Technical analysis - Page 323

September 4, 2020

• Soy broke resistance level 960,00 • Likely to rise to 990,00 Soy recently broke above the powerful resistance level 960,00 – which started the sharp downtrend at the beginning of 2020, as can be seen below. The breakout of.

September 3, 2020

• Sugar broke key support level 12.22 • Likely to fall to 11.80 Sugar continues to decline after the earlier breakout of the key support level 12.22 (former strong resistance level in June and July). The breakout of the support.

September 3, 2020

• NZDJPY reversed from key resistance level 71.60 • Likely to fall to 71,00 NZDJPY today reversed down from the key resistance level 71.60 (which also reversed the previous sharp upward impulses in June and July). The resistance zone near.

September 3, 2020

• GBPUSD reversed from long-term resistance level 1.3480 • Likely to fall to 1,3200 GBPUSD recently reversed down with the daily Shooting Star from the powerful long-term resistance level 1.3480 (which also stopped the strong daily uptrend in December of.

September 3, 2020

• EURGBP reversed from support level 0.8860 • Likely to rise to 0.8945 EURGBP recently reversed up from the support level 0.8860 (former monthly low from the start of June). The support zone near the support level 0.8860 was strengthened.

September 3, 2020

• Verizon broke key resistance level 60,90 • Likely to rise to 62,00 Verizon today opened with the upward gap – breaking through the key resistance level 60,90 (former monthly top from January). The breakout of the resistance level 60,90.

September 2, 2020

• Ebay reversed from support level 54,00 • Likely to rise to 58.60 Ebay today reversed up from the pivotal support level 54,00 (which has been reversing the price from the end of July). The support zone near the support.

September 2, 2020

• AUDNZD falling inside impulse wave 3 • Likely to reach to 1,0800 AUDNZD continues to fall inside the sharp impulse wave 3 – which previously broke the daily up channel from July (which enclosed the previous minor impulse sequence.

September 2, 2020

• AUDCAD reversed from resistance level 0,9640 • Likely to fall to 0.9550 AUDCAD is currently in the profit-taking correction from the nearby resistance level 0,9640 (which reversed the previous waves (iii) and 5) located near the upper daily Bollinger.

September 2, 2020

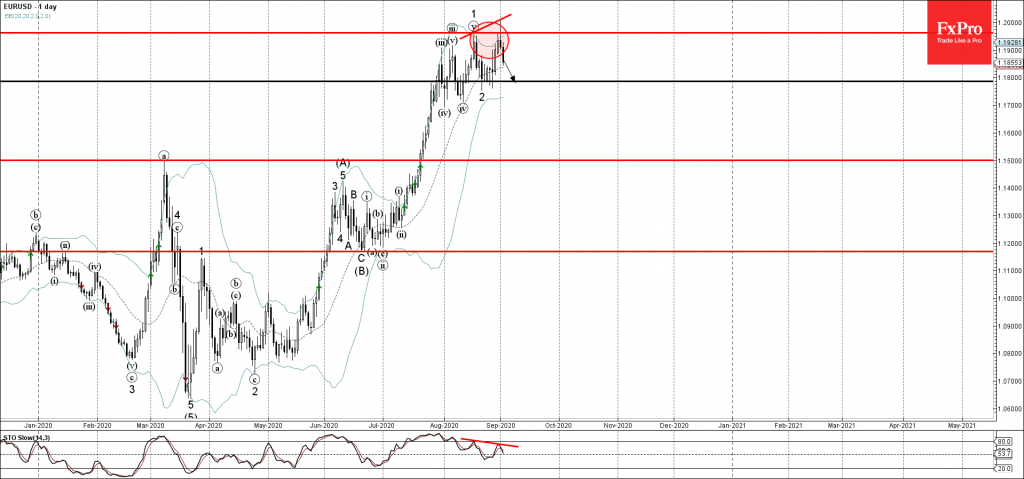

• EURUSD reversed from resistance level 1.1960 • Likely to fall to 1,1800 EURUSD recently reversed down sharply from the resistance level 1.1960 (top of the previous impulse wave 1) standing close to the upper daily Bollinger Band and the.

September 1, 2020

• GBPCHF broke resistance level 1.2000 • Likely to rise to 1.2250 GBPCHF recently broke above the key resistance level 1.2000 (which is the upper boundary of the tight sideways price range inside which the pair has been moving from.