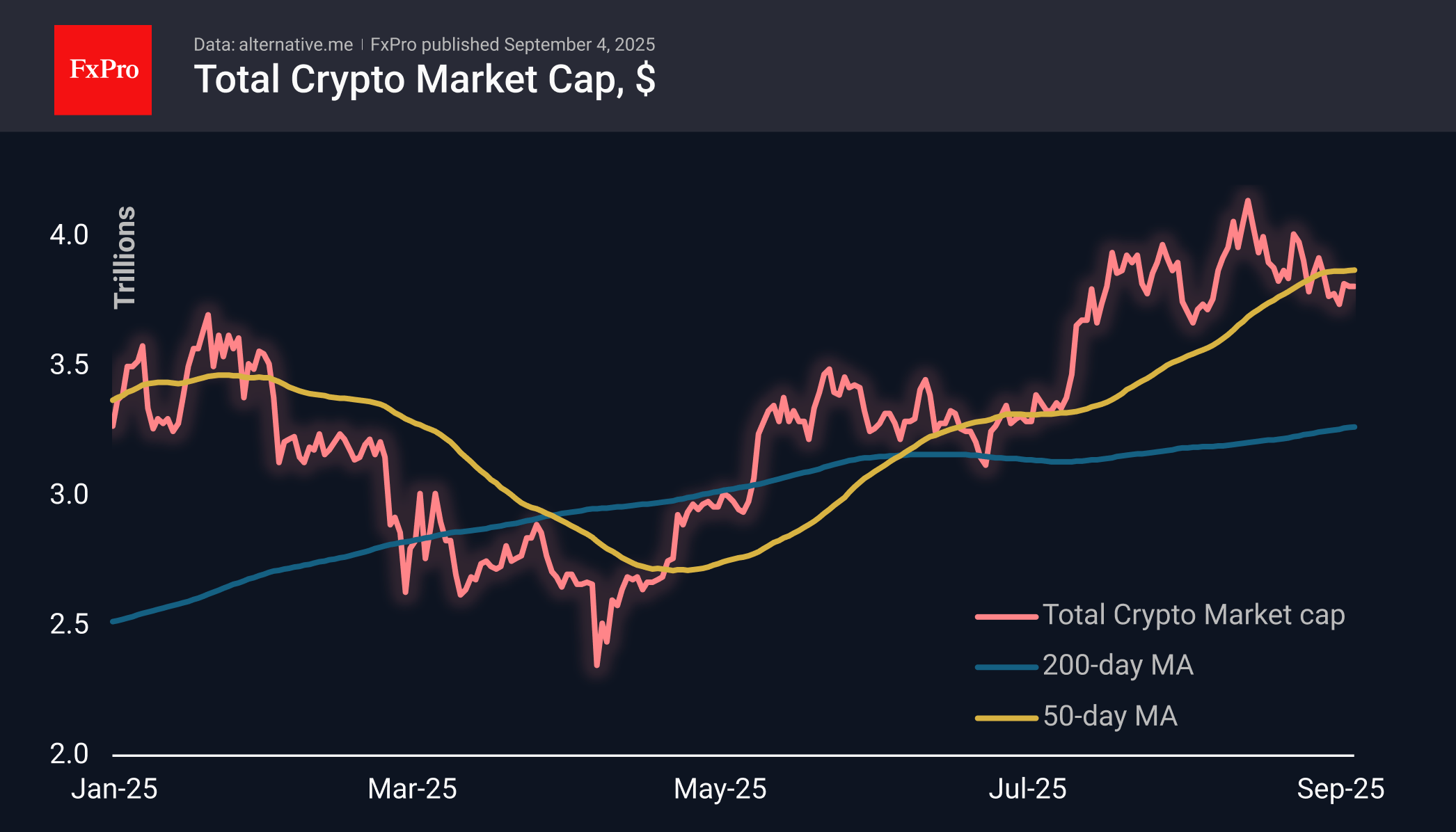

The crypto market is flat at $3.81T. BTC dips on macro fears, ETH leads gains, SOL eyes $250, meme tokens see renewed interest, and the SEC/CFTC plans spot trading.

