Technical analysis - Page 31

September 23, 2025

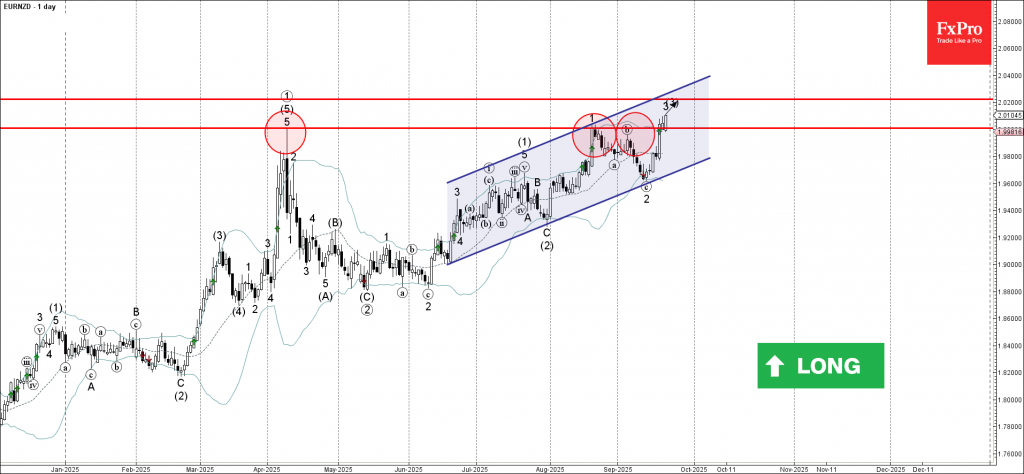

EURNZD: ⬆️ Buy – EURNZD broke key resistance level 2.0010 – Likely to rise to resistance level 2.0200 EURNZD currency pair recently broke above the key resistance level 2.0010 (which has been reversing the price from the start of April)..

September 23, 2025

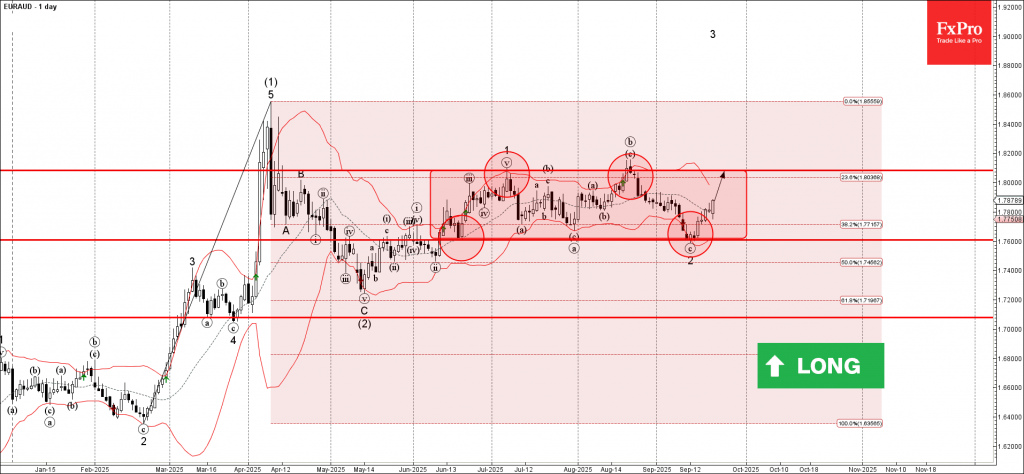

EURAUD: ⬆️ Buy – EURAUD reversed from support zone – Likely to rise to resistance level 1.8085 EURAUD currency pair recently reversed up from the support zone between the support level 1.7600 (lower border of the sideways price range from.

