Technical analysis - Page 329

August 13, 2020

• Silver reversed from key support level 23.30 • Likely to rise to 29.75 Silver recently reversed up with the Long-legged Doji from the key support level 23.30 (low of the previous daily Bullish Engulfing from the end of August).

August 12, 2020

• CHFJPY broke key resistance level 116.40 • Likely to rise to 118.00 CHFJPY recently broke the key resistance level 116.40 (which previously stopped the upward price move at the start of July and at the end of July). The.

August 12, 2020

• GBPCAD broke support level 1.7345 • Likely to fall to 1.7200 GBPCAD recently broke the support level 1.7345 (low of the previous correction (a)), intersecting with the 38.2% Fibonacci retracement of the previous upward impulse from June. The breakout.

August 12, 2020

• CADJPY broke round resistance level 80.00 • Likely to rise to 81.65 CADJPY continues to rise after the earlier breakout of the round resistance level 80.00 (former monthly high from July), coinciding with the 50% Fibonacci correction of the.

August 12, 2020

• Gold reversed from support level 1900.00 • Likely to rise to 2000.00 Gold recently reversed up from the round support level 1900.00, intersecting win the 50% Fibonacci correction of the previous upward impulse from June. The support zone near.

August 12, 2020

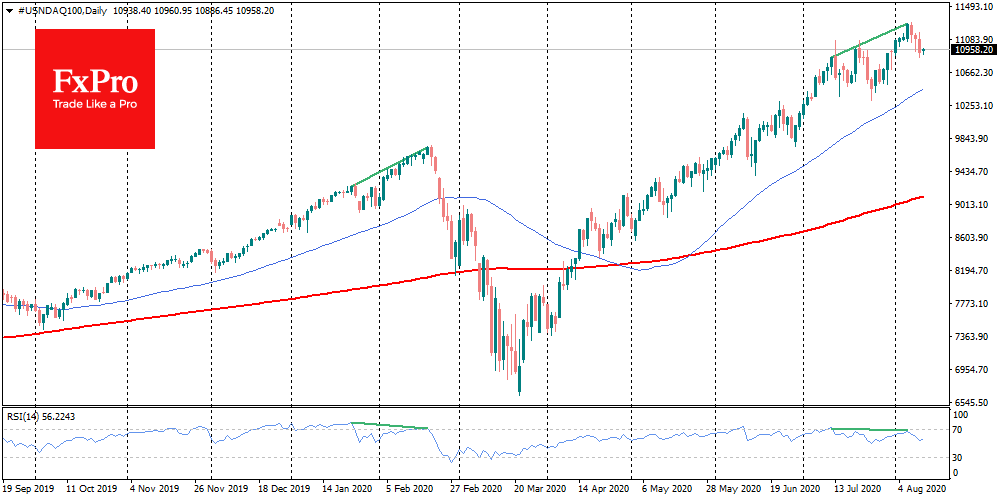

The world markets are under pressure on Wednesday morning. Negotiations on stimulus packages in the US remain at a standstill, and hopes for a coronavirus vaccine are leading investors to revise their strategies in favour of companies most affected earlier.

August 11, 2020

• Platinum reversed from major resistance level 1025. • Likely to fall to 938.00 Platinum continues to fall after the earlier downward reversal from the major resistance level 1025.00 (top of the weekly Shooting Star from the start of this.

August 11, 2020

• NZDCAD broke key support level 0.8800 • Likely to fall to 0.8700 NZDCAD recently broke below the key support level 0.8800 (former strong resistance from June), which coincided with the 38.2% Fibonacci retracement of the previous upward impulse from.

August 11, 2020

• EURJPY reversed from key support level 124.30 • Likely to rise to 125.60 EURJPY recently reversed up sharply from the key support level 124.30 (former powerful resistance from the start of June), intersecting with the 50% Fibonacci retracement of.

August 11, 2020

• Catepillar broke key resistance level 140.00 • Likely to rise to 150.00 Catepillar earlier broke above the key resistance level 140.00 (former strong support from December, which has been steadily reversing all upward impulses from February). The breakout of.

August 10, 2020

• 3M rising inside corrective wave (ii) • Likely to test to 163.50 3M continues to rise inside the short-term corrective wave (ii) – which started earlier from the key support level 150.00 (which reversed the price in June.