September 4, 2025

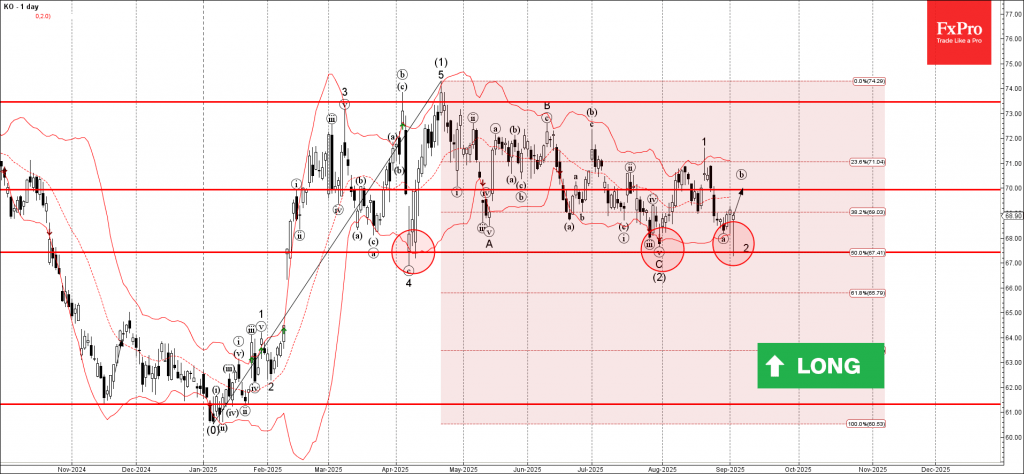

Coca-Cola: ⬆️ Buy – Coca-Cola reversed from the support area – Likely to rise to resistance level 70.00 Coca-Cola recently reversed from the support area between the strong support level 67.45 (which has been reversing the price from April), lower.

September 4, 2025

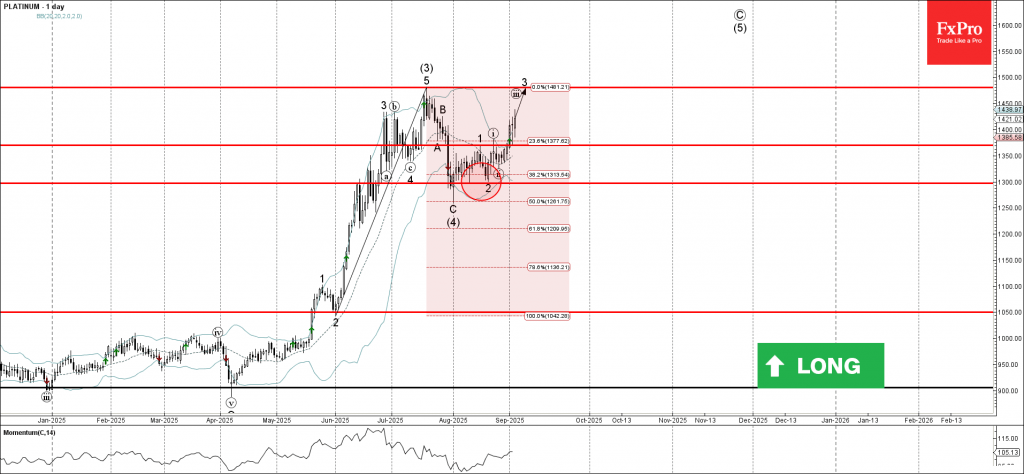

Platinum: ⬆️ Buy – Platinum rising inside impulse wave 3 – Likely to reach resistance level 1480.00 Platinum continues to rise inside the impulse wave 3, which started earlier from the support zone between the support level 1300.00 (which has.

September 3, 2025

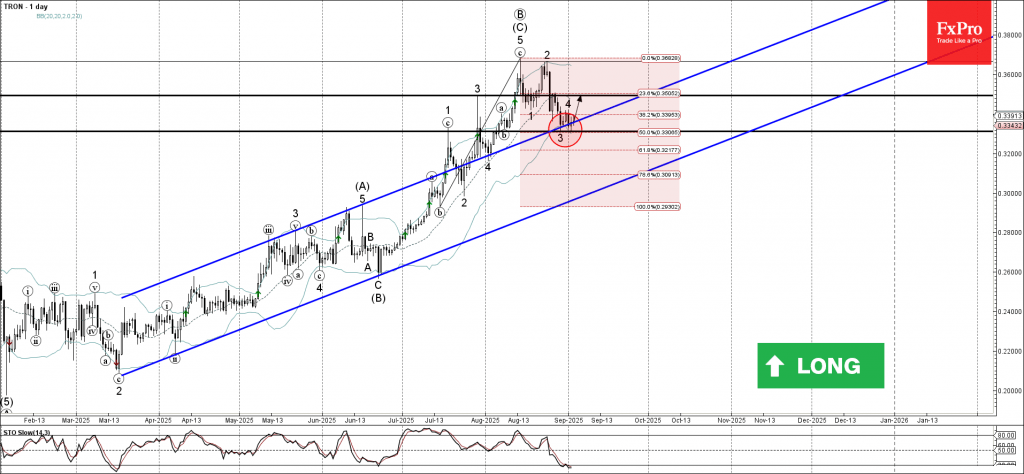

Tron: ⬆️ Buy – Tron reversed from the support zone – Likely to rise to resistance level 0.3495 Tron recently reversed from the support zone between the support level 0.3310 (low of wave b from August), lower daily Bollinger Band.

