Technical analysis - Page 328

August 17, 2020

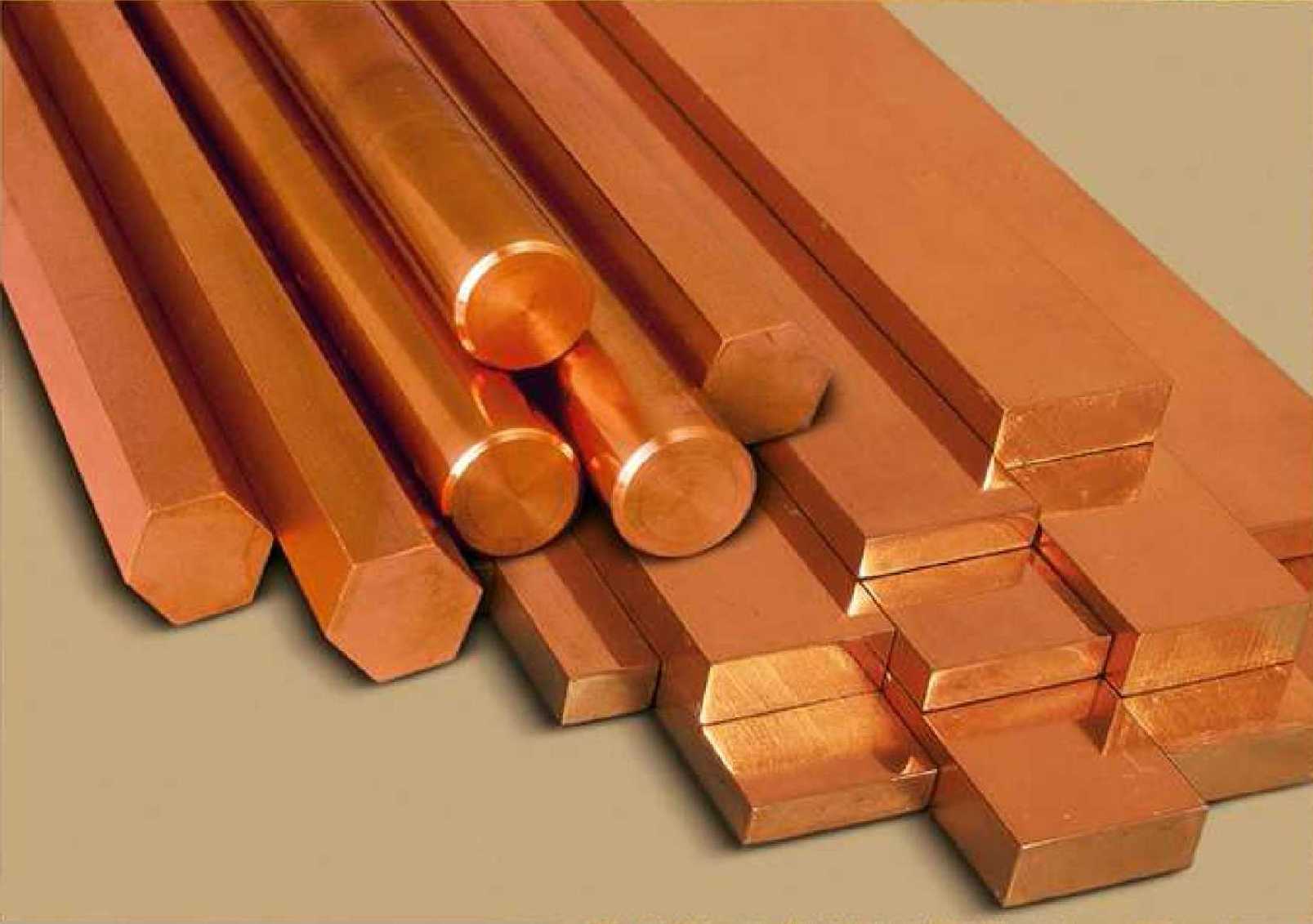

• Copper broke daily down channel from • Likely to rise to 299.00 Copper recently reversed up from the support level 280.00 (low of the (A)-wave of the previous intermediate corrective wave (2) from July). The upward reversal from the.

August 17, 2020

As the price of Bitcoin continues to meet resistance passing $12,000, its hash rate has hit a new all-time high. Data from Blockchain.com confirms that on Aug. 15, Bitcoin’s seven-day average hash rate reached a new peak of 129.075 TH/s..

August 14, 2020

Wall Street was muted on Friday, with the S&P 500 slipping from near record highs, as a slowdown in domestic retail sales growth added to worries about a wobbly post-pandemic economic recovery in the absence of a new U.S. fiscal.

August 14, 2020

• Natural gas broke key resistance level 2.27 • Likely to rise to 2.400 Natural gas today broke sharply above the key resistance level 2.27 (top of the previous sharp upward impulse wave (iii)). The breakout of the resistance level.

August 14, 2020

• AUDCAD reversed from support level 0.9420 • Likely to rise to 0.9530 AUDCAD recently reversed up from the pivotal support level 0.9420 (former strong resistance level from June), intersecting with the lower daily Bollinger band and with the 38.2%.

August 14, 2020

• GBPNZD broke resistance area • Likely to rise to 2.0150 GBPNZD recently broke the resistance area lying between the resistance level 2.000 (which also reversed the price at the start of June), intersecting with the 61.8% Fibonacci correction of.

August 14, 2020

• GBPUSD reversed from round support level 1.3000 • Likely to rise to 1.3200 GBPUSD recently reversed up from the round support level 1,3000 (which reversed the price multiple times from the start of August, as can be seen below)..

August 14, 2020

• Costco reversed from support zone • Likely to rise to 345.00 Costco recently reversed up from the support zone lying at the intersection of the support level 331.40 (former top of the previous impulse wave 1 from July) and.

August 13, 2020

• Sugar broke key resistance level 13.00 • Likely to rise to 13.5 Sugar today broke above the resistance level 13.00 (which stopped the previous minor impulse wave (iii) at the start of this month). The breakout of the resistance.

August 13, 2020

• EURJPY broke key resistance level 125.65 • Likely to rise to 127.00 EURJPY continues to rise inside the sharp upward impulse wave (iii) – which previously broke above the key resistance level 125.65 (top of the daily Evening Star.

August 13, 2020

• EURUSD reversed from support level 1.1710 • Likely to rise to 1.1900 EURUSD recently reversed up from the support level 1.1710 (low of the previous correction (iv)), intersecting with the 38.2% Fibonacci correction of the previous upward impulse from.