Technical analysis - Page 339

July 8, 2020

• Costco broke pivotal resistance level 315.00 • Likely to rise to 322.00 Costco recently broke above the pivotal resistance level 315.00 (which stopped the earlier B-wave at the start of June, as can be seen below). The breakout of.

July 7, 2020

• Natural gas broke resistance level 1.824 • Likely to rise to 1.970 Natural gas recently broke above the key resistance level 1.824 (which reversed the price multiple times at the start of June). The breakout of the resistance level.

July 7, 2020

• NZDCAD rising inside impulse waves 3 and (5) • Likely to rise to 0.8950 NZDCAD continues to rise after the earlier breakout of the key resistance level 0.8800 (which has been reversing the price from the end of 2019)..

July 7, 2020

• GBPJPY broke resistance area • Likely to rise to 136.30 GBPJPY recently broke the resistance area lying between the resistance level 133.90 (top of the previous impulse wave (1)) and the 38.2% Fibonacci correction of the previous ABC correction.

July 7, 2020

• Ebay rising inside weekly impulse waves 3 and (3) • Likely to reach 60.00 Ebay continues to rise inside the two nested, different-size upward impulse waves 3 and (3), as can be seen from the weekly Ebay chart. The.

July 6, 2020

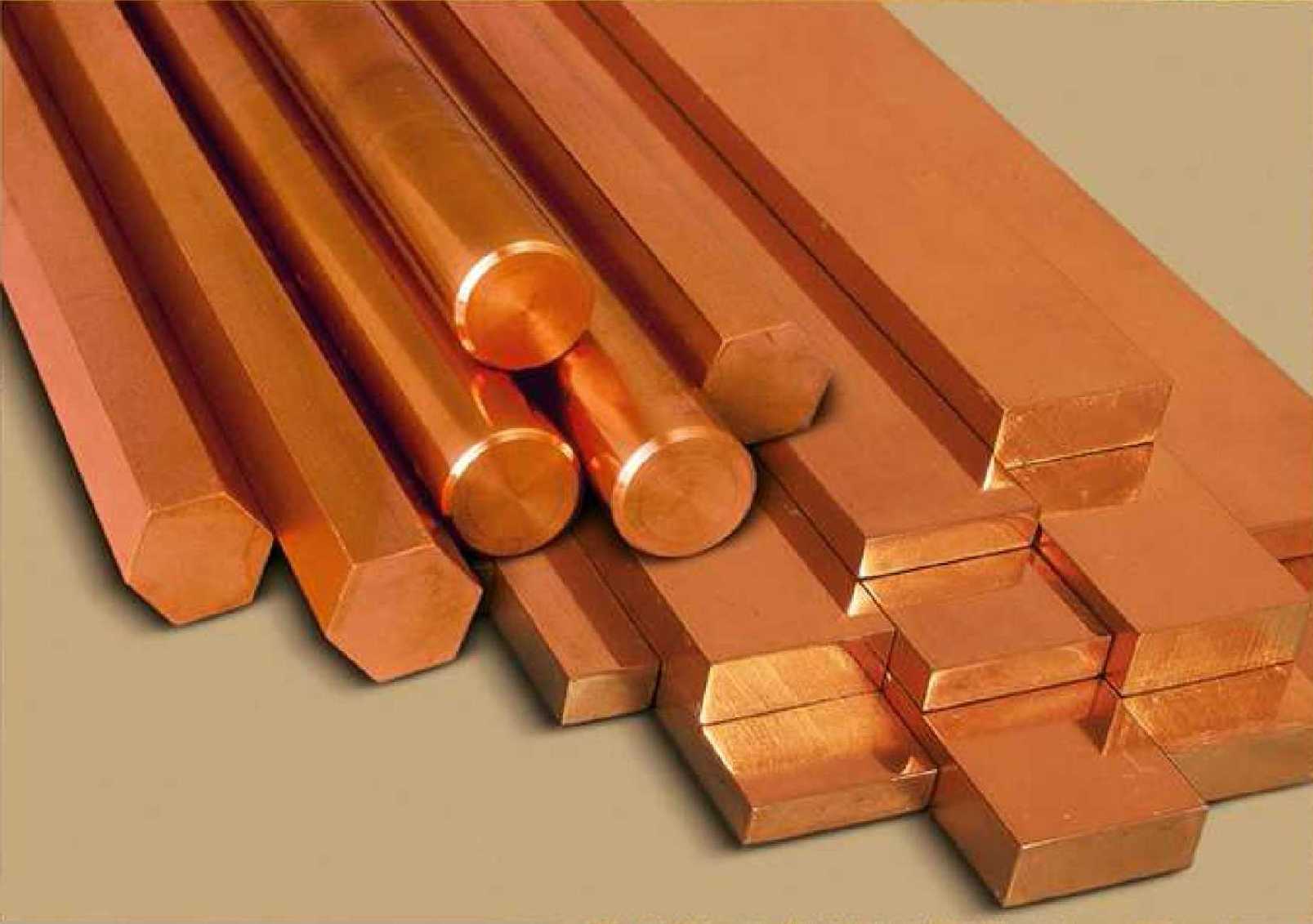

• Copper broke resistance level 276.80 • Likely to rise to 288.50 Copper continues to rise inside the short-term impulse wave (iii) which started earlier from the pivotal support 269.90 (former resistance from the start of June). The price today.

July 6, 2020

• EURUSD rising inside wave (ii) • Likely to rise to 1.3500 EURUSD continues to rise inside the short-term corrective wave (ii) which started earlier from the support 1.1200, intersecting with the 38.2% Fibonacci retracement of the previous sharp upward.

July 6, 2020

• EURJPY broke resistance level 121.40 • Likely to rise to 122.00 EURJPY recently broke the resistance level 121.40 – coinciding with the 38.2% Fibonacci retracement of the previous sharp downward ABC correction 2. The breakout of the resistance level.

July 6, 2020

• Alibaba broke key resistance level 230.00 • Likely to rise to 240.00 Alibaba recently broke with the sharp upward gap above the key resistance level 230.00 (former multi-month high from January and June). The breakout of the resistance level.

July 3, 2020

• Gold reversed from support level 1760.00 • Likely to rise to 1790.00 Gold recently reversed up from the support level 1760.00 (former resistance level which stopped the earlier impulse wave 1 in the middle of May). The upward reversal.

July 3, 2020

• NZDCAD broke key resistance level 0.8800 • Likely to rise to 0.8900 NZDCAD continues to rise after the earlier breakout of the key resistance level 0.8800 – which has been reversing the price from last December. The breakout of.