September 23, 2025

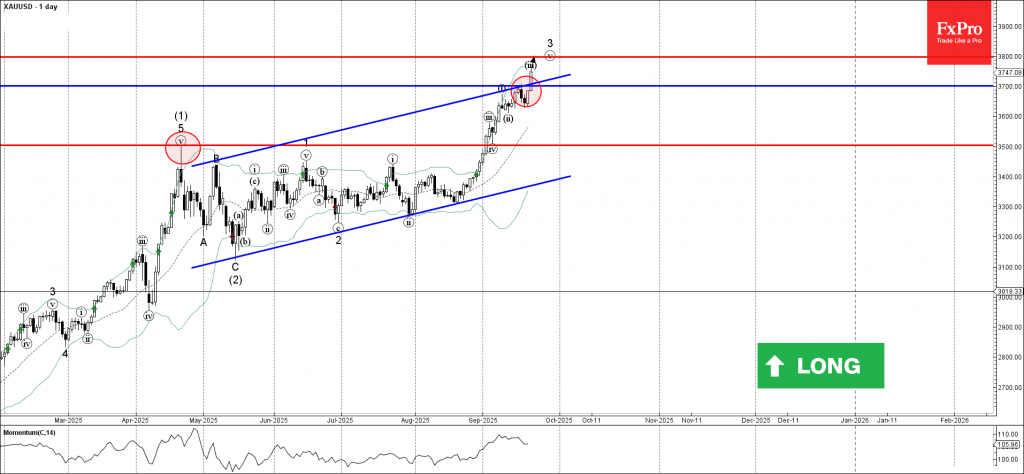

Gold: ⬆️ Buy – Gold broke resistance zone – Likely to rise to resistance level 3800.00 Gold recently broke the resistance zone between the resistance level 3700.00 and the resistance trendline of the daily up channel from April. The breakout.

September 23, 2025

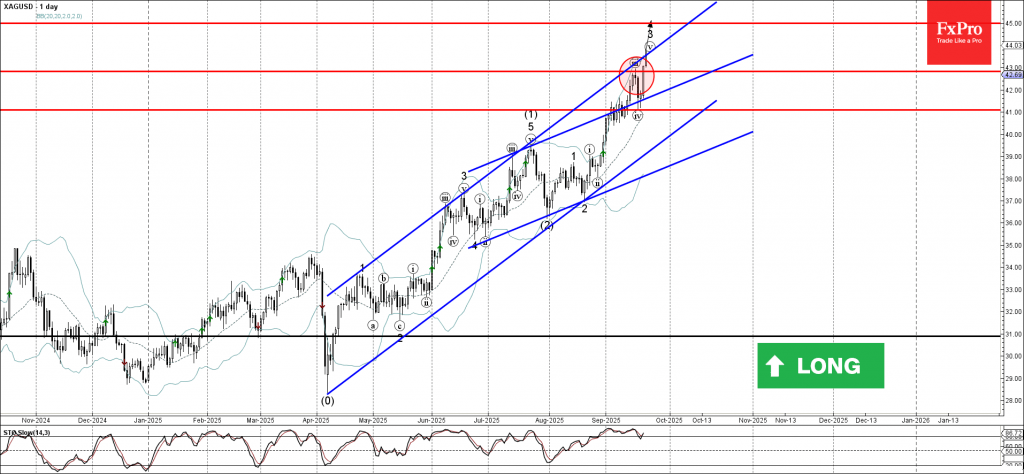

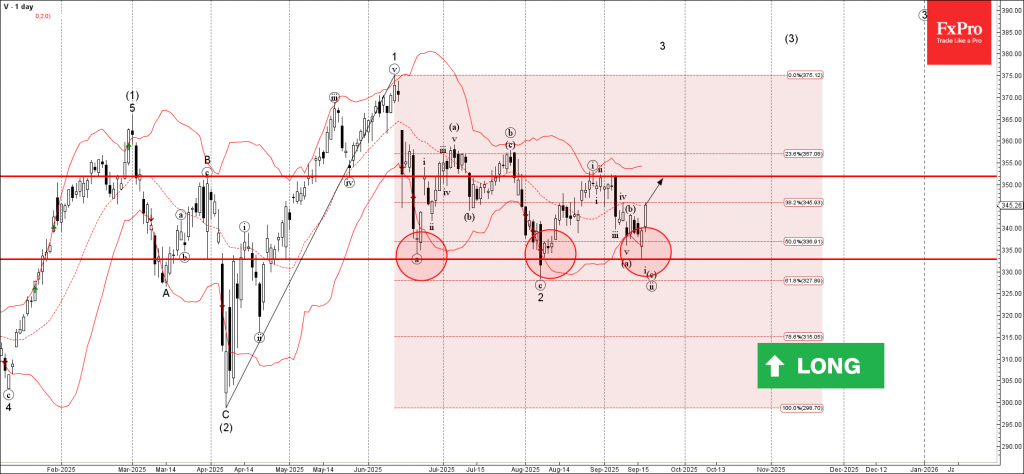

Silver: ⬆️ Buy – Silver reversed from support zone – Likely to rise to resistance level 45.00 Silver recently reversed from the support zone between the support level 41.00 and the upper trendline of the recently broken up channel from.

