Technical analysis - Page 32

September 17, 2025

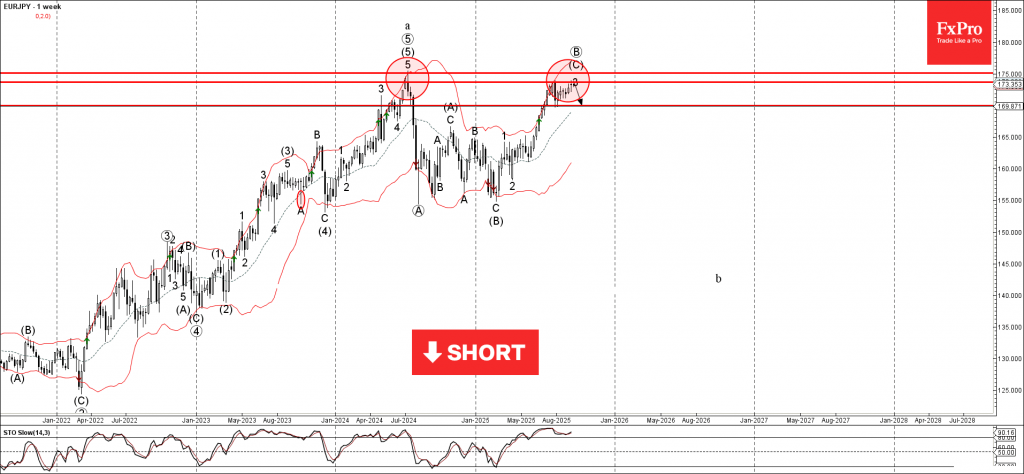

EURJPY: ⬇️ Sell – EURJPY reversed from resistance zone – Likely to fall to support level 169.9 EURJPY currency pair recently reversed down from the resistance zone between the resistance levels 173.65 (which stopped the price earlier this year) and.

September 17, 2025

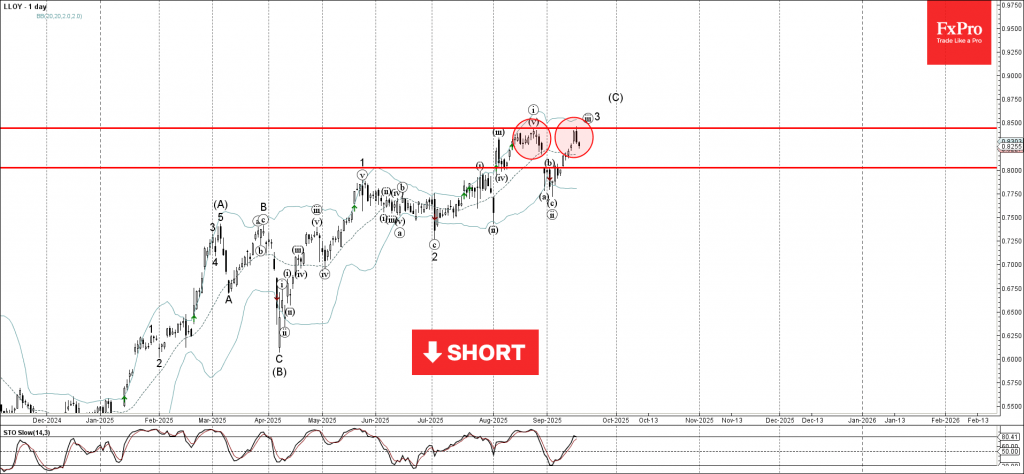

LLOY: ⬇️ Sell – LLOY reversed from resistance zone – Likely to fall to support level 0.8000 LLOY recently reversed down from the resistance zone between the resistance level 0.8445 (former monthly high from August) and the upper daily Bollinger.