September 3, 2025

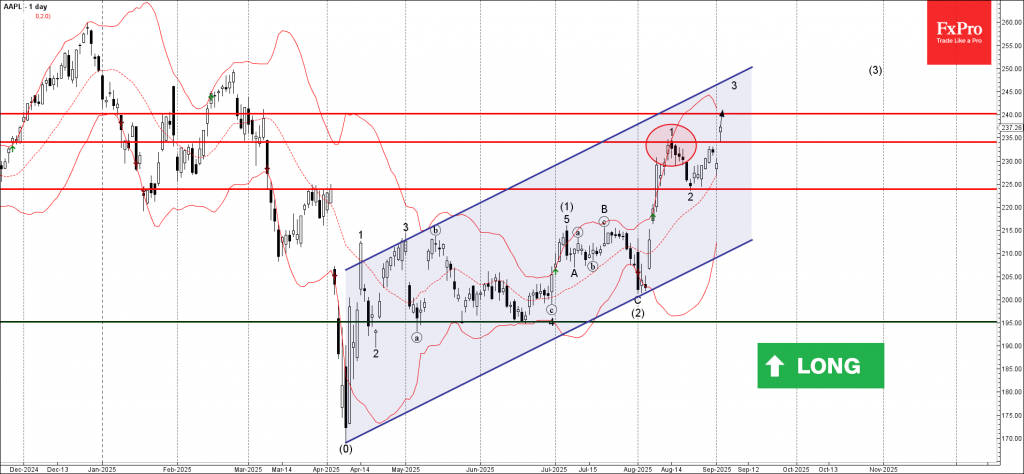

Apple: ⬆️ Buy – Apple broke the resistance level 234.00 – Likely to rise to resistance level 240.00 Apple recently broke with the upward gap above the resistance level 234.00, which stopped the previous minor impulse wave 1 at the.

September 3, 2025

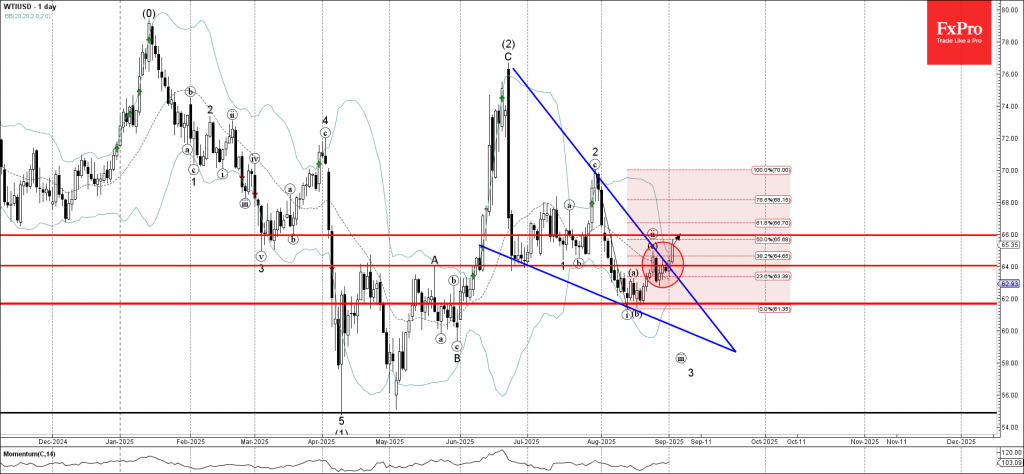

WTI crude oil: ⬆️ Buy – WTI crude oil broke the resistance level 64.00 – Likely to rise to resistance level 66.00 WTI crude oil recently broke the resistance level 64.00 intersecting with the resistance trendline of the daily Falling.