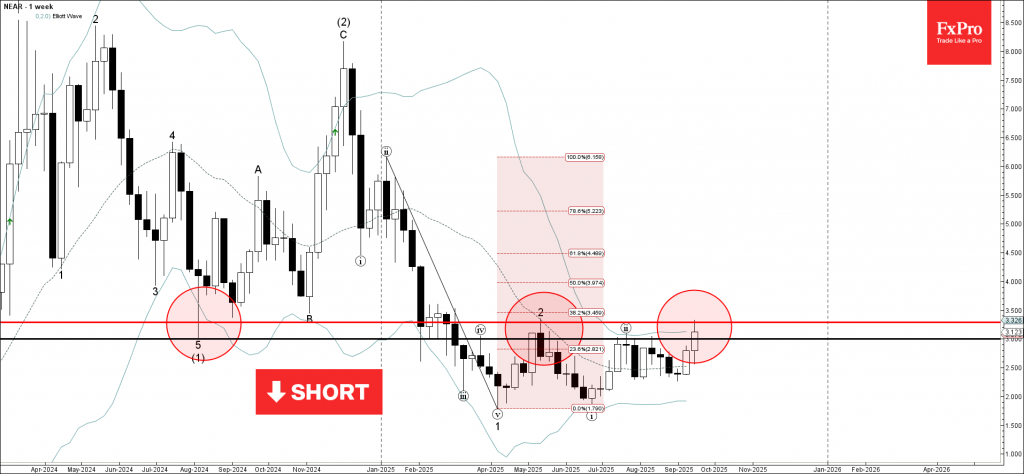

September 20, 2025

NEAR: ⬇️ Sell – NEAR reversed from resistance zone – Likely to fall to support level 3.000 NEAR cryptocurrency recently reversed down from the resistance zone between the resistance level 3.290 (former strong support from 2024, which stopped the previous wave 2.

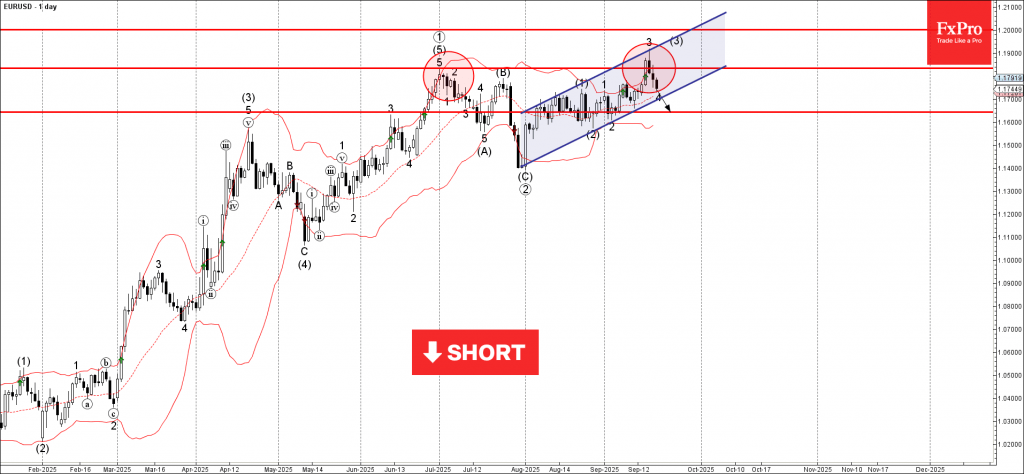

September 20, 2025

EURUSD: ⬇️ Sell – EURUSD reversed from resistance zone – Likely to fall to support level 1.1640 EURUSD currency pair recently reversed down from the resistance zone between the resistance level 1.1835 (former multi-month high from June), upper daily Bollinger.

