Technical analysis - Page 317

September 28, 2020

• GBPCHF broke the resistance area • Likely to rise to 1.2100 GBPCHF recently broke the resistance area lying between the resistance level 1.1820 (former top of the previous minor impulse wave (a)) and the 38.2% Fibonacci correction of the.

September 28, 2020

• AUDCAD reversed from support zone • Likely to rise to 0.9500 AUDCAD recently reversed up from the support zone located between the key support level 0.9415 (low of the previous correction A), lower daily Bollinger Band and the 50%.

September 28, 2020

• AUDCHF reversed from support level 0.6500 • Likely to rise to 0.6600 AUDCHF recently reversed up from the support area lying between the strong support level 0.6500 (which has been steadily reversing the price from the middle of June),.

September 28, 2020

• Gold approached support level 1865.00 • Likely to fall to 1800.00 Gold recently broke the key support level 1905.00 (low of the previous corrections B and D) and is currently trading near the powerful support level 1865.00 (low of.

September 25, 2020

• Papa John’s approaching key support level 80.00 • Likely to fall to 75.00 Papa John’s recently reversed down from the resistance zone located between the resistance level 87.70 and the 50% Fibonacci correction of the downward impulse C from.

September 25, 2020

• Wheat reversed from resistance zone • Likely to fall to 534.00 Wheat recently reversed down with the daily Bearish Engulfing from the resistance zone located between the resistance level 578.00 (which stopped the price in March), upper daily Bollinger.

September 25, 2020

• NZDJPY reversed from support zone • Likely to rise to 70.00 NZDJPY recently reversed up from the support zone located between the support level 68.70 (low of wave A from August), lower daily Bollinger Band and the 38.2% Fibonacci.

September 25, 2020

• AUDNZD broke support zone • Likely to fall to 1.0670 AUDNZD under bearish pressure after the earlier breakout of the support zone located between the support level 1.0800 and the 50% Fibonacci correction of the upward impulse from July..

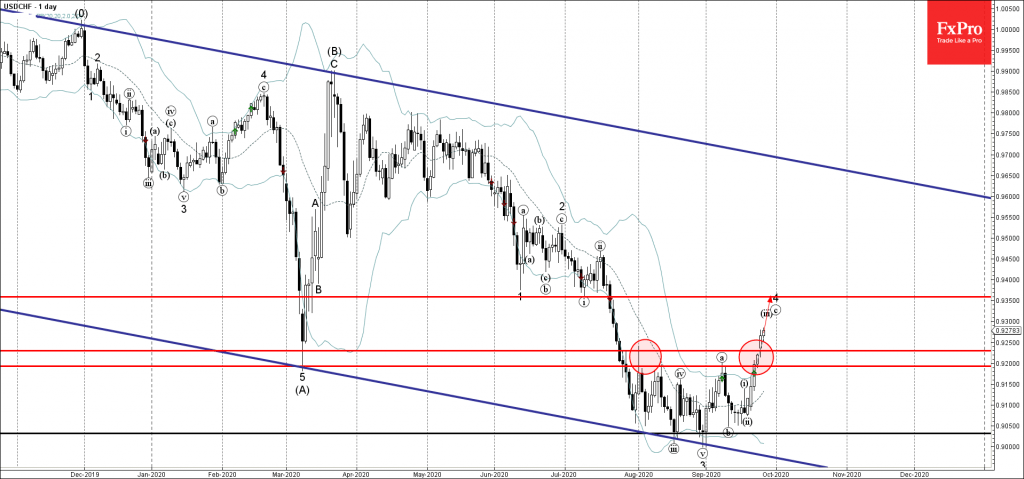

September 25, 2020

• USDCHF rising inside impulse wave c • Likely to rise to 0.9350 USDCHF continues to rise inside the sharp upward impulse wave c, which previously broke the resistance zone lying between the resistance levels 0.9190 and 0.9230. The breakout.

September 24, 2020

• Copper broke support zone • Likely to fall to 290.00 Copper recently broke the support area located between the support level 296.00 (which former the daily Bullish Engulfing and Piercing Line earlier this month) and the 38.2% Fibonacci retracement.

September 24, 2020

• EURUSD broke support zone • Likely to fall to 1.1560 EURUSD recently broke the support area located between the support level 1.1755 (which stopped the previous waves 4, (1) and 1) and the 38.2% Fibonacci retracement of the previous.