Technical analysis - Page 343

June 23, 2020

• AUDUSD reversed from support zone• Likely to rise 0.7030 AUDUSD recently reversed up from the support area lying at the intersection of the pivotal support level 0.6800 (which also reversed the price earlier this month), support trendline of the.

June 23, 2020

• EURUSD reversed from support zone• Likely to rise 1.1400 EURUSD recently reversed up from the support zone lying between the support level 1.1200 and the 38.2% Fibonacci retracement of the previous upward impulse from the middle of May. The.

June 23, 2020

• Costco rising inside impulse wave (3)• Likely to rise 310.00 Costco recently reversed up sharply from the key support area between the pivotal support level 295.00 (monthly low fr0m May), lower daily Bollinger band and the 50% Fibonacci correction.

June 22, 2020

The start of this week marks a clear contrast from last Monday. Concerns over coronavirus have faded and with it stock market volatility. Overall conditions on stocks futures remain uncertain, yet more stable compared to seven days ago. With that,.

June 22, 2020

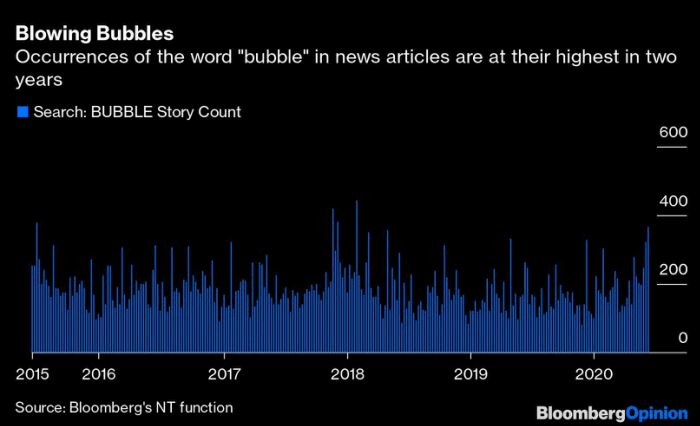

Many of the world’s leading investors are concerned that the recent gains in the U.S. stock market are overdone, given the uncertain economic outlook and the risks of a second wave of the Covid-19 virus. But American equities are in.

June 22, 2020

• Platinum reversed from support zone • Likely to rise to 875.00 Platinum recently reversed up from the support zone lying between the support level 820.00 (former strong resistance from April), lower daily Bollinger band and the 50% Fibonacci retracement.

June 22, 2020

• NZDJPY reversed from key support level 68.25 • Likely to rise to 70.00 NZDJPY recently reversed up sharply from the key support level 68.25 (which stopped the previous A-wave) – strengthened by the 38.2% Fibonacci retracement of the former.

June 22, 2020

• GBPNZD falling inside impulse wave 5 • Likely to fall to 1,9000 GBPNZD recently broke through the l support level 1,9400 (which has been steadily reversing the pair from October of 2019). The breakout of the support level 1,9400.

June 22, 2020

• Visa rising inside impulse wave (v) • Likely to reach 200.00 Visa continues to rise inside the minor impulse wave (v), which started recently from the support zone lying between the support level 188.00 (low of the daily Hammer.

June 19, 2020

• Apple broke resistance level 352,00 • Likely to rise to 380,00 Apple recently broke through the resistance level 352,00 (which stopped the recent sharp short-term impulse wave 3 at the start of June). The breakout of this resistance level.

June 19, 2020

• Wheat broke key support level 495,00 • Likely to fall to 476.00 and 472.00 Wheat continues to fall sharply after the recent breakout of the key support level 495,00 (which stopped the earlier impulse waves (1) and 1 in.