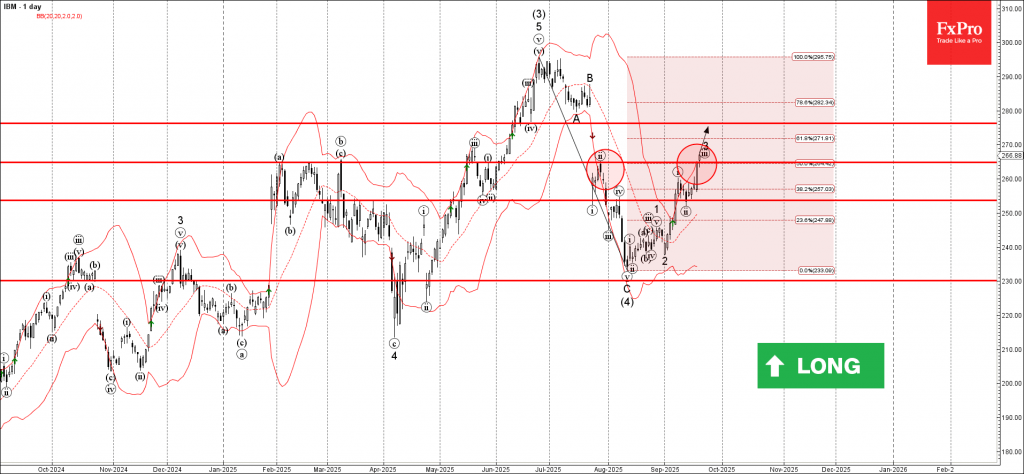

September 20, 2025

IBM: ⬆️ Buy – IBM broke resistance level 264.80 – Likely to rise to resistance level 276.30 IBM recently broke the resistance zone between the resistance level 264.80 (which stopped the previous wave (ii) in July) and the 50% Fibonacci correction of.

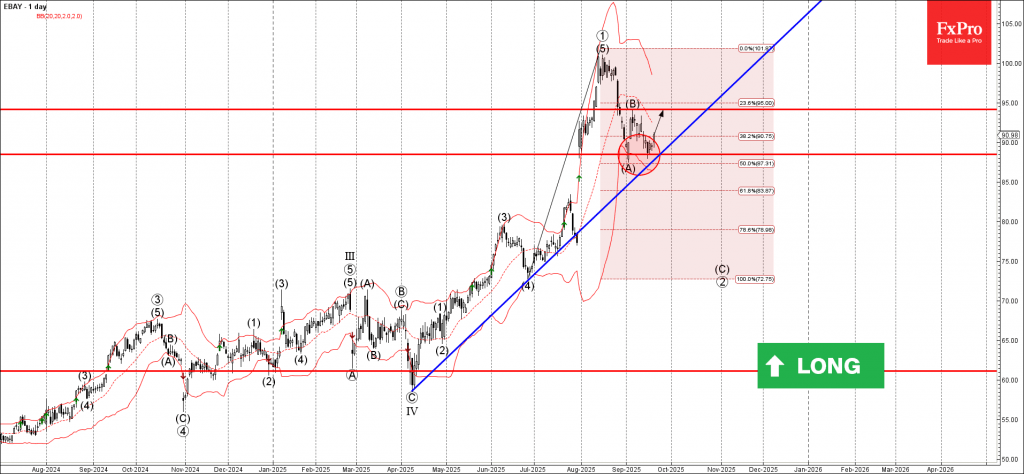

September 20, 2025

Ebay: ⬆️ Buy – Ebay reversed from support zone – Likely to rise to resistance level 95.00 Ebay recently reversed up from the support zone between the key support level 88.50 (which stopped the previous wave (A) at the start of September)..

