Technical analysis - Page 347

June 9, 2020

• Apple broke multi-month resistance 328.00 • Likely to rise to 350.00 Apple recently broke above the key multi-month resistance level 328.00 (which previously stopped the sharp upward impulse sequence in January, as can be seen below). The breakout.

June 9, 2020

• GBPAUD under bullish pressure • Likely to rise to 1.8400 GBPAUD under bullish pressure after the earlier upward reversal from the support area lying between the key support level 1.8080 (former monthly low from October of 2019) and the.

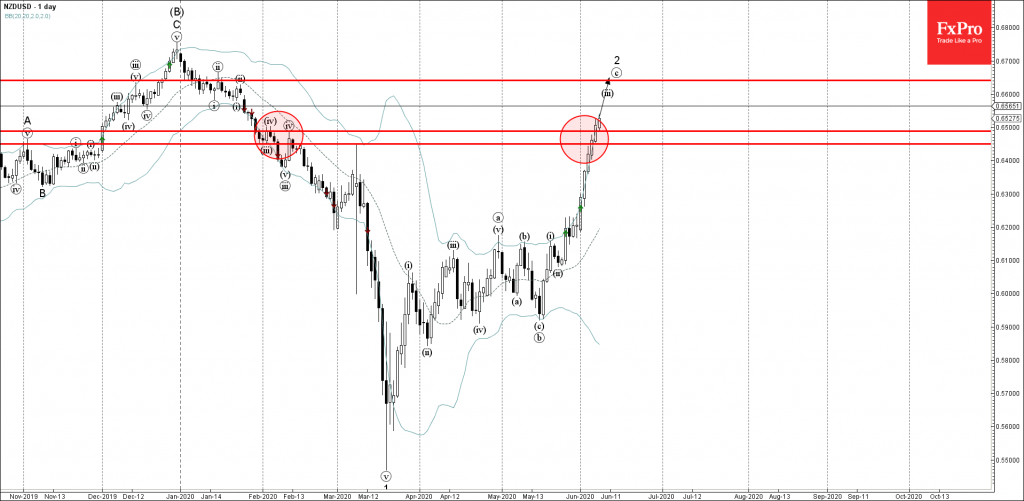

June 8, 2020

• NZDUSD broke resistance area • Likely to rise to 0.6640 NZDUSD recently broke the resistance area lying between the resistance levels 0.6450 (monthly high from March) and 0.6490 (monthly high from February). The breakout of this resistance area accelerated.

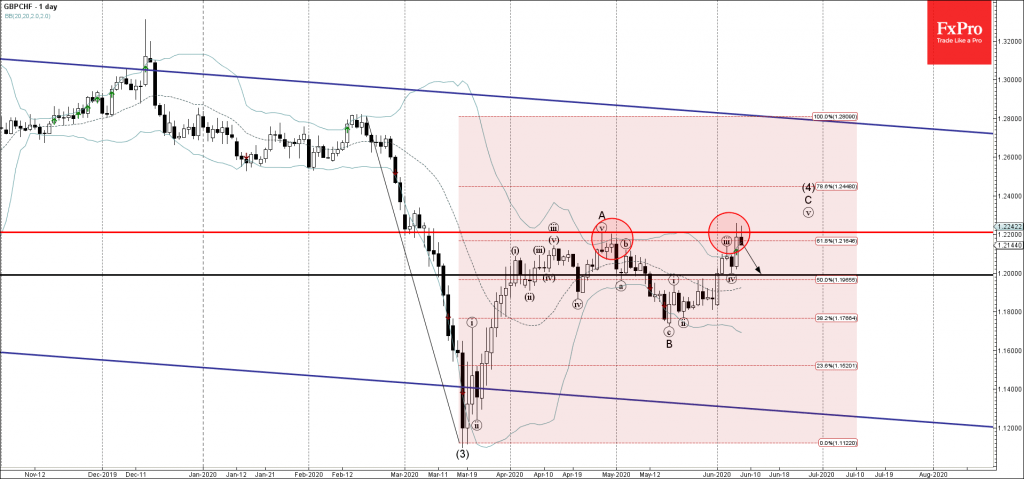

June 8, 2020

• GBPCHF reversed from resistance area • Likely to fall to 1.2000 GBPCHF recently reversed down from the resistance area lying between the key resistance level 1.2200 (former monthly high from April), upper daily Bollinger band and the 61.8% Fibonacci.

June 8, 2020

• Copper broke key resistance level 250.00 • Likely to rise to 262.00 Copper recently broke above the key resistance level 250.00 (which revered the price twice in the middle of March, as can be seen below). The breakout of.

June 8, 2020

• AUDJPY reversed from powerful resistance level 76.30 • Likely to fall to 74.40 AUDJPY recently reversed down from the powerful resistance level 76.30 (which has been steadily reversing the price from the middle of last year, as can be.

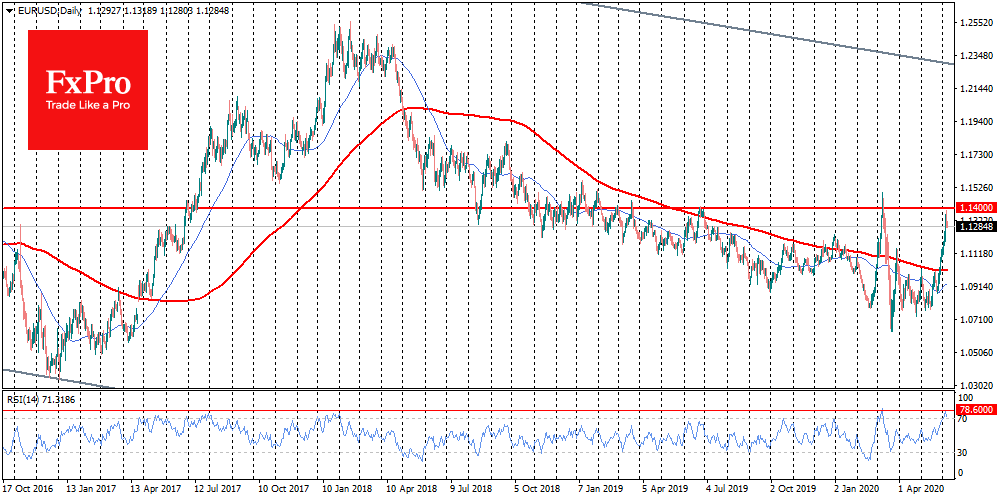

June 8, 2020

Growth in U.S. employment by 2.5 million instead of the expected decline by 7.5 million triggered one of the most energetic growth impulses in recent years. Nasdaq updated historical highs; Dow Jones climbed by more than 3%, S&P500 strengthened by.

June 5, 2020

• Platinum broke support area • Likely to fall to 800.00 Platinum recently broke the support area lying between the key support level 850.00 (which stopped the two previous waves (i) and (b)) and the 38.2% Fibonacci correction of the.

June 5, 2020

• EURCHF broke multiple resistance levels • Likely to rise to 1.0950 EURCHF has been rising forcefully over the last few trading sessions breaking through a series of key resistance levels – the last one being 1.0860. The breakout of.

June 5, 2020

• EURCAD reversed from resistance area • Likely to fall to 1.5065 EURCAD recently reversed down from the resistance area lying between the key resistance level 1.530 (which has been reversing the price from May) and the upper daily Bollinger.

June 5, 2020

• CHFJPY reversed from resistance area • Likely to fall to 113.25 CHFJPY recently reversed down sharply from the strong resistance area lying between the major resistance level 114.30 (monthly high from January and February) and the upper daily Bollinger.