September 17, 2025

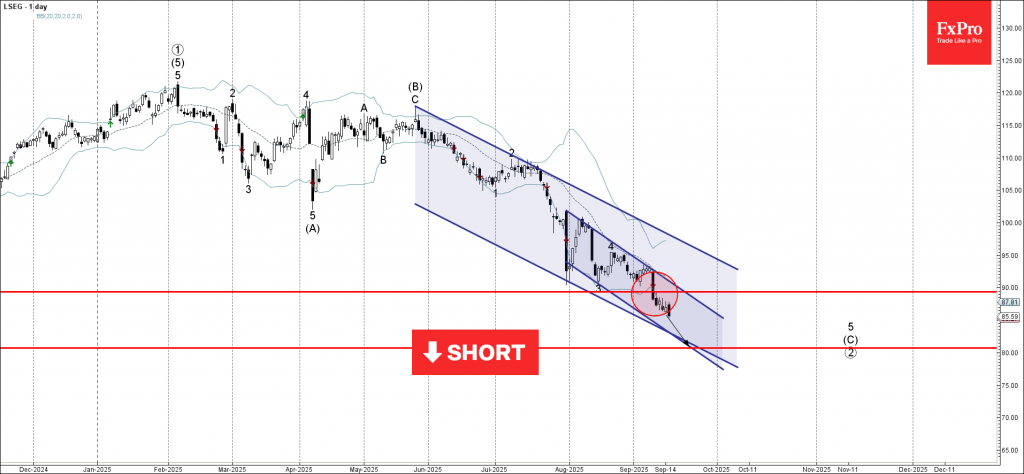

LSEG: ⬇️ Sell – LSEG broke support level 90.00 – Likely to fall to support level 80.00 LSEG under the bearish pressure after the earlier breakout of the support level 90.00 (which has been reversing the price from July). The.

September 17, 2025

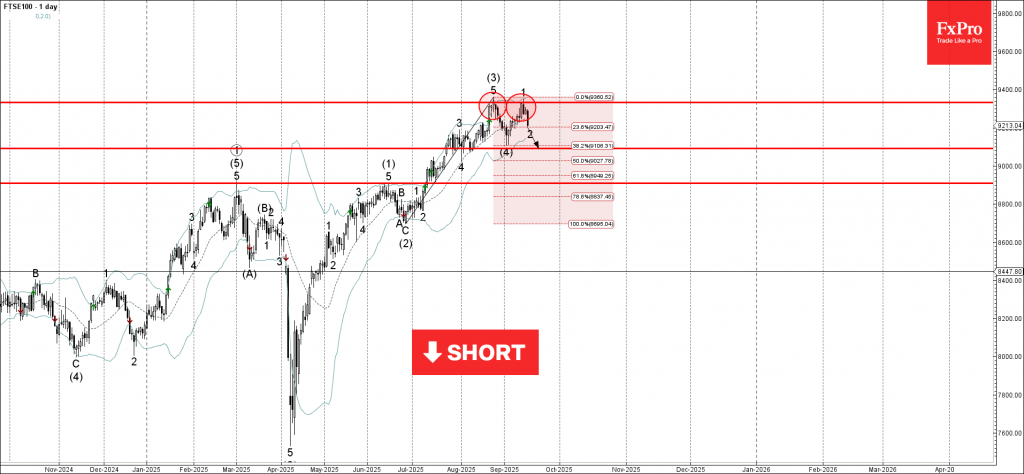

FTSE 100: ⬇️ Sell – FTSE 100 reversed from resistance zone – Likely to fall to support level 9090.00 FTSE 100 index recently reversed down from the resistance zone between the key resistance level 9330,00 (which stopped the previous wave.