September 18, 2025

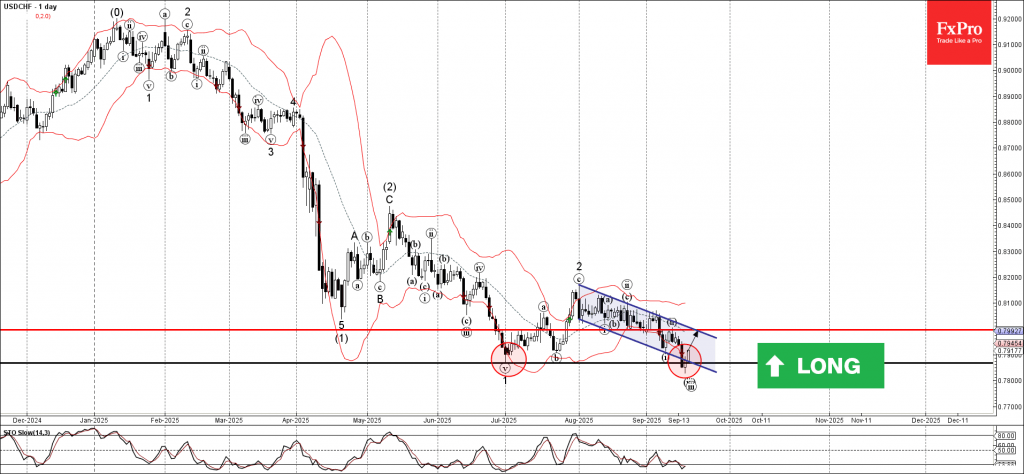

USDCHF: ⬆️ Buy – USDCHF reversed from support zone – Likely to rise to resistance level 0.8000 USDCHF recently reversed up from the support zone located between the pivotal support level 0.7865 (which stopped the sharp downtrend in June), lower daily Bollinger.

September 18, 2025

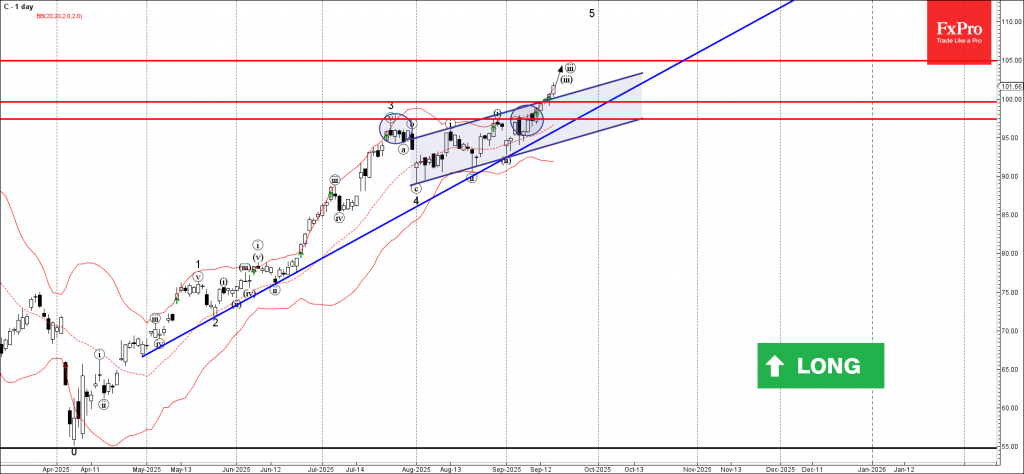

Citibank: ⬆️ Buy – Citibank broke the daily up channel – Likely to rise to resistance level 105.00 Citibank recently broke the resistance trendline of the daily up channel from the end of July coinciding with the round resistance level 100.00. The.

September 18, 2025

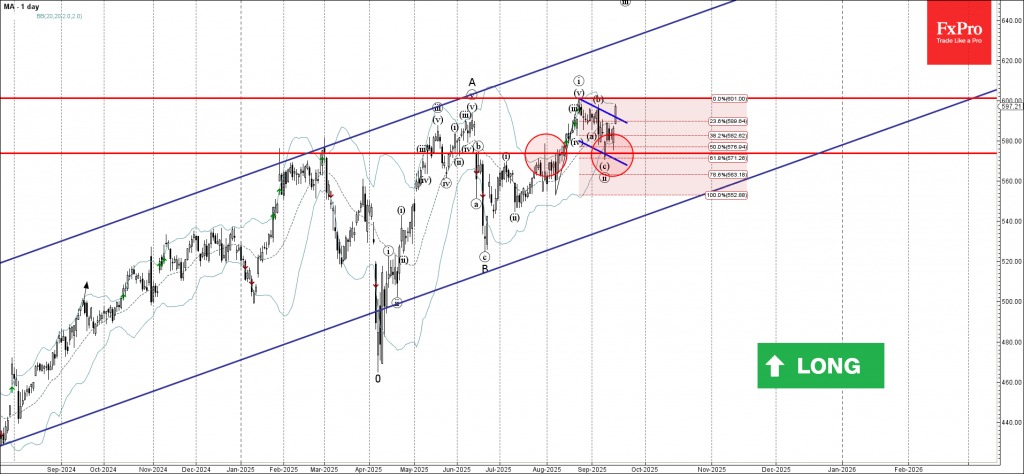

Mastercard: ⬆️ Buy – Mastercard broke daily down channel – Likely to rise to resistance level 600.00 Mastercard recently broke the resistance trendline of the daily down channel from the end of August (which enclosed the previous minor ABC correction ii). The.