September 3, 2025

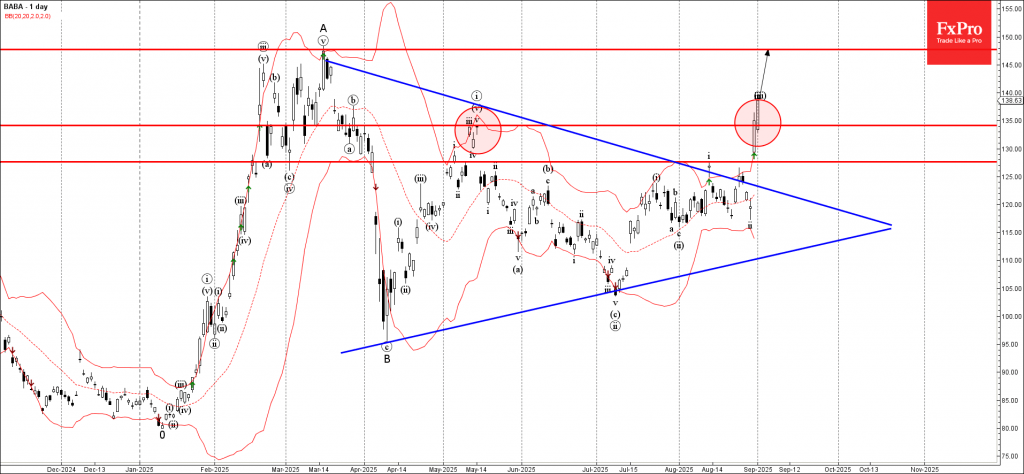

Alibaba Group: ⬆️ Buy – Alibaba Group broke resistance level 135.00 – Likely to rise to resistance level 147.70 Alibaba Group recently broke the resistance level 135.00 (former monthly high from May), which was preceded by the breakout of the.

September 2, 2025

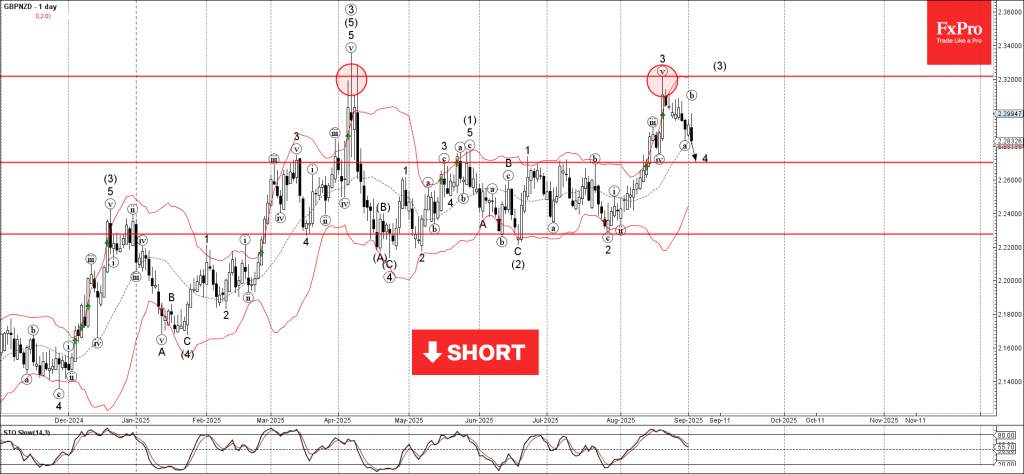

GBPNZD: ⬇️ Sell – GBPNZD reversed from the resistance zone – Likely to fall to support level 2.270 GBPNZD currency pair recently reversed from the resistance zone between the strong resistance level 2.3200 (which stopped the daily uptrend in April).