September 17, 2025

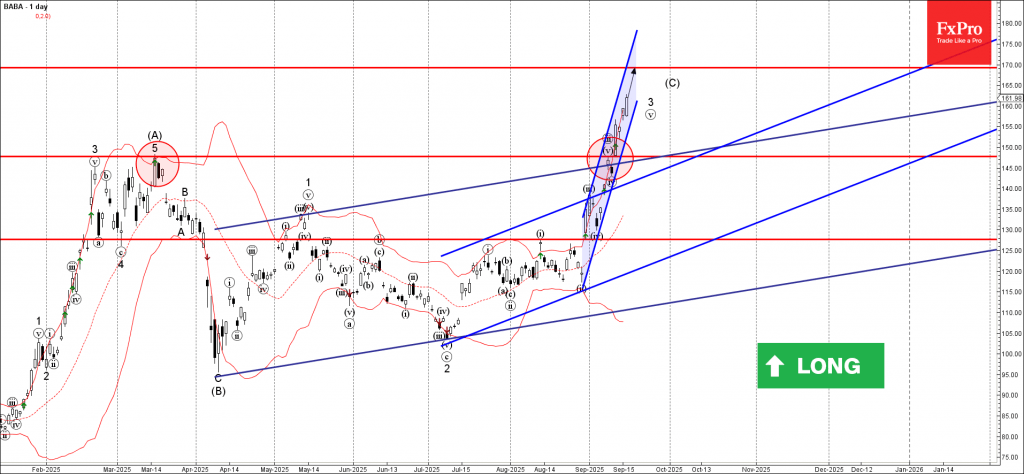

Alibaba: ⬆️ Buy – Alibaba broke key resistance level 147.70 – Likely to rise to resistance level 170.00 Alibaba Group has been rising sharply in the last few trading sessions after the earlier breakout of the key resistance level 147.70.

September 17, 2025

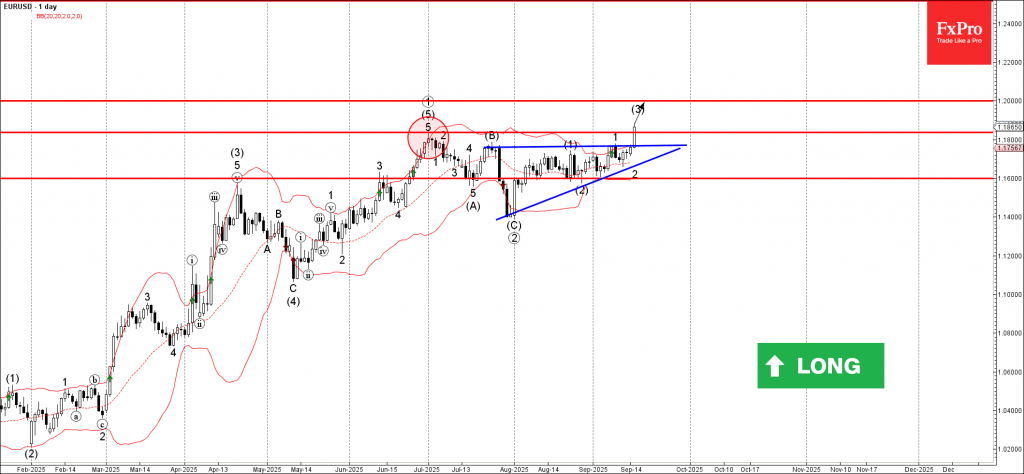

EURUSD: ⬆️ Buy – EURUSD broke key resistance level 1.1835 – Likely to rise to resistance level 1.2000 EURUSD currency pair recently broke above the key resistance level 1.1835 (which stopped the previous impulse wave (5) at the end of.

September 16, 2025

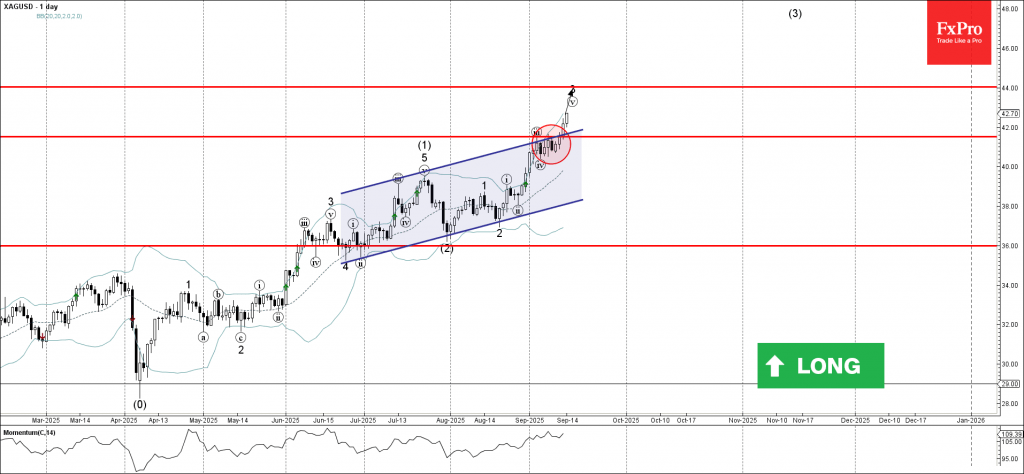

Silver: ⬆️ Buy – Silver broke the resistance area – Likely to rise to resistance level 44.00 Silver recently broke the resistance area between the key resistance level 41.50 (which stopped the previous impulse wave iii) coinciding with the resistance.

September 16, 2025

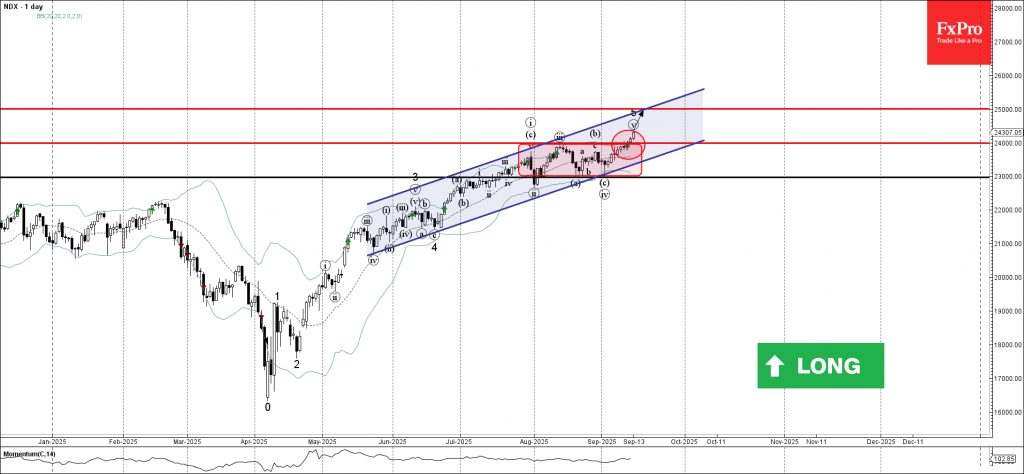

Nasdaq-100: ⬆️ Buy – Nasdaq-100 broke key resistance level 24000.00 – Likely to rise to resistance level 25000.00 Nasdaq-100 index recently broke above the key resistance level 24000.00 (upper border of the narrow sideways price range inside which the index.

September 15, 2025

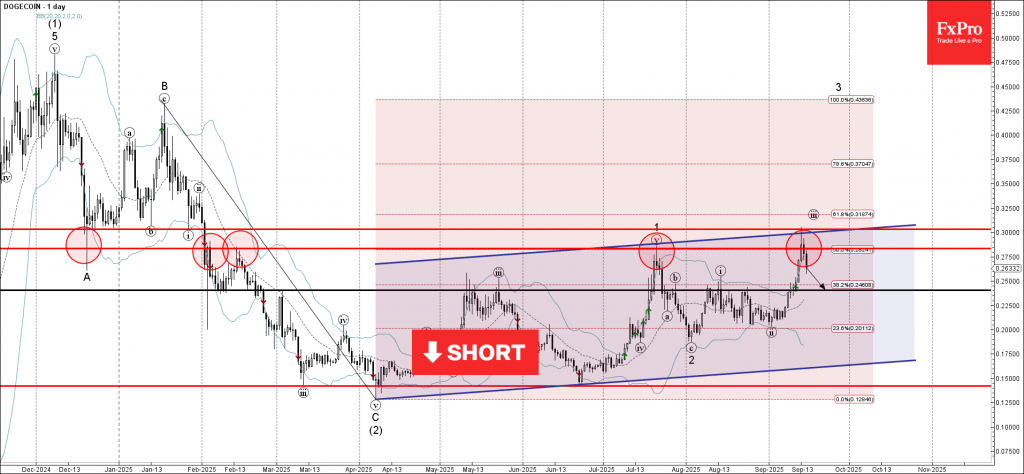

Dogecoin: ⬇️ Sell – Dogecoin reversed from the resistance area – Likely to fall to support level 0.2400 Dogecoin cryptocurrency recently reversed from the resistance area between the resistance levels 0.2750 (former monthly high from July), 0.3000 and the upper daily.

September 15, 2025

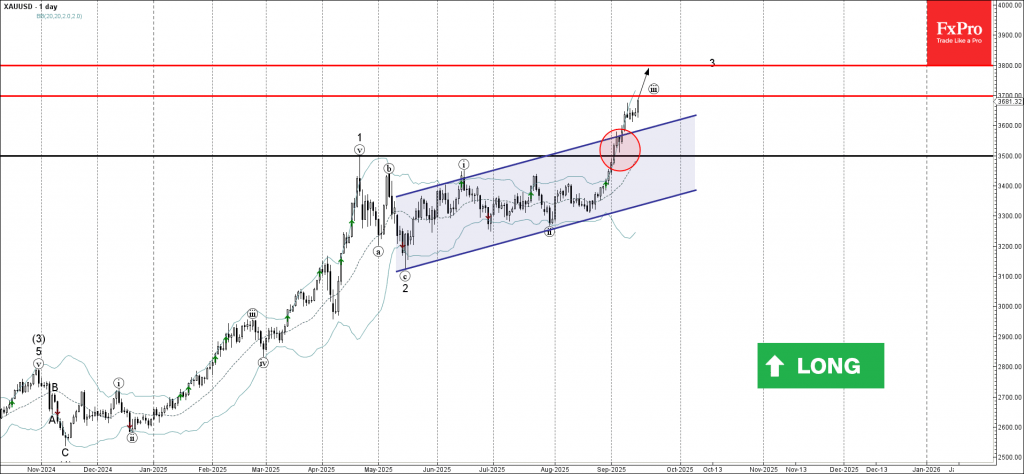

Gold: ⬆️ Buy – Gold broke resistance area – Likely to rise to resistance levels 3700.00 and 3800.00 Gold recently broke the resistance area between the key resistance level 3500.00 (which stopped the sharp impulse wave 1 in April) and the.

September 12, 2025

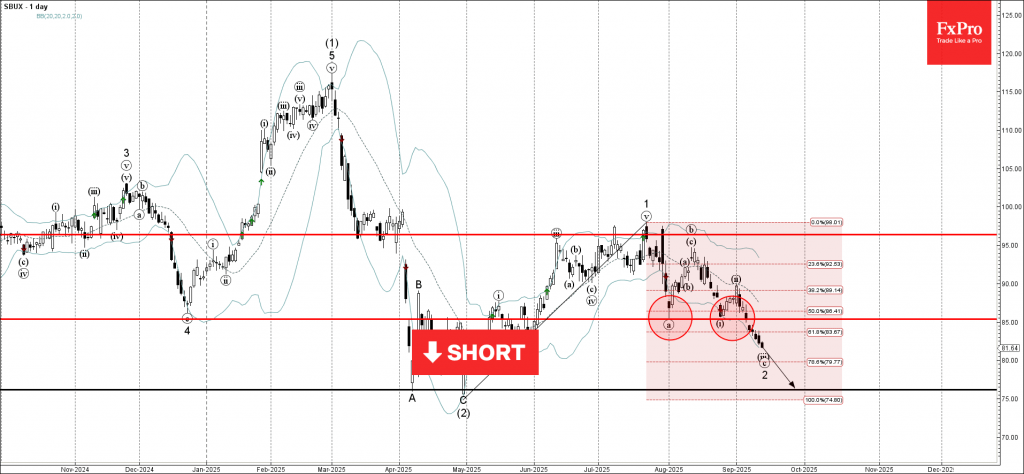

Starbucks: ⬇️ Sell – Starbucks broke the support area – Likely to fall to support level 76.15 Starbucks recently broke the support area between the support level 85.00 (which stopped 2 earlier waves – 1 and i) and the 50% Fibonacci correction.