Technical analysis - Page 348

June 4, 2020

• CHFJPY broke key resistance level 112,50 • Likely to rise to 114,00 CHFJPY rising sharply after the earlier breakout of the key resistance level 112,50 (which stopped the previous short-term correction (ii) in April). The breakout of the resistance.

June 4, 2020

• Soy broke resistance level 860.00 • Likely to rise to 870.00 and 890.00 Soy recently broke above the resistance level 860.00, intersecting with the resistance trendline of the wide daily down channel from the start of March. The breakout.

June 4, 2020

• EURUSD broke resistance area • Likely to rise to 1,1350 EURUSD continues to rise after the earlier breakout of the resistance area lying between the pivotal resistance level 1,1150 and the 61,8% Fibonacci correction of the previous downward impulse.

June 4, 2020

• EURCHF under bullish pressure • Likely to rise to 1,0850 EURCHF recently broke sharply above the key resistance level 1.0785 (upward target set in our previous forecast for this currency pair). The breakout of the resistance level 1.07860 coincided.

June 4, 2020

• American Express broke round resistance level 100,00 • Likely to rise to 108,700 American Express recently broke the round resistance level 100,00, standing near the 50% Fibonacci correction of the earlier sharp downward correction from February. The breakout of.

June 4, 2020

U.S. stock-index futures were trading lower Thursday morning after a series of gains pushed the Nasdaq Composite to within 2% of its all-time high, as a gradual restart to the U.S. and world economies from coronavirus-induced closures helps support bullish.

June 4, 2020

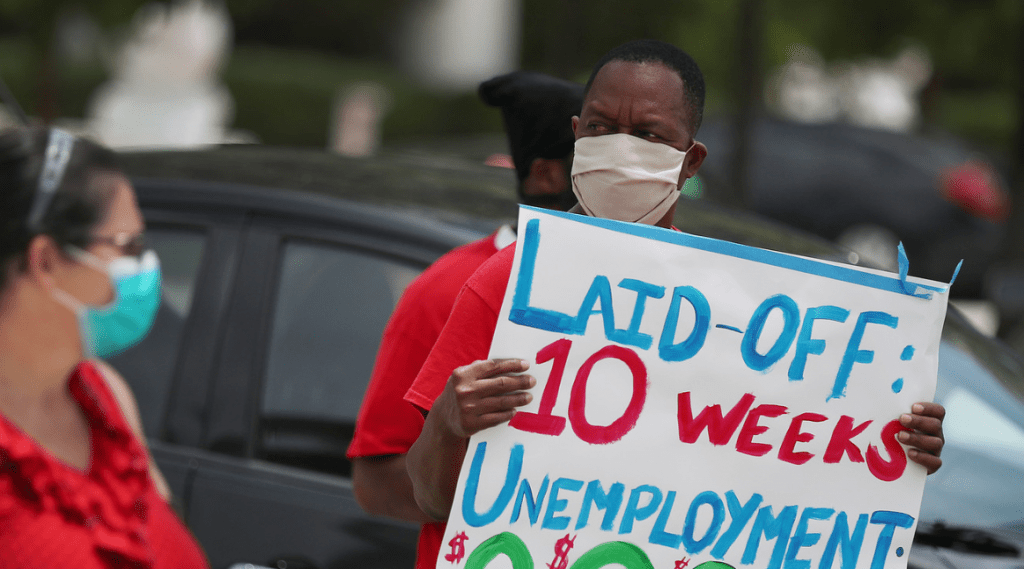

U.S. private payrolls fell less than expected in May, suggesting layoffs were abating as businesses reopen, though the overall economy’s recovery from the COVID-19 pandemic will be slow. Though the worst of job losses is probably behind, economists estimate that.

June 3, 2020

• EURCAD reversed from support level 1.5065 • Likely to rise to 1.5300 EURCAD recently reversed up from the pivotal support level 1.5065, which has been repeatedly reversing the pair from April, as can be seen below. The support area.

June 3, 2020

• EURJPY rising inside sharp C-wave • Likely to rise to 123.00 EURJPY continues to rise inside the sharp C-wave of medium-term ABC correction (2) from the start of May – which previously broke the pivotal resistance level 121.00. The.

June 3, 2020

• AUDNZD reversed from key resistance zone • Likely to fall to 1.0700 AUDNZD recently reversed down from the key resistance zone lying between the multi-month resistance level 1.0855 (monthly high from November) and the upper daily Bollinger band. The.

June 3, 2020

• IBEX 35 broke resistance area • Likely to rise to 7750.00 IBEX 35 continue to rise after the earlier breakout of the resistance area lying between the resistance level 7250.00, upper trendline of the daily Ascending triangle from March.