September 2, 2025

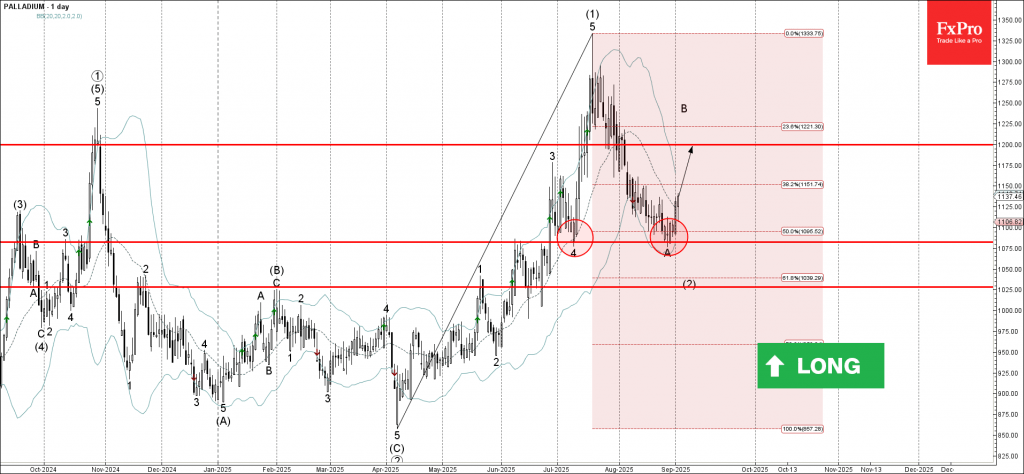

Palladium: ⬆️ Buy – Palladium reversed from the support zone – Likely to rise to resistance level 1200.00 Palladium recently reversed up from the support zone between the key support level 1075.00 (low of the previous wave A), 50% Fibonacci.

September 2, 2025

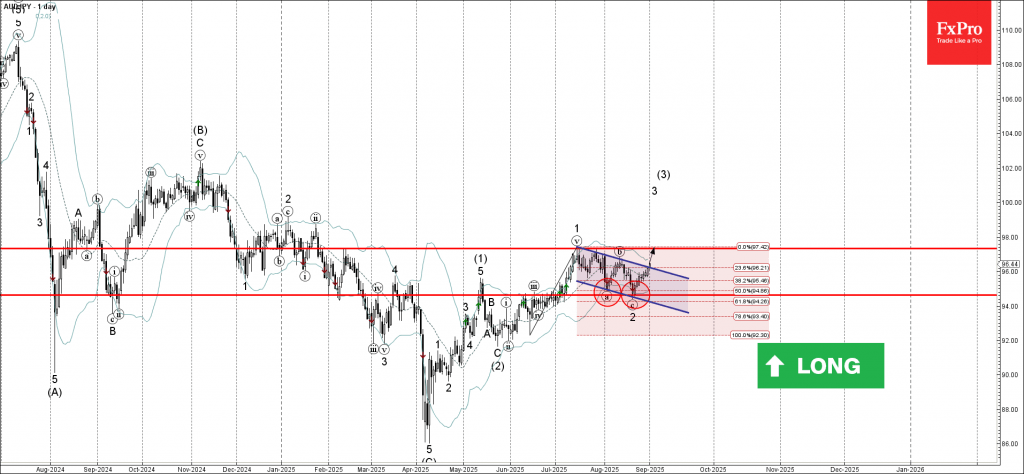

AUDJPY: ⬆️ Buy – AUDJPY broke daily Down Channel – Likely to rise to resistance level 97.30 AUDJPY currency pair today broke the resistance the resistance trendline of the daily Down Channel from the start of July (which encloses the.

September 2, 2025

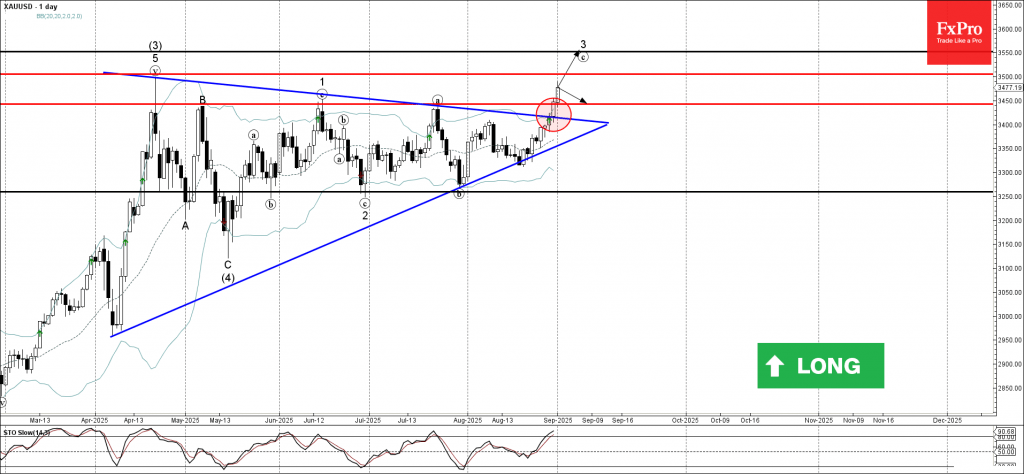

Gold: ⬆️ Buy – Gold broke resistance zone – Likely to rise to resistance level 3500.00 Gold recently broke the resistance zone between the resistance level 3450.00 (which has been reversing the price from May, as can be seen from.