Technical analysis - Page 319

September 21, 2020

• NZDCHF reversed from resistance area • Likely to fall to 0.6035 NZDCHF recently reversed down from the resistance zone located between the resistance level 0.6160 (top of the previous wave 2) and the upper daily Bollinger Band. The downward.

September 21, 2020

• NZDUSD reversed from resistance area • Likely to fall to 0.6600 NZDUSD recently reversed down from the resistance area lying between the resistance level 0.6785 (which also stopped the pair at the start of September) and the upper daily.

September 18, 2020

• Corn rising inside waves (iii) and (3) • Likely to rise to 385.90 Corn continues to rise inside the short-term impulse wave (iii), which started earlier from the key support level 362.70 (former resistance from the end of August)..

September 18, 2020

• AUDNZD under bearish pressure • Likely to fall to 1.0720 AUDNZD under bearish pressure after the earlier breakout of the support zone set between the support level 1.0810 (low of the previous impose wave 1) and the 50% Fibonacci.

September 18, 2020

• EURAUD reversed from support zone • Likely to rise to 1.6400 EURAUD recently reversed up from the support zone located between the powerful support level 1.6125 (which has been reversing the price from the middle of July) and the.

September 18, 2020

• CHFJPY broke support zone • Likely to fall to 114.00 CHFJPY recently broke through the support zone located between the key support level 115.50 (which has been steadily reversing the price from the start of August) and the 50%.

September 18, 2020

• Soy broke round resistance level 1000.00 • Likely to rise to 1065.00 Soy recently broke through the round resistance level 1000.00 – which accelerated the active impulse waves (iii), (v) and C. The breakout of the resistance level 1000.00.

September 17, 2020

• Ebay broke support zone • Likely to fall to 46.00 Ebay continues to fall sharply after the earlier breakout of the support zone located between the support level 51.00 (which stopped the previous impulse wave (i)) and the 38.2%.

September 17, 2020

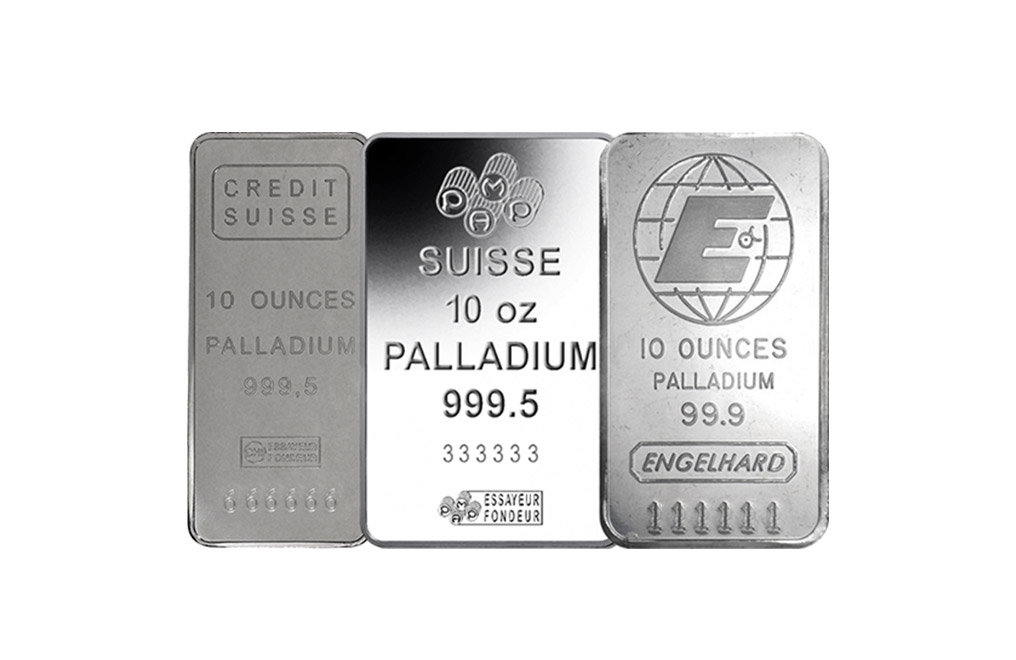

• Palladium reversed from resistance zone • Likely to fall to 2265.00 Palladium recently reversed down from the resistance zone located between the resistance level 2400.00 (which formed the top of the previous daily candlesticks reversal pattern Evening Star Doji.

September 17, 2020

• NZDCAD broke resistance area • Likely to rise to 0.8915 and 0.9000 NZDCAD recently broke resistance area located between the resistance level 0.8850 (which stopped the previous impulse wave (1)) and the 61.8% Fibonacci correction of the downward correction.

September 17, 2020

• EURJPY broke support area • Likely to fall to 123.00 EURJPY recently broke the support area located between the support level 124.50 (which stopped the previous waves iv, (iv) and (a)) and the 38.2% Fibonacci correction of the upward.