Technical analysis - Page 324

September 1, 2020

• Cotton reversed from key support level 64.50 • Likely to rise to 66.35 Cotton recently reversed up from the key support level 64.50 (former strong resistance level, which reversed the price at the start of June and July). The.

September 1, 2020

• EURCHF broke resistance level 1.0830 • Likely to rise to 1,0910 EURCHF recently broke the resistance level 1.0830 (upper border of the sideways price range inside which the pair has been moving from the middle of July). The breakout.

August 31, 2020

• EURGBP reversed from support level 0.8915 • Likely to rise to 0.9000 EURGBP recently reversed up from the pivotal support level 0.8915 (which also revered the price in the middle of June). The support zone near the support level.

August 31, 2020

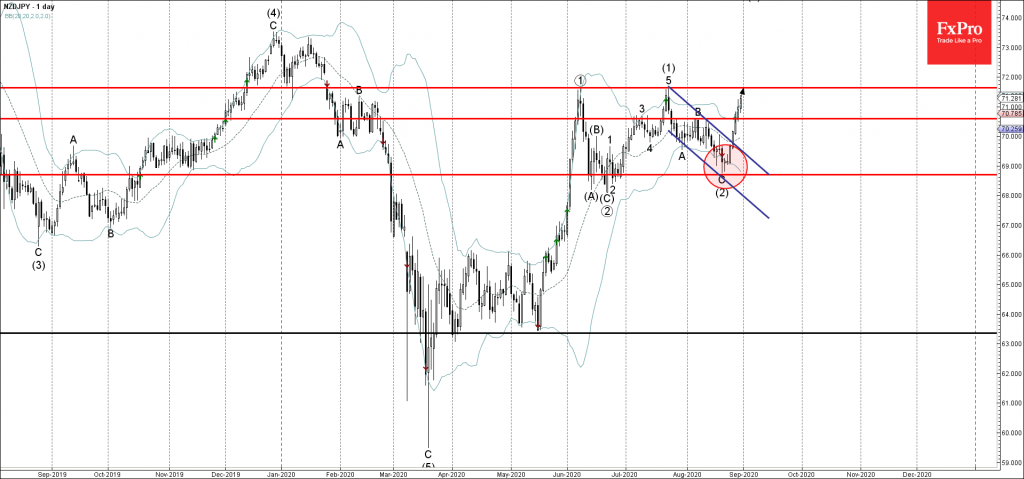

• NZDJPY broke key resistance level 70.60 • Likely to rise to 71.60 NZDJPY recently broke the key resistance level 70.60 – top of the B-wave of the previous ABC correction (2) from the middle of July. The breakout of.

August 31, 2020

• AUDJPY broke resistance level 76.45 • Likely to rise to 78.90 AUDJPY continues to rise inside the upward impulse wave C which recently broke the key resistance level 76.45 (which has been steadily reversing the price from the end.

August 31, 2020

• Wheat broke key resistance level 550.00 • Likely to rise to 570.00 Wheat opened today with the upward gap breaking above the key resistance level 550.00 (which stopped the (a)-wave of the active ABC correction 2 in the middle.

August 28, 2020

• AUDUSD broke resistance level 0.7250 • Likely to rise to 0.7400 AUDUSD recently broke sharply above the resistance level 0.7250 (which stopped the two previous impulse waves (5) and (1) – as can be seen from the daily AUDUSD.

August 28, 2020

• Gold rising inside daily up channel • Likely to rise to 2000.00 Gold recently reversed once again from the support trendline of the wide daily up channel from March (like it did earlier this month). The support zone near.

August 28, 2020

• AUDCAD broke daily down channel • Likely to rise to 0.9655 AUDCAD recently broke the resistance trendline of the daily down channel from July (which enclosed the previous ABC correction (A)). The breakout of this down channel coincided with.

August 28, 2020

• EURJPY reversed from resistance level 126.70 • Likely to fall to 124.40 EURJPY recently reversed down exactly from the resistance level 126.70 (which stopped the previous minor impulse wave (i) at the start of August). The resistance zone near.

August 28, 2020

• NZDCAD broke resistance level 0.8800 • Likely to rise to 0.8900 NZDCAD continues to rise inside the sharp upward impulse wave ③, breaking today the resistance level 0.8800 (former support from the start of August). The